US Banking Crisis Looms as ‘Credit Tightening’ Mentions Reach Record Highs on Company Calls

Recent data reveals that while the banking industry in the U.S. is facing significant challenges, executives are mentioning “credit tightening” more frequently in earnings calls than during the 2008 financial crisis. Additionally, Google Trends data indicates a surge in search queries related to bank failures and crises. The findings suggest that the U.S. economy is experiencing a period of instability and uncertainty, prompting concerns among market observers.

‘Credit Tightening’ Mentions on Company Calls Highlight Concerns Over the Stability of the U.S. Banking Industry

The U.S. economy is struggling with a trifecta of challenges: soaring inflation, steep interest rates, and a banking industry in disarray. Since Silvergate Bank’s announcement on March 8, 2023, that it would cease operations and liquidate its assets, the country has witnessed a string of significant bank failures. Silicon Valley Bank, Signature Bank, and First Republic Bank have all followed suit, marking the second, third, and fourth largest bank failures in U.S. history.

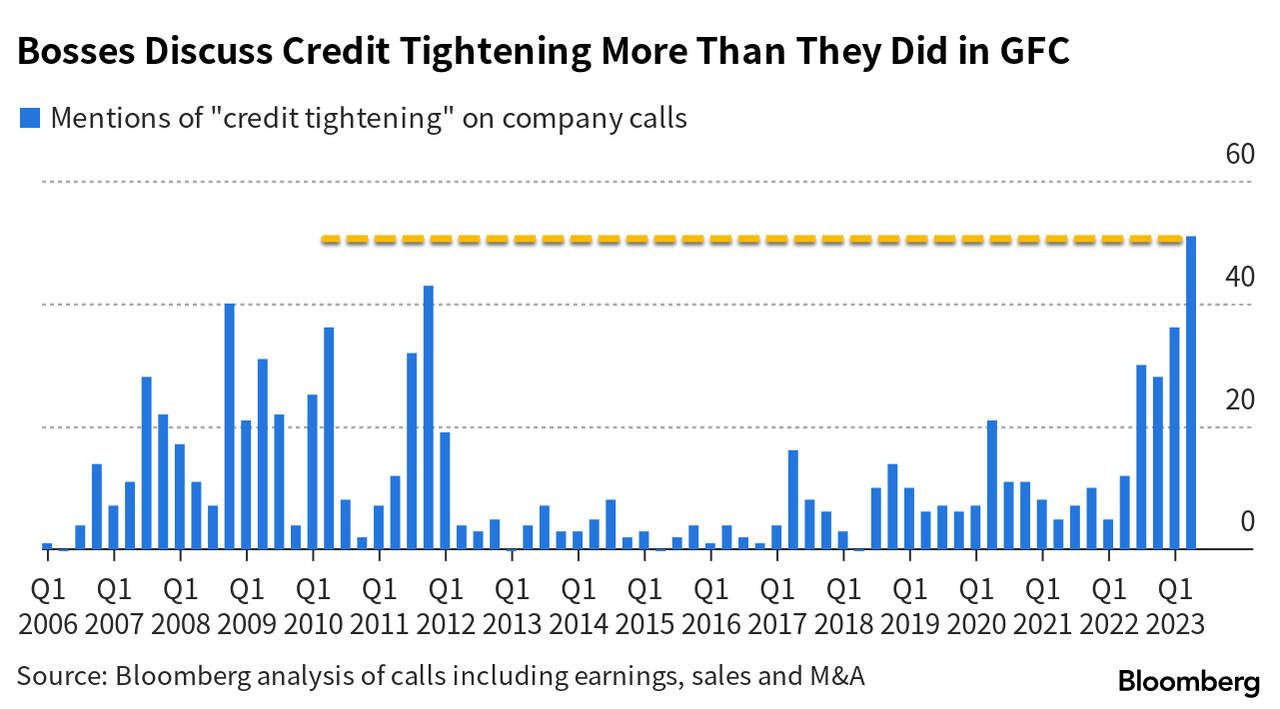

A report published on May 4, 2023, sheds light on the banking sector’s ongoing issues. According to the research, executives are increasingly using the term “credit tightening” during their earning calls. The report cites Bloomberg data, which reveals that the frequency of “credit tightening” mentions on company calls has surpassed the levels seen during the 2008 financial crisis. This trend is alarming for the banking industry, as it suggests that executives are struggling to manage credit risk and maintain profitability.

The banking industry is showing signs of caution, as evidenced by the increasing mentions of “credit tightening” on company calls. This trend is concerning, as it often leads to a negative impact on the economy. When banks become more cautious about lending money, it becomes harder for market participants to obtain credit, which can slow down economic growth. In addition to this, the report also notes that news stories alluding to “credit tightening” have reached record highs.

Google Trends Shows an Uptick of Searches Related to ‘Bank Failure,’ ‘Bank Crisis,’ and ‘Credit Tightening’

On March 19, 2023, Bitcoin.com reported that Google Trends data revealed a trend in search queries related to the banking industry. Searches for terms like “banking crisis” and “bank runs” had skyrocketed at the time. Current 30-day statistics show that the search query “bank crisis” reached a score of 89 out of 100 on April 6, and a perfect score of 100 on April 18.

By the end of April, the score had dropped to 68 out of 100. Similarly, the search query “bank failure” hit a score of 78 on April 26, and a perfect score of 100 on April 28. The topic of the banking crisis has gained significant traction in several states, including Maine, Vermont, Massachusetts, Nebraska, and Arizona. Meanwhile, the issue of bank failures has piqued the interest of people in Alaska, West Virginia, Delaware, Maine, and Montana.

According to Google Trends, related topics and associated queries include the U.S. government and First Republic Bank. Similar to the report on May 4, another trending search query is “credit tightening,” which reached a perfect score of 100 on April 6, and a score of 62 on April 21. This topic is particularly popular in California, Florida, and New York.

What do you think the surge in “credit tightening” mentions on company calls and the increase in search queries related to bank failures and crises mean for the future of the banking industry and the U.S. economy as a whole? Share your thoughts in the comments section below.

Go to Source

Author: Jamie Redman