VC Roundup: Web3 infrastructure, ‘tokenization of everything’ drawing investors

Funding for crypto startups rose to over $1 billion in April, with investors focusing on tokenization, Web3 infrastructure, and institutional demand amid the bull market.

Venture funding for crypto startups peaked at $1 billion in April, marking the second consecutive month above that pivotal mark this year with 161 investment rounds, indicating investors’ renewed interest amid the bull market.

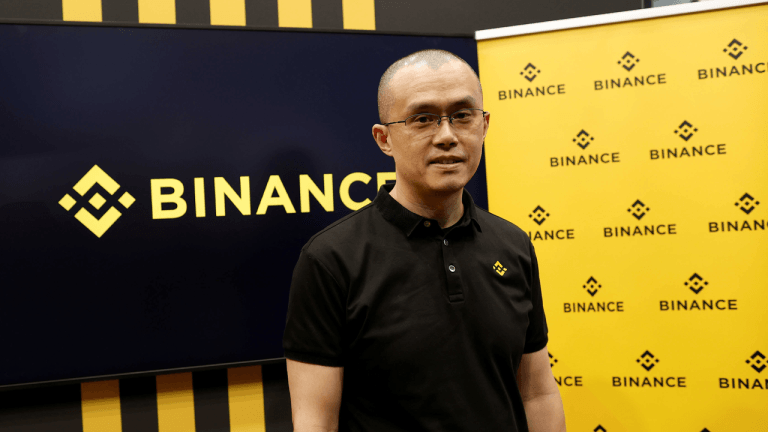

Key trends catching venture firms’ attention include decentralized infrastructure, solutions for institutional adoption, and the ‘tokenization of everything,’ aa told by Xiao Xiao, partner at HashKey Capital. In written comments to Cointelegraph, Xiao discussed HashKey’s investment priorities at the moment:

Another area of attention for HashKey is the convergence of artificial intelligence and blockchain technology. “Enhanced data analytics powered by AI are offering deeper market insights, superior fraud detection, and optimized trading strategies, leading to greater operational efficiency and security,” said Xiao.

Go to Source

Author: Ana Paula Pereira