What is crypto contagion, and how does it affect the market?

Learn about crypto contagion, its impact on the market and how to protect yourself as a stakeholder.

How can various stakeholders protect themselves from crypto contagion?

Crypto contagion can significantly impact multiple stakeholders in the crypto market, including investors, businesses and the broader financial system. To protect themselves from the negative effects of crypto contagion, each stakeholder should take specific steps.

By diversifying portfolios, investors can lower exposure to crypto contagion. This entails purchasing various cryptocurrencies and additional assets like stocks and bonds. Diversification can lessen the risk and the effects of any cryptocurrency being depegged. To be educated and make wise investment choices, it is also crucial for investors to keep an eye on market trends and news about cryptocurrencies.

Crypto-related businesses, such as exchanges and mining operations, can protect themselves by maintaining strong risk management practices. This entails routine stress testing to recognize and reduce potential risks, ensuring enough reserves to handle potential losses. Stress testing involves evaluating the performance of a system under adverse conditions. To create and preserve client trust, these businesses must also retain transparency and successful interaction.

By being informed and monitoring market developments, traders may guard against the negative impacts of crypto contagion. Before investing in any cryptocurrency, traders should perform due diligence and keep up with recent developments in the cryptocurrency market. Traders can reduce risk exposure by placing stop-loss orders and other risk management tactics.

Banks can protect themselves from the harmful effects of crypto contagion by implementing strict Know Your Customer and Anti-Money Laundering policies to prevent illicit activities related to cryptocurrencies. Additionally, banks can maintain sufficient reserves to manage potential losses from crypto contagion and regularly stress-test systems to identify and mitigate potential risks.

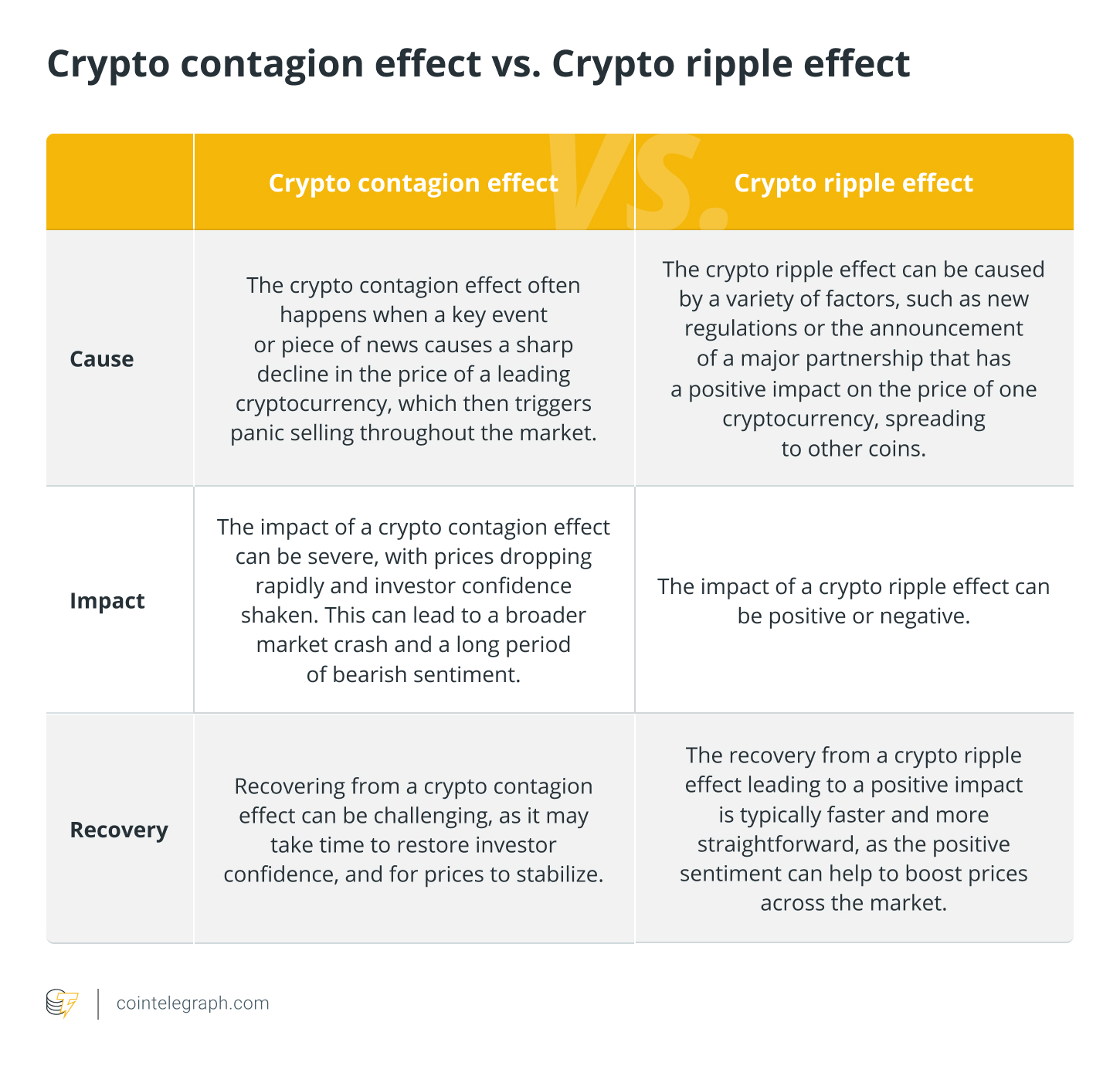

What is the difference between the crypto contagion effect and crypto ripple effect?

Both the crypto contagion effect and the crypto ripple effect refer to the spread of market changes and investor behavior across the cryptocurrency market. The fundamental difference is that the ripple effect can be either positive or negative, and relates to how changes in one cryptocurrency might affect others in the market. In contrast, the contagion effect often suggests a negative spread of fear or panic, resulting in widespread selling and price decreases.

Here are the key differences between the crypto contagion and ripple effects:

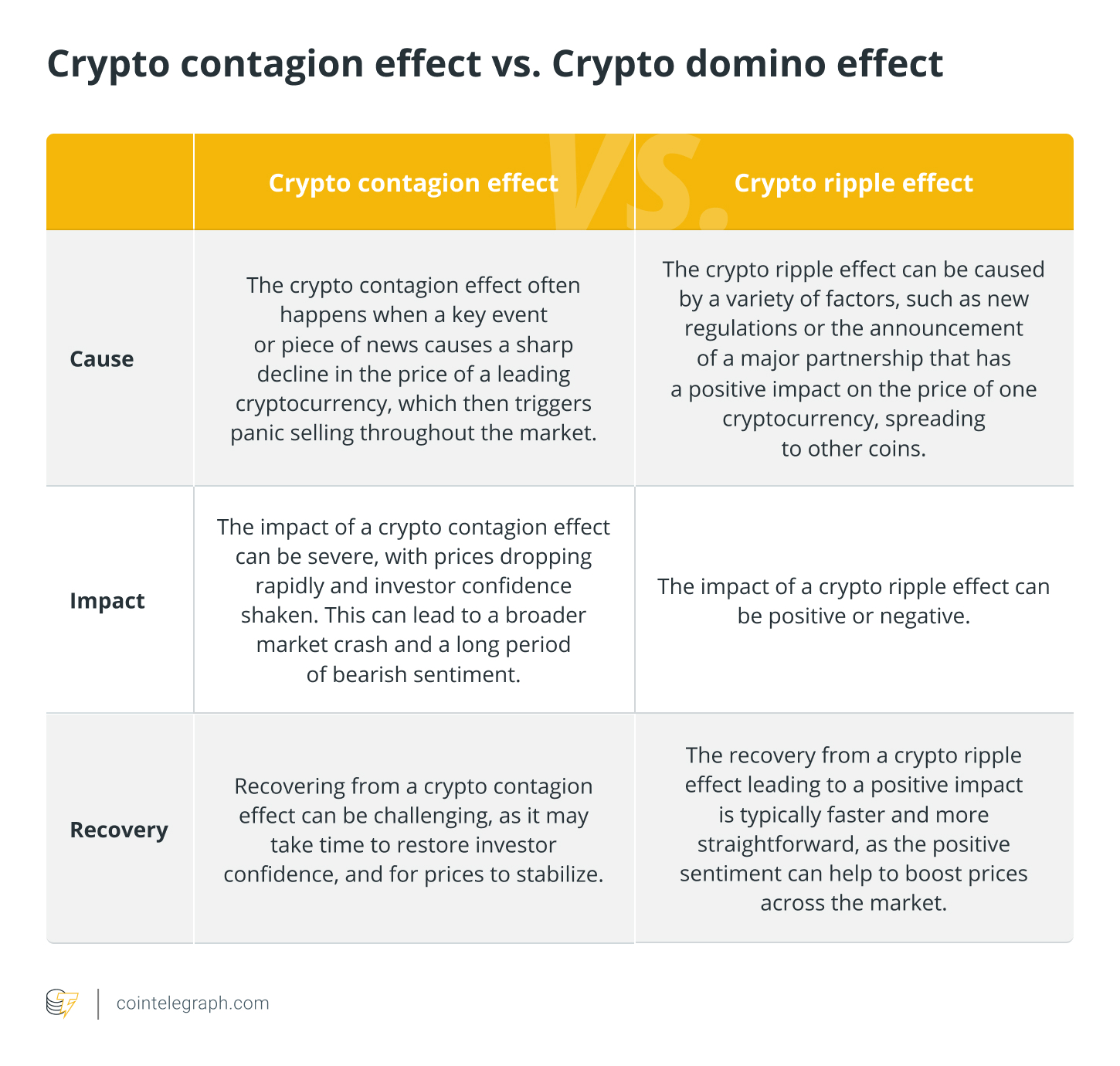

What is the difference between the crypto contagion effect and the crypto domino effect?

The crypto contagion effect refers to the spread of market unrest from one cryptocurrency to another. However, the crypto domino effect outlines a scenario in which the failure of one cryptocurrency sets off a chain reaction that causes further collapses.

Here are the key differences between the crypto contagion and domino effects:

Can stablecoins depegging create a contagion effect in the crypto market?

Depegging can create a contagion effect in the crypto market, particularly if investors perceive it as a sign of broader instability or lack of trust in the market.

A loss of confidence in the entire stablecoin market may stem from a stablecoin — intended to retain a “stable” value — losing its peg to the underlying asset it is intended to track.

Investors may start to worry about the stability of other stablecoins designed to maintain a similar peg if they start to question the stability of one stablecoin. If the negative mood spreads to other digital assets, it may cause a broader market slump and a sell-off of stablecoins.

Related: USDC depegs as Circle confirms $3.3B stuck with Silicon Valley Bank

Additionally, a decline in support for stablecoins could seriously impact the adoption of the cryptocurrency ecosystem. Since the market is volatile, stablecoins are frequently used as a medium of exchange between different cryptocurrencies or as a reserve of value. Stablecoins’ declining dependability could cause trade to stop and more market volatility.

How does crypto contagion affect the market?

While the micro-level effects are focused on individual investors and crypto-related businesses, the macro-level effects can have far-reaching implications, potentially impacting multiple industries and the global financial system’s stability.

The effects of crypto contagion on a micro and macro level can be very different. A loss of faith in a specific cryptocurrency can, on a micro level, trigger a sell-off and lower its price. Individual investors who own that cryptocurrency may suffer financial losses as a result. It may also impact the income and profitability of businesses involved in the cryptocurrency industry, such as exchanges and mining activities. Also, it could impair the ability of businesses that use cryptocurrencies as a form of payment or exchange to function and transact effectively.

Crypto contagion can affect the macroeconomy more broadly. A decline in investment and economic growth brought on by a lack of investor faith in cryptocurrencies may impact several businesses and industries.

A collapse in the value of the multi-billion-dollar cryptocurrency industry might have a substantial effect on the world’s financial markets. However, as cryptocurrencies become increasingly interwoven into the global financial system, a general decline in confidence might adversely affect the stability of the entire financial system.

Related: Circle’s USDC instability causes domino effect on DAI, USDD stablecoins

What is crypto contagion?

Crypto contagion is a phenomenon where a negative event in the cryptocurrency market triggers a chain reaction, causing a broader market downturn.

The contagion effect occurs when the decline in value of one cryptocurrency spreads to other cryptocurrencies or digital assets, resulting in a loss of confidence in the entire market. Investors may panic and sell off their holdings, escalating the negative trend. Various factors, including regulatory crackdowns, hacking attacks and market manipulation, can cause cryptocurrency contagion.

Regulatory crackdowns are one adverse event that can cause crypto contagion. It can result in a decline in value if a government adopts stringent rules on the usage or trade of a specific cryptocurrency. As a result, that coin may see a sell-off, which could impact other cryptocurrencies as investors begin to worry that similar laws may also be imposed on them.

Market manipulation may also contribute to the crypto contagion. A coordinated purchase or sale of a particular cryptocurrency by several traders or whales may result in an abrupt price change that causes a response across the market. A broader market slump or upswing may result from this, setting off a chain reaction of panicked purchasing or selling.

Another factor that can cause crypto contagion is hacking incidents. A loss of faith in the market’s security may result from the stealing of funds from a significant exchange or wallet. Investors could begin selling off other cryptocurrencies, including the one that was hacked, as they panic about the prospect of other hacks.

Go to Source

Author: Jagjit Singh