Zimbabwe sells millions of gold-backed crypto tokens despite IMF warning

The Reserve Bank of Zimbabwe’s first gold-backed cryptocurrency sale has been a success.

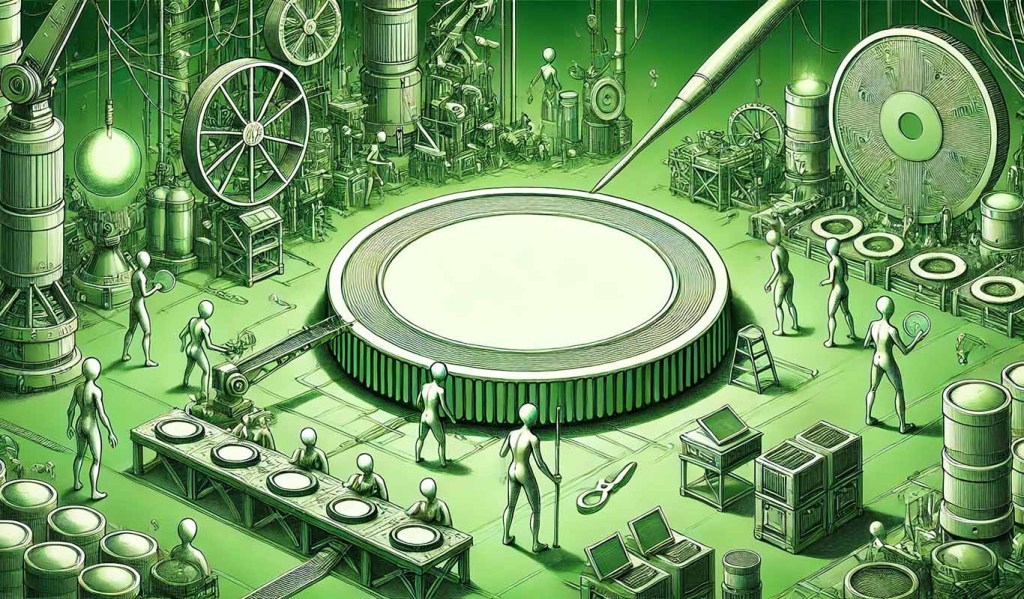

The Reserve Bank of Zimbabwe has sold 14 billion Zimbabwean dollars’ worth of gold-backed digital tokens — worth around $39 million — despite a warning from the International Monetary Fund.

On May 12, the central bank of Zimbabwe announced that it had received 135 applications for a total of 14.07 billion Zimbabwean dollars to buy the gold-backed cryptocurrency.

The Zimbabwean dollar is officially trading at 362 Zimbabwean dollars to one United States, according to XE.com — but much higher on the street — making the stash nominally worth around $38.9 million.

The crypto tokens, first introduced in April, are backed by 139.57 kilograms of gold, with the sale running from May 8 to May 12.

The tokens were sold at a minimum price of $10 for individuals and $5,000 for corporations and other entities. The minimum vesting period for the tokens is 180 days, and they can be held in e-gold wallets or on e-gold cards.

The move is reportedly part of an effort to stabilize the country’s economy and the continued depreciation of the local currency against the greenback.

A second round of digital token sales will be held and the bank has requested applications be submitted this week to be settled by May 18. According to local media, RBZ Governor Dr. John Mangudya commented:

“The issuance of the gold-backed digital tokens is meant to expand the value-preserving instruments available in the economy and enhance divisibility of the investment instruments and widen their access and usage by the public.”

The move follows a caution from the International Monetary Fund against the African nation’s plan for the gold-backed currency, arguing it should instead liberalize its foreign-exchange market, according to a May 9 Bloomberg report.

“A careful assessment should be conducted to ensure the benefits from this measure outweigh the costs and potential risks including, for instance, macroeconomic and financial stability risks, legal and operational risks, governance risks, cost of forgone FX reserves,” an IMF spokesperson told Bloomberg.

Related: Zimbabwe’s central bank to issue gold-backed digital currency: Report

Zimbabwe has been battling currency volatility and inflation for over a decade. In 2009, the country adopted the USD as its currency following a period of hyperinflation rendering the local currency worthless.

The Zimbabwe dollar was reintroduced in 2019 to revive the local economy, but volatility ensued again.

Magazine: Bitcoin in Senegal: Why is this African country using BTC?

Go to Source

Author: Martin Young