ZKsync’s Matter Labs cuts 16% of workforce in restructuring move

Key Takeaways

- Matter Labs cuts 16% of workforce due to changing market conditions and business needs.

- ZKsync Era ranks eighth among Ethereum L2s with $793 million TVL, facing declining trading volume.

Share this article

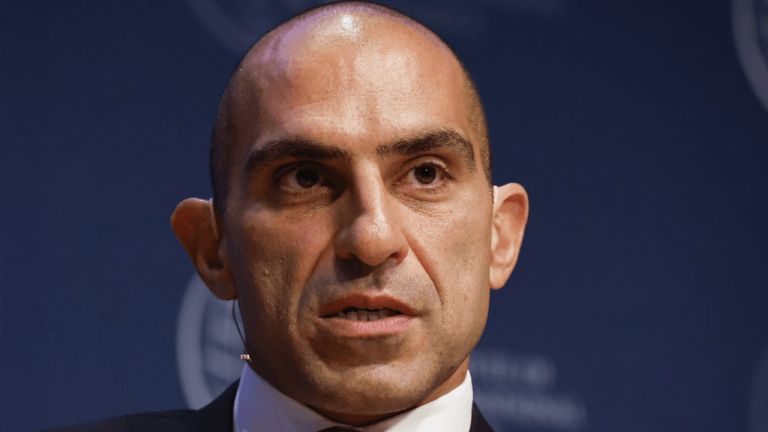

Matter Labs’ CEO Alex Gluchowski announced today that the firm is letting go roughly 16% of its team. The firm is behind the Ethereum layer-2 (L2) blockchain ZKsync Era.

Gluchowski explained in a message sent to his team that Matter Labs is “restructuring the organization,” and that changes in the market environment and business needs have led to the decision.

Although he didn’t elaborate further, Matter Labs’ CEO stated that many teams deploying applications on the ZKsync Era infrastructure “now require a different type of technology and support than they had previously.”

Moreover, following the launch of its Elastic Chain and the governance entity ZK Nation, Gluchowski said it was time to re-evaluate Matter Labs’ goals and structure.

“We went through a large org planning exercise, and it became clear that the talent and roles we have today do not perfectly match our needs,” he added.

Competitive landscape

According to L2Beat’s data, ZKsync Era is failing to keep up with the pace of other Ethereum L2 blockchains. Its total value locked (TVL) sits at $793 million, which grants it the spot of the eighth-largest Ethereum L2.

Moreover, the on-chain trading volume in ZKsync Era has been shrinking since May, amounting to just a little over $500 million in August. Notably, the zero-knowledge proof-based rollup hasn’t made it to the top 10 blockchains in monthly trading volume since April.

Thus, the competitive L2 landscape might be one of the reasons why Matter Labs decided to cut costs and re-evaluate its approach to the decentralized finance (DeFi) ecosystem.

Despite the news, the ZK token price didn’t seem to react negatively to it, as it is down 3.37% in the past 24 hours. This correction aligns with a broader market movement, as Ethereum (ETH) is tanking 3% in the same period, followed by a 2% correction by Optimism’s OP and a 3.1% drawdown by Arbitrum’s ARB.

Share this article

Go to Source

Author: Gino Matos