$1,580,000,000,000 in Crypto Leaves Curve Finance After Vulnerability Leads to Hack: On-Chain Data

Curve Finance, one of the biggest decentralized exchanges in crypto, is experiencing a massive flight of capital as the platform recovers from an exploit.

Early on Sunday, Curve said that because of a vulnerability with programming language Vyper 0.2.15, several liquidity pools on the platform were exploited, and asked users in the affected pools to withdraw their funds.

Curve, an automated market maker (AMM), caters mostly to stablecoins, allowing traders to earn yield, capture arbitrage or exchange their coins. Clara Medalie, director of research at Kaiko, told Bloomberg that “falling liquidity is never a good thing for markets, especially stablecoins, which need to trade with a very tight range.”

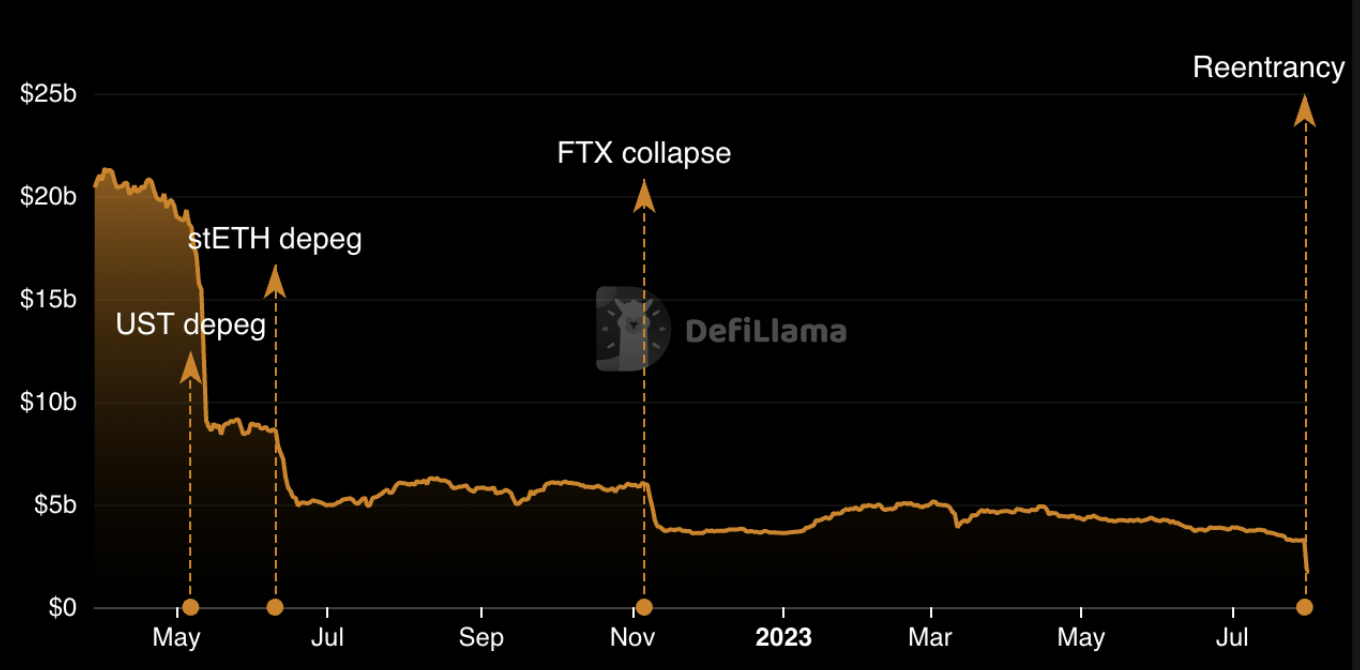

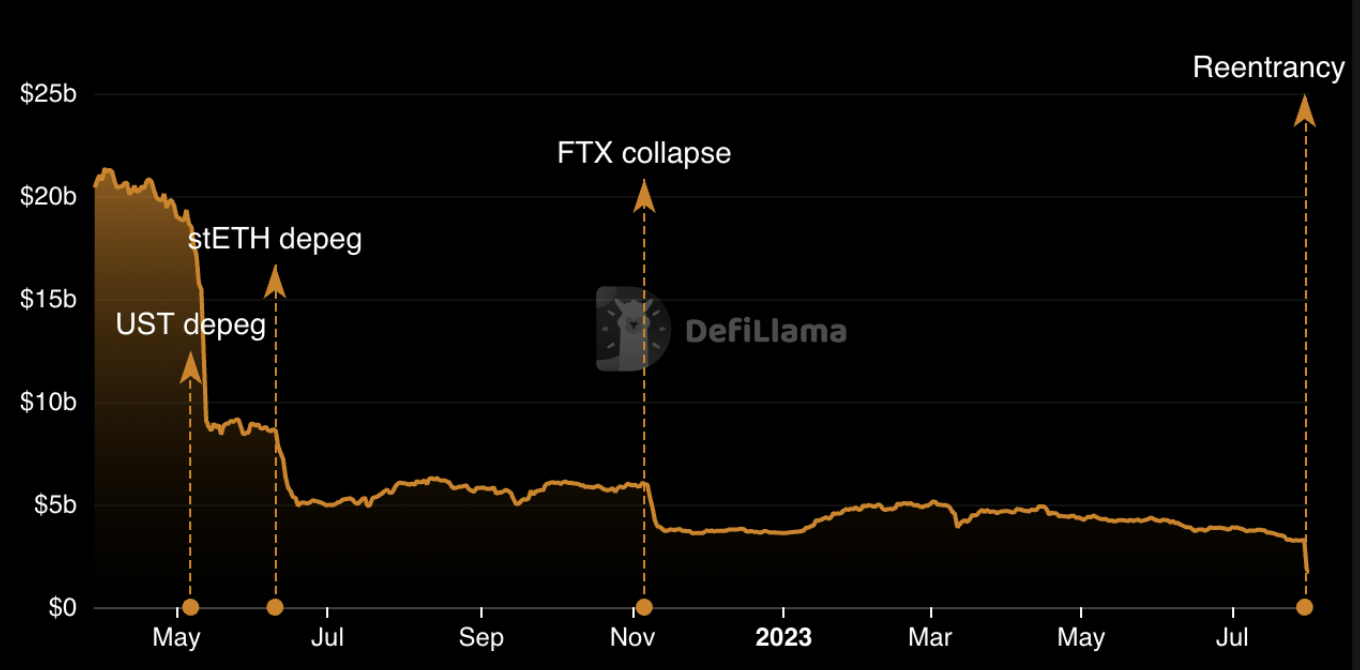

According to blockchain analytics service DefiLlama, Curve’s total value locked (TVL), or value sitting in the platform’s smart contracts, has plunged by nearly 50%.

Just before the exploit, Curve’s TVL was sitting at $3.25 billion. At time of writing, the TVL is $1.67, representing a $1.58 billion flight of crypto assets from the platform as traders take extra precautions. Only about $70 million is gone due to actual theft, according to crypto security analysis.

CRV, Curve’s native token, has fallen 19% since the hack, trading at $0.59, down from $0.75.

According to Kaiko, market makers may have stepped in to prevent further price depreciation, based on a sudden surge in buy-side liquidity on centralized exchanges.

“Right after news broke of the Curve exploit, CRV bid-side liquidity started increasing on centralized exchanges.

During a price crash liquidity typically drops, so this trend suggests market makers stepped in quickly to prevent further losses.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/ppl/Fotomay

The post $1,580,000,000,000 in Crypto Leaves Curve Finance After Vulnerability Leads to Hack: On-Chain Data appeared first on The Daily Hodl.

Go to Source

Author: Alex Richardson

$1,580,000,000,000 in Crypto Leaves Curve Finance After Vulnerability Leads to Hack: On-Chain Data

Curve Finance, one of the biggest decentralized exchanges in crypto, is experiencing a massive flight of capital as the platform recovers from an exploit.

Early on Sunday, Curve said that because of a vulnerability with programming language Vyper 0.2.15, several liquidity pools on the platform were exploited, and asked users in the affected pools to withdraw their funds.

Curve, an automated market maker (AMM), caters mostly to stablecoins, allowing traders to earn yield, capture arbitrage or exchange their coins. Clara Medalie, director of research at Kaiko, told Bloomberg that “falling liquidity is never a good thing for markets, especially stablecoins, which need to trade with a very tight range.”

According to blockchain analytics service DefiLlama, Curve’s total value locked (TVL), or value sitting in the platform’s smart contracts, has plunged by nearly 50%.

Just before the exploit, Curve’s TVL was sitting at $3.25 billion. At time of writing, the TVL is $1.67, representing a $1.58 billion flight of crypto assets from the platform as traders take extra precautions. Only about $70 million is gone due to actual theft, according to crypto security analysis.

CRV, Curve’s native token, has fallen 19% since the hack, trading at $0.59, down from $0.75.

According to Kaiko, market makers may have stepped in to prevent further price depreciation, based on a sudden surge in buy-side liquidity on centralized exchanges.

“Right after news broke of the Curve exploit, CRV bid-side liquidity started increasing on centralized exchanges.

During a price crash liquidity typically drops, so this trend suggests market makers stepped in quickly to prevent further losses.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/ppl/Fotomay

The post $1,580,000,000,000 in Crypto Leaves Curve Finance After Vulnerability Leads to Hack: On-Chain Data appeared first on The Daily Hodl.

Go to Source

Author: Alex Richardson