3 reasons why Avalanche (AVAX) price can double by March 2023

The latest AVAX price rally comes on the heels of Avalanche’s partnership with Amazon Web Services as the cryptocurrency market rebounds.

Avalanche (AVAX) has opened 2023 with a bang, rising nearly 55% in the first two weeks. And now, a mix of technical and fundamental indicators hints that the token will keep rallying into March.

AVAX price breakout underway

The AVAX/USD pair appears to have been forming a falling wedge pattern since May 2022 and has now entered the breakout stage of this pattern.

A falling wedge forms when the price trends lower inside a range defined by two converging, descending trendlines. The pattern resolves as the price breaks out of its range to the upside. As a rule of technical analysis, the price can rise as high as the distance between its upper and lower trendlines.

Applying the theory on AVAX’s falling wedge pattern brings the token’s breakout target at around $34, a 115% increase from current price levels.

Avalanche’s Amazon partnership

AVAX’s bullish setup appears as Ava Labs — the developer of the Avalanche network — becomes an official blockchain solution provider to Amazon Web Services (AWS).

Notably, the firm will implement new features that make it easier for developers to run an Avalanche node through the AWS Marketplace. Additionally, developers can create Avalanche subnets with a few clicks.

The partnership will increase Avalanche’s utility among enterprises and governments in a perfect scenario which, in turn, could boost demand for AVAX tokens. These prospects have helped the Avalanche token rise nearly 30% in a 24-hour adjusted timeframe.

Amazon partnership should get us this pump. Are you ready ? pic.twitter.com/6fCBZ6rbXo

— Crypto Bull ( Until 5th Sep 2025 ) (@holdersignals) January 11, 2023

Macro boosts bullish scenario

AVAX’s bullish falling wedge setup emerges amid improving macroeconomic fundamentals for riskier assets, which may benefit the crypto market in the coming months.

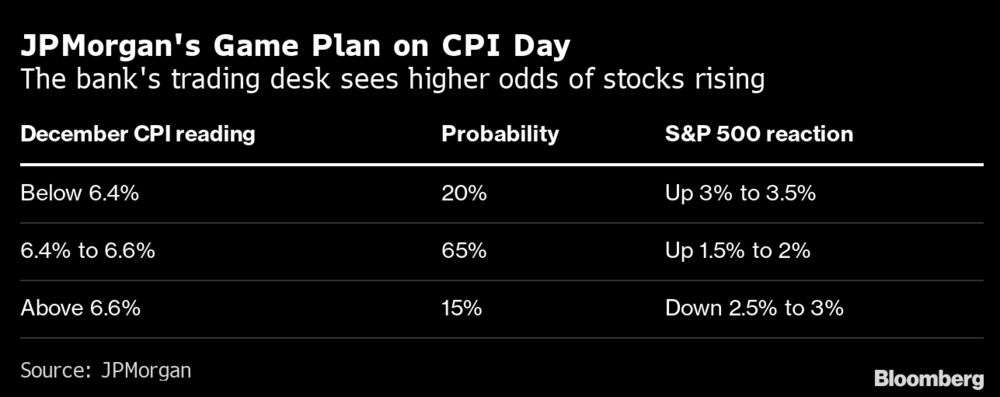

According to a Bloomberg survey, economists are positioned for a drop in the United States Consumer Price Index (CPI). Ideally, declining inflation may prompt the Federal Reserve to stop its interest rate hikes, which leaves investors with excess cash to invest in riskier markets.

The next CPI report will come out on Jan. 12. JPMorgan & Chase sees a 20% probability of the S&P 500 index rising by 3–3.5% if the December inflation figure comes in at 6.4%. The index could rise 1.5–2% if the inflation reading comes inside the 6.4–6.5% range, a scenario with a 65% possibility.

Thus, AVAX/USD could rise alongside the U.S. benchmark index on a lowered inflation reading, with a rally continuing at least until the Fed’s meeting on Jan. 31.

Downside risks remain

Meanwhile, AVAX shows signs of indecision near $15.75, a strong resistance level supported during the June to November 2022 session.

Related: Bitcoin price targets include new $14K dip as Fed’s Powell avoids inflation

If the price fails to close above the said resistance line decisively, the likelihood of a correction toward its next support line near $10.50 increases. The same level was instrumental as support in June to July 2021 session, as shown below.

In other words, AVAX risks a 35% drop from its current price levels, a move that could invalidate the falling wedge setup altogether.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Go to Source

Author: Yashu Gola