Chamber of Digital Commerce opposes SEC’s overreach in Binance lawsuit

United States-based advocacy group, the Chamber of Digital Commerce, claims the SEC employs the enforcement-based method to classify digital assets as securities and impose penalties on cryptocurrency businesses.

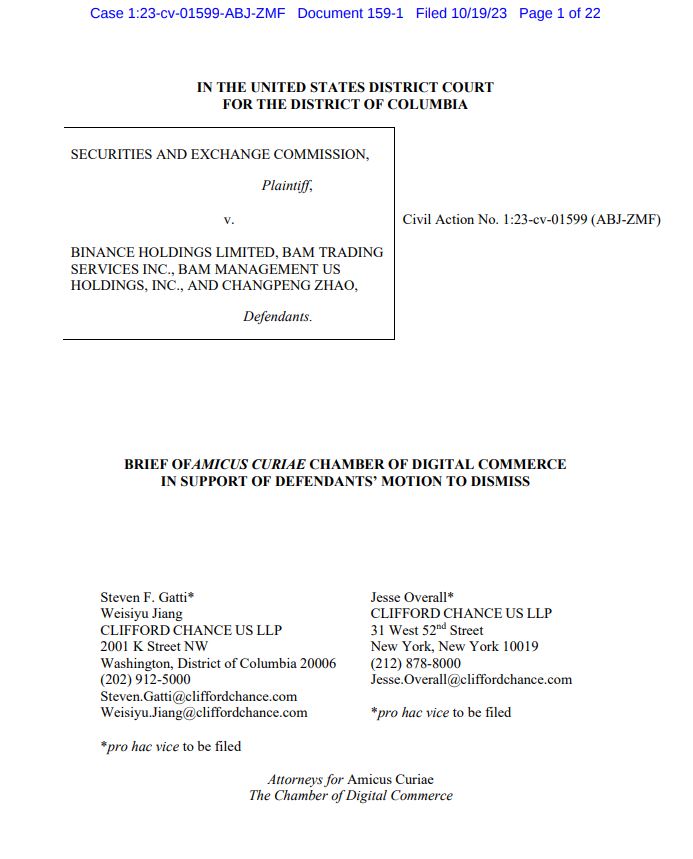

The United States-based Chamber of Digital Commerce has aligned with various digital assets firms, associations, legal experts and legislators in a collective effort to challenge the U.S. Securities and Exchange Commission (SEC) vs. Binance lawsuit.

According to a recently filed amicus brief, the advocacy group also seeks to thwart the SEC’s attempt to oversee the cryptocurrency sector without explicit authorization from the U.S. Congress and halt the SEC’s method of regulation through enforcement.

Cody Carbone, vice president of policy at the Chamber of Digital Commerce, stated:

“The SEC continues to try to regulate the entire digital asset ecosystem through enforcement actions, instead of issuing guidance or going through the proper notice and comment rulemaking channels. The enforcement actions are paralyzing the market and sending digital asset innovation overseas.”

The organization argues that the SEC employs the enforcement-based method to classify digital assets as securities and impose penalties on cryptocurrency businesses. It claims this approach hampers innovation and compels crypto companies to relocate abroad.

Furthermore, the Chamber states that the SEC lacks the congressional authority to oversee all digital assets as securities. While legislative bodies endeavor to establish a regulatory framework, the SEC’s actions pose risks to the industry and its stakeholders, it stated.

The organization has appealed to the court for the dismissal of the lawsuit based on various claims, such as the SEC exceeding its jurisdiction, digital assets not constituting investment contracts and token transactions not meeting the criteria for Exchange Act registration requirements.

Related: Chamber of Digital Commerce launches Digital Power Network miners’ coalition

Binance.US, along with Binance Holdings and Binance CEO Changpeng Zhao, recently submitted a motion to dismiss the lawsuit, asserting that the SEC has exceeded its jurisdiction. Binance.US has also criticized the SEC’s recent document discovery and deposition requests as “unreasonable.“

On Sept. 12, attorneys for BAM Trading Services, which operates the Binance.US cryptocurrency exchange, filed sealed documents in opposition to the SEC seeking additional details from Binance.US.

Magazine: Crypto regulation: Does SEC Chair Gary Gensler have the final say?

Go to Source

Author: Amaka Nwaokocha