Grayscale Ethereum ETF outflows hit record low of nearly $40 million

Key Takeaways

- Grayscale’s Ethereum ETF experienced its lowest daily outflow.

- Despite mixed performance, the nine ETFs collectively saw net inflows of $98 million on Wednesday.

Share this article

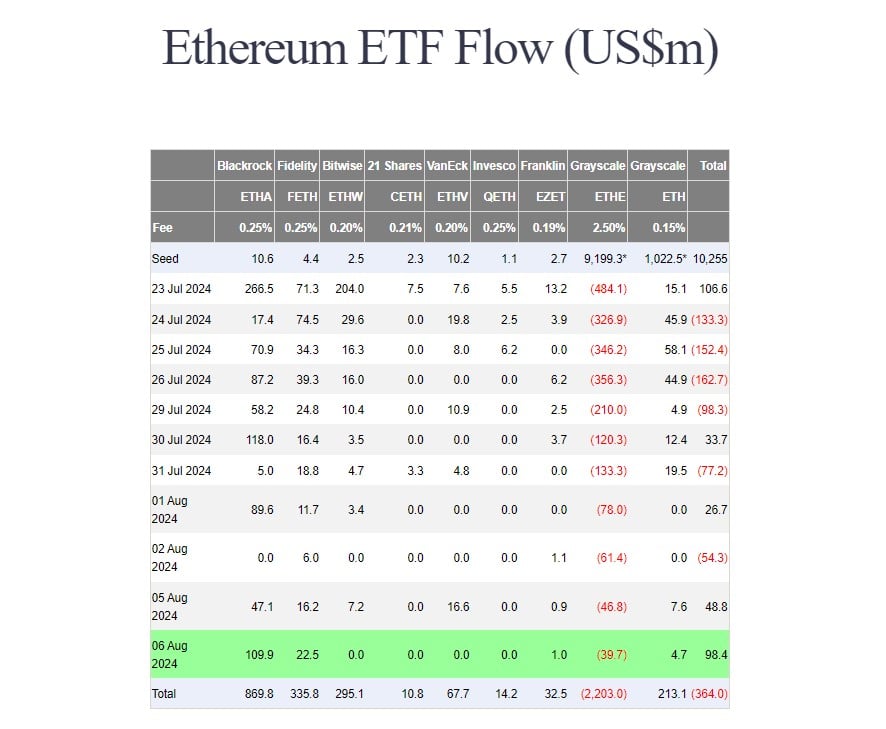

Around $40 million exited the Grayscale Ethereum Trust, now trading as an exchange-traded fund (ETF) on August 6, according to data from Farside Investors. This marks the lowest daily outflow since its conversion from a trust last month.

The daily pace of outflows from the fund, operating under the ETHE ticker, hit a peak of $484 million on its debut date. ETHE outflows topped $1.5 billion after the first week of trading.

However, the pace of exits has cooled since the start of this week. On Monday, ETHE reported over $61 million in net outflows, followed by approximately $47 million drained on Tuesday. With the new outflows reported on Wednesday, the total ETHE outflows have exceeded $147 million so far this week.

Previously, analyst Mads Eberhardts anticipated a slowdown in ETHE outflows this week. He also suggested a potential price increase after outflows stabilized.

US spot Ethereum ETFs are experiencing a mixed trend due to slower inflows into the majority of funds. BlackRock’s iShares Ethereum Trust (ETHA) has been the most successful among others in the group. The ETF ended Wednesday with almost $110 million in net inflows, bringing the total to nearly $870 million since its launch.

Overall, the nine funds took in a net $98 million in cash on Wednesday. Fidelity’s Ethereum (FETH) fund followed BlackRock with $22.5 million in inflows. Other gains were also seen in Grayscale’s Ethereum Mini Trust (ETH) and Franklin Templeton’s Ethereum ETF (EZET).

Share this article

Go to Source

Author: Vivian Nguyen