Binance.US coins trade at premium amid litigation fears, fiat gateway issues

Stablecoins such as USDT and USDC were trading for 3% to 4% higher than par value at the time of publication.

On June 7, multiple coins and tokens listed on Binance.US, the U.S. subsidiary of cryptocurrency exchange Binance, began deviating from their fair value to trade at premiums. Coins such as Bitcoin (BTC) and Ether (ETH) were priced at $27,445 and $1,911, respectively, compared to CoinMarketCap averages of $26,490 and $1,850.

Meanwhile, stablecoin tokens such as Tether (USDT) and USD Coin (USDC) broke their par value to trade at $1.03 and $1.04, respectively. The same day, Binance.US removed over a dozen USDT-based trading pairs, paused its over-the-counter trading portal, and limited the maximum trade amount of its buy, sell, and convert services to $10,000.

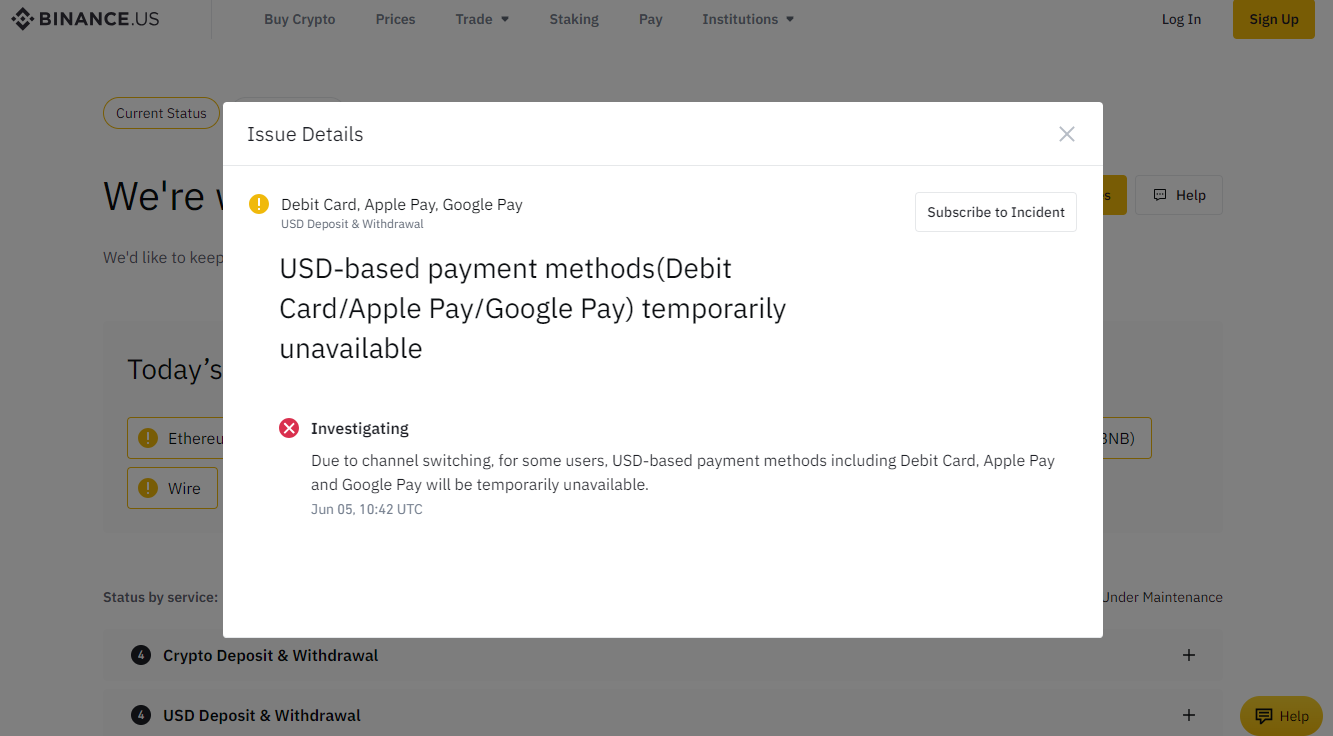

In addition, according to its support page, Binance.US wire deposits were stated as “temporarily unavailable,” while withdrawals are “functioning normally.” However, the exchange also stated that U.S. dollar-based payment methods, including debit cards, Apple Pay, and Google Pay, were also temporarily available for some users due to “channel switching.”

Aside from funding issues, investors were also stirred by a U.S. Securities and Exchange Commission (SEC) emergency motion to freeze Binance.US’ assets and repatriate funds held by U.S. customers. In response, Binance staff wrote:

“User assets remain safe and secure and the platform continues to be fully operational with deposits and withdrawals functioning as normal.”

On June 5, the SEC sued Binance, alleging the operations of an unregistered exchange in the U.S. along with the sale of unregistered securities. The commission also accused the exchange of “commingling” and “diverting” investors’ funds. Changpeng Zhao, CEO of Binance, received a civil summons to respond to the allegations on June 7.

Magazine: US and China try to crush Binance, SBF’s $40M bribe claim

Go to Source

Author: Zhiyuan Sun