Bitcoin ETF outflows signal shifting sentiment — Farside Investors

Share this article

Bitcoin exchange-traded funds (ETFs) experienced a minor outflow of $4.3 million on April 18, marking the fifth consecutive trading day of outflows, according to data from Farside Investors, an investment management firm based in London.

However, this outflow was the smallest among the previous five trading days, potentially signaling a change in investor sentiment.

Grayscale’s GBTC, the largest Bitcoin ETF by assets under management, saw outflows of $90 million on April 18, bringing its total outflows to $16.68 billion. The fund’s average daily outflow of $245.4 million hasn’t been reached since April 8, suggesting a deceleration in outflows.

This slowdown in outflows could be attributed to a growing sense of regulatory clarity and the potential for more countries to follow the lead of nations like El Salvador and the Central African Republic in adopting Bitcoin as legal tender.

By contrast, several other Bitcoin ETFs experienced inflows on the same day. BlackRock’s IBIT and Fidelity’s FBTC saw inflows of $18.8 million and $37.4 million, respectively, while BITB, ARKB, and HODL also witnessed inflows, indicating a growing breadth of interest among investors.

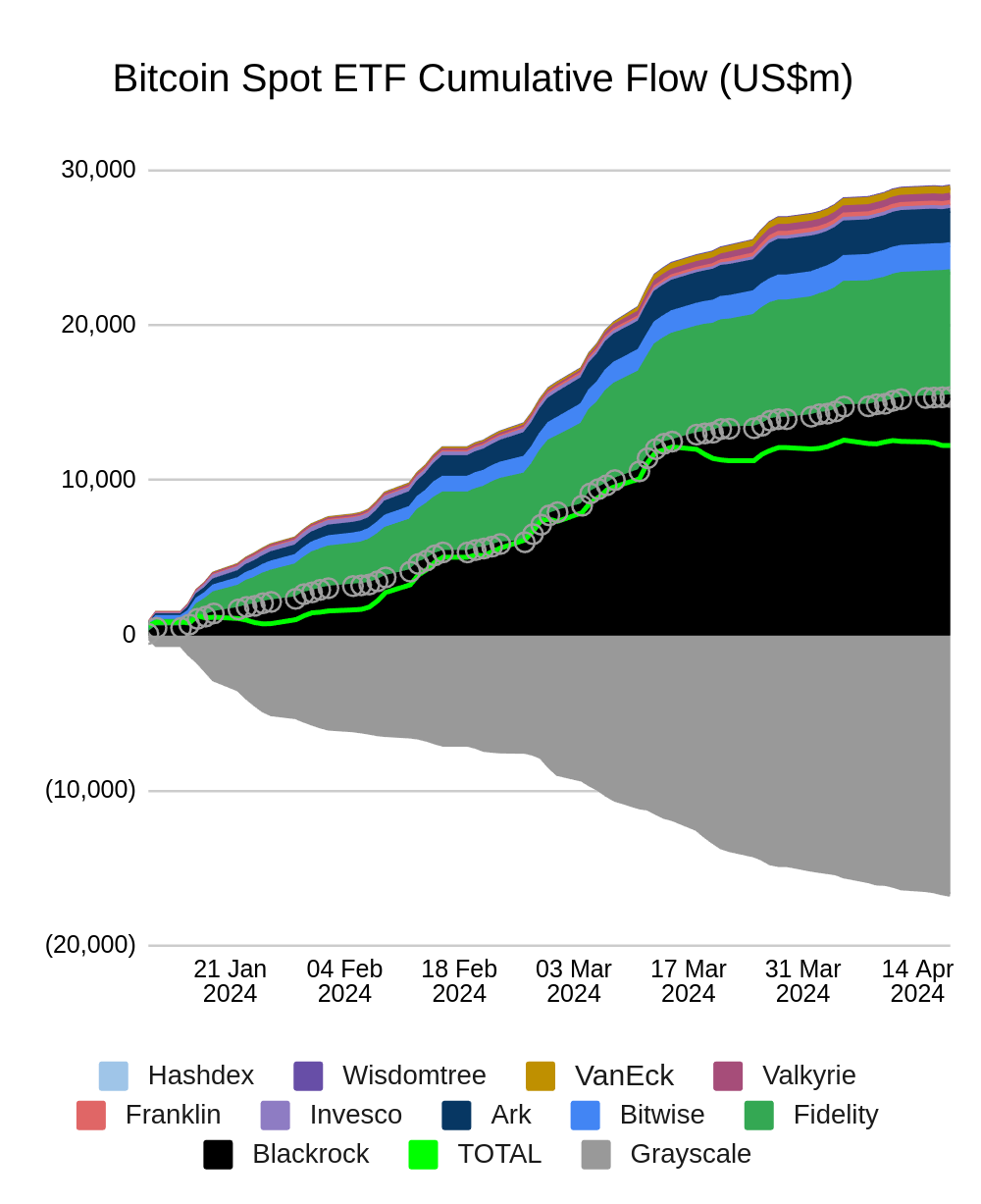

According to the Bitcoin Spot ETF Cumulative Flow chart, which spans from January 21, 2024, to April 14, 2024, the total cumulative inflow of Bitcoin Spot ETFs has reached approximately $27 billion. The chart reveals that Grayscale’s GBTC has been the dominant player, accounting for a substantial portion of the total inflow. Other notable ETFs include Valkyrie, Bitwise, Fidelity, BlackRock, VanEck, Ark, Invesco, WisdomTree, and Franklin.

The cumulative inflow experienced steady growth from January to mid-March 2024, followed by a more rapid increase in the second half of March. However, the growth appears to have slowed down in early April. The chart provides a comprehensive overview of the relative performance and market share of various Bitcoin Spot ETFs, highlighting the significant growth in institutional interest and investment in Bitcoin through regulated investment vehicles.

Despite the mixed variances for the flows, Bitcoin ETFs have collectively attracted $12.27 billion in net inflows since their inception, as per Farside’s data. The total inflows across all Bitcoin ETFs amounted to $15.39 billion, with an average daily inflow of $226.3 million.

This diversity in ETF flows suggests that institutional investors are increasingly viewing Bitcoin as a viable asset class, despite the regulatory uncertainties that persist in many jurisdictions, Farside’s analysis shows.

Share this article

Go to Source

Author: Vince Dioquino