DeFi and Web3 gaming dominate blockchain industry in Q1

Share this article

Decentralized finance (DeFi) has emerged as a dominant force in the blockchain space, surpassing stablecoins in daily transactions and concluding the first quarter with approximately 7 million daily transactions, reveals the “OnChain Report Q1 2024” by QuickNode and Artemis. All major DeFi protocol categories, including Liquid Staking, Lending, Bridges, Yield, and Derivatives, have seen their total value locked (TVL) increase two to threefold during Q1 2024.

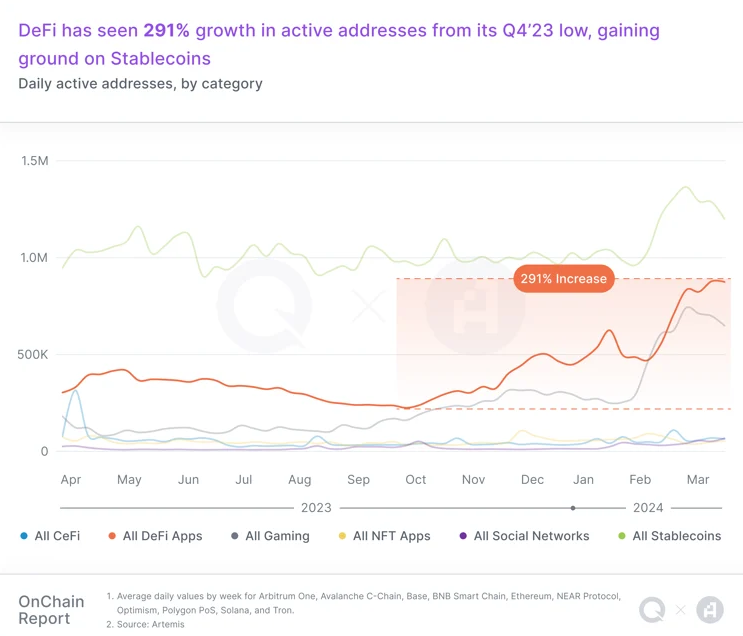

The first quarter marked the beginning of what the report calls ‘DeFi Summer part 2,’ with a staggering 291% quarter-over-quarter (QoQ) increase in user activity. This resurgence has sparked optimism and a strategic shift in the DeFi landscape, despite regulatory challenges from the SEC.

In parallel, Web3 gaming has not only surpassed stablecoins in transaction volume but has also become the fastest-growing category year-over-year. The sector has experienced a 155% QoQ jump in active addresses, indicating a significant rise in player engagement and a testament to Web3’s capacity to attract and retain players.

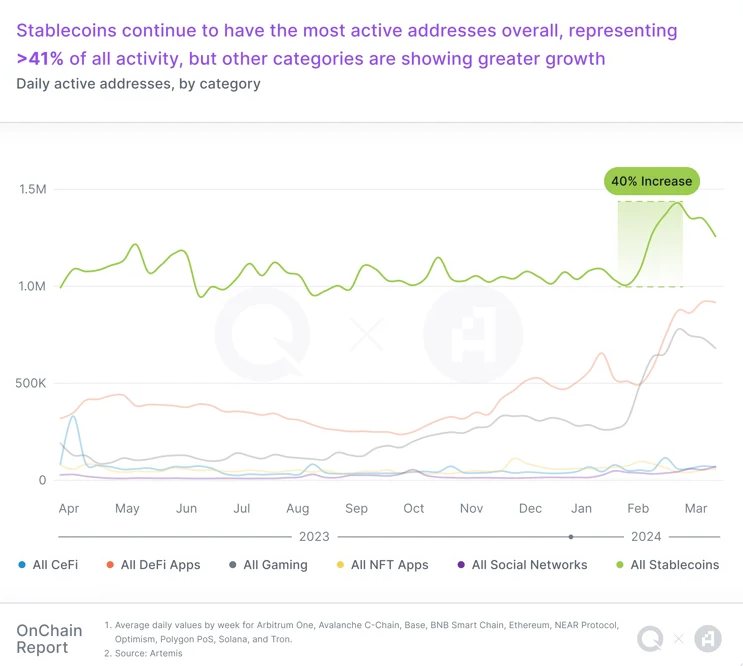

However, stablecoins are still the most active sector in blockchain for the fifth consecutive quarter, with over 41% of the activity related to addresses interacting with those assets and a 42% QoQ increase in this metric. Factors contributing to this surge include the approval and listing of spot Bitcoin exchange-traded funds (ETFs), the upcoming Bitcoin halving in April, an exodus from hyperinflated fiat currencies, and the revival of DeFi.

Layer-2 blockchains have also seen remarkable growth, with platforms like Arbitrum and Base doubling their TVL, signaling a continued interest in expanding on-chain liquidity.

Decentralized social platforms, while smaller in scale, have experienced a 425% QoQ growth in daily active addresses, offering users more control over their data and a stake in the platforms’ success.

Share this article

Go to Source

Author: Gino Matos