GRT has turned technically overbought, but its long-term potential remains skewed to the upside, thanks to healthy network fundamentals.

The Graph (GRT) price slipped on Feb. 8 alongside a broader correction across the top crypto assets.

GRT price skyrockets wi other data management tokens

GRT price plunged nearly 14.5% intraday to $0.18, showing signs of short-term upside exhaustion after rising over 200% earlier in the year. At its sessional high, the token was changing hands for $0.23 on Feb 7, its highest level in nine months

Buy flocked into the GRT market amid a relatively stronger risk-on mood, led by the Federal Reserve's slower interest rate hikes and a strong recovery witnessed in the Bitcoin (BTC) market, which typically influences altcoins into tailing the trend.

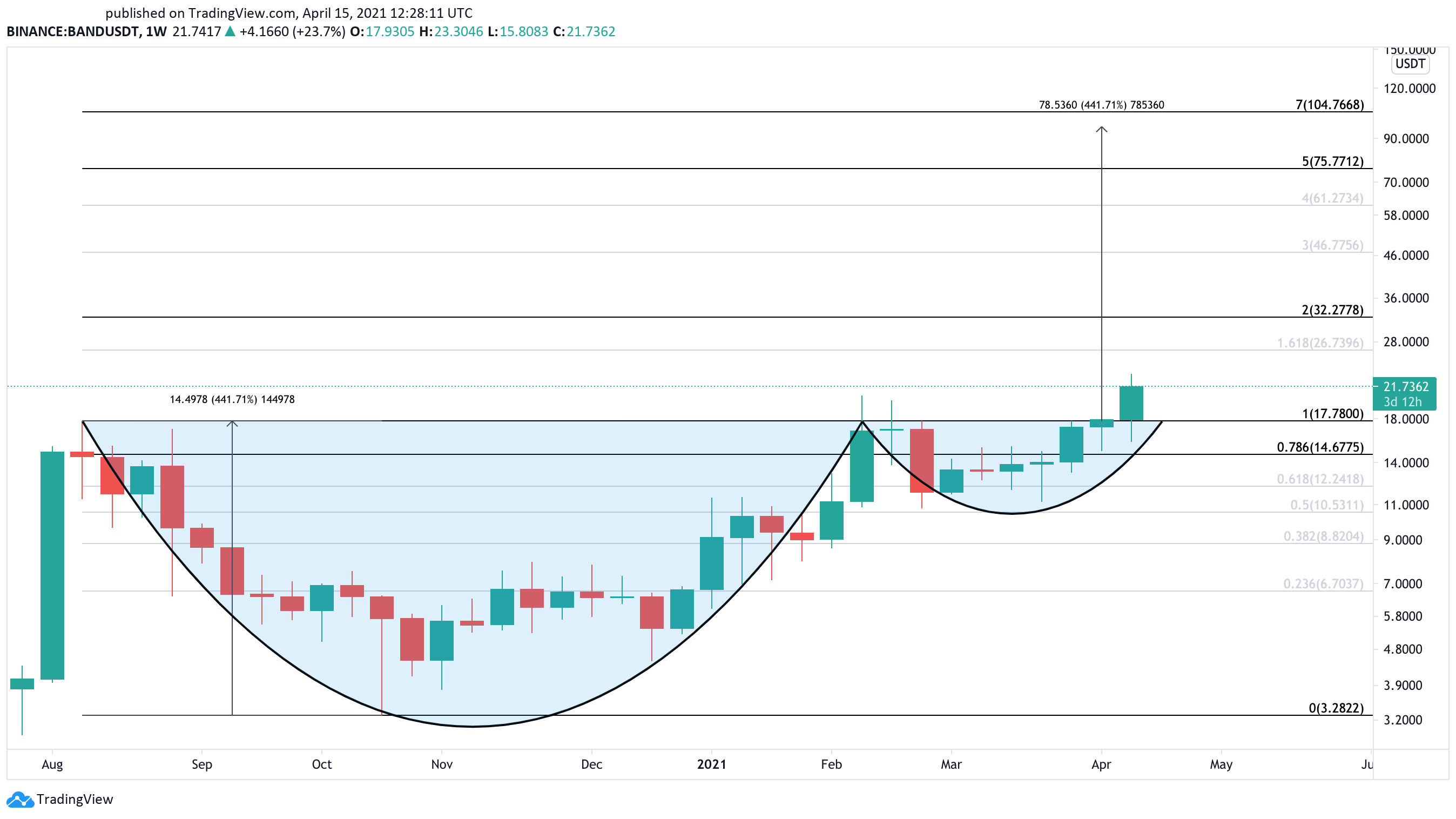

The GRT price rally also accompanied similar gains across data management platform tokens. This sector's market capitalization doubled so far in 2023, with Ocean Protocol (OCEAN), Mask Network (MASK), and Band Protocol (BAND) recording over 200%, 100%, and 60% gains, respectively.

Will The Graph's price correction continue?

The impressive GRT price rally has left The Graph as technically overbought, according to its daily relative strength index (RSI) indicator.

Notably, the daily RSI has exceeded 70, which traditional analysts consider an "overbought" signal. This typically leads to upside exhaustion, followed by consolidation or a significant price correction.

In either case, GRT's overbought status risks plunging its price by 30% in the next month to $0.13, a support level from the May-June 2022 consolidation session. The line also appears near the GRT/USD pair's 200-day exponential moving average (200-day EMA; the blue wave) near $0.11.

Nevertheless, from a fundamental perspective, GRT looks stronger due to its healthy network metrics.

For instance, The Graph recorded 66% quarter-over-quarter growth in its revenue from query fees in Q4 2022 due to the migration of subgraphs from its hosted service to the decentralized network (mainnet) in and after March 2022.

The Graph ecosystem involves two key players: on-chain API (or subgraph) developers and data consumers. Data consumers pay subgraph developers a fee to obtain data from blockchains, called query fees. This fee is paid in GRT tokens.

"Query fees should continue to increase as more subgraphs are migrated to mainnet in the coming quarters," noted Mihai Grigore, a researcher at Messari, in his quarterly report on the project, adding:

"This increase in volume may attract more key participants to the protocol as it drives profitability for existing ones."

Related: Blockchain indexer The Graph says adoption is still strong 2 years after mainnet launch

As a result, GRT's long-term bias could remain skewed toward the bulls. Moreover, independent analyst Altcoin Sherpa anticipates a strong bounce after The Graph token tests $0.13 as support.

"I'll just wait for a consolidation or dip and buy," he wrote, adding:

"You're going to look for stuff like this at .13 on lower TFs; some consolidation before another leg. Given how badly this one got rekt, I think it has more left in the tank. Insane volume."

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.