Four stablecoins have reduced their supplies this month, while the stablecoin token TrueUSD (TUSD) has seen its supply jump 110% higher over the last 30 days. TUSD resides natively on four different blockchains. The number of Ethereum-based TUSD rose 27%, while the number of Tron-based TUSD stablecoins increased by 218%. TUSD Supply Swells, Tron-Issued Stablecoins […]

Four stablecoins have reduced their supplies this month, while the stablecoin token TrueUSD (TUSD) has seen its supply jump 110% higher over the last 30 days. TUSD resides natively on four different blockchains. The number of Ethereum-based TUSD rose 27%, while the number of Tron-based TUSD stablecoins increased by 218%. TUSD Supply Swells, Tron-Issued Stablecoins […]

Binance’s BNB Chain (BNB) outperformed other Ethereum (ETH) competitors in the second quarter of 2022, according to crypto insights firm Messari. In a new analysis, Messari notes the BNB Chain has had a “breakout year” in terms of its non-fungible tokens (NFT) sector with the chain witnessing exponential growth in its NFT secondary sales volume […]

The post BNB Chain Outran Other Ethereum Competitors in Several Metrics During Q2: Insights Firm Messari appeared first on The Daily Hodl.

The native token of a decentralized exchange (DEX) is heating up after news broke that it was receiving an investment from the venture capital wing of crypto behemoth Binance. Today, Binance Labs announced it has invested an undisclosed amount in PancakeSwap (CAKE). Binance says the investment will provide both technological and marketing support as part […]

The post Binance Triggers Rally for Decentralized Finance Altcoin With Announcement of Strategic Investment appeared first on The Daily Hodl.

Steady ecosystem growth, institutional investment and a healthy derivatives market are strong signals that SOL will continue to be a top contender in 2022.

Solana (SOL) has become a top contender in the smart contract industry and in the past year, the network's total value locked (TVL) grew by $660 million and stretches across more than 40 decentralized applications to hit an all-time high above $11 billion.

Even with this growth, investors have reason to question whether the current $56 billion market capitalization is justified and how it compares to competing networks like Binance Smart hain (BNB), Avalanche (AVAX) and Polygon (MATIC).

By analyzing the past six-month price performance, there's an apparent decoupling from Terra (LUNA), Solana and Avalanche when compared to other smart contract platform competitors.

Solana's market capitalization is more than double that of Avalanche and Terra, each of which has a $26 billion market cap. Searching Solana's latest news on Cointelegraph yields an exciting array of institutional investments, ranging from the $314 million private token sale by Solana Labs in June, to an $18 million fundraise in September by Solana's DEX project Orca.

There's solid evidence of a growing ecosystem judging by investor appetite. However, to understand how successful Solana's scalability solution is, we have to evaluate its usage metrics.

Looking at the number of active addresses on Solana's DApps is a good place to start.

Ethereum's leading DApp by active addresses is Uniswap, which has 188,200. Therefore, Raydium’s 97,600 weekly users is rather impressive, considering it was launched just 10 months ago. Meanwhile, back in Feb. 2021, Uniswap already held over $4.3 billion TVL.

As for Solana’s NFT marketplace Magic Eden, its 58,400 weekly active addresses also account for more than half of Ethereum’s OpenSea, the sector’s absolute market leader in volume and users activity.

Avalanche user activity is highly concentrated on the Trader Joe decentralized finance app, but its $715 million weekly volume pales in comparison to Uniswap’s $22.1 billion or Raydium’s $12.5 billion. The same can be said by Polygon, which has $573 million in trading activity at its QuickSwap DEX.

Solana currently holds the third largest futures open interest, which is the most relevant metric in derivatives contracts. This indicator aggregates the total number of contracts held by market participants regardless of the recent trading activity.

Despite the sharp drop since the Nov. 8 peak at $1.9 billion, the current $860 million futures open interest ranks Solana the third derivatives market by size. For example, Binance Coin (BNB) futures holds $520 million, followed by Terra (LUNA) with $430 million.

Undoubtedly, there's an impressive amount of activity coming from Solana's on-chain data and derivatives markets. The network’s TVL increased by 15x over the past six months and Solana's DApps users is nearly half the amount of users on the Ethereum network.

Solana seems to be quickly closing the gap in three important metrics: TVL, active users and derivatives markets. Competitors like Terra, Avalanche and Polygon seem a long way behind, which possibly justifies the market capitalization premium.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

During the last few months, cross-chain bridge technology has grown a great deal and users can now swap assets between a myriad of networks. Today, between eight different bridges there’s $7.6 billion total-value locked across these platforms. Cross-Chain Bridges There’s a decent quantity of cross-chain blockchain bridges these days and it has allowed users to […]

During the last few months, cross-chain bridge technology has grown a great deal and users can now swap assets between a myriad of networks. Today, between eight different bridges there’s $7.6 billion total-value locked across these platforms. Cross-Chain Bridges There’s a decent quantity of cross-chain blockchain bridges these days and it has allowed users to […] For quite some time now cryptocurrency traders have been leveraging bitcoin-based assets tethered to alternative blockchains. Mid-May statistics show there’s more than 299,000 bitcoin, worth over $12.8 billion today, tied to wrapped or synthetic bitcoin projects hosted on Ethereum or the Binance Smart Chain. Layer 2 and Sidechain Competitors Command $251 Million in Bitcoin Value […]

For quite some time now cryptocurrency traders have been leveraging bitcoin-based assets tethered to alternative blockchains. Mid-May statistics show there’s more than 299,000 bitcoin, worth over $12.8 billion today, tied to wrapped or synthetic bitcoin projects hosted on Ethereum or the Binance Smart Chain. Layer 2 and Sidechain Competitors Command $251 Million in Bitcoin Value […]Speculation mounts around Binance as some believe it could become the world’s leading settlement layer. However, new research reveals high centralization levels in Binance Smart Chain, which might affect BNB’s price action.

Binance’s native token, BNB, has enjoyed an impressive bull rally since the beginning of the year. The utility token has posted year-to-date returns of over 1,600%, going from $37.40 to a new all-time high of $640.50.

The upward price action allowed it to become one of the top-performing cryptocurrencies in Q1 2021

As speculation mounts, large investors have been adding more tokens to their portfolios. On-chain data shows that a significant number of addresses with millions of dollars in BNB, colloquially known as “whales,” have joined the network over the past two months.

Roughly ten new addresses holding 100,000 to 1,000,000 BNB have been created since early February, representing a 33.33% increase in that period.

The rising number of Binance Coin whales may seem insignificant at first glance. However, seeing as these whales hold between $60 million and $600 million in BNB, the sudden spike in buying pressure could translate into millions of dollars.

The increasing demand for Binance Coin has been fueled by the success of Binance Smart Chain (BSC). Transaction volumes have tripled those on the Ethereum blockchain, making some industry leaders believe this protocol will become the world’s main settlement layer.

Despite the hype around BNB, a recent report reveals high centralization levels among the 21 BSC validators.

According to Ryan Watkins, senior research analyst at Messari, each BSC validator seems to be “some way connected or tied to Binance.” The way every new block is produced shows that validators take turns in a “seemingly predefined order.”

Such behavior leads Watkins to believe that there isn’t any “stake-weighted mechanism” running on the Binance protocol.

“The reason why BSC is faster and more scalable is not because of some magical technological innovation. No, it’s instead the magic of centralization. BSC is an Ethereum fork with a centralized validator set. That’s it. Nothing more,” said Watkins.

Even though cheap and faster transactions have made BSC undoubtedly preferable, the lack of censorship resistance may come at a higher cost.

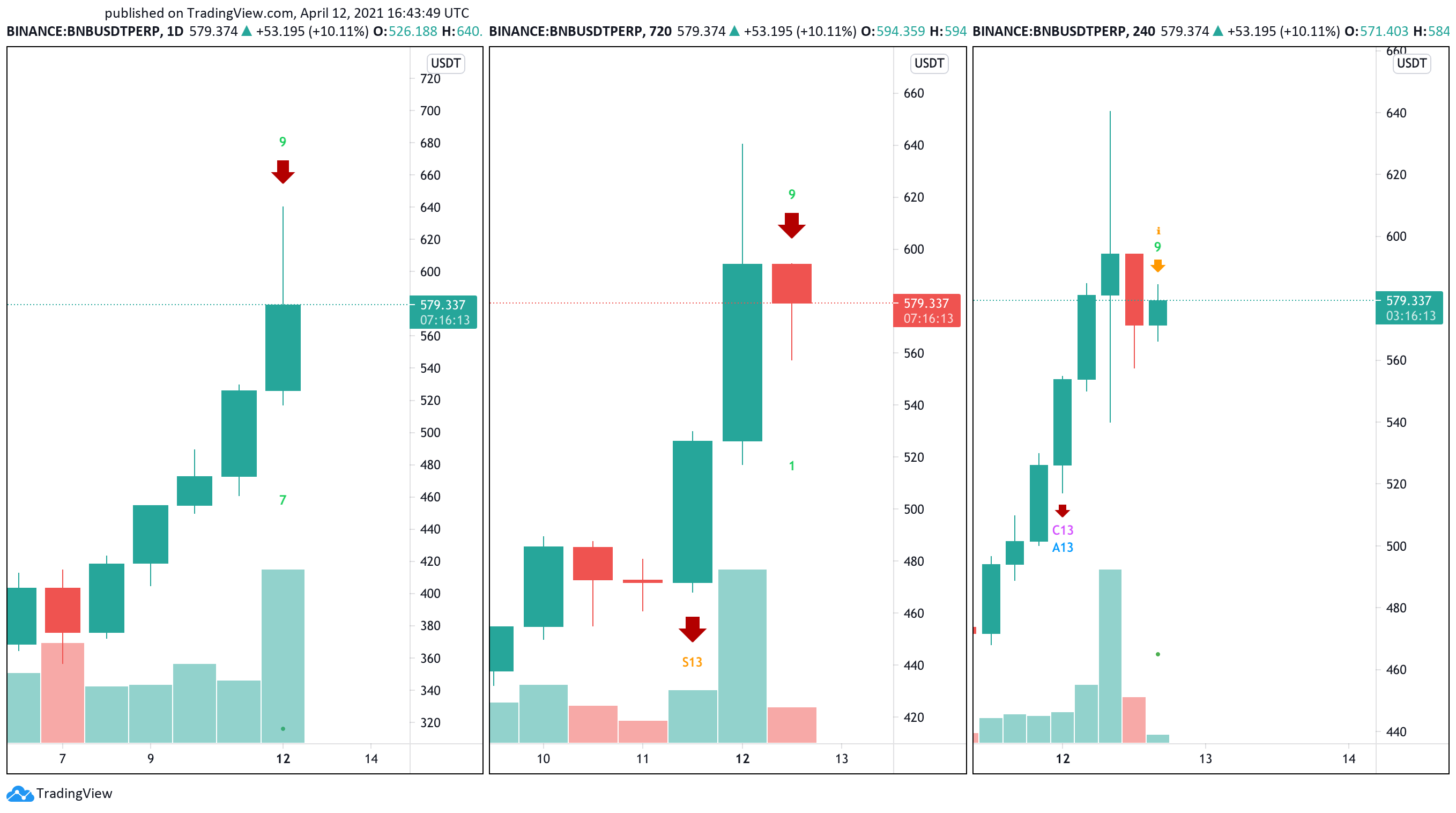

Binance Coin seems to be preparing for a retracement following its recent rise to new all-time highs.

The Tom DeMark (TD) Sequential indicator currently presents sell signals in the form of green nine candlesticks on BNB’s 1-day, 12-hour, and 4-hour chart. The emergence of these bearish formations across multiple timeframes is quite pessimistic for this cryptocurrency’s near-term price action.

If validated, Binance Coin could enter a one to four daily candlesticks correction before the uptrend resumes. Breaking below the $540 support level could push the utility token toward the next interest areas at $450 or $380.

Given the substantial increase in upward pressure that BNB has seen over the last few months, the bullish outlook cannot be disregarded.

Slicing through the recent high of $640.50 may generate FOMO among market participants, pushing prices to $750 or even $800.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

To date, Binance Coin has rallied 900%, which makes the token’s $64 billion market cap larger than Santander, the Bank of Montreal and UBS.

2021 has been an impressive year for Binance Coin (BNB), which so far has rallied by more than 900%.

One of the primary drivers of BNB's growth was continued congestion on the Ethereum network. As this struggle carried on, Binance Smart Chain (BSC) emerged as an alternative, meeting the rapidly growing decentralized finance (DeFi) sector's demands.

As BNB reached a $64 billion market capitalization, it has surpassed traditional banks, including Santander, the Bank of Montreal, and UBS. Meanwhile, some analysts point to the estimated value and impact of Coinbase's upcoming direct listing ($100-billion valuation) as a catalyst for the BNB price hike.

Binance financials are better than coinbase $BNB

— Yaz (@YazTrades) April 6, 2021

Coinbase valuation 80-100 billion on NASDAQ listing

Quarterly burn

Can participate in $TKO launchpad

Can farm $TLM for 30 days #BSC ecosystem growing at a rapid pace

Estimated valuation for me is 80 bill+

Current = 62B

A common narrative spun up over the past few weeks is that the direct listing of COIN is also adding value to centralized exchange tokens. Analysts are also speculating that other U.S.-based regulated exchanges like Kraken and Gemini will likely follow Coinbase's path and attempt to raise funds through a stock offering.

To understand BNB's potential, one must first understand the differences between equities (stocks). After this is cleared up, it will be possible to analyze the possible drivers of BNB's appreciation.

BNB token provides holders with a discount on trading fees, and it is required for those wishing to participate in Binance Launchpad token sales. As BNB gained liquidity, it also became a base pair for other cryptocurrencies at Binance exchange.

Over time, other uses emerged as the Binance Smart Chain gained traction. For example, BNB can cover network fees and as serve as a utility token in the ecosystem, which includes decentralized apps (dApps) and games.

Periodically Binance burns (destroys) some of the non-circulating BNB tokens based on the exchange's overall trading volume. This strategy's efficacy vanished over time as investors understood that these destroyed tokens never entered the circulating supply.

The Binance Smart Chain network uses a Proof of Stake Authority which eliminates the need for miners or expensive transaction fees. The platform kept its compatibility with the Ethereum Virtual Machine (EVM) and has a similar token and smart contract structure.

Many tokenized (or pegged) cryptocurrencies have gained relevance in Binance's networks, allowing users to bypass miner fees. Another benefit provided by Binance Smart Chain's BEP-20 model is staking and farming capabilities in its vast network of decentralized applications, including the PancakeSwap DEX and Venus lending platform.

As shown above, Binance Smart Chain has been gaining ground on other DeFi protocols in terms of total value locked. Thus, new use cases for the BNB token emerged to take center stage as farming, liquidity pools, and base pairs utilized the token throughout the network.

Equity shareholders are entitled to a piece of a listed companies' net earnings. This amount will vary between each quarter, as the board of directors may opt to repay debt or incorporate some of that money into reserves. However, banks are known cash cows and thus usually a reliable source of dividends payouts.

Santander (SAN) dividends paid over the last 12 months divided by the current stock price yield a 3.7% gain, and Bank of Montreal (BMO) shareholders received a similar yield. Switzerland-based UBS yields went down in 2020, but historically it has averaged 5%.

Bank shareholders effectively have voting rights in shareholders meetings, and minority groups could block measures that would hurt them financially. On the other hand, these equity holders are 100% dependent on the bank's net income and growth.

BNB, on the other hand, could survive without the direct influence of Binance exchange. In the future, if Binance Smart Chain achieves independent developers and validators, its ecosystem might continue to thrive. In theory, if token loses its dependency as the ecosystem grows, becoming less centralized.

If done correctly, BNB's market capitalization could surpass that of the entire traditional banking system, but before this can happen these networks and decentralized applications need to gain adoption and prove that they can stand up to the needs of mainstream investors and banking clients.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.