The crypto enterprise Coinbase, rooted in San Francisco, experienced an influx of online visits that surpassed the tenfold increase anticipated by their projections. Brian Armstrong, the CEO of Coinbase, shared updates about the heightened traffic following the exchange’s operational hiccups, which coincided with bitcoin’s climb to $64,000 on Wednesday. Coinbase Traffic Spike Surpasses Expectations Coinbase, […]

The crypto enterprise Coinbase, rooted in San Francisco, experienced an influx of online visits that surpassed the tenfold increase anticipated by their projections. Brian Armstrong, the CEO of Coinbase, shared updates about the heightened traffic following the exchange’s operational hiccups, which coincided with bitcoin’s climb to $64,000 on Wednesday. Coinbase Traffic Spike Surpasses Expectations Coinbase, […]

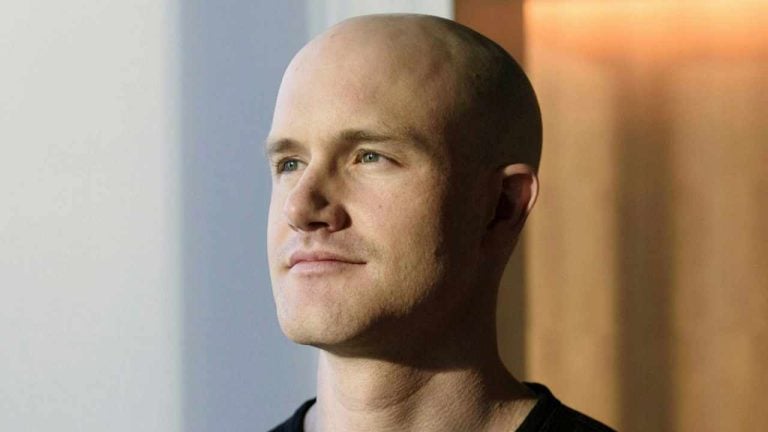

Coinbase CEO Brian Armstrong said decentralization and open-sourcing AI is a better alternative to regulating the space.

Brian Armstrong, the CEO of crypto exchange Coinbase, expressed his stance on artificial intelligence (AI) regulation in a recent post on the social media platform X (formerly Twitter).

On Sept. 23, Armstrong explained that he believes that AI should not be regulated. According to the Coinbase CEO, the AI space needs to develop as soon as possible because of reasons such as national security. In addition, Armstrong also noted that despite the best intentions of regulators, regulation “has unintended consequences,” arguing that it kills innovation and competition.

Count me as someone who believes AI should not be regulated

— Brian Armstrong ️ (@brian_armstrong) September 22, 2023

We need to make progress on it as fast as possible for many reasons (including national security). And the track record on regulation is that it has unintended consequences and kills competition/innovation, despite best…

The Coinbase executive cited the internet as an example. Armstrong believes there was a “golden age of innovation” on the internet and software because it was not regulated. The Coinbase CEO suggested the same should be applied to AI technology.

Furthermore, Armstrong also presented an alternative to regulation in terms of protecting the AI space. According to the executive, it would be better to “decentralize it and open source it to let the cat out of the bag.”

Related: Tether acquires stake in Bitcoin miner Northern Data, hinting at AI collaboration

Meanwhile, various jurisdictions across the globe have either started to regulate AI or express concerns about its potential effects. On Aug. 15, China’s provisional guidelines for AI activity and management came into effect. The regulations were published on July 10 and were a joint effort between six of the country’s government agencies. This is the first set of AI rules implemented within the country amid the recent AI boom.

In the United Kingdom, the competition regulator studied AI in order to identify its potential impact on competition and consumers. On Sept. 18, the U.K.’s Competition and Markets Authority concluded that while AI has the potential to change people’s work and lives, the changes may happen too fast and could have a significant impact on competition.

Magazine: ‘AI has killed the industry’: EasyTranslate boss on adapting to change

Brian Armstrong said that voting yes to the bill would protect innovation and national security in the United States.

Coinbase CEO Brian Armstrong has urged United States citizens to take action and email their representatives to vote “yes” on the Financial Innovation and Technology for the 21 Century Act (FIT21), which may provide regulatory clarity for crypto.

On July 26, lawmakers voted in favor of FIT21 and the Blockchain Regulatory Certainty Act. The bills are expected to deliver clarity for crypto firms, including setting the differences in jurisdiction between securities and commodities regulators in the country.

In a tweet, Armstrong said that as the voting will continue the next day, Americans have the ability to urge their representatives to vote “yes” to FIT21. According to the Coinbase CEO, the bill would still evolve during the legislative process. However, the Coinbase CEO believes that this is a vote that would protect Americans’ digital assets, innovation and national security.

Important action you can take to protect the value of your crypto in America:

— Brian Armstrong ️ (@brian_armstrong) July 27, 2023

Today, two House committees started voting to take an important step on legislation that will create regulatory clarity for crypto. They will continue tomorrow. The bill will evolve during the…

Furthermore, Coinbase said that apart from protecting consumers and strengthening national security, it also has the potential to “promote job opportunities” in the country. This suggests that U.S.-based crypto companies looking at other jurisdictions may decide to keep their businesses within the country and continue to employ local talent.

Related: UAE infrastructure for crypto is more ‘business-friendly’ than the US, says exec

Earlier this year, various crypto companies decided to test out different areas of the world that may be a good fit amid the regulatory uncertainty in the US. On May 8, Armstrong visited the United Arab Emirates to test its potential as a strategic hub for Coinbase. On May 26, crypto exchange Gemini picked Ireland as a headquarters for its European operations amid what industry observers dubbed as a "war on crypto" happening in the US.

Despite the difficulties in the US, Coinbase continued its efforts to engage with U.S. regulators throughout the year. On Feb 13, the Coinbase CEO invited regulators to chat about crypto and get ice cream in Washington D.C. On July 19, Armstrong reportedly met with members of Congress behind closed doors to discuss digital asset legislation.

Opinion: GOP crypto maxis almost as bad as Dems’ ‘anti-crypto army’

Coinbase CEO Brian Armstrong has called on Congress to pass clear crypto legislation, warning that the U.S. risks losing its status as a financial hub. “Crypto is open to everyone in the world and others are leading,” the executive stressed. Coinbase’s CEO on Cryptocurrency Regulation The CEO of the Nasdaq-listed cryptocurrency exchange Coinbase (Nasdaq: COIN), […]

Coinbase CEO Brian Armstrong has called on Congress to pass clear crypto legislation, warning that the U.S. risks losing its status as a financial hub. “Crypto is open to everyone in the world and others are leading,” the executive stressed. Coinbase’s CEO on Cryptocurrency Regulation The CEO of the Nasdaq-listed cryptocurrency exchange Coinbase (Nasdaq: COIN), […] According to Coinbase CEO Brian Armstrong, as of Sept. 30, 2022, the company holds 2 million bitcoin worth $39.9 billion. The news Armstrong shared comes at a time when the general public is looking directly at exchange balances following FTX’s turbulent collapse. Coinbase Co-Founder Shares Company’s Q3 Shareholder Letter — Says as of Sept. 30, […]

According to Coinbase CEO Brian Armstrong, as of Sept. 30, 2022, the company holds 2 million bitcoin worth $39.9 billion. The news Armstrong shared comes at a time when the general public is looking directly at exchange balances following FTX’s turbulent collapse. Coinbase Co-Founder Shares Company’s Q3 Shareholder Letter — Says as of Sept. 30, […] Amid the crypto market carnage, the digital currency exchange Coinbase revealed it has decided to lay off 18% of its workforce. The announcement follows the company’s original plans to slow the hiring process and the firm rescinding a number of employment offers. Coinbase ‘Grew Too Quickly,’ Crypto Exchange CEO Says On June 14, Coinbase published […]

Amid the crypto market carnage, the digital currency exchange Coinbase revealed it has decided to lay off 18% of its workforce. The announcement follows the company’s original plans to slow the hiring process and the firm rescinding a number of employment offers. Coinbase ‘Grew Too Quickly,’ Crypto Exchange CEO Says On June 14, Coinbase published […]

“There are so many customers beating a path to our door that we have to have all hands on deck just to keep everything running,” Coinbase CEO Brian Armstrong explained on earnings call.

Cryptocurrency exchange Coinbase has disclosed its first net loss as a public company of $430 million in Q1, but CEO Brian Armstrong said on an earnings call that he's “never been more bullish on where we are as a company.”

In its first quarter 2022 report Coinbase disclosed that revenue had dropped 27% to $1.17 billion, down from $1.6 billion in the first quarter of 2021 and a long way off its Q4 2021 revenue of $2.5 billion. Monthly transacting users also dropped by over 19% to 9.2 million, from last quarter's 11.4 million.

Shares of Coinbase had already fallen by over 16% to close at $73 over the day, and after the earnings disclosure after hours trading saw the price fall further to $61 at the time of writing. Coinbase's shares have been on a steady fall since November 2021 where it almost reached the $380 high from its initial public offering in April last year.

Despite the figures, Armstrong explained why he was still optimistic on an earnings call:

“There are so many customers beating a path to our door that we have to have all hands on deck just to keep everything running, so the down periods are often sometimes kind of a welcome change from that in the sense that we get to focus on building the next layer of innovation that will benefit us in the next cycle.”

Armstrong said that the company was “greedy when others are fearful”, acquiring talent and focusing on projects and infrastructure for the future. Addressing what he called the “elephant in the room” of the company earnings downturn, he said:

“The broader markets are down. We're seeing a downmarket for growth tech stocks and risk assets, Coinbase and crypto is no exception to that. The good news is as a crypto company we've lived through many different cycles in crypto, including major draw downs, which I think make us well suited to operate through these environments.”

He reminded shareholders of a prospectus released by the company a year ago which stated it aimed to grow crypto adoption long term, operating the company at a rough break even.

In its shareholder letter Coinbase mentioned its recent non-fungible token (NFT) market launch as an area it was focusing more on in a bid to become a market leader in the space and its ambition to develop its platform as an “on-ramp to the cryptoeconomy”.

Related: Coinbase CEO responds to insider trading allegations with changes for token listings

Armstrong stated that 54% of the platform's active users are doing something other than crypto trading, but didn’t clarify what activities and made no mention of the new NFT marketplace in his opening statement.

When asked specifically if the company is pleased with the activity in its NFT marketplace, Armstrong said it doesn't share “metrics on any of our new initiatives” adding that “there's a lot to build and the opportunity in the NFT space is enormous.”

The first day of the public opening of the marketplace saw only $75,000 in transaction volume taking place across 150 transactions according to on-chain metrics, a small percentage of the over 8 million email addresses which signed up for the waitlist.

Finishing his opening address Armstrong said the industry was in its early days and Coinbase sees the opportunities ahead adding that “regardless of whether the market is up or down, we're going to keep building.”

According to a recent report, a secretly held, invitation-only crypto gala took place in Beverly Hills called the “Medici LA 22” event. The exclusive cryptocurrency gathering took place under the radar, but the two-day meeting was reported on after “130 or so” attendees met. An Exclusive, Closed-Door Meeting Took Place in Beverly Hills With Wall […]

According to a recent report, a secretly held, invitation-only crypto gala took place in Beverly Hills called the “Medici LA 22” event. The exclusive cryptocurrency gathering took place under the radar, but the two-day meeting was reported on after “130 or so” attendees met. An Exclusive, Closed-Door Meeting Took Place in Beverly Hills With Wall […] Canada’s securities regulator has flagged tweets by Coinbase CEO Brian Armstrong and Kraken CEO Jesse Powell encouraging people to use non-custodial wallets to evade freeze orders by the Trudeau government. “We are aware of this information and have shared it with the RCMP and relevant federal authorities,” said the Canadian regulator. Tweets by CEOs of […]

Canada’s securities regulator has flagged tweets by Coinbase CEO Brian Armstrong and Kraken CEO Jesse Powell encouraging people to use non-custodial wallets to evade freeze orders by the Trudeau government. “We are aware of this information and have shared it with the RCMP and relevant federal authorities,” said the Canadian regulator. Tweets by CEOs of […] Tesla CEO Elon Musk says there is no crisis that compels hasty cryptocurrency regulation. He agrees with Coinbase CEO Brian Armstrong that the U.S. government should not pick winners or losers in cryptocurrency innovation. Elon Musk and Coinbase CEO Agree on Crypto Regulation Tesla CEO Elon Musk has chimed in on the heated discussion of […]

Tesla CEO Elon Musk says there is no crisis that compels hasty cryptocurrency regulation. He agrees with Coinbase CEO Brian Armstrong that the U.S. government should not pick winners or losers in cryptocurrency innovation. Elon Musk and Coinbase CEO Agree on Crypto Regulation Tesla CEO Elon Musk has chimed in on the heated discussion of […]