Compass Mining is constructing a new Bitcoin mining facility in Iowa, aiming to expand its self-owned infrastructure portfolio in the United States. Compass Mining’s Iowa Expansion Highlights Growing U.S. Presence Compass Mining has announced the development of a bitcoin mining facility on a five-acre site in Iowa. The company plans to energize eight megawatts (MW) […]

Compass Mining is constructing a new Bitcoin mining facility in Iowa, aiming to expand its self-owned infrastructure portfolio in the United States. Compass Mining’s Iowa Expansion Highlights Growing U.S. Presence Compass Mining has announced the development of a bitcoin mining facility on a five-acre site in Iowa. The company plans to energize eight megawatts (MW) […] Compass Mining has announced a partnership with Mindshift, a licensed digital asset service provider in South Korea, to extend bitcoin mining services to the region. The collaboration aims to address challenges like high electricity costs while making bitcoin mining more accessible to South Korean residents. Compass Mining Collaborates With Mindshift The partnership between Compass Mining, […]

Compass Mining has announced a partnership with Mindshift, a licensed digital asset service provider in South Korea, to extend bitcoin mining services to the region. The collaboration aims to address challenges like high electricity costs while making bitcoin mining more accessible to South Korean residents. Compass Mining Collaborates With Mindshift The partnership between Compass Mining, […]

With a new quarterly production record, Marathon Digital is now on track to meet its mid-year target of 23 exahashes.

Bitcoin (BTC) mining firm Marathon Digital has reported a quarterly record of 2,195 BTC mined over the first quarter of 2023, currently worth around $62 million.

Marathon reported in an April 3 update that the 2,195 mined BTC is a 74% increase from the first quarter of last year and a 41% increase from Q4 2022.

It comes on the back of the miner increasing its operational hash rate by 195% from Q1 2022.

Marathon also recorded a monthly record of 825 BTC mined in March — currently valued at around $23.3 million — and marked a 21% production increase from February.

$MARA's March Production Update is here:

— Marathon Digital Holdings (NASDAQ: MARA) (@MarathonDH) April 3, 2023

- Increased #Bitcoin Production 21% MoM

- Produced a Record 825 BTC in March ’23

- Produced a Record 2,195 BTC in Q1 ’23

- Increased Hash Rate 64% in Q1 ’23 (11.5 EH/s)

- Reported Unrestricted Cash and Cash Equiv. of $124.9M

- Increased… pic.twitter.com/Jc1ACI2kY2

In a statement, CEO Fred Thiel said Marathon made “notable progress” on executing its two primary initiatives for 2023 — to energize its previously purchased mining rigs to reach 23 exahashes by the end of the second quarter and to optimize performance.

The firm is now exactly on target, having increased its operational hash rate from 7.0 exahashes on Jan. 1 to 11.5 exahashes as of March 31.

Marathon’s management attributed the increase in efficiency to it bringing online 25,900 Bitcoin miners based in various facilities in North Dakota, bringing its fleet to 105,200 mining rigs as of April 1.

Marathon explained its operational improvements cleaned up part of its balance sheet by wiping out $50 billion in debt in addition to repaying its loan back to the now-failed Silvergate Bank:

“We reduced our debt by $50 million and increased our unrestricted Bitcoin holdings by 3,132 Bitcoin after we prepaid our term loan and terminated our credit facilities with Silvergate Bank.”

The firm finished the quarter with approximately $124.9 million in unrestricted cash and cash equivalents, and 11,466 BTC, which equates to over $450 million.

Marathon noted the figures have not been audited.

Related: Bitcoin ASIC miner prices hovering at lows not seen in years

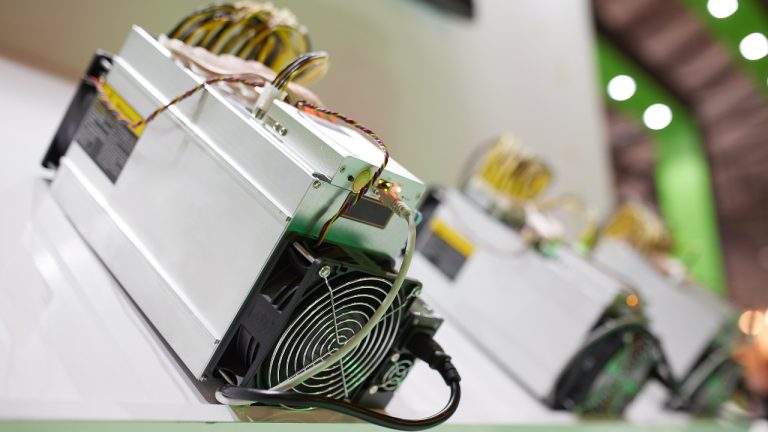

Marathon expects operational efficiencies to continue having purchased a new batch of Antminer S19 XPs Bitcoin mining rigs that are said to be nearly 30% more efficient than the Antminer S19 Pro.

Once those miners are installed approximately 66% of Marathon’s hash rate will come from the S19 XPs, it said.

The design of S19 XPs has, however, been criticized by fellow Bitcoin mining firm Compass Mining.

In a March report the firm identified “three flaws” of the new S19s which may result in the mining rig overheating, or in some cases, shutting down completely.

Magazine: Hodler’s Digest: FTX EU opens withdrawal, Elon Musk calls for AI halt, and Binance news

Compass Mining, a bitcoin mining firm, published a blog post stating that Bitmain, the company behind the application-specific integrated circuit (ASIC) mining rig, has made changes to its design. The post advised miners to be aware of the changes as Compass Mining identified “three issues” with two different Antminer S19 series mining devices. Bitcoin Miner […]

Compass Mining, a bitcoin mining firm, published a blog post stating that Bitmain, the company behind the application-specific integrated circuit (ASIC) mining rig, has made changes to its design. The post advised miners to be aware of the changes as Compass Mining identified “three issues” with two different Antminer S19 series mining devices. Bitcoin Miner […]

The lawsuit alleges that Compass Mining didn’t disclose to Bit River that it was only the ‘middleman,’ not the owner of its customers’ machines.

Customers are suing Compass Mining for over $2 million, alleging fraud, after the company cut ties with Russian hosting company Bit River and failed to return customers’ Bitcoin machines, citing a non-applicable United States sanction as the reason.

According to a court document filed on Jan. 17, Compass Mining issued a notice in April 2022 that it has terminated its “relationships and dealings with Bit River” due to the sanctions imposed by Executive Order 14024.

It is alleged that Compass “did not offer” to return or even retrieve the assets that its customers entrusted the company with to host at Bit River’s facilities in Russia.

However, it was stated that it is “false” that the return of the mining machines would be in violation of Executive Order 14024, which prohibits dealings with sanctioned entities.

The court document noted that Compass has “both the right and obligation to effect the return of its customers’ miners.”

Compass representatives met customers’ concerns with hostility, saying that it is “unable to conduct or even facilitate” any business dealings with Bit River.

When its customers had no option but to contact Bit River, the Russian firm allegedly pointed them back to Compass. Bit River representatives responded to those that reached out:

“From a legal point of view, Bit River’s contract is with Compass, and all equipment is owned by Compass. Thus you must address all questions directly with Compass.”

The court document noted that Compass should have disclosed to Bit River they are “simply the middleman” and the machines were actually paid for and owned by the plaintiffs themselves.

The partnership with Bit River was originally intended to enable Compass’ customers to host their machines at Bit River’s facilities to take advantage of “enterprise-grade, low-cost and low-carbon cryptocurrency mining facilities in Russia.”

Related: Only for foreign trade: Bank of Russia stands against free crypto investment

The court document further stated that Compass’ promise of its machines' “uptime of 95%” was inaccurate, stating that it was actually “closer to 50-60%.” In some instances, miners were not online at all for weeks or months at a time.

In July 2022, Compass was the first mining firm to announce job cuts amid the ongoing crypto winter. The firm laid off 15% of its employees while top executives and staff took major pay cuts.

On October 26, the bitcoin mining operator Aspen Creek Digital Corporation (ACDC) announced that the company has commenced operations at its solar farm-powered high performance computing center (HPCC) in Texas. ACDC further detailed that the company inked a deal with the firm Compass Mining in order to host 27 megawatts (MW) of capacity, which will […]

On October 26, the bitcoin mining operator Aspen Creek Digital Corporation (ACDC) announced that the company has commenced operations at its solar farm-powered high performance computing center (HPCC) in Texas. ACDC further detailed that the company inked a deal with the firm Compass Mining in order to host 27 megawatts (MW) of capacity, which will […]

The Bitcoin mining company plans to expand its fleet of mining devices comes on the back of staff lay-offs and executive salary cuts just weeks before.

Mere weeks after announcing staff lay-offs and salary cuts, Compass Mining has unveiled expansion plans in the form of a 75 megawatt (MW) hosting partnership with Compute North for its data center in Granbury, Texas.

The announcement on July 21 comes only a two weeks after the company retrenched 15% of its employees and implemented salary cuts for its top executives as a means to weather difficult market conditions.

It also follows the resignation of key executives including CEO Whit Gibbs and chief finance officer Jodie Fisher in late June, as well as losing one of its Maine-based hosting facilities after allegedly missing payments relating to utility bills and hosting fees.

Compass said the newest large-scale deployment will begin in August and continue for several months.

The expansion includes plans to deploy 25,000 application specific integrated circuit (ASIC) miners to the existing Wolf Hollow plant site in Granbury, including a variety of next generation Bitcoin miners.

According to Compass, the facility is state of the art and powered by a 1.1 gigawatt (GW) combined cycle natural gas fueled plant, which uses advanced gas turbine designs and air cooling to decrease carbon emissions and water dependence.

The data center also has a fully curtailable load and can shut down at a moment's notice should the draw on the grid exceed capacity.

This adds to existing Compass facilities across the U.S, Canada and Iceland, with major operations in Texas, Ontario, New Mexico and Florida.

Crypto miners in Texas however have had a difficult month as a result of a record-breaking heatwave in the state, which has caused a strain on the energy grid.

Major Bitcoin miners have been working with the Electric Reliability Council of Texas (ERCOT) by temporarily shutting down or severely reducing their operations in the state to reduce the toll on the grid.

Crypto mining firms are still coming to Texas in droves though, attracted by less regulatory oversight and lower energy costs.

Despite the recent heatwave impacting local mining operations, publicly listed mining stocks appear to be performing well, according to NASDAQ data.

Three of the biggest miners by market cap are all in the green as of July 22.

Related: Bitcoin mining stocks rebound sharply despite a 70% drop in BTC miners' revenue

Marathon Digital Holdings Inc has seen a 99.85% increase in its stock price over the past month, while Riot Blockchain Inc is up 65.65% and Canaan Inc is up 42.27% over the past month.

It comes as the price of Bitcoin (BTC) has also reached a one-month high, reaching $22,938 at the time of writing.

Compass Mining parts ways with 15% of its workforce while senior employees and executives take major pay-cuts in the wake of the cryptocurrency downturn.

Ongoing strife in the cryptocurrency space has forced Compass Mining to lay off 15% of its employees while top executives and staff take major pay-cuts.

The firm announced its decision to downscale its workforce in a bid to weather difficult market conditions, just a week after the resignation of CEO Whit Gibbs and chief finance officer Jodie Fisher.

Chief technology officer Paul Gosker and chief mining officer Thomas Heller have taken over the reins at the firm as interim co-presidents and CEOs. The duo penned a letter to staff, investors and the wider community outlining the company’s road ahead.

While 15% of the company’s workforce faces difficult layoffs, the acting CEOs also announced that senior employees and its executive team will take significant pay cuts of up to 50%. The Compass Mining website currently displays its workforce — with 78 individuals making up the current team.

Cointelegraph has reached out to the company to ascertain the exact number of staff that will leave the business.

Compass Mining began operations in January 2021 as a mining hosting service. To date, it has sold over half a billion dollars of mining equipment and currently operates more than 30,000 mining machines for its customers.

Gosker and Heller’s message highlighted a fateful pitfall of the business’s initial success, as its efforts to upscale to meet increasing demand led to the company growing too quickly:

“When we launched, we were amazed by the level of demand for our services, and as a result, we tried to address the operational, financial and technology bottlenecks faced by all growing companies by hiring more people.”

Compass is the first mining firm to announce job cuts amid the ongoing downturn across cryptocurrency markets, but it is not the only casualty in the ecosystem.

Related: Another miner cashes in: Argo Blockchain reports selling 637 BTC to pay debts

As previously reported, a host of high-profile firms are at opposite ends of the spectrum. The likes of major exchanges Binance, Ripple and Kraken are looking to bolster their workforces, while Gemini, Coinbase and Crypto.com have begun reducing their staff numbers.

A number of major mining companies have also been forced to sell off portions of their Bitcoin (BTC) holdings in response to cryptocurrency market sell-offs since June.

The facility owner Dynamics Mining publicly took to Twitter to share the letter terminating its hosting agreement with Compass Mining, saying it had unpaid bills.

Bitcoin (BTC) mining hardware and hosting company Compass Mining has lost one of its Maine-based hosting facilities after the owner, Dynamics Mining, terminated the hosting agreement between the two, claiming Compass failed to pay the required bills.

Dynamics posted on Twitter late on June 26 a letter it sent to Compass Mining which stated as of June 14th, the hosting contract between the two was terminated. Dynamics alleged Compass has six late payments and three non-payments related to utility bills and hosting fees.

Effective June 14th @compass_mining facility hosting agreement in Maine was terminated by @dynamics2k for failure to pay power consumption charges. 6 late payment and 3 non payments. @MiningScandals pic.twitter.com/cSfnWMmqTY

— DynamicsMining (@DynamicsMining) June 27, 2022

In a follow-up tweet a few hours later, on June 27, Dynamics alleged the power consumption bills totaled $1.2 million, and Compass had only paid around $665,000. It said Compass claims to have given the money required for the bills, but Dynamics alleged it was used to build other facilities instead.

Cointelegraph contacted both Dynamics Mining and Compass Mining for comment but did not receive a response from either by publication time.

The very public situation caused Compass Mining CEO Whit Gibbs to say it would “fight this battle in court, not on Twitter.”

But the individual behind the Dynamics account hit back at Gibbs, saying all Compass had to do “was pay $250k for three months of power consumption” and that “Twitter is the voice of your customer base, not the courtroom.”

@compass_mining all you had to was pay $250k for 3 months of power consumption. Since you don't give your clients their Serial Numbers I couldn't even help them. Twitter is the voice of your customer base, not the courtroom. ✌ https://t.co/BihbrpuAmk

— DynamicsMining (@DynamicsMining) June 27, 2022

Compass Mining sells Application Specific Integrated Circuit (ASIC) miners, specialized cryptocurrency mining devices, which come with an option to be hosted in its facilities located across the United States and Canada. It is unknown what will happen to customer miners located at the facility.

Compass states that in the event of an emergency, it may “rearrange, remove, or relocate Customer Hardware without any liability to Compass” as per its hosting agreement.

Related: The Bitcoin shitcoin machine: Mining BTC with biogas

The terms also see customers “waive their rights to seek remedies in court” or be involved in any Class Action lawsuits, and any proceedings must be bought forward by each individual customer if they were to file a lawsuit against Compass.

The situation comes when many cryptocurrency miners face a challenging market environment with the continuing price slide of Bitcoin and increasing energy costs.

In mid-June, when Bitcoin fell below $24,000, the profitability of many of the older ASIC miners dropped into the negative zone, and even some of the newer generation mining rigs are near or past their shutdown thresholds based on the price of the asset.

Around the same time, with Bitcoin mining profitability dropping over 75% from the market top, the volume of BTC sent by miners to crypto exchanges reached a seven-month-high on June 15. Several public Bitcoin mining firms sold 100% of their Bitcoin production in May, according to reports.

The U.S.-based company Compass Mining plans to sell $30 million worth of bitcoin mining equipment that’s currently located in Siberia. The decision to sell the mining rigs follows the U.S. government sanctioning the bitcoin mining operation Bitriver and ten subsidiaries. Compass is hoping to offload 12 megawatts of capacity, according to a company executive. Compass […]

The U.S.-based company Compass Mining plans to sell $30 million worth of bitcoin mining equipment that’s currently located in Siberia. The decision to sell the mining rigs follows the U.S. government sanctioning the bitcoin mining operation Bitriver and ten subsidiaries. Compass is hoping to offload 12 megawatts of capacity, according to a company executive. Compass […]