Financial fraud has been a part of transactional business since the dawn of transactional business. If you were unfortunate enough to have been on the other side of an insurance deal with Hegestratos, he would have had you insure the corn cargo on his ship – then removed the corn, sold the corn, sank the […]

Financial fraud has been a part of transactional business since the dawn of transactional business. If you were unfortunate enough to have been on the other side of an insurance deal with Hegestratos, he would have had you insure the corn cargo on his ship – then removed the corn, sold the corn, sank the […]

The post The Kraken security playbook: how to avoid holiday crypto scams appeared first on Kraken Blog.

The firm is aiming to provide catchy crypto education content that provides a better alternative to "fin-fluencers" on TikTok.

Crypto-curious teens may be able to try their hand at real crypto trading after the launch of education and trading app Stack — aimed at teaching under 18s how to trade and hodl crypto.

The crypto trading app was launched by mobile software firm Stack on Sept. 8, with the aim of offering young crypto enthusiasts better educational alternatives to what they may find from crypto influencers on social media platforms such as Reddit and TikTok.

The app will of course comes with parental controls, and the accounts on Stack are regulated under the Uniform Transfers to Minors Act which allows parents and legal guardians to maintain ownership of the account and assets until their teenager turns 18.

In a Sept. 8 announcement, Stack CEO Will Rush highlighted that there is strong demand in Gen Z to learn about crypto, but the educational content they consume online is usually via social media apps or blog posts that arguably lack substance.

The CEO states that Stack is trying to fill a gap in the market by “building content to specifically resonate with teens.”

"All of our research about Gen Z demonstrates that they are self-learners but also that they follow trends that evolve in minutes instead of days, months or years. This means that too often, TikTok or Reddit is their financial advisor.”

Expanding on those comments with fintech news website TechCrunch, Rush stated that “we need a big lift to make it relevant to teenagers and are looking at educational topics like NFTs, Metaverse, and web3.”

“We aim to be the trusted account for democratizing investing for young people,” he said.

Alongside educational crypto content, Stack is offers buying, selling, and holding services for seven digital assets including Bitcoin (BTC), Ether (ETH), Cardano (ADA), Solana (SOL), USD Coin (USDC), Litecoin (LTC) and Polygon (MATIC).

Instead of charging trading fees, the crypto exchange app uses a $3 per month subscription fee.

The crypto app will also not allow off-platform transfers at this stage, with Rush stating this enables the firm to “eliminate up to 98% of all crypto fraud and scams” that occurs in the sector.

The company has also suggested that this will encourage teens to become long-term hodlers, rather than putting their focus on wild day-trading speculation. The app is available on Android and Apple devices, with users 13 and over being able to sign up.

Alongside the app launch, the firm also revealed that it has raised $2.7 million worth of funding from the Madrona Venture Group.

Related: From games to piggy banks: Educating the Bitcoin ‘minors’ of the future

The VC firm highlighted in a Sept. 8 blog post that the company is tapping into a growing but underserved market:

“Gen Z is considered an entrepreneurial generation. As a result, many of them are crypto-curious. Coinbase and FTX have served as consumer entry points to crypto through crypto trading and educational content. However, they are inaccessible to the minors — the next generation of consumers.”

“The team has numerous high-school-based investment clubs around the country interested in getting into the initial rollout. We find Stack’s 5,000-person wait list for the iOS or Android app impressive,” Madrona added.

A survey from online educational platform Study.com in late August found that more than two-thirds of crypto-versed parents and college graduates in the U.S. think that crypto should be taught in schools so that students can “learn about the future of our economy.”

The survey polled 1094 people, with 67% of respondents stating that crypto education should be mandatory in school.

About 14% of Saudi residents are either current crypto investors or have traded crypto in the past six months, the latest Kucoin study has found. The study has also found that 76% of investors have less than one year of experience and thus may be in need of relevant crypto education. Crypto Winter Effect Around […]

About 14% of Saudi residents are either current crypto investors or have traded crypto in the past six months, the latest Kucoin study has found. The study has also found that 76% of investors have less than one year of experience and thus may be in need of relevant crypto education. Crypto Winter Effect Around […]

The industry will be able to “tap into future talent” as the partnership sees Judo Bank and Web3 firm Banxa and co-creating content, hosting lectures, providing case studies and even giving students access to their networks.

Australia’s Swinburne University of Technology has partnered with two financial technology firms which will provide its students exposure to the financial technology and cryptocurrency business world.

The partnership is between Swinburne and small business loan provider Judo Bank along with Banxa, a payment service provider with a fiat to crypto platform whose clients include Binance, KuCoin, and Trezor amongst others.

Students of the university’s Master of Financial Technology (FinTech) course will be “exposed to real life examples and cases across the spectrum of financial services,” Dr. Dimitrios Salampasis Swinburne’s Director of the Master of FinTech told Cointelegraph.

Dr. Salampasis said Judo Bank is “one of the most innovative FinTech unicorns, one of the very few unicorns in Australia” while Banxa is a “massively interesting organization” who are “very serious in the job that they do in the blockchain and the crypto space”.

“This space is very new. I mean, when I put together the course a couple of years ago, we didn't really know what that meant. Other universities around the globe have different FinTech offerings, but I believe, particularly for the FinTech space, you need some proper working experience.”

“Maybe they want to show our students some simulations of their processes, do some sort of presentation on their products and services or have a debate,” he said, “maybe even give our students a real project to work on.”

The partnership sees Banxa and Judo Bank co-creating content, hosting lectures and providing case studies. Students will have access to each of the companies networks as part of the partnership, which Dr. Salampasis says will allow the industry to “tap into future talent”.

“The whole vision behind this degree is to bring industry in to ensure relevance on the things we teach, to be able to bring these real life insights for leadership in the classroom. We can ensure the students get exposed to whatever the latest developments are in the space, because the general FinTech space is moving so quickly.”

Dr. Salampasis was 2021’s Blockchain Educator of the Year Awardee from the country’s main industry body Blockchain Australia.

Related: Needed: A massive education project to fight hacks and scams

Cointelegraph reported last week that Dr. Salampasis had been one of the few people Finder spoke to for its regular predictions survey who warned about the inherent risks in the Terra ecosystem which subsequently collapsed.

He said the event had caused terrible publicity for the space, but he was hopeful with more education such situations could be avoided in future.

“In general, blockchain and crypto have received a lot of negative attention and publicity. Part of our role as a university is to ‘de-risk’ the space, to provide real information, real awareness, and educate our students to become the next leaders in the space, to work with people who actually know what they're doing.”

Universities around the US are starting to pay attention to the rapid adoption of digital assets as crypto continues to steal the spotlight from the traditional financial landscape. Today, the Aresty Institute of Executive Education at the Wharton University of Pennsylvania announced its partnership with the crypto exchange giant Coinbase to allow students to pay […]

The post Crypto College? Ivy League Institution Partners With Coinbase To Enable Digital Asset Payments for Blockchain Curriculum appeared first on The Daily Hodl.

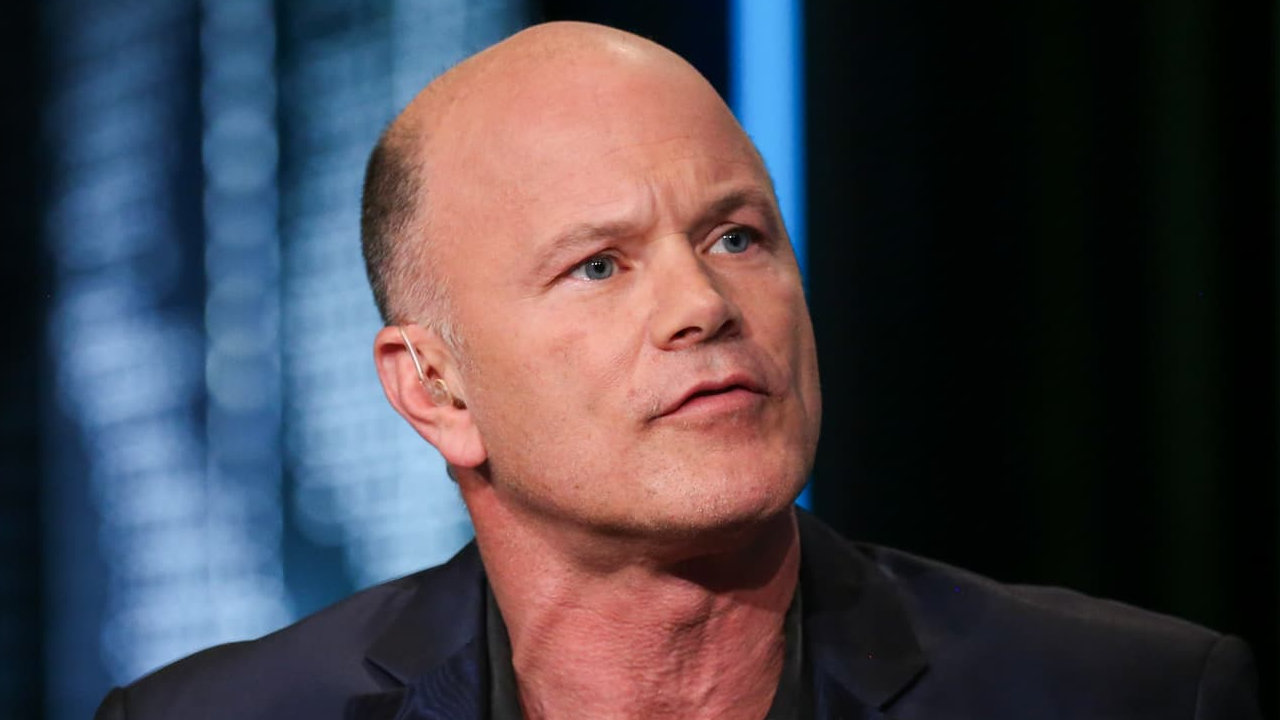

Galaxy Digital CEO Michael Novogratz says that cryptocurrencies, such as bitcoin, have bounced back because institutional investors are buying. Responding to U.S. Senator Elizabeth Warren’s anti-crypto stance, he stated, “We need to do a much better job going to D.C.” to educate lawmakers. Novogratz Says Institutions Are Buying Galaxy Digital CEO Mike Novogratz talked about […]

Galaxy Digital CEO Michael Novogratz says that cryptocurrencies, such as bitcoin, have bounced back because institutional investors are buying. Responding to U.S. Senator Elizabeth Warren’s anti-crypto stance, he stated, “We need to do a much better job going to D.C.” to educate lawmakers. Novogratz Says Institutions Are Buying Galaxy Digital CEO Mike Novogratz talked about […] A Zimbabwean fintech lawyer, Prosper Mwedzi, recently initiated a process that seeks to bring recognition and regulation of cryptocurrencies. Under this private member bill procedure, a legislative proposition initiated by private citizens will be debated in the Zimbabwean parliament. If the crypto regulation bill succeeds in garnering the required support, it will become part of […]

A Zimbabwean fintech lawyer, Prosper Mwedzi, recently initiated a process that seeks to bring recognition and regulation of cryptocurrencies. Under this private member bill procedure, a legislative proposition initiated by private citizens will be debated in the Zimbabwean parliament. If the crypto regulation bill succeeds in garnering the required support, it will become part of […] According to reports, over 100,000 African youths have taken part in Binance’s crypto and blockchain education barely a year after the learning program was launched. Dubbed the Binance Masterclass, the education initiative is aimed at equipping newcomers with basic knowledge about cryptocurrencies. Also, as one report explains, the initiative seeks to stop young African traders […]

According to reports, over 100,000 African youths have taken part in Binance’s crypto and blockchain education barely a year after the learning program was launched. Dubbed the Binance Masterclass, the education initiative is aimed at equipping newcomers with basic knowledge about cryptocurrencies. Also, as one report explains, the initiative seeks to stop young African traders […]