A little-known crypto asset is skyrocketing after its surprise addition to the global crypto exchange Binance. The decentralized code collaboration project Radicle (RAD) shot from $9.34 to $23.85 – a 155% price increase – after the announcement. The altcoin currently sits at $21.33. The Radicle network serves as an alternative to GitHub by allowing developers […]

The post Obscure Crypto Asset Explodes 155% After Receiving Burst of Support From Binance appeared first on The Daily Hodl.

An Ethereum competitor is launching a $300 million fund to support decentralized finance (DeFi) innovation on its network. Blockchain company Algorand Foundation is putting 150 million ALGO, worth $309 million at time of writing, into the Viridis DeFi Program in an effort to fuel the growth of development on its platform. Sean Lee, chief executive […]

The post Ethereum Competitor Launches $300,000,000 DeFi Fund to Fuel Crypto Adoption appeared first on The Daily Hodl.

OKEx is expanding its decentralized finance footprint with a DeFi Hub and a marketplace for creating and selling NFTs.

Global crypto exchange OKEx is ramping up its decentralized finance (DeFi) efforts with the introduction of the DeFi Hub, a decentralized digital asset ecosystem that includes a marketplace for nonfungible tokens (NFTs).

According to a Sep. 2 announcement, the crypto spot and derivatives exchange launched its DeFi Hub with two initial tools, NFT Marketplace and DeFi Dashboard. The NFT Marketplace enables users to mint their own NFTs to sell with a royalty fee that is set by the creator.

Users would be able to import NFTs from other supported platforms like OKExChain to the OKEx NFT Marketplace, where they can buy, sell or trade nonfungible tokens “with zero fees paid out to OKEx.”

The new DeFi Hub requires a connection with the OKEx Wallet, a multi-chain decentralized wallet offered by the exchange as a browser extension. It offers a holistic view of users’ decentralized assets across major blockchain networks and protocols with a DeFi Dashboard feature.

Underscoring the need for a comprehensive system for the fast-growing NFT market, OKEx director Lennix Lai said that the DeFi Hub aims to accelerate the adoption of nonfungible tokens with the NFT Marketplace. “We’re also thrilled to launch DeFi Dashboard to bring much-needed improvements to users’ visualizations of their cryptocurrency portfolios," he added.

Related: Record $900-million month for NFT sales as CryptoPunks go stratospheric

Widely used as a new way to create digital arts, NFTs are verifiably unique representations of digital and physical goods. Since they are nonfungible like a regular currency, their value is set by the buyers’ appetite and a seven-figure pricetag for digital art is not uncommon in the NFT world.

With the growing demand for this new form of digital ownership, NFT marketplaces are becoming the new frontier not only within the crypto ecosystem but in the broad technology world as well. Last month, Chinese e-commerce giant Alibaba launched an NFT marketplace to allow trademark holders to sell tokenized licenses to their intellectual property.

Global cryptocurrency exchange Binance has made regulatory compliance its top priority. The exchange is on a hiring spree to “significantly” add to its compliance and legal teams. “We are going through a pivot from a technology innovator into a financial services company, so we need to be fully compliant,” said the CEO of Binance. Binance’s […]

Global cryptocurrency exchange Binance has made regulatory compliance its top priority. The exchange is on a hiring spree to “significantly” add to its compliance and legal teams. “We are going through a pivot from a technology innovator into a financial services company, so we need to be fully compliant,” said the CEO of Binance. Binance’s […]

Many DeFi projects face a painful dilemma: Should their protocols be designed for professional traders, or everyday consumers yet to embrace crypto in their masses?

Cryptocurrencies have garnered something of a reputation as being fast, dangerous and lethal for many — so much so that the average investor is scared of digital assets.

The volatility that’s associated with this new asset class has also meant that gaining exposure to the world’s biggest coins has been likened to an experience that’s not for the faint-hearted — or, in traditional investor terms, “not for the wise.”

Inevitably, this will spark endless debate on whether crypto is something for everyday consumers to be scared of. Is investing a small percentage of one’s portfolio into digital assets prudent or reckless? Are regulators going overboard when they warn that people who purchase cryptocurrencies should be prepared to lose the shirt off their backs? And are there any ways for people to enter this exciting but intimidating world safely?

The current mood music surrounding cryptocurrencies have created something of an echo chamber within the nascent DeFi ecosystem. Traders are predominantly the people who use these protocols. This creates wider ramifications for fledgling projects that are seeking to enter the space — and a rather unpleasant dilemma comes to the fore. Should new platforms adopt a long-term view and build an environment that’s built for the masses, meaning they may only attract a small number of users for the foreseeable future? Or should they create ecosystems that are designed for traders — something that could attract a large but fickle following who are always looking for a new project to move on to?

Across the DeFi ecosystem, a vortex of projects is simultaneously aiming for very different target markets. Some are living in the now, while others have their sights firmly set on the future.

For the holy grail of DeFi to be achieved — the much-anticipated milestone of mass adoption — it’s worth taking a step back and considering what the typical consumer is like.

Of course, everybody likes an opportunity to make a quick buck. But those already in the crypto space often take for granted that many consumers are unprepared to take the type of risks that are often associated with the fast-moving, 24/7 world of trading digital assets.

If you’ve been involved in the crypto space for years, it may also be difficult to appreciate that most trading platforms are exceedingly confusing for newcomers. The crypto curious end up being bombarded with information — far more than they can realistically process — and this doesn’t foster an atmosphere where they can feel confident in the choices that they make.

News websites like Cointelegraph can help — and there are an ever-increasing number of educational resources that are geared toward beginners. But there’s also a danger that those who end up getting their news from social networks may end up being suckered in to buying whichever coin is pumping at the moment and losing money in the process.

Although the worlds of DeFi and retail banking are like night and day, there are things that these two financial worlds have in common. Leveraging this can be the key to unlocking mass adoption — presenting decentralized finance in a way that the public will understand, even if they have no interest in getting their heads around spreads and technical analysis.

Most consumers understand that, living in a world where interest rates are low and inflation is through the roof, they are losing money on a daily basis.

They’re familiar with the concept of savings accounts — and the fact that their nest egg can grow if it is locked away for a set amount of time.

Platforms such as UniFarm say they deliver a familiar experience for crypto newcomers who crave simplicity. Now, all they need to do is find a token that they believe in and stake it. Returns are automatically diversified on their behalf — and crucially, funds can also be unstaked at any point. This gives peace of mind to those who may be feeling nervous about having their assets locked away for extended periods of time.

UniFarm says that its app is both clean and simple, packaged in a user interface that anyone will be able to understand. This helps reduce the risk of inexperienced users making costly mistakes by pressing the wrong button, or not knowing how to complete a transaction.

The platform’s co-founder and chief operating officer Tarusha Mittal said: “At UniFarm, our aim is to help DeFi appeal to the masses by being simple, smart and adding massive value.”

Mittal and fellow co-founder Mohit Madan describe themselves as long-term serial entrepreneurs in the world of blockchain — and both have now been in the space for over a decade. They together founded one of India’s first Ethereum exchanges in 2015 and now have a massive undertaking in the form of OroPocket — the parent company of UniFarm and another project called OpenDeFi.

UniFarm had a working product in place by late January 2021, and a plethora of milestones have been achieved over the past four months. This included a successful $2 million funding round that was led by AU21 Capital and a number of other notable blockchain funds.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you all important information that we could obtain, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor this article can be considered as an investment advice.

The DeFi platform’s native token price dropped more than 60% following a compromise by an unknown party.

Decentralized e-commerce platform Bondly Finance is the latest decentralized finance (DeFi) platform to suffer an alleged exploit. The developer team advised the DeFi community to stop trading Bondly, the platform’s native token, following a suspected exploit on July 15.

Bondly Finance has yet to provide details regarding the attack, aside from being compromised by an unknown party. “Rest assure, we have already taken action and will be operating as usual as soon as possible,” the official announcement reads.

Bondly token price tanked more than 60% within three hours following the attack. PeckShield, a blockchain security and data analytics company, explained the price drop with a 373 million token mint on the Ethereum blockchain. The security firm also claims that the huge mint on Ethereum was performed by the owner’s address, essentially accusing Bondly of performing a rug pull.

Founded by the former managing partner at Shuttle Capital, Brandon Smith, Bondly was launched on Polkadot in 2020 as a DeFi protocol to “offer an ecosystem of decentralized products that enable anyone to execute digital payments between peers,” the official description states.

Related: Growing pains? DeFi exploits plunder BSC, which calls for reinforcements

Flash loan attacks, rug pulls or exploits are not uncommon in the DeFi ecosystem. PancakeBunny, a popular decentralized finance protocol built on Binance Smart Chain (BSC), was the subject of an exploit in May after a hacker made off with more than $200 million worth of crypto assets.

BSC-based DeFi exchange BurgerSwap was also exploited by hackers with about $7.2 million worth of crypto assets, including Burger tokens, Wrapped BNB and Tether (USDT) stolen from the platform.

Another BSC-powered DeFi project, Bogged Finance, suffered a flash loan exploit that drained $3 million, which was half the liquidity on the platform at the time of the attack.

Initial DEX offerings have a fair bit in common with initial coin offerings but come out on top in cost, effort, and fairness.

Initial DEX offerings are the new initial coin offerings. So, what’s the difference between an IDO and an ICO, other than that one letter?

A lot actually.

In some ways, ICOs and IDOs have more in common with each other than they do with initial exchange offerings, which have more than a few features of the traditional initial public offering of stock markets.

While IDOs and IEOs are both listed directly on exchanges — decentralized exchanges, or DEXs, in the case of the former and centralized exchanges for the latter — IDOs are very much a do-it-yourself process like ICOs.

One big difference between IDOs and ICOs is the amount of money raised. No one sees a 10-figure IDO matching Block.one’s $4 billion ICO or Telegram’s $1.7 billion raise anytime soon.

Those ICOs also showed the power of the SEC, which generally went easy on companies willing to pay fines and issue mea culpas. Block.one‚ which raised $4 billion, paid a comparatively paltry $24 million fine. Telegram, which fought the SEC, ended up returning $1.2 billion of the $1.7 billion raised and shutting down its TON blockchain.

IEOs, on the other hand, are controlled by exchanges, which act in many ways like the underwriters — middlemen — which lead companies going public on the NYSE or Nasdaq through the process. In IEOs, centralized exchanges like Binance Launchpad and Huobi Prime vet the issuers, provide regulatory and know-your-customer (KYC) and anti-money-laundering (AML) services, and market the sales — for which they charge an arm and a leg. Unlike underwriters, crypto exchanges do not buy out and resell the tokens — in fact, more than a few IEO sales fail, despite the cost.

In both the IDO and the ICO, the token-issuer pays no direct fees to middlemen, which is much more in line with the peer-to-peer ethos of Bitcoin and its successors. That said, IDO launchpads like Polkastarter and Binance Launchpad are changing that as they become more common, but don’t have nearly the cost and control of centralized IEOs

However, every IDO and ICO issuer is responsible for its own marketing, and each must create the smart contract used to sell tokens — including arranging any audits — and carry out its own legal vetting. This likely includes outsourcing AML and KYC compliance, as well as general securities offering registration requirements.

Then there’s the matter of the tokens. ICO tokens are often minted after the sale, which takes place on the company’s website. That comes with a big cost, as the issuer needs an exchange listing, preferably a top centralized exchange. That can reportedly cost anywhere from $100,000 to several million dollars — which removes a significant downside to IEOs, in which the listing cost is built into the fees.

A benefit of IDOs is that, by their nature, the token is immediately listed on the decentralized exchange on which the offering occurred. That said, despite the decentralized finance (DeFi) boom, even top DEXs like Uniswap or PancakeSwap have far less liquidity than the top centralized exchanges, and tend to be more difficult to use, which can keep some potential buyers away.

One thing that IDOs and ICOs do share is that they rely on knowledgeable community activists to vet the offerings, which either builds community and provides true decentralization, or is a serious Achilles’ heel that leaves prospective buyers short on information, depending on your perspective.

The ICO/IDO debate also has a fairness issue. IDOs shares are immediately tradable — there’s actually no way to impose the lock-up periods frequently used by ICOs. ICOs often offer insiders and early investors favorable terms that aren’t available to regular buyers. That’s not doable in the confines of a smart contract controlled IDO.

Which isn’t to say IDOs haven’t had their glitches — DeFi lending platform bZx’s mid-2020 Uniswap IDO was dominated by bots that beat every other would-be buyer and jacked prices up before dumping. The DeFi launchpads handle that by limiting buyers to a pre-approved whitelist with a strict per-buyer maximum. But to get whitelisted, buyers must own and hold the launchpad’s native token.

That doesn’t change the reality that hot IDOs tend to sell out in seconds. In April, OccamRazer, an IDO launchpad for the decentralized Cardano protocol showed off its chops by holding a hugely successful IDO of its own, selling 200,000 OCC tokens in just 20 seconds. Like many popular IDOs, it was massively oversubscribed, leaving the vast majority of the 150,000 would-be buyers out of luck.

While IDOs are largely being used by DeFi projects, nothing is stopping centralized crypto companies from taking advantage of their advantages in cost and time — the process is a lot less intensive, making IDOs perfect for small companies.

One non-DeFi company that’s going the IDO route is Estonia-based CoinsPaid, a business-to-business crypto payments solutions company that offers a number of products. Most notable is Cryptoprocessing by CoinsPaid, a white label-ready cryptocurrency payments gateway that accepts more than 30 coins and 20 fiat currencies, promising the best exchange rates. Its ecosystem also includes an institution-focused exchange and OTC desk, cryptoprocessing, and B-to-B and B-to-C hot wallets audited by Kaspersky Lab and 10Guards, and a cryptocurrency explorer.

Saying that security is a key in all of its offerings, Kaspersky-certified CoinsPaid noted that its business quintupled in 2020, giving it a 5% share of all global on-chain Bitcoin transactions.

A top global cryptoprocessing company, CoinsPaid was crowned Payment Provider of the Year at the AIBC Dubai show last month. Having secured its position in the payments niche, the fintech is in the process of expanding its services to include decentralized finance (DeFi).

Launched on June 1, CoinsPaid’s IDO launched CPD, a DeFi cryptocurrency that will serve as a utility token, offering 20% discounts to B-to-B and B-to-C customers who pay in CPD. B-to-B customers get an additional 5%-20% discount when staking CPD, while B-to-C customers get 5%-30%. There is also a 10% B-to-B customer promotion. Using CPD tokens in payment gets a 50% discount on all transactions, and unspecified discounts on all future products.

On the actual DeFi side of things, CoinsPaid offers a 20% staking APY, a 10%-50% CPD bonus on yield when investing through the CoinsPaid dashboard, and a monthly token burn. The company is selling 16 million of its 800 million CPD. Token swaps are available for ether (ETH), tron (TRX), Binance smart chain tokens (BSC), solana (SOL), and polkadot (DOT).

Offering coming later this year include a CPD loyalty system and a media site in Q3, with a DeFi dashboard scheduled for Q1 2022.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you all important information that we could obtain, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor this article can be considered as an investment advice.

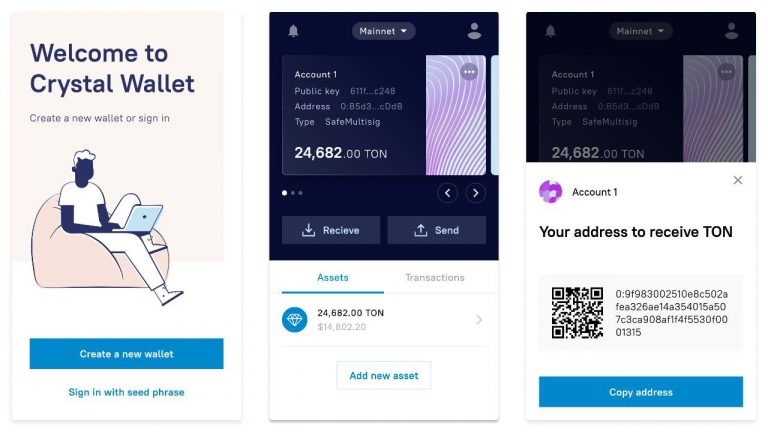

A highly scalable, decentralized blockchain platform gets a convenient browser wallet to facilitate dApps development. Crystal Wallet Metamask. Anyone who has worked with Ethereum for more than a week is familiar with this browser wallet. It lets countless decentralized applications (dApps) connect to Ethereum, send transactions, and interact with smart contracts. Metamask has become an […]

A highly scalable, decentralized blockchain platform gets a convenient browser wallet to facilitate dApps development. Crystal Wallet Metamask. Anyone who has worked with Ethereum for more than a week is familiar with this browser wallet. It lets countless decentralized applications (dApps) connect to Ethereum, send transactions, and interact with smart contracts. Metamask has become an […]