“The Global South is where we should be looking” for Bitcoin adoption, Paxful CEO Ray Youssef told Cointelegraph in an interview at the gym.

Cointelegraph hit the gym with Ray Youssef, co-founder and CEO of Paxful, to tackle Bitcoin adoption in the Global South. In between sets and a little out of breath, Youssef told Cointelegraph, “The Global South is where we should be looking” for Bitcoin (BTC) adoption.

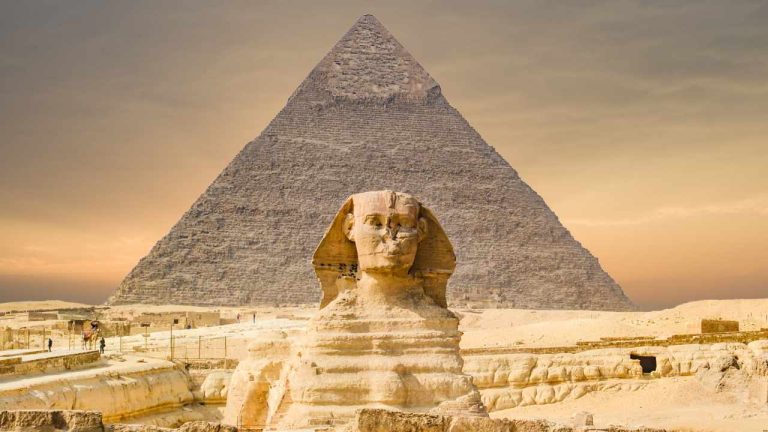

A New Yorker born in Egypt, Youssef regularly visits Africa and the Global South to promote Bitcoin and peer-to-peer finance. He is determined to bring Bitcoin to those living and working across Africa and to undermine the “economic apartheid” created by government-issued fiat money.

Youssef is a firm believer that government-backed, fiat money is a scourge on human progress. He posited, “Creating money is the greatest creative opportunity of any government,” before launching into a diatribe against Western governments as he pumped iron. Nonetheless, thanks to Bitcoin, people around the world — especially in the Global South — now have the means to fight back against economic repression:

“The good news is we have a few tools at our disposal. We have the internet, we have mobile phones, and now, we have Bitcoin peer-to-peer, electronic cash.”

Youssef’s business, Paxful, currently numbers 10 million users worldwide. But the CEO explained that the crypto community needs to move a lot faster in order to reach a billion users in the next five to 10 years. He referred to the explosive growth of telecommunication companies such as M-Pesa in Kenya as examples that adoption can flourish rapidly:

“The telcos have shown us the path, but we aren’t listening. We’re still trying to replace banks with wallets, and that is not the path to a billion citizens. We need something more.”

Ultimately, the key to unlocking growth in emerging markets is teaching citizens about Bitcoin and the properties of hard money, Youssef believes.

“A focus on education is great. But primarily we have to shift away from this mindset that we have right now of just replacing banks with wallets.”

It’s true that Bitcoin wallets do act as a replacement for banks. In El Salvador, for example — a heavily unbanked country — Bitcoin adoption onboarded 4 million users in a year: 70% of the unbanked population gained international payment and remittance services.

However, Youssef went one step further, envisioning a world where Bitcoin helps the unbanked trade and transact freely, creating an abundance of entrepreneurship.

Related: Bitcoin in space is good for user privacy, says Adam Back

Finally, Youssef also joked that Ronnie Coleman, a bodybuilder and eight-time Mr. Olympia winner, would be a Bitcoiner. Cointelegraph reached out to Coleman for comment and will update when possible.