Meta reportedly plans an integration to allow social media users to display their NFTs on Facebook and Instagram.

Multinational tech conglomerate Meta is reportedly diving into nonfungible tokens (NFTs) by integrating a feature that will let users show off their NFTs on their Facebook and Instagram profiles. According to the report, Meta is currently working on prototypes that will allow users to mint collectible tokens.

Meta is also discussing potentially launching a marketplace that allows the buying and selling of NFTs. However, while the news may excite millions of NFT enthusiasts that use social media, all of the projects are within the earliest stages and may still change accordingly.

The discussions follow a push to onboard more staff to help with Meta’s projects. Back on January 12, Meta initiated a push to hire more employees and got around one hundred people to jump ship from Microsoft. Meanwhile, to avoid staff from ditching them for Meta, Apple offered bonuses from $50,000 to $180,000 along with stock options.

Formerly known as Facebook, Meta’s major rebranding lets the company focus on initiatives beyond social media. Last year, the company announced its plans to create a metaverse that connects physical experiences to online social experiences. The company also released previews of haptic gloves that may be rolled out for use in its future metaverse.

Related: Facebook’s centralized metaverse a threat to the decentralized ecosystem?

Potential earnings in the NFT world are becoming very hard to ignore. Firms even predict that traditional brands will dive into the NFT space and explore how to earn within the market.

Just recently, leading NFT marketplace Opensea surpassed $3.5 billion in monthly transaction volume. This means that over $169 million are being spent each day in NFT trading just within the platform. According to NFT sales tracking statistics, the NFT market has had a total of $25 billion in all-time sales so far.

According to former staff, around 100 people have already jumped ship from Microsoft to Meta alone. Meanwhile, Apple is offering generous bonuses to hold onto their workers.

Employees from Microsoft and Apple are jumping ship to join Meta Platforms as the company sets its sights on creating the Metaverse.

According to former employees of Microsoft quoted by the Wall Street Journal, around 100 people have ditched the tech giant’s augmented reality team over the past year to join Meta Platforms. They claim that Meta has been particularly focused on snapping up people who have worked on Microsoft’s HoloLens augmented reality (AR) headsets.

According to the WSJ, Linkedin profiles show that more than 70 people who were part of Microsoft’s HoloLens team have left the project over the past year, with more than 40 of them taking on new positions at Meta.

Microsoft’s first mover advantage in the AR space makes its employees valuable assets to Meta. Microsoft announced its HoloLens project more than five years ago in 2016, with the technology developing into one of the world’s most advanced headsets.

Apple is attempting to counteract an employee exodus to Meta by offering lucrative stock options and bonuses worth between $50,000 and $180,000, according to a report by Bloomberg. In late Dec 2021, the company offered the bonuses to a group of engineers in silicon design, hardware and some software operations workers.

Meta Platforms was formerly known as Facebook until a major rebranding exercise in Oct 2021, signalling the company’s growing ambitions beyond social media. Its virtual reality hardware business “Reality Labs” has been hard at work in the months since, successfully creating a prototype of its virtual reality “haptic gloves” in mid-Nov 2021.

Announcing @Meta — the Facebook company’s new name. Meta is helping to build the metaverse, a place where we’ll play and connect in 3D. Welcome to the next chapter of social connection. pic.twitter.com/ywSJPLsCoD

— Meta (@Meta) October 28, 2021

Despite these early successes, the centralized Meta’s attempts to dominate the Metaverse has led to no shortage of criticism in the wider community, which includes leaders in the crypto, NFT, blockchain and GameFi spaces.

Some crypto leaders such as Hodl Asset’s Jenny Ta have suggested that Mark Zuckerberg shouldn’t be the one to lead Facebook into the Metaverse at all, given his history regarding data mining, privacy and content policies.

“In order for him to have a clean slate for Meta, he must step down and he must have a new CEO to run it,” she said in a November interview with Cointelegraph.

Both Microsoft and Apple have had their sights set on the Metaverse for quite some time. In early Nov. 2021, Microsoft announced a slew of Teams updates and upgrades to its Xbox gaming console, along with a new product called “Dynamics 365 Connected Spaces.”

The metaverse is here, and it’s not only transforming how we see the world but how we participate in it – from the factory floor to the meeting room. Take a look. pic.twitter.com/h5tsdYMXRD

— Satya Nadella (@satyanadella) November 2, 2021

“The Metaverse enables us to embed computing into the real world and to embed the real world into computing,” Microsoft CEO Satya Nadella said at the time.

“What’s most important is that we are able to bring our humanity with us, and choose how we want to experience this world.”

Experts share how Bored Ape Yacht Club's success has changed the NFT landscape for good.

Within months after its launch in April 2021, Bored Ape Yacht Club (BAYC) has become one of the main reasons Wall Street should take the emerging nonfungible token (NFT) market seriously, thanks to its recent sales turnover of over $1 billion.

For the uninitiated, BAYC is a collection of 10,000 cartoons of anthropomorphic apes with stylish clothes and disreputable expressions. Each ape is practically an image file that should be worthless in a sane world. Nonetheless, they have been managing to fetch astonishing sums, sometimes from some of the world's most renowned celebrities.

For instance, Jimmy Fallon, a popular American TV host, bought the image of a Bored Ape that wore a striped T-shirt and heart-shaped shades for almost $220,000 in November last year. And very recently, Academy Award-winning rapper Eminem paid nearly $462,000 for an ape that somewhat resembled him.

Meanwhile, one of the rarest Bored Apes, which had a gold fur trait, fetched $3.4 million in an online auction held by Sotheby's in October, breaking the record of another rare ape with laser eyes, which was sold to the Sandbox for $2.9 million a month before.

The BAYC collection fetches its value from NFTs, digital ownership proofs logged on a public blockchain. Think Bitcoin (BTC), but each "coin" is indivisible and unique in some way.

Meanwhile, most NFT projects, including BAYC, settle via the Ethereum blockchain, priced in its native token Ether (ETH).

But rarity is not the only reason people pay millions of dollars for Bored Apes. In addition to owning a unique avatar, people also gain admissions to an exclusive membership club, imposed with tokens. That gives them entry into an inner circle of elites, bringing them status and more profitable opportunities.

APE FEST 2021 details posted in the BAYC Discord:https://t.co/KjYGPhYWCP

— Bored Ape Yacht Club (@BoredApeYC) October 1, 2021

☠️⛵️ pic.twitter.com/jvY38qf6NK

Evan Luthra, the CEO, and founder of EL Group International and a BAYC's exclusive club member discussed the allure attached to the elite association. The 26-year old angel investor referred to the membership as something that is "very strong for the Wall Street folks."

"I think there is a new celebrity joining the club every single day."

Bored Ape collectibles also enable their owners to enter private messaging boards on Discord and gain privileged access to other NFTs.

Bored Ape collectibles also enable their owners to enter private messaging boards on Discord and gain privileged access to other NFTs. And then, there is a certain reselling value attached to these NFTs, as visible in its rising "floor price," which reflects the lowest bid one may open for the collectibles.

As of Jan.7, the BAYC floor price was 68 ETH, or around $217,800, up 380% from its mid-August low.

Noelle Acheson, head of market insights at Genesis Trading, credited BAYC for being more flexible in collaborations than CryptoPunks, one of the only high-profile NFT collectible series that came before it.

These collaborations include a BAYC-inspired Adidas gear, the signing of a talent agency, a potential Bored Ape music group, and other related assets emerging around the languid ape characters.

"So, the concept of floor prices — which drives institutional investment in NFTs as well as their increasing use as collateral for loans — no longer depends just on how much investors think someone else will pay further down the road," Acheson explained, adding:

"Floor prices, and an asset’s appreciation potential, now also depends on what else the NFTs can be used for, other than just displaying."

Luthra agreed, adding that the continuous involvement of celebrities with BAYC would further boost its recognition among retail and institutional investors alike. That may bring more demand for its NFT collection, which, in turn, would push its floor price higher.

Jelmer Rotteveel, the co-founder of NFT collection MoonwalkerFM, attached one more bullish backstop to the BAYC core valuation: the ongoing hype around Meta, rebranded from Facebook to support the social media giant's metaverse ambitions.

"With the emergence of Meta we will be entering a new way of communication and business," he told Cointelegraph, adding that NFTs would become an integral part of the metaverse sector, with users supporting unique digital avatars, such as Bored Apes, to interact with one another digitally.

He added:

"I believe that people will be looking more closely at the developments of NFT projects like BAYC, and, just like you saw with cryptocurrency, they will be stepping in one by one."

Acheson noted that Facebook/Meta has committed to spending approximately $10 billion on metaverse development, citing its CEO Mark Zuckerberg's statement that they would look into decentralized metaverse applications.

"Whether we believe him or not — investors are likely to think about getting in ahead of those flows," she added.

As stated, BAYC's net sales recently crossed the $1-billion-mark, almost 10% of what Apple earned in 2021. Meanwhile, the NFT sector, on the whole, processed sales worth $41 billion, which came to be almost equal to the global art sales in the year, data from Chainalysis showed

Matt Hougan, the chief investment officer of Bitwise Asset Management, admitted that many of their clients had been looking for exposure in the NFT space without needing to crisscross through its daunting technology.

In response, Bitwise launched a dedicated fund last mont, which tracks its own Bitwise Blue-Chip NFT Collections Index — a basket of the ten largest NFT collections weighted by market capitalization — and buys and holds artworks from BAYC, CryptoPunks, and other NFT projects.

Related: The NFT world is gradually bridging the gap between niche and mainstream

The "Blue-Chip NFT Index Fund" is available only to institutional investors who invest at least $25,000 into the product.

Rebekah Keida, director of marketing at New York-based investment management firm, XBTO, favored the prospects of Including blue-chip NFT projects like BAYC or CryptoPunks into funds on Wall Street.

Keida says that it would open the floodgates for accredited investors to pour thousands, even millions, of dollars into these digital projects.

"The opportunities afforded by the increased capital flow enhances the legitimacy of top NFT projects while allowing investors a diverse bet in crypto," she told Cointelegraph.

Luthra showed confidence in asset managers' ability to tail Meta's foray into the metaverse sector, which, in turn, would benefit the NFT projects like the BAYC, saying:

"If Meta thinks that the future lies in the metaverse and that's where they are investing their time and energy, it only makes logical sense for asset managers to deploy funds towards the industry. As the space matures and there is more opportunities available, I am confident we will see many more metaverse related funds pop up to capitalize on the opportunity."

Meanwhile, Sami Chlagou, CEO at Cross the ages metaverse game, compared Meta's potential involvement in the NFT space with "lighting a lamp in the heads of investors who are much more backward about this concept."

"Whether you think Meta's decision is good or bad, the fact remains that when one of the largest social networking groups open to innovation and known for shaking up our environment talks about a subject, it opens doors and the desire to get involved."

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

In the past year, internet giants like Amazon and Google all experienced outages which were blamed on errors and failed upgrades. The occurrence of such outages and their impact around the world again highlighted the importance of having a decentralized internet. Also, just like how the Covid-19 pandemic showed the world that blockchain-based digital currencies […]

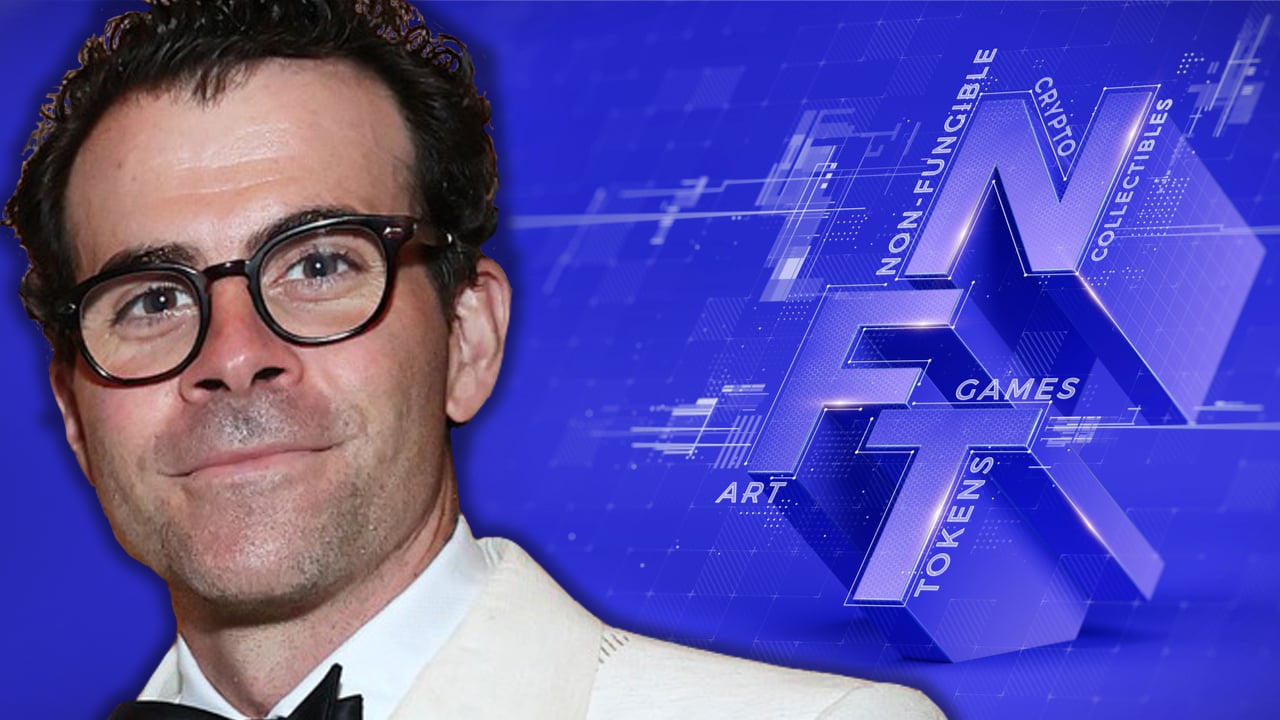

In the past year, internet giants like Amazon and Google all experienced outages which were blamed on errors and failed upgrades. The occurrence of such outages and their impact around the world again highlighted the importance of having a decentralized internet. Also, just like how the Covid-19 pandemic showed the world that blockchain-based digital currencies […] According to the CEO of Instagram, Adam Mosseri, the social media application is looking into non-fungible token (NFT) technology. During an ask-me-anything (AMA) session on Instagram, Mosseri said that the company wants to make NFTs “more accessible to a wider audience.” Instagram CEO: ‘We Are Definitely Actively Exploring NFTs’ Following the firm’s parent company Facebook […]

According to the CEO of Instagram, Adam Mosseri, the social media application is looking into non-fungible token (NFT) technology. During an ask-me-anything (AMA) session on Instagram, Mosseri said that the company wants to make NFTs “more accessible to a wider audience.” Instagram CEO: ‘We Are Definitely Actively Exploring NFTs’ Following the firm’s parent company Facebook […]

One of the world’s largest mobile messaging services is launching a new feature enabling its users to send and receive crypto assets. American platform WhatsApp just announced a new pilot program that integrates Novi, the digital wallet developed by leading social media platform Facebook, now Meta. US-based WhatsApp users will now be able to exchange […]

The post WhatsApp Rolls Out Crypto Payments Pilot Program in the US appeared first on The Daily Hodl.

Novi, the remittance and payments initiative of Meta (formerly Facebook), has launched a Whatsapp pilot test for customers in the U.S. This means that a small number of Whatsapp users will be able to send and receive payments, as well as purchase digital dollars directly from the interface of the messaging service. This is an […]

Novi, the remittance and payments initiative of Meta (formerly Facebook), has launched a Whatsapp pilot test for customers in the U.S. This means that a small number of Whatsapp users will be able to send and receive payments, as well as purchase digital dollars directly from the interface of the messaging service. This is an […]

“We believe fundamental limitations in existing crypto infrastructure are frustrating broader adoption of Web 3.0,” said Mysten’s team, citing the scalability of existing chains as well as the lack of interoperability of many smart contracts.

Mysten Labs, the research and development firm founded by former engineers from social media giant Facebook, has announced the completion of a $36 million funding round towards its goal developing a Web 3.0 infrastructure platform.

In a Monday announcement on Medium, the team behind Mysten Labs said the firm had raised $36 million in a Series A funding round led by Andreessen Horowitz with participation from Redpoint, Lightspeed, Coinbase Ventures, Electric Capital, Standard Crypto, NFX, Slow Ventures, Scribble Ventures, Samsung NEXT and others. According to a CNBC report, CEO Evan Cheng said Mystery would use the funds to build the infrastructure necessary for cryptocurrency- and blockchain-focused firms to deliver technology.

“We believe fundamental limitations in existing crypto infrastructure are frustrating broader adoption of Web 3.0,” said Mysten’s team, citing the scalability of existing chains as well as the lack of interoperability of many smart contracts.

In addition to the development of Web 3.0 infrastructure, Mysten said it planned to launch a “next-generation NFT platform for the Metaverse” in 2022. The project is aimed at allowing users to more easily move assets across different virtual environments without sacrificing functionality.

Related: Sommelier partners with Mysten Labs to launch Cosmos smart contracts

Founded in September 2021 by former cryptographical program engineers behind the blockchain architecture for Facebook’s — now Meta's — crypto-payments platform Diem and mobile wallet Novi, Mysten Labs is led by CEO Evan Chang, CTO Sam Blackshear, COO Adeniyi Abiodun, and chief scientist George Danezis. The most recent head of Novi, David Marcus, announced on Dec. 1 that he planned to step down by the end of the year. Meta — then Facebook — began piloting Novi in the United States and Guatemala in October.