Along with longshot Democratic hopeful Robert F. Kennedy Jr., Francis Suarez was one of the few openly crypto-friendly candidates running in 2024.

Miami Mayor Francis Suarez, one of the few cryptocurrency-friendly candidates running for president of the United States in 2024, has announced he will be suspending his campaign.

In an Aug. 29 announcement on X (formerly Twitter), Suarez said that while running for U.S. president had been “one of the greatest honors of [his] life,” he made the decision to end his campaign and suggested he would support “a strong nominee” from the Republican Party. The Miami mayor announced in June he intended to seek the Republican nomination for U.S. president in the 2024 election, but he did not qualify for the first party debate on Aug. 23.

Running for President of the United States has been one of the greatest honors of my life. This country has given so much to my family and me. The prospect of giving back at the highest levels of public service is a motivator if not a calling. Throughout this process, I have met…

— Mayor Francis Suarez (@FrancisSuarez) August 29, 2023

As mayor of Miami, Suarez made headlines in 2021 after announcing he would accept some of his paychecks in Bitcoin (BTC) and supporting the MiamiCoin (MIA) token project. Along with longshot Democratic hopeful Robert F. Kennedy Jr., the Miami mayor was one of the few openly crypto-friendly candidates running in 2024.

Related: Robert Kennedy Jr. reveals buying 2 Bitcoin for each of his 7 children

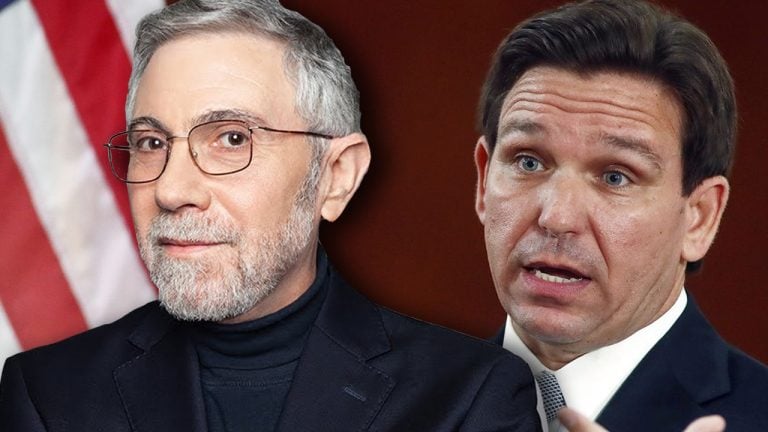

According to many recent polls, Florida Gov. Ron DeSantis trails behind former President Donald Trump for the Republican nomination for president. Trump did not attend the first party debate and faces both state and federal criminal charges related to his alleged role in attempting to overturn the results of the 2020 presidential election, which he lost to current U.S. President Joe Biden.

The 2024 elections in the U.S. could change the way the government handles digital asset legislation. Democrats currently hold a slim majority in the Senate, but 34 seats out of 100 will be up for grabs in the next election. Members of the Republican Party have a majority of seats in the House of Representatives, but the fate of all 435 will be decided in November 2024.

Magazine: Opinion: GOP crypto maxis almost as bad as Dems’ ‘anti-crypto army’