The 12th president of the Federal Reserve Bank of St. Louis, James Bullard, thinks the U.S. central bank can increase the benchmark bank interest rate by 75 basis points this year. Bullard believes the Fed could raise rates to 3.5% by the fourth quarter of 2022 to combat the red hot inflation plaguing the U.S […]

The 12th president of the Federal Reserve Bank of St. Louis, James Bullard, thinks the U.S. central bank can increase the benchmark bank interest rate by 75 basis points this year. Bullard believes the Fed could raise rates to 3.5% by the fourth quarter of 2022 to combat the red hot inflation plaguing the U.S […]

A leading crypto analytics firm says that Ethereum (ETH) has been moving off exchanges since late February. In a new blog post, Santiment says that the exchange outflow should help reduce sell-pressure for ETH, which just cracked above $3,000 this week. “ETH saw an acceleration in Supply on Exchange in early Feb 2022, which quite […]

The post Ethereum (ETH) Disappearing From Exchanges As ETH 2.0 Deposits Accelerate: Santiment appeared first on The Daily Hodl.

Ether’s price has been sideways for 27 days, but pro traders are not confident about the $2,500 support, according to derivatives.

Ether (ETH) investors are having a rough time in 2022, with ETH accumulating 25% losses year-to-date as of March 17. Still, the cryptocurrency has bounced multiple times near $2,500 over the past couple of months, signaling a solid support level.

On March 15, Ethereum developer Tim Beiko announced that the Kiln testnet — formerly Ethereum 2.0 — successfully passed the Ethereum “Merge.” The process involves taking Ethereum’s Execution Layer from the existing proof-of-work layer and merging it with the Consensus Layer from the Beacon Chain. The end goal is to turn the blockchain into a proof-of-stake network.

The United States Federal Open Market Committee (FOMC) increased interest rates to 0.50% on March 16 — the first such move since 2018. The monetary authority warned of persisting “upward pressure on inflation,” precisely the problem that cryptocurrencies’ digital scarcity aims to solve.

Investors fear that further rate hikes by the FOMC could have negative consequences on risk markets. For example, a higher cost of borrowing reduces economic stimulus, creating a hurdle for businesses’ expansion and consumer spending.

Regardless of its potential, Ether’s 80% historical volatility shifts most investors’ perception to see it as a risky asset that will inevitably succumb to an eventual broader market correction.

To understand how professional traders are positioned, one should look at Ether’s futures and options market data. Firstly, the basis indicator measures the difference between longer-term futures contracts and the current spot market levels.

The annualized premium of Ether futures should run between 5% and 12% to compensate traders for “locking in” the money for two to three months until the contract expires. Levels below 5% are extremely bearish, while numbers above 12% indicate bullishness.

The above chart shows that Ether’s basis indicator recovered from 2% on March 13 to the current 3.5%. However, such a level falls below the 5% threshold expected on neutral markets, signaling that pro traders are far from comfortable holding ETH futures longs.

Thus, one can assess that an eventual break of the $3,200 resistance will catch those investors off guard, creating strong buying activity to cover short positions.

Ether’s daily closing price has been ranging from $2,500 to $3,000 for the past 27 days, making it difficult to discern a direction in the market. In that sense, the 25% delta skew is extremely useful, as it shows whether arbitrage desks and market makers are overcharging for upside or downside protection.

If those traders fear an Ether price crash, the skew indicator will move above 10%. On the other hand, generalized excitement reflects a negative 10% skew. That is precisely why the metric is known as the pro traders’ “fear and greed” metric.

Related: How professional Ethereum traders place bullish ETH price bets while limiting losses

As shown above, the skew indicator has been over 10% since March 11, indicating fear, as these options traders are overcharging for downside protection.

Even though there was a modest improvement on Ether’s futures premium, the indicator remains on a bearish level. Considering the ETH options markets pricing a higher risk of downside, it is safe to conclude that professional traders are not confident that the current $2,500 support will hold.

However, not everything is lost for Ether bulls, as the cheap futures premium offers the opportunity to leverage long at a low cost. As long as the Ethereum network continues to advance on solving its scalability problem, it is still possible that the $3,200 resistance gets revisited considering the global macroeconomic uncertainty and inflation.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

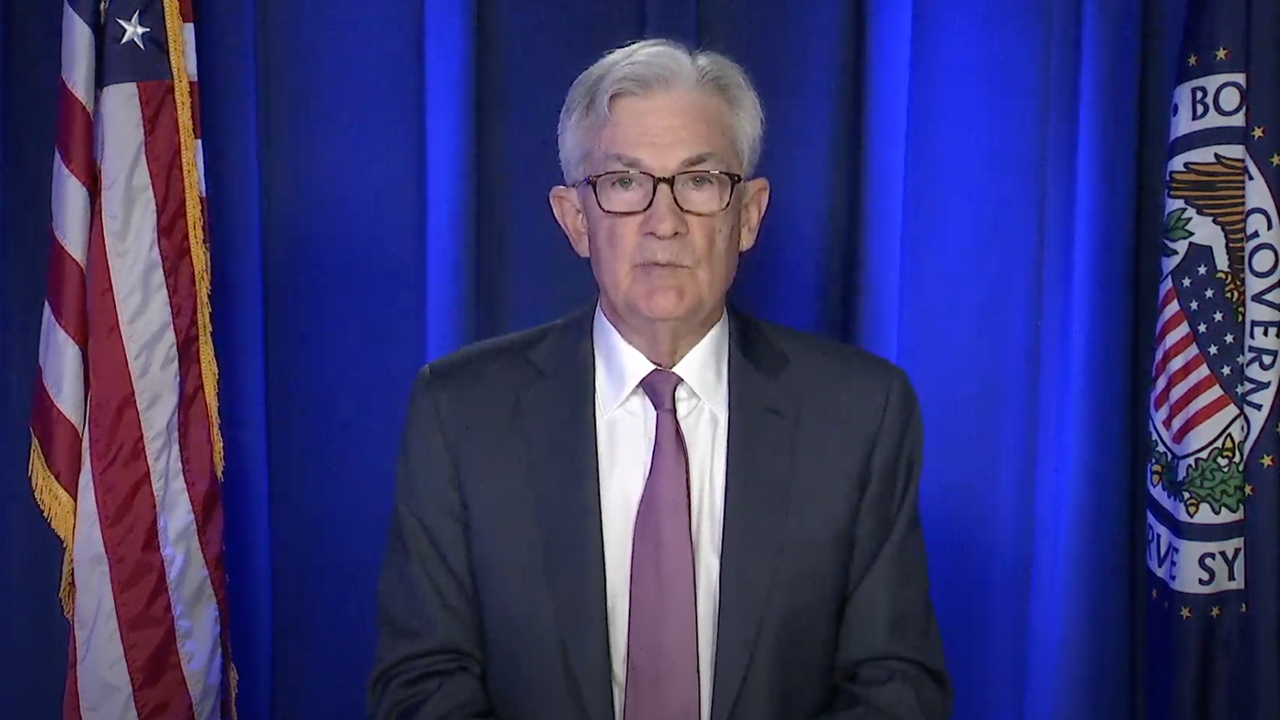

On Wednesday, the Federal Open Market Committee (FOMC) and Fed chair Jerome Powell held a press conference concerning the American economy, the central bank’s plans to address inflation, and the ongoing Russia-Ukraine war. Powell announced that the FOMC decided to increase the benchmark bank rate by a quarter percentage and further noted the Fed anticipates […]

On Wednesday, the Federal Open Market Committee (FOMC) and Fed chair Jerome Powell held a press conference concerning the American economy, the central bank’s plans to address inflation, and the ongoing Russia-Ukraine war. Powell announced that the FOMC decided to increase the benchmark bank rate by a quarter percentage and further noted the Fed anticipates […]

BTC price struggles to sustain $40,000, but Friday's options expiry might give bulls the $160 million profit needed to keep the positive momentum.

Over the past two months, Bitcoin (BTC) has respected a slightly ascending trend, bouncing multiple times from its support.

Even though that might sound positive, Bitcoin's performance year-to-date remains a lackluster negative 14%. On the other hand, the Bloomberg Commodity Index (BCOM) gained 2% in the same period.

The broader commodity index benefited from price increases in crude oil, natural gas, gold, corn, and lean hogs. Worsening macroeconomic conditions pressured the supply curve, which, in turn, shifted the equilibrium price toward a higher level.

Moreover, the United States approved a $1.5 trillion spending bill on March 15 that funds the government through September. President Joe Biden's signing of the legislation averts a government shutdown but further pressures the U.S. national debt, now over $30.3 trillion.

Still, cryptocurrency traders are increasingly concerned about the U.S. Federal Reserve rate hikes expected throughout 2022 to contain inflationary pressure.

Investors took profits on riskier assets, causing the U.S. Dollar Index (DXY) to reach its highest level in 21 months at 99.2 on March 11. The index measures the dollar's strength against a basket of top foreign currencies.

Bitcoin's recovery above $40,000 on March 26 took bears by surprise as only 7% of the bearish option bets for March 18 have been placed above such a price level.

Bulls might have been fooled by the recent $45,000 resistance test on March 1 as their bets for Friday's $760 million options expiry go all the way to $65,000.

A broader view using the 1.26 call-to-put ratio shows more sizable bets as the call (buy) open interest stands at $425 million against the $335 million put (sell) options. Nevertheless, as Bitcoin is now back above $40,000, most bearish bets will likely become worthless.

For instance, if Bitcoin's price remains above $40,000 at 8:00am UTC on March 18, only $24 million worth of those put (sell) options will be available. This difference happens because there is no use in a right to sell Bitcoin at $40,000 if it trades above that level on expiry.

Below are the three most likely scenarios based on the current price action. The number of options contracts available on March 18 for call (bull) and put (bear) instruments varies depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

This crude estimate considers the call options used in bullish bets, and the put options exclusively in neutral-to-bearish trades. Even so, this oversimplification disregards more complex investment strategies.

For instance, a trader could have sold a call option, effectively gaining a negative exposure to Bitcoin above a specific price. But unfortunately, there's no easy way to estimate this effect.

Related: Bitcoin risks final 'bear market capitulation' as rich investors continue BTC selloff — analyst

Bitcoin bears need to pressure the price below $40,000 on Friday to avoid a $105 million loss. On the other hand, bulls' best case scenario requires a push above $41,000 to increase their gains to $160 million.

Bitcoin bulls had $98 million leverage long positions liquidated on March 16, so there's less incentive to push the price higher in the short term. With this said, bulls will likely try to defend $40,000 support until March 18 options expiry.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

On the eve of tomorrow’s FOMC meeting, bitcoin once again failed to climb past its long-term resistance level of $40,000, as markets consolidated. Although prices moved away from recent support, upside momentum slowed as BTC neared its ceiling. As of writing, ETH was trading at its level of support. Bitcoin Bitcoin came close to breaking […]

On the eve of tomorrow’s FOMC meeting, bitcoin once again failed to climb past its long-term resistance level of $40,000, as markets consolidated. Although prices moved away from recent support, upside momentum slowed as BTC neared its ceiling. As of writing, ETH was trading at its level of support. Bitcoin Bitcoin came close to breaking […]

The Federal Open Market Committee (FOMC) has banned members of the U.S. Federal Reserve from partaking in the crypto and stock markets. In a new press release, the FOMC unanimously adopted a comprehensive set of new rules for the investment activities of Federal Reserve members after recent resignations from key officials due to allegations of […]

The post Federal Reserve Officials Banned From Trading Crypto and Stocks in New Directive appeared first on The Daily Hodl.

The Federal Reserve has banned its senior officials from investing in cryptocurrency. “Officials covered by the new rules will have 12 months from the effective date of the rules to dispose of all impermissible holdings,” said the Federal Open Market Committee. Senior Federal Reserve Officials Prohibited From Investing in Cryptocurrency The Federal Open Market Committee […]

The Federal Reserve has banned its senior officials from investing in cryptocurrency. “Officials covered by the new rules will have 12 months from the effective date of the rules to dispose of all impermissible holdings,” said the Federal Open Market Committee. Senior Federal Reserve Officials Prohibited From Investing in Cryptocurrency The Federal Open Market Committee […]

The odds are on for a March rate increase after Wednesday’s FOMC minutes, but stocks also fear geopolitical instability this week.

Bitcoin (BTC) dipped below $43,000 on Feb. 17 as another day on ranging compounded hopes for an incoming breakout.

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD acting in a slightly widened zone with $44,500 as a ceiling over the past 24 hours.

The pair had returned to the top of its intraday range overnight on the back of United States Federal Reserve comments.

Expected to provide cues about potential interest rate hikes, the Federal Open Market Committee (FOMC) minutes from a meeting in late January ultimately provided few surprises. A hike could come in March, but no firm commitment was voiced over the process.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run,” an accompanying statement read.

“In support of these goals, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent. With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate.”

The FOMC added that it was aiming to halt asset purchases altogether in March, in line with previous plans, with February’s purchases due to amount to at least $30 billion.

With little in the way of fresh news, crypto markets were thus uninspiring going into Thursday. Zooming out, however, optimism was still firmly present on the strength of the past two weeks’ BTC price action.

“My bias has changed a bit and now favor a squeeze towards 53k before mid March,” popular trader and analyst Pentoshi said as part of his latest Twitter update.

Others likewise noted the comparatively robust price performance this month compared to previous episodes in Bitcoin’s comedown from all-time highs last November.

By bouncing at near $33,000 in January, for example, a miner capitulation event — where miners are forced to sell or stop mining altogether due to Bitcoin’s spot price being less than their cost of production — was successfully avoided.

Like I have said for the past week for #Bitcoin; no reason to panic until support failed, no reason to be too excited until resistance breaks

— Matthew Hyland (@MatthewHyland_) February 16, 2022

Just let it do its thing, take your emotions out of it: https://t.co/pBeQl17glc

As Cointelegraph reported, support levels were creeping up throughout recent days as buyers bet on a potential dip being less shallow than previously expected.

Other macro signals on the day came in the form of fresh uncertainty over the Russia–Ukraine saga, with reports of hostilities emerging overnight.

Related: Price analysis 2/16: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOT

Stock market futures were down at least 0.5% prior to the Wall Street open.

Possible news of mortars fired between Russia Ukraine.

— Cantering Clark (@CanteringClark) February 17, 2022

Oil up, risk down / audjpy down.

If it’s real, will shock through all markets.

Earlier, the U.S. government called claims that Russia was attempting to de-escalate the situation on the Ukrainian border — something that would have conversely steaded nervous markets — “false.”

“Yesterday, the Russian government said it was withdrawing troops from the border of Ukraine... we now know it was false,” a senior official said on Wednesday quoted by the Financial Times.

Both Bitcoin and altcoins remain highly correlated to equities as 2022 progresses.