A widely followed crypto analyst says he thinks he knows what’s fueling Bitcoin’s (BTC) most recent upward rally. Crypto trader Michaël van de Poppe tells his 653,200 Twitter followers that he expected more downside out of BTC than he’s currently seeing. “Bill to propose Bitcoin mining in the US is a positive thing for the markets, probably […]

The post Top Crypto Analyst Says Proposed US Crypto Mining Good for Bitcoin Markets, Expects Continuation to $40,000 appeared first on The Daily Hodl.

EUR/USD raced to a six-week high on Thursday, as markets continued to react to the U.S. Federal Reserve’s 25-basis-point rate hike. The greenback was lower across the board, falling versus several G7 currencies, including the British pound. EUR/USD On Thursday, the world’s most traded currency pair rose for a sixth straight session, as markets continued […]

EUR/USD raced to a six-week high on Thursday, as markets continued to react to the U.S. Federal Reserve’s 25-basis-point rate hike. The greenback was lower across the board, falling versus several G7 currencies, including the British pound. EUR/USD On Thursday, the world’s most traded currency pair rose for a sixth straight session, as markets continued […] Following the fallout over the past two weeks in the U.S. banking industry, the Federal Reserve raised the federal funds rate by 25 basis points (bps) on Wednesday, citing the need for the inflation rate to return to 2% over the long run. Fed Raises Rate Despite Calamity in the U.S. Banking Sector It’s been […]

Following the fallout over the past two weeks in the U.S. banking industry, the Federal Reserve raised the federal funds rate by 25 basis points (bps) on Wednesday, citing the need for the inflation rate to return to 2% over the long run. Fed Raises Rate Despite Calamity in the U.S. Banking Sector It’s been […]

Bitcoin may celebrate no matter what the Fed decides on interest rates, but the extent of longs that would be liquidated below $20,000 has one analyst worried.

Bitcoin (BTC) may “take out shorts” to crack $30,000 during the day’s key United States macroeconomic policy updates, analysis says.

As bets pile up over how BTC price will react to the Federal Reserve’s decision on interest rates, $30,000 is in sight — but a drop to below $20,000 is not off the table.

Bitcoin is hours away from what popular trader Crypto Tony calls “one of the most anticipated” Fed meetings ever.

The Federal Open Market Committee (FOMC) will decide on how to tweak baseline interest rates on March 22, amid suspicions that the ongoing U.S. banking crisis has disrupted policy.

From ongoing rate hikes forecast just last month, markets are now considering the chances that the Fed will pause the cycle, data from CME Group’s FedWatch Tool shows.

This would be a key boon for risk assets, as the Fed would be tacitly implying that the eighteen months it has spent removing liquidity from the economy has not been the silver bullet to recovery.

Liquidity is already on the up thanks to the failure of several banks, Cointelegraph reported, with a chunk of the quantitative tightening (QT) removals undone in a single week.

“So FOMC today which means one thing, VOLATALITY. No doubt we will trend sideways util the meeting, which means tread cautiously,” Crypto Tony told Twitter followers in a brief on the day.

“My main play is to take profit at $30,000 if it comes.”

Markets commentator Tedtalksmacro meanwhile laid out the probabilities of each Fed path and their likely impact on risk assets.

FOMC scenarios.

— tedtalksmacro (@tedtalksmacro) March 21, 2023

50bps hike (outlier): short risk assets, bear trend resumes.

25bps hike (most likely): Nothing burger, the dot plot + press conference dictate the market's move.

Pause (second most likely): Get very long #Bitcoin

Cut (outlier): Mortgage the house and buy BTC pic.twitter.com/gkrPXfloEc

“Slow grind upwards on Bitcoin, which means that my eyes are still focused on $28,700,” Cointelegraph contributor Michaël van de Poppe, founder and CEO of trading firm Eight, continued.

“I'm expecting us to sweep into that high around FOMC and then we'll have some consolidation. CME gap at $28,700 too.”

Van de Poppe referred to a so-called “gap” on CME Group’s Bitcoin futures markets formed when their price began a new trading week in a different position to that which it finished the week prior. Historically, spot price has gone up or down in order to “fill” such gaps.

The gap in focus was created in June 2022, data from TradingView confirms.

Adopting a more conservative view, however, popular analyst Justin Bennett warned that the current spot price trading range represents significant historical resistance.

Related: Bitcoin hits new 9-month highs above $28K as markets flipflop over FOMC

A “squeeze” of shorts could result in $30,000 appearing, he acknowledged, but a sudden dive could have the opposite effect — longs are betting that $20,000, at least, will hold.

“Look, maybe we see BTC take out short liquidations up to $30k,” Bennett summarized.

“But do you really want to get bullish at macro resistance with a massive block of long liquidations sub $20k? I don't.”

An accompanying chart showed the extent of liquidations, which would be triggered by such a move below the $20,000 mark.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Federal Reserve Bank of Atlanta’s president has warned of disastrous economic consequences similar to those seen during the financial crisis of the 1970s if the Fed loosens its policy prematurely. Noting that “inflation remains too high,” he stressed: “We don’t want a repeat, so we must defeat inflation now.” Fed Officials on Rate Hikes and […]

Federal Reserve Bank of Atlanta’s president has warned of disastrous economic consequences similar to those seen during the financial crisis of the 1970s if the Fed loosens its policy prematurely. Noting that “inflation remains too high,” he stressed: “We don’t want a repeat, so we must defeat inflation now.” Fed Officials on Rate Hikes and […] U.S. inflation levels dropped slightly in January, sliding from 6.5% to 6.4%. However, inflation remains higher than expected, causing concern among investors that the U.S. central bank will continue to hike the benchmark federal funds rate. Inflation in the US Remains High, Causing Uncertainty in Markets Inflation in the United States exceeded expectations among analysts […]

U.S. inflation levels dropped slightly in January, sliding from 6.5% to 6.4%. However, inflation remains higher than expected, causing concern among investors that the U.S. central bank will continue to hike the benchmark federal funds rate. Inflation in the US Remains High, Causing Uncertainty in Markets Inflation in the United States exceeded expectations among analysts […]

Bitcoin looks like it is treading on thin ice as February fails to match the gains of last month.

Bitcoin (BTC) starts the second week of February in a newly bearish mood as multi-month highs fail to hold.

In what may yet bring vindication to those predicting a major BTC price comedown, BTC/USD is back under $23,000 and making lower lows on hourly timeframes.

Feb. 6 trading may not yet be underway in Europe or the United States, but Asian markets are already falling and the U.S. dollar gaining — potential further hurdles for Bitcoin bulls to overcome.

With some macroeconomic data to come from the Federal Reserve this week, attention is mostly focused on next week’s inflation check in the form of the Consumer Price Index (CPI) for January.

In the build-up to this event, the results of which are already hotly contested, volatility may gain a fresh foothold across risk assets.

Add to that those aforementioned concerns that Bitcoin is long overdue a more significant retracement than those seen in recent weeks, and the recipe is there for difficult, but potentially lucrative trading conditions.

Cointelegraph takes a look at the state of play on Bitcoin this week and considers the factors at play in moving the markets.

It is very much a tale of two Bitcoins when it comes to analyzing BTC price action this week.

BTC/USD has managed to retain the majority of its stunning January gains, these totaling almost 40%. At the same time, signs of a comedown on the cards are increasingly making themselves known.

The weekly close, while comparatively strong at just under $23,000, still failed to beat the previous one, and also represented a rejection at a key resistance level from mid-2022.

“BTC is failing its retest of ~$23400 for the time being,” popular trader and analyst Rekt Capital summarized about the topic on Feb. 5.

An accompanying weekly chart highlighted the support and resistance zones in play.

“Important BTC can Weekly Close above this level for a chance at upside. August 2022 shows that a failed retest could see BTC drop deeper in the blue-blue range,” he continued.

“Technically, retest still in progress.”

As Cointelegraph reported over the weekend, traders are already betting on where a potential pullback may end up — and which levels could act as definitive support to buoy Bitcoin’s newfound bullish momentum further.

These currently center around $20,000, a psychologically significant number and also the site of Bitcoin’s old all-time high from 2017.

BTC/USD traded at around $22,700 at the time of writing, data from Cointelegraph Markets Pro and TradingView showed, continuing to push lower during Asia trading hours.

“Some bids were filled on this recent push down (green box) but most of the remaining bids below have been pulled (red box),” trader Credible Crypto wrote about order book activity on Feb. 5.

“If we continue lower here eyes still on 19-21k region as a logical bounce zone.”

For a quietly confident Il Capo of Crypto, meanwhile, it is already crunch time when it comes to the trend reversal. A supporter of new macro lows throughout the January gains, the trader and social media pundit argued that breaking below $22,500 would be “bearish confirmation.”

“Current bear market rally has created the perfect environment for people to keep buying all the dips when the current trend reverses,” he wrote during a Twitter debate.

“Perfect scenario for a capitulation event in the next few weeks.”

The week in macro looks decidedly calm compared to the start of February, with less in the way of data and more by way of commentary set to define the mood.

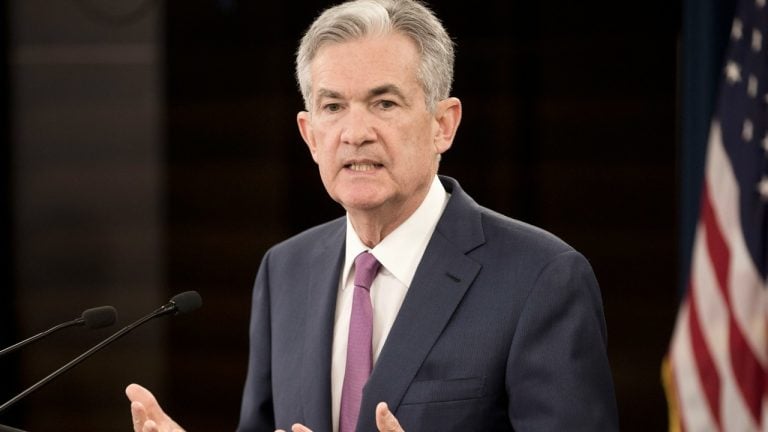

That commentary will come courtesy of Fed officials, including Chair Jerome Powell, and any hint of policy change contained within their language has the potential to shift markets.

The week prior saw just such a phenomenon play out, as Powell used the word “disinflation” no fewer than fifteen times during a speech and Q&A session accompanying the Fed’s move to enact a 0.25% interest rate hike.

Ahead of fresh key data next week, talk in analytics circles is on how the Fed might transition from a restrictive to accommodative economic policy and when.

As Cointelegraph reported, not everyone believes that the U.S. will pull off the “soft landing” when it comes to lowering inflation and will instead experience a recession.

“DON't be surprised if the term "soft-landing" remains around for a while before the rug being pulled in Q3 or Q4 this year,” investor Andy West, co-founder of Longlead Capital Partners and HedgQuarters, concluded in a dedicated Twitter thread at the weekend.

In the meantime, it may be a case of business as usual, however, with smaller rate hikes after Powell’s “mini victory lap” over declining inflation, further analysis argues.

“Personally, my belief is that the Fed will most likely raise by +0.25% in the upcoming two meetings (March & May),” Caleb Franzen, senior market analyst at CubicAnalytics, wrote in a blog post on Feb. 4.

“Of course, all future actions by the Fed will be dependent on the continued evolution of inflation data & broader macroeconomic conditions.”

Franzen acknowledged that while recession was not currently an apt description of the U.S. economy, conditions could still worsen going forward, referencing three such cases in past years.

Closer to home, next week’s CPI release is already on the radar for many. The extent to which January’s data supports the waning inflation narrative should be key.

“Post-FOMC, we have a heap of 2nd tier data releases including the important ISM services and NFP,” trading firm QCP Capital wrote in forward guidance mailed to Telegram channel subscribers last week.

“However the decider will be the Valentine's Day CPI - and we think there are upside risks to that release.”

Turning to Bitcoin, it is network fundamentals currently offering some stability amid a turbulent environment.

According to current estimates from BTC.com, difficulty is stable at all-time highs, with only a modest negative readjustment forecast in six days’ time.

This could well end up positive depending on Bitcoin price action, however, and a look at hash rate data suggests that miners remain in fierce competition.

A countertrend comes in the form of miners’ economic behavior. The latest data from on-chain analytics firm Glassnode shows that sales of BTC by miners continue to increase, with their reserves dropping faster over 30-day periods.

Reserves correspondingly totaled their lowest in a month on Feb. 6, with miners’ balance at 1,822,605.594 BTC.

Overall, however, current price action has provided “relief” for miners, Philip Swift, co-founder of trading suite Decentrader says.

In a tweet last week, Swift referenced the Puell Multiple, a measure of relative value of BTC mined, which has left its “capitulation zone” to reflect better profitability.

“After 191 days in capitulation zone, the Puell Multiple has rallied. Showing relief for miners via increased revenue and likely reduced sell pressure,” he commented.

Some on-chain data is still surging ahead despite the slowdown in BTC price gains.

Of interest this week is Bitcoin’s network value to transaction (NVT) signal, which is now at levels not seen in nearly two years.

NVT signal measures the value of BTC transferred on-chain against the Bitcoin market cap. It is an adaption of the NVT ratio indicator, but uses a 90-day moving average of transaction volume instead of raw data.

NVT at multi-year highs may be cause for concern — network valuation is relatively high compared to value transferred, a scenario which may prove “unsustainable,” in the words of its creator, Willy Woo.

As Cointelegraph reported late last year, however, there are multiple nuances to NVT which make its various incarnations diverge from one another to provide a complex picture of on-chain value at a given price.

“Bitcoin's NVT is showing indications of value normalization and the start of a new market regime,” Charles Edwards, CEO of crypto investment firm Capriole, commented about a further tweak of NVT, dubbed dynamic range NVT, on Feb. 6.

“The message is the same further through history and more often than not it is good news in the mid- to long-term. In the short-term, this is a place we typically see volatility.”

In a glimmer of hope, on-chain research firm Santiment notes that the number of smaller Bitcoin wallets has ballooned this year.

Related: Bitcoin, Ethereum and select altcoins set to resume rally despite February slump

Since BTC/USD crossed the $20,000 mark once more on Jan. 13, 620,000 wallets with a maximum of 0.1 BTC have reappeared.

That event, Santiment says, marks the moment when “FOMO returned” to the market, and the subsequent growth in wallet numbers means that these are at their highest since Nov. 19.

“There have been ~620k small Bitcoin addresses that have popped back up on the network since FOMO returned on January 13th when price regained $20k,” Twitter commentary confirmed on Feb. 6.

“These 0.1 BTC or less addresses grew slowly in 2022, but 2023 is showing a return of trader optimism.”

A look at the Crypto Fear & Greed Index meanwhile shows “greed” still being the primary description of market sentiment.

On Jan. 30, the Index hit its “greediest” since Bitcoin’s November 2021 all-time highs.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

While the rate increase was expected by the markets and Jerome Powell indicated more increases will come, the market has reacted positively to the Fed chairman’s comments.

The price of Bitcoin (BTC) broke through the $24,000 ceiling and the total crypto market cap jumped nearly 4% after United States Federal Reserve Chair Jerome Powell indicated that inflation had begun slowing down in the world’s largest economy.

“We can now say, I think for the first time, that the disinflationary process has started […] we see it really in goods prices,” said Powell during a Feb. 1 Federal Open Market Committee press briefing shortly after announcing an interest rate hike of 25 basis points.

The rate hike and Powell’s remarks appeared to have gone down well in the crypto markets, which had been trading sideways in the lead-up to the speech but saw market cap increase by over $40 billion in the hours after the announcement.

The global crypto market cap is now at $1.09 trillion, up 3.88% over the last day, according to the latest figures from Coinmarketcap.

Meanwhile, BTC tipped slightly over $24,000 for the first time in 2023, reaching $24,161.27 according to Coinmarketcap.

Related: Bitcoin bulls plan to flip $23K to support by aiming to win this week’s $1B options expiry

That being said, Powell said they still expect inflation to continue rising in the services sector for some time and to be prepared for “ongoing rate rises.”

“We see ourselves as having more persistent inflation in that [services] sector, which will take longer to get down, and we have to complete the job. That’s what we’re here for.”

Powell noted that “ongoing rate rises” would still be appropriate as the Federal Reserve attempts to bring inflation back to its 2% target level.

Fed Reserve hikes by 0.25%. Its 8th hike. The Fed did not indicate its at the end of its hiking cycle. But, Fed chair said in his speech he sees inflation coming down soon. 50% of inflation is in “disinflationary” phase. Markets react positively. #FOMC #Fed #asx $spx $ndq $xjo pic.twitter.com/1misOrnD2b

— Jessica Amir (@JessicaDAmir) February 1, 2023

It should be noted that disinflation refers to a slowdown in the rate of increase of general price levels, as opposed to deflation, where the general price level of goods and services decreases.

The U.S. Federal Reserve raised its benchmark federal funds rate by 0.25% on Wednesday after markets priced in near 100% certainty the Federal Open Market Committee (FOMC) would codify the quarter-point increase. The FOMC statement further detailed that ongoing rate increases are anticipated to bring inflation down to the target range of 2%. FOMC Outlines […]

The U.S. Federal Reserve raised its benchmark federal funds rate by 0.25% on Wednesday after markets priced in near 100% certainty the Federal Open Market Committee (FOMC) would codify the quarter-point increase. The FOMC statement further detailed that ongoing rate increases are anticipated to bring inflation down to the target range of 2%. FOMC Outlines […]