The former billionaire paid four “macks” for a haircut before his trial while staying at the Brooklyn Metropolitan Detention Center.

The crypto trading days of former FTX CEO Sam Bankman-Fried are over, and the recently convicted founder has found a new thing to trade while in jail — fish.

The Wall Street Journal reported on Nov. 23 that Bankman-Fried recently traded four packets of Mackerel — known in prison as “macks” — for a haircut before his criminal trial last month.

Mackerel packets have risen to be the hottest trading commodity in United States prisons since tobacco products were banned. Postage stamps and soup packets — “soups” — respectively come second and third on the value hierarchy. The commissary of the Metropolitan Detention Center (MDC) where Bankman-Fried is housed sells mackerel packets for $1.30.

Bankman-Fried is sharing a cell at the Brooklyn prison with former Honduran president Juan Hernández and a former senior Mexican police officer, sources familiar with the matter told The Journal.

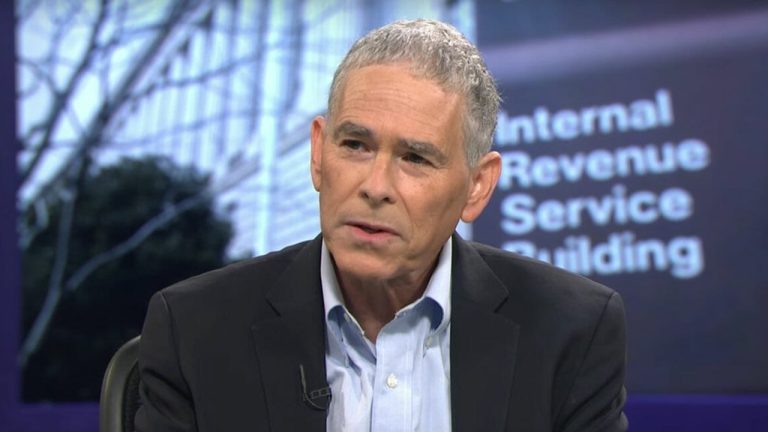

Social media pundits questioned the legitimacy of the reports and controversial tech figure Martin Shkreli known as “pharma bro” — who spent more than four years in federal prison — confirmed macks were a staple currency in U.S. jails.

In a Nov. 24 post on X (formerly Twitter), Shkreli claimed paying four macks for a haircut was a “rip off” but noted it was still less than paying someone a book of stamps.

Related: FTX Foundation staffer fights for $275K bonus promised by SBF

Shkreli explained in the MDC that the market for macks was larger than stamps compared to a regular state federal prison but warned against holding too many mack packs, saying any more than 500 becomes suspicious.

four mack is a ripoff. but if you're stunting you would toss homie a book (a book of stamps).

— Martin Shkreli (e/acc) (@wagieeacc) November 23, 2023

in MDC mac spot market is bigger than stamp spot market. in prison prison, stamp spot market is more liquid. mac is very dense and its suspicious to be holding 500 macs. however, it's…

As a vegan, Bankman-Fried wouldn’t eat mackerel, making them a more easily traded commodity for the recently convicted former billionaire.

On Nov. 21, the court of appeals denied Bankman-Fried’s request to be released from prison while he awaits his sentencing hearing, currently scheduled for March 28 next year.

Bankman-Fried was found guilty of seven fraud- and money laundering-related charges on Nov. 2.

Magazine: This is your brain on crypto — Substance abuse grows among crypto traders