Neither FTX CEO Sam Bankman-Fried nor any FTX official has provided its users with clarity as to why FTX’s website was taken down.

Financially-troubled crypto exchange FTX has brought its website back online following a period of intermittent downtime — with the trading platform now sporting a banner confirming withdrawals are halted and advising users against depositing.

The FTX website returned online at approximately 9:00 pm UTC on Nov. 9, after encountering five separate periods of network downtime spanning over two hours, according to the “IS IT DOWN OR JUST ME” website.

The crypto community on Twitter has also noticed a new bright red banner that can be seen throughout the website that reads:

“FTX is currently unable to process withdrawals. We strongly advise against depositing.”

A pinned message on the official FTX Telegram Group on Nov. 8 also confirmed the halting of withdrawals, without any estimates about when they would return.

"We are waiting for confirmation from our team to ramp it up. Right now we dont have an ETA but surely will communicate it as soon as we have it," a member of FTX support staff wrote in the message.

Attempting to sign up for a new account on the website also comes with an alert that “signups are paused” at this current time, Cointelegraph has discovered.

This suggests that deposits, while “strongly advised against,” are only accessible to those who have existing accounts on the trading platform.

Meanwhile, two websites linked to the crypto exchange including Alameda Research and FTX Ventures remain down at the time of writing.

Related: Binance’s victory over FTX means more users moving away from central exchanges

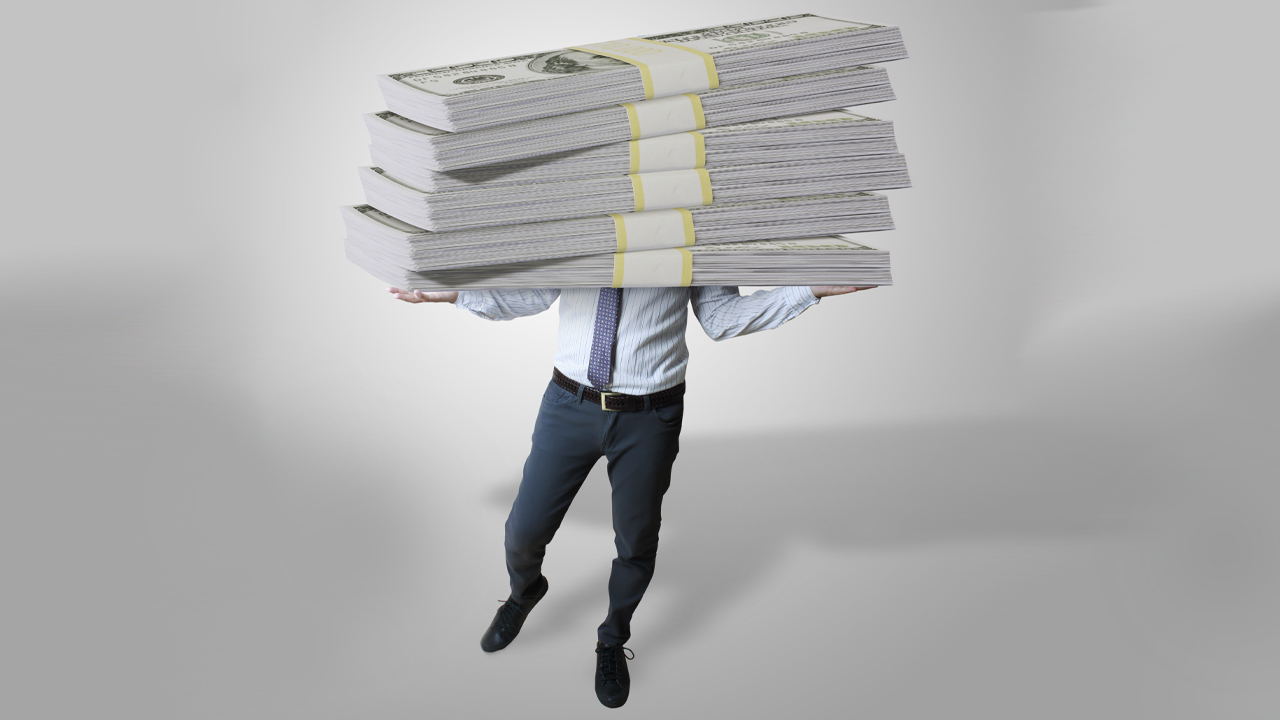

It comes amid an ongoing liquidity crisis being faced by the crypto exchange.

A Nov. 9 report from the Wall Street Journal claims that the exchange is facing a shortfall of $8 billion, and is unable to meet withdrawal demands without emergency funding.

Binance initially signed a non-binding letter of intent to buy out the embattled exchange but pulled out less than 48 hours later, citing the mishandling of customer funds and alleged U.S. agency investigations as the reasons for its change in decision.

Google search results for “FTX website” also saw a large spike over the last few hours following the reports that the FTX website was intermittently going down, according to Google Trends: