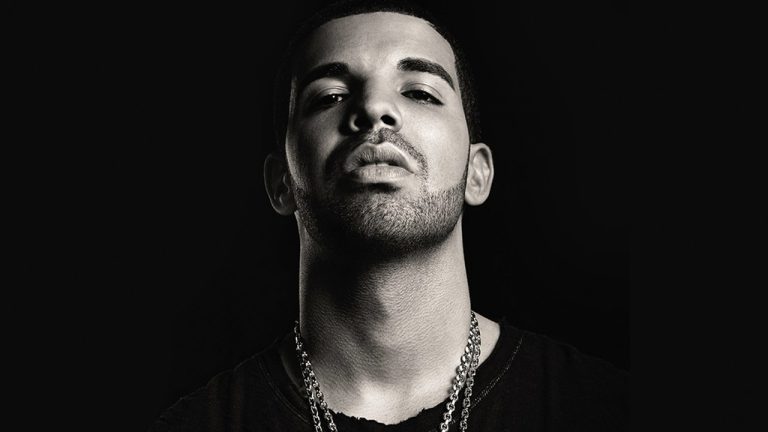

The Canadian rapper and singer Drake lost $400,000 in bitcoin after betting that the YouTuber-turned-boxer Jake Paul would beat Tommy Fury by knockout. Drake could have potentially raked in a $1.44 million bitcoin payout, but Fury won the fight in a split-decision victory. Drake Loses $400K Bitcoin Bet on Jake Paul’s Bout On Feb. 26, […]

The Canadian rapper and singer Drake lost $400,000 in bitcoin after betting that the YouTuber-turned-boxer Jake Paul would beat Tommy Fury by knockout. Drake could have potentially raked in a $1.44 million bitcoin payout, but Fury won the fight in a split-decision victory. Drake Loses $400K Bitcoin Bet on Jake Paul’s Bout On Feb. 26, […]

What began as a Redditor “just dabbling” two years ago blew into full-blown crypto trading addiction that all came to a head three weeks ago.

A self-confessed crypto trading addict and father of two is facing the dire prospect of losing his family forever after secretly racking up $180,000 in debt from his crypto trading habits.

Posting his story on the r/relationship advice subreddit on Feb. 21, Reddit user “Leather_Opposite2135” said he started dabbling in cryptocurrency trading around 2021.

Fast forward two years to the present day and he’s been kicked out by his wife and is at least $180,000 in debt.

“It started just dabbling,” said Leather. “It’s a tech space so I found it very interesting. Joined a bunch of online spaces (discord) and eventually watched a few people trading btc and immediately got hooked.”

Within a year, he had already “burnt” $50,000 from trading cryptocurrency, with the funds lost coming mainly from his software business.

“Skip forward another year and it got really bad,” said Leather, noting that his addiction had started to take hold as he started to fund his trading through other means, such as personal loans and credit cards.

“I’m sure you’ve heard it before, but I found all sorts of ways to fund it, including getting personal loans, credit cards, lying about all of it.”

“I was gambling on my phone when I went to the bathroom, when the kids were sleeping, on my computer when not busy with work.”

Leather noted that around three weeks ago he finally came clean about the debt to his wife, who didn’t take the news well, threatening to leave him and take ownership of their house.

He’s since banned himself from crypto, handed over control of his trading accounts to his wife, and has been seeing a gambling addiction counselor weekly, but admitted it was initially hard to shake the addiction.

“Emotionally, I was all over the place for the first 2 weeks. Cold turkey from something I spent 10 hours a day on (minimum) [...] All the while the little voice telling me to go looks at charts on the shoulder.”

The original post has since been deleted by Leather_Opposite2135 on Reddit but is neither the first nor last story shedding light on the possible dangers of crypto trading addiction.

Rehabilitation centers around the world have begun adding crypto trading addiction to their list of services treating compulsive habits, next to alcohol, drugs and behavioral health.

“Clinically, we have certainly seen an increase in people coming to therapy who report difficulties in managing their crypto trading behavior,” clinical psychologist Dr. Anastasia Hronis told Cointelegraph in an email.

“In a similar way to gambling, many of them will report that it disrupts their day to day life, they spend a lot of time thinking about it, and may also be experiencing financial hardship as a result.”

Dr. Hronis noted that similar to online gambling addiction, there is an “ease of accessibility” with crypto trading “that can be quite dangerous for individuals.”

Related: How to build a crypto portfolio without spending any money or time trading

“A person can be seen to be engaging in their normal day-to-day life e.g. going to work, spending time with family and friends, participating in hobbies etc, while still trading alongside. This means that an addiction can actually become quite severe before anyone else in that person's life notices.”

“Given the newness of crypto trading, I think that treatment is still catching up to some degree. While the general principles of treating an addiction can certainly be applied here, there are nuances with crypto trading that would benefit from being better understood for better inform clinical treatments,” added Dr. Hronis.

According to Lynette Zang, chief market analyst at ITM Trading, U.S. banks have the legal authority to confiscate people’s funds due to legislation passed by Congress. In a recent interview, Zang discussed how the purchasing power of the U.S. dollar has dwindled to “roughly three cents,” her belief that central bank digital currencies (CBDCs) will […]

According to Lynette Zang, chief market analyst at ITM Trading, U.S. banks have the legal authority to confiscate people’s funds due to legislation passed by Congress. In a recent interview, Zang discussed how the purchasing power of the U.S. dollar has dwindled to “roughly three cents,” her belief that central bank digital currencies (CBDCs) will […]

The rehabilitation center estimates that about 1% of cryptocurrency traders will develop an "extreme" addiction to crypto trading.

A luxury rehabilitation center in Spain has recently added services aimed at treating a relatively new kind of addiction — crypto trading.

The center, called “The Balance,” is a Switzerland-founded wellness center, with its main facility located on the Spanish island of Mallorca along with representations in Spain, London and Switzerland.

While it has been known to treat addiction ailments such as alcohol, drugs and behavioral health — it has now recently begun offering services aimed at combatting crypto trading addiction, according to a report from the BBC.

The Feb. 5 report revealed that one of the center’s clients reached out so that he could “wean off crypto” after reportedly pouring in $200,000 worth of crypto trades each week.

The treatment involves a four week stay — which comprises of therapy, massages and yoga. The bill can be upwards of $75,000.

In another part of the world, Castle Craig Hospital — a Scottish-based addiction rehabilitation clinic treating high-adrenaline crypto traders since 2018 — has seen over 100 clients come in with “dangerous” cryptocurrency problems.

In Asia, Diamond Rehabilitation — a Thailand-based wellness center operating since 2019 — has also added services dedicated to cryptocurrency addiction rehab and treatment.

The organization said it approaches rehab through the use of Cognitive Behavioral Therapy (CBT), Motivational Interviewing (MI) and Psychodynamic Theory (PT) as part of its comprehensive, multi-stage approach to help traders overcome their addiction.

Related: How to control stress and depression in a crypto winter

It is believed that the euphoric highs and crushing lows of the fast-paced, 24/7 cryptocurrency trading arena have brought in real demand for rehabilitation centers to offer services for trading addicts.

An article by Family Addiction Specialist estimates about 1% cryptocurrency traders will develop a severe pathological addiction, while 10% will experience other problems beyond that of a financial loss.

Data from cryptocurrency payments platform TripleA estimates that over 420 million people have traded cryptocurrencies. This could mean that at least 4.2 million people may be suitable for such services.

Symptoms of this addiction according to Family Addiction Specialist, includes constantly checking the prices online — particularly in the middle of the night.

Fabio Panetta, part of the Executive Committee of the European Central Bank (ECB), believes that unbacked cryptocurrency assets are vehicles for gambling without intrinsic value, which need to be regulated. In an opinion piece, Panetta states that while cryptocurrency regulation is a good answer to the problem, it must also touch on decentralized finance structures. […]

Fabio Panetta, part of the Executive Committee of the European Central Bank (ECB), believes that unbacked cryptocurrency assets are vehicles for gambling without intrinsic value, which need to be regulated. In an opinion piece, Panetta states that while cryptocurrency regulation is a good answer to the problem, it must also touch on decentralized finance structures. […]

Billionaire David Rubenstein says that crypto investors are essentially playing at casinos and that he’s identified the motivation behind it. In a new interview on crypto influencer Anthony Pompliano’s YouTube channel, the Bloomberg host says that traders are choosing to buy crypto assets because they are trusting governments and fiat currencies less. “I used to […]

The post Billionaire David Rubenstein Compares Crypto to Gambling, Says Investors Take the Risk for This Reason appeared first on The Daily Hodl.

The QRNG uses a fluctuating quantum system to guarantee unpredictable randomness, which can be used in Web3 gaming and gambling.

Researchers at Australia National University have teamed up with blockchain oracle provider AP13 to launch the first Quantum Random Number Generator (QRNG).

The joint effort will allow Web3 entities to access a completely unpredictable random number generation system that is highly secure and free to use.

Random number generators are not new, but the QRNG system is the first of its kind to generate a random number using quantum mechanics. This provides the first genuinely random number mechanism beyond the pseudo-mathematical systems currently used that may be biased or repeated.

There are several traditional applications for random numbers, such as gambling and lotteries, sports and competitions, and sampling and statistics. As more organizations look to embrace the world of Web3, a tamper-proof, true random number generator not reliant on third parties will be required.

API3’s QRNG measures random quantum fluctuations in phase and amplitude of an electromagnetic field in a vacuum to guarantee unpredictable randomness and generate the numbers. Dr. Aaron Tranter from the ANU Research School of Physics explained the process to Cointelegraph:

“Quantum mechanics predicts that a vacuum, generally regarded as the absence of 'things', actually contains particles popping in and out of existence. This is the origin of the term vacuum noise. This noise is fundamentally random and can actually be measured using a laser, optics, and some fast electronics. We measure these fluctuations and convert them into random numbers which are then served to the AWS cloud for distribution via an API gateway.”

The system is currently available as an application programming interface (API) for 13 blockchains, including Ethereum, BNB Chain, Arbitrum, Avalanche, Optimism, Polygon, Fantom, and Moonbeam. Users need not pay for the service, but there will be a minor network fee for calling the API.

Web3 and Metaverse gaming could be one of the biggest beneficiaries of such a system as games continuously rely on a degree of randomness and unpredictability to keep players engaged.

Blockchain-based gambling applications would also greatly benefit from a tamper-proof random number generator, resulting in greater trust in the betting platforms.

Dr. Tranter added that people can use random numbers for whatever application they want, from the generation of unique NFTs and artwork to automated decision making. He explained:

“For example, if you wanted to draw randomly from a pool of clients for a task then you would want to ensure that you are truly sampling randomly. This could include distribution of resources, assigning of tasks and even decentralized quorums for voting.”

He added they could also be used for crypto wallet generation since the current solution of pseudo-random number generators can often result in repetition or have complex patterns that could be exploited. “A QRNG is guaranteed to be truly random by the laws of quantum mechanics, removing this loophole,” he added.

Related: Quantum computing to run economic models on crypto adoption

Web3 applications that involve public participation, such as random token distribution or drawn winners, will also benefit from a tamper-proof system.

API3 QRNG is hosted by the Australia National University Quantum Optics Group on Amazon Web Services (AWS), and all data passed between servers is encrypted. Additionally, the random numbers are destroyed after use, so the firm never has access to them.

Cryptocurrency and smart contracts are redefining the future of online betting. Esports, meanwhile, represent a growing market for gambling.

Cryptocurrency wallet Exodus has officially integrated with SportX, an online sports and crypto betting platform, giving users the ability to wager on esports games through smart contracts executed on the Polygon network.

The partnership, which was announced Tuesday, gives Exodus’ more than 1 million users access to SportX’s decentralized betting exchange where they can place bets on a wide range of sports and esports games using cryptocurrency. The minimum bet amount is $5, denominated in USD Coin (USDC), which can be sent directly to the Exodus wallet or exchanged from any of the 138 cryptocurrencies it supports. All markets created, traded and settled on SportX are facilitated by the Polygon network.

Currently, SportX is authorized for use in Canada, South America, most European countries excluding France and the Netherlands and throughout most of Asia.

Esports, which refers to multiplayer video games played competitively in front of spectators, has grown to become a billion-dollar industry, with mainstream developers such as Halo entering the market.

What a statement from Halo. Their re-entry into esports has been nothing short of incredible. Balanced maps, ranked play and a multi-million dollar tournament circuit out of the gate two weeks after release. Bravo @Halo.

— 100T Nadeshot (@Nadeshot) November 22, 2021

And congratulations @OpTic on the first

Although the relationship between cryptocurrency and esports is still nascent, industry observers have identified a “special connection” between the two domains. Both communities share similar demographics and employ technologies that transcend geographic locations. The financialization of gaming, also known as GameFi, is also expected to present new opportunities for the esports industry. (However, GameFi is not limited to the financialization of esports, but digital gaming more generally.)

Related: Coinbase partners with esports gaming organization competing in League of Legends

Crypto exchanges, meanwhile, continue to expand their footprint in the esports market, with the Sam Bankman-Fried-led FTX leading the way. In August, the derivatives exchange inked a seven-year deal with Dolphin Entertainment to create nonfungible tokens that target brands in several sectors, including esports. In June, FTX sealed a $210 million naming rights deal with esports giant TSM.

The NFT gaming market is growing by leaps and bounds as gaming regulatory bodies and traditional gaming corporations shun the ecosystem.

The gaming industry is a multi-billionaire dollar market traditionally dominated by giant corporations like Atari, Sony, Microsoft and Nintendo, among others.

Throughout their history, these major firms have aimed to provide entertaining gaming experiences to attract new players and expand their market share.

However, nonfungible tokens (NFTs) are attempting to give gamers a financial incentive for playing games in the form of NFTs, in addition to providing an engaging gaming ecosystem.

These games, known as play-to-earn (P2E) games are played in a Metaverse that is essentially a fictional universe. The P2E gaming model dictates that the users of the platform are financially rewarded for their time and effort within the game. Due to this, the model has a chance to gain a portion of the $175.8 billion global gaming market that is touted to grow to more than $200 billion in 2024, as per a report by Newzoo.

Minh Doan, the co-founder of Warena, a personalized NFT game, told Cointelegraph more on the relevance of this model. He said:

“Today, we call the play-to-earn model on the blockchain GameFi — the combination of decentralized finance and game mechanics — has become a real sensation in the market due to the fact that during gameplay, users receive tokens that can grow by tens and even hundreds of times in value.”

The protocols in the NFT gaming sub-sector have been gaining a lot of traction in terms of users and volumes. Their associated native tokens have been performed extremely well too. The native token of the Ethereum-based NFT game Axie Infinity (AXS) has been leading the charge for the sub-sector. The token has posted 83.35% gains in the last 90 days, 706% gains in the last 180 days and over 73,000% yearly gains.

AXS currently changes hands in the $120 range and has risen to become one of the top 25 cryptocurrencies in terms of market capitalization as per data from CoinMarketCap, making it the only NFT gaming-related token to make the cut. The platform itself has witnessed impressive growth in terms of users and volumes since its launch. According to data from Dappradar, there has been trading activity worth $2.6 billion on the platform with 836,149 traders participating. The platform has also announced a staking program for its native token.

Related: The Metaverse, play-to-earn, and the new economic model of gaming.

Cointelegraph spoke to Alex Salnikov, the co-founder and head of product of Rarible, an NFT marketplace, who explained more on the drivers of this growth noticed in the NFT gaming platforms, both in terms of volume and users. He said:

“This growth aligns with the broader acceleration of the NFT market and seems to highlight the versatility of use cases for NFTs. Also, gamification has generally been trending in crypto and it matches particularly well with the concept of NFTs that are so closely tied to interactive and fun community engagement experiences.”

He also added that the value proposition of blockchain technology is understandable and native for the gaming industry, including P2E experiences and in-game assets with clear provenance.

Even though the most utilized blockchain network for the deployment of decentralized applications (DApps) is Ethereum, in the NFT gaming ecosystem, there are several other blockchain networks like Binance Smart Chain (BSC), Polygon, Hive, Harmony, Solana and Flow that are also gaining large user bases along with growing volumes.

Salnikov further mentioned, “Polygon is generally considered to be one of the leading blockchains for gaming due to its EVM-compatibility, high throughput and low gas fees. It’s also the leading sidechain of Ethereum, meaning that it’s connected to the main NFT ecosystem on layer one.”

Cointelegraph spoke with Jesse Reich, the co-founder and CEO of Splinterlands, one of the leading NFT gaming platforms in terms of users, about the protocol’s choice of the Hive network to build their game. He said:

“People have thought our choice of Hive has been bizarre since the early days, but it has a freemium structure. Players can sign up with a username and password and get started. It's hard to replicate that on POW blockchains with gas fees.”

On Oct. 12, Binance announced a $1 billion accelerator fund for the overall development of the BSC ecosystem. Popular games on BSC like MOBOX: NFT Farmer, Faraland, ZOO Crypto World, and CryptoBlades are bound to grow as a result of this fund leading to massive adoption of the network.

Despite the growth seen across various platforms and networks in the NFT gaming sub-sector, the long-term proposition of these games could be in question, since gamers from the traditional gaming community are used to playing games that are extremely well designed. These titles also boast impressive gaming ecosystems, as a majority of them are backed by large corporations that have ample resources and development infrastructure.

At this stage, this cannot be said of the games that use NFTs, native tokens and other incentives to reward users as they are still in the nascent stage of their development and thus, are not as sophisticated. Thus, it is essential to gauge the time and effort the users of these platforms are putting in to earn these rewards on games that might not be as stimulating as the mainstream games that are relatively easy to access as well.

Reich mentioned further that “First and foremost, there has to be a game that's fun to be a mega-hit. Grind-to-earn, I'm sure, will be a thing along with play-to-earn and it'll come down to what minimum wage is someone willing to accept for computer click work.”

Doan stated that these games are a completely new generation of games that are hard to compare with traditional PC games. He said:

“This is something of a leisure economy, where users are paid to play games and can later multiply their income like real traders. The beauty of NFT games is that young people — the main target audience — easily understand trends and technical nuances that are sometimes difficult for other users.”

Despite the rapidly expanding NFT gaming ecosystem, the traditional gaming giants are yet to adapt to blockchain technology or NFT integrations in their pre-existing games. In fact, a few of them have explicitly ruled out the possibility.

Valve recently announced the removal of blockchain games from its platform Steam and even asked users to not publish any content related to cryptocurrencies and NFTs. The Steam marketplace hosts immensely popular games like Counter-Strike, Battlefield, Halo and Resident Evil, among thousands of others.

The corporation flirted with crypto back in 2016 when they announced that they would accept Bitcoin (BTC) payments, but soon put a stop to the service, citing high fees and volatility.

In the aftermath of this ban, the CEO of Epic Games, Tim Sweeney, announced that his company is open to hosting and supporting games that use cryptocurrencies and blockchain-based assets.

Epic — the firm behind the immensely popular Fortnite — did note that developers will not be able to use the platform payment service to accept cryptocurrencies. Instead, they will need to use their own payment systems. This could become a barrier to adoption and inclusion for games without this infrastructure.

The perception held by Valve extends to regulators in the gaming industry as well. On Oct. 14, the Gambling Commission of the United Kingdom began an inquiry into one of the most popular NFT fantasy soccer games, Sorare. The gambling watchdog is evaluating whether the platform would need an operating license and if their services constitute gambling.

Sorare has categorically stated that even though it is willing to have an open dialogue and engage with regulatory bodies to explain its game, it does not “offer any forms of regulated gambling.” The platform is valued at over $4.3 billion and growing at a fast rate.

Since the entire ecosystem is at such a nascent stage in its development, it seems to be more of a waiting game to gauge the true potential, utility and long-term propositions of integrating crypto, blockchain and NFTs in gaming ecosystems.

Sony, the electronics giant, has revealed a patent that would introduce bitcoin wagering in its consumer electronic products and consoles, like the Playstation system. Spectators of a game could wager about what will happen next in an e-sports competition, and odds would be calculated by a machine algorithm depending on rankings or previous match history. […]

Sony, the electronics giant, has revealed a patent that would introduce bitcoin wagering in its consumer electronic products and consoles, like the Playstation system. Spectators of a game could wager about what will happen next in an e-sports competition, and odds would be calculated by a machine algorithm depending on rankings or previous match history. […]