Crypto-focused venture capital giant Digital Currency Group (DCG) is snapping up another $500 million worth of Grayscale Bitcoin Trust (GBTC) shares. DCG backs more than 175 blockchain-related companies in over 35 countries and is the parent company of Grayscale. The move brings DCG’s total investment in Grayscale to $750 million. DCG plans to use cash […]

The post Crypto VC Giant Ramps Up Bitcoin Investment by $500,000,000 appeared first on The Daily Hodl.

Digital Currency Group has purchased a total of $194 million worth of GBTC shares so far.

Digital Currency Group, the parent company of digital asset manager Grayscale Investments, is now authorized to purchase up to $750 million worth of shares of Grayscale Bitcoin Trust.

The company announced Monday that DCG increased its prior authorization to buy up to $250 million worth of GBTC shares by an extra $500 million.

The share purchase authorization does not obligate DCG to acquire any certain amount of shares in any period, and it may be expanded, modified or discontinued at any time, DCG noted. Actual purchases will depend on many factors like the levels of available cash as well as price and market conditions, the firm said.

DCG mentioned that the firm had purchased a total of $193.5 million worth of GBTC shares as of Friday. DCG plans to use cash to fund the purchases and will make the purchases at management’s discretion in compliance with Rule 10b-18 under the Securities Exchange Act, the company noted.

The news comes shortly after DCG originally announced in March its plan to purchase up to $250 million of GBTC shares. The move came amid volatile conditions for GBTC and plans to hire talent in the exchange-traded fund industry, which signaled a potential diversification by the firm.

Launched back in 2013 as the Bitcoin Investment Trust, GBTC is the world’s largest Bitcoin (BTC) fund, offering investors the opportunity to gain exposure to Bitcoin through a publicly quoted private trust. As of Friday, the assets under management in GBTC amounted to more than $36 billion, with Grayscale’s total AUM standing at $46.7 billion. In mid-April — when Bitcoin touched it’s all-time highs above $64,000 — Grayscale’s total AUM topped $50 billion.

Accredited investors will soon have over the counter access to a DOT investment trust

In a market once dominated by a handful of BTC vehicles, there are now a growing number of products offering investors access to gains from popular altcoins like Polkadot.

Yesterday, Osprey Funds announced the launch of the Osprey Polkadot Trust. The fund, which will be available to accredited investors with a $25,000 minimum, is set to be listed on the OTCQX market “as soon as possible,” per a press release from the company. Coinbase will serve as the fund's custodian.

The fund will give investors access to one of the largest layer one smart contract chains via familiar rails, and joins a growing list of digital assets equity investors can now gain exposure to.

“The appetite for next generation crypto investment vehicles is only increasing,” said Osprey CEO Greg King. “Osprey is just getting started on a series of compelling investment funds that will provide access to some of the most exciting coins and tokens.”

Osprey has positioned itself as a competitor to investment giant Greyscale, which currently offers 14 digital asset investment trusts, per the Greyscale website. Osprey’s OBTC fund boasts a .49% management fee, which they claim makes it the “lowest-cost publicly traded bitcoin fund in the U.S.”

The choice to offer a Polkadot fund may be in an effort to gain an edge on Greyscale. DOT is not among the assets Greyscale offers funds for, and it isn’t part of the “Large Cap” trust despite being the fourth-largest layer one smart contract token by marketcap, meaning Osprey may be catering to a market demand that isn’t presently serviced.

King told Cointelegraph that the decision to offer a DOT fund was part a vote of confidence in the growing ecosystem, as well as an effort to offer a wider range of digital asset investment vehicles.

"Our decision to launch a Polkadot trust next is both a vote of confidence and also addresses the market’s need for access vehicles. We believe Polkadot shows significant promise and is still in the very early stages. Every product we launch will be something the Osprey team has researched and believes is a sustainable crypto project with significant investment potential," he said.

Polkadot is among the growing number of non-Ethereum chains that have been seeing a spike in organic developer activity. Earlier this month six top ecosystem projects joined together to create an index token, PINT, and Clover Finance made DeFi migration easier with an Ethereum-to-Polkadot bridge.

Digital Currency Group and Coinbase have made Time Magazine’s 2021 top 100 most influential companies list.

Time Magazine continues to warm up to crypto, naming Digital Currency Group and Coinbase in the magazine’s 2021 Top 100 Most Influential Companies list.

Published on April 27, the Top 100 emphasized the impact the two crypto giants have made over the past 12 months. The list consisted of four different categories — Pioneers, Leaders, Innovators and Disrupters.

Digital Currency Group was categorized as a Disrupter alongside other big names such as Tesla, Huawei, Shopify and Clubhouse. Time noted that the DCG is “demystifying crypto for investors” through its subsidiaries, asset manager Grayscale and crypto news website CoinDesk. As of today Grayscale has $45.5 billion total assets under management, or AUM:

“In January 2020, Grayscale’s Bitcoin Trust became the first financial product backed entirely by digital currency to report to the Securities and Exchange Commission—opening the Trust (and, by extension, the blockchain) to more potential investors.”

While Grayscale had a mammoth performance over the past year, its parent company's inclusion on the list may also be influenced by a recent partnership with Time. The publication and Grayscale are teaming up to drop a series of educational videos based on crypto, with Time also agreeing to be paid by Grayscale in Bitcoin and hold BTC on its balance sheet.

Coinbase was listed under Titan along with mainstream giants Facebook, Alibaba, Google, Walmart and Amazon. The exchange was described as “shoring up crypto’s credibility” in relation to its direct listing on the Nasdaq on April 14. The exchange earned more revenue in Q1 this year than all of 2020, with a reported $1.8 billion in Q1 compared to around $1.2 billion in all of last year:

“It’s been a huge year for cryptocurrencies, but nothing’s been as validating as the April 14 direct listing of Coinbase, which operates an exchange where 56 million users buy and sell Bitcoin and more. Coinbase ended its first day of trading worth nearly $86 billion—making it the most valuable U.S. financial exchange, and giving cryptocurrencies a boost of Wall Street cred.”

The addition of Coinbase and Digital Currency Group is another step along the road of mainstream acceptance of crypto. Just a short while ago it would have been hard to imagine the duo elevated into the company of renowned institutions in the Top 100 list such as Disney, BP, Paypal, Adidas, Spotify and AirBnB.

Time was first published in March 1923, and the magazine and online publication has continued to gradually expose itself to the crypto world. In March, it auctioned off its first set of tokenized magazine covers as NFTs, with the highest-selling NFT fetching almost $250,000.

Last week it announced a partnership with Crypto.com to accept one-time crypto payments for its 18-month digital subscription, offering 10% cashback to readers who paid in Cypto.com’s CRO coin.

According to a recent filing with the SEC, the Chicago-based Rothschild Investment has made a substantial investment in Ethereum.

The firm purchased 265,302 shares of the Grayscale Ethereum Trust (ETHE), an investment vehicle that offers exposure to Ethereum. In its investment holdings report (Form 13- FHR), the firm revealed its shares in the ETH Trust were valued at $4.75 million on Mar. 31.

Interestingly, this investment exceeds Rothschild Investment’s exposure to Bitcoin. The firm also disclosed its holdings of 38,346 shares of Grayscale Bitcoin Trust (GBTC), worth $1.92 million in its SEC filing.

Since the beginning of the year, ETH has rallied by 250%, outperforming Bitcoin by a slight margin. The cryptocurrency recently hit its all-time high price of $2,500 amid the growing interest in digital currencies.

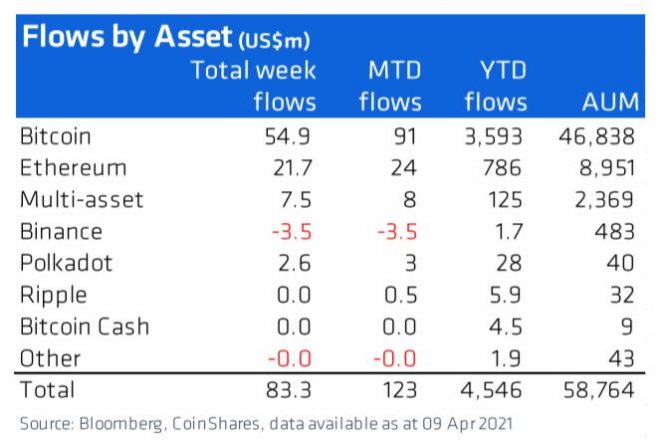

Institutional interest in Ethereum has been on the rise in recent months. According to a CoinShares report, during the first week of February, out of $245 million total inflows into crypto investment products, $195 million (80%) were focused on Ethereum.

Ethereum’s appeal to investments may be grounded in the asset’s utility in decentralized finance (DeFi) applications. Furthermore, Ethereum has been declared a non-security asset from the regulatory perspective, making it the safest altcoin to park funds.

Rothschild Investment is not be confused with UK-based Rothschild multinational banking group.

Rothschild Investment Corp, has acquired more than 250,000 shares in Grayscale’s ETH trust, and added 8000 shares to its BTC trust holdings — however the firm holds zero ties to the famed Rothschild family dynasty.

Chicago-based financial institution Rothschild Investment Corp, has acquired 265,302 shares in Grayscale’s ETH trust, according to a filing on April 15 with the United States Securities Commission or SEC.

The firm also added more Grayscale Bitcoin trust shares to its holdings, with the latest SEC filing revealing that it increased its tally from 30,454 in January up to 38,346 this month.

Rothschild Investment has been accumulating GBTC since 2017, and the latest filing shows the firm’s appetite for crypto exposure is not slowing down. Ether proponent Ryan Adams, the founder of crypto investment firm Mythos Capital and Bankless, commented on the latest move noting that “BTC is the gateway drug to ETH.”

BTC is the gateway drug to ETH https://t.co/1w7p66OkOF

— RYAN SΞAN ADAMS - rsa.eth (@RyanSAdams) April 15, 2021

The brokerage firm’s history spans back to 1908, and it has been investing in crypto for a relatively long time when compared to the mass inflow of institutions who have swooped in during the past 12 months. An SEC filing showed that the firm owned $210,000 worth of GBTC in July 2017, when BTC was priced around $2000.

Founding members Monroe Rothschild and brother in-law Samuel Karger reportedly have no relation to the famed Rothschild family dynasty, much to the confusion of the crypto community despite the New York Times publishing an article that clarified the situation in 1995.

Not the Rotschild you think https://t.co/KVUy9u1ETy

— Yann Ranchere (@tek_fin) July 23, 2017

Grayscale is the leading U.S. digital asset manager that offers institutional exposure to crypto, the firm holds roughly 660,000 BTC, which accounts for 3.5% of BTC in circulation.

The firm revealed yesterday that its total assets under management has now reached $50.6 billion, its ETH trust, or ETHE, is now up to more than $7 billion worth of AUM, with its shares currently trading at around $24. GTBC has surpassed $41 billion in AUM, and shares are trading at around $59.

04/15/21 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

— Grayscale (@Grayscale) April 15, 2021

Total AUM: $50.6 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $ZEC $BAT $LINK $MANA $FIL $LPT pic.twitter.com/mldap6VMoK

Grayscale continues to grow, passing $50 billion. That's equivalent to the world’s second-largest commodity ETF.

Major U.S. asset manager Grayscale has just surpassed $50 billion in cryptocurrency assets under management for the first time. Grayscale's AUM is creeping ever closer to the $57 billion holdings of the largest commodity ETF.

MILESTONE: We just reached $50 billion AUM. Yet another reason to #GoGrayscale. pic.twitter.com/Jrk7n6TAOI

— Grayscale (@Grayscale) April 14, 2021

The company has plans to convert into an ETF when regulations allow.

If the ETF had been approved already, Grayscale would be the second-largest commodity ETF behind SPDR Gold Shares. GLD is a physically-backed gold exchange-traded fund (ETF) with listings on stock exchanges in the U.S., Mexico, Singapore, Japan, and Hong Kong.

Grayscale CEO Michael Sonnenshein tweeted that he believes the Grayscale Bitcoin Fund, or GBTC, is likely to surpass the GLD fund by market cap in a few months.

'We believe gold symbolizes the diminishing potential for sustained commodity-price advances, notably vs #Bitcoin. Assets in @Grayscale's $GBTC, the dominant on-exchange vehicle, are set to pass funds in the leading gold-ETF tracker $GLD in a few months'@mikemcglone11 @JSeyff pic.twitter.com/YQwA6M5WFm

— Michael Sonnenshein (@Sonnenshein) April 14, 2021

Grayscale provides cryptocurrency exposure to institutional investors and holds approximately 660,000 BTC in total representing 3.5% of Bitcoin’s 18.68 million circulating supply. Almost 655,000 of these are held in Grayscale's Bitcoin Trust.

Grayscale doesn’t just deal in Bitcoin, with almost 20% of the company’s AUM spread across a dozen other cryptocurrencies including Ethereum ($7.4b), Litecoin ($405m), Ethereum Classic ($267m), and Bitcoin Cash ($234m). In the last month, five more trusts were created — Decentraland's MANA ($18.6m), Livepeer ($13m), Filecoin ($7.7m), Basic Attention Token ($4.8m) and Chainlink ($4.5m).

The firm is already the largest U.S. digital asset manager by a large margin, with Pantera, the second-largest manager, holding only $4.3 billion, less than one-tenth of the $50 billion held by Grayscale.

Yesterday the asset manager announced a partnership with Time Magazine to produce an educational crypto videos series. The magazine also agreed to receive payment in Bitcoin and hold the digital asset on its balance sheet.

TIME magazine has partnered up with Grayscale to drop a series of educational crypto videos, and has agreed to be paid in Bitcoin.

Institutional fund manager Grayscale has partnered with acclaimed New York-based magazine TIME to produce an educational video series on the subject of crypto assets.

The partnership was announced on April by Grayscale’s CEO, Michael Sonnenshein, with Sonnenshein revealing that TIME and its president, Keith Grossman, will receive payment in Bitcoin.

Further, TIME does not intend to convert the Bitcoin it receives through the deal into fiat, and will hold the crypto asset on its balance sheet. No further details of the partnership have been revealed so far.

Thrilled @Grayscale is partnering w/ @TIME on a new video series coming this summer explaining the #crypto space.

— Michael Sonnenshein (@Sonnenshein) April 12, 2021

Equally as important, @KeithGrossman & @TIME has agreed to be paid in #Bitcoin - and will hold the $BTC on their balance sheet. A first for our media partnerships!

TIME was first published on March 3, 1923, with the magazine and online publication having been active in the crypto space of late. In March, TIME cashed in on the NFT mania by dropping a set of tokenized magazine covers on NFT marketplace SuperRare, with the “TIME Space Exploration - January 19th, 1959” NFT fetching 135 ETH worth almost $250,000 on March 30.

The company also revealed they were seeking a crypto-friendly Chief Financial Officer in the same month after listing the position on Linkedin.

"The media industry is undergoing a rapid evolution. TIME is seeking a Chief Financial Officer who can help guide its transformation," the listing said.

According to Bitcointreasuries.com, TIME will become the 33rd publicly traded company to hold Bitcoin on its balance sheet. TIME joins the ranks of top U.S. companies Microstrategy — who have invested billions into BTC from August 2020, Square — who added 4,709 BTC to their treasury in October, and Tesla — which purchased $1.5 billion worth of BTC in January. Multinational investment corporation Blackrock also began dabbling in crypto during February, profiting more than $360,000 from a small long using Bitcoin futures.

This deal marks a significant partnership between giants of the mainstream and crypto worlds. Grayscale was founded in 2013 and has $46 billion worth of crypto assets under management, including roughly 3% of Bitcoin’s total circulating supply.

TIME Magazine is taking further steps toward crypto adoption, as revealed today by Grayscale CEO Michael Sonnenshein.

Sonnenshein noted that the company is taking three actions. First, TIME is partnering with Grayscale to release a series of educational videos, which will be broadcast this summer.

Second, TIME as a company will hold Bitcoin on its balance sheet. That means the firm is making an investment similar to those made by Tesla and MicroStrategy in recent months.

Finally, Keith Grossman, who has served as the president of TIME since July 2019, will be paid in Bitcoin.

Sonnenshein did not say how much Bitcoin TIME intends to purchase, or how much Grossman will be paid. However, it seems likely that the firm will make a multi-million dollar investment.

This is one of several cryptocurrency-related announcements that TIME Magazine has made over the past month.

Beginning in March, TIME turned several of its classic magazine covers into NFT tokens and auctioned them on the trading site OpenSea. One of the covers in TIME’s second series of NFTs was purchased for $200,000 by TRON CEO Justin Sun.

TIME has also announced that it will accept Bitcoin payments for subscriptions and that it is hiring a CFO familiar with Bitcoin.

At the time of writing this author held less than $75 of Bitcoin, Ethereum, and altcoins.

Forbes ranks the top traditional asset managers, but who ranks the top regulated digital asset managers?

Cointelegraph Consulting’s 2021 ranking of the top five United States-based regulated crypto asset management firms highlights that Bitcoin’s explosive growth in price has catapulted many digital asset managers past the half-billion-dollar mark.

As more and more investors are turning to the digital asset market, these companies are on track to becoming important players in the U.S. financial industry.

Grayscale is one of the largest and well-known firms in the crypto world, which was founded in 2013 by its parent organization — Digital Currency Group. Grayscale now has a total of more than $40 billion in assets under management, which consist of investments in Bitcoin (BTC), Ether (ETH), Bitcoin Cash (BCH), Litecoin (LTC), Zcash (ZEC), Stellar (XLM), Horizen (ZEN) and more. The fund offers various products to its clients, both single-asset products and diversified baskets.

Pantera Capital was founded in 2003 by Dan Morehead and is headquartered in California. Pantera is focused on a wide range of assets connected with the digital economy — private equity, tokens and more. Pantera’s $4 billion in AUM is distributed among four main funds: liquid token fund, early-stage token fund, Bitcoin fund and venture fund.

Bitwise was founded in 2017 by a team of software experts combined with experienced asset managers and is located in San Francisco. This company has more than $1 billion in AUM, which is concentrated in several funds: 10 crypto index fund, decentralized finance crypto index fund, Bitcoin fund, and Ethereum fund, among others.

This firm has several offices across the world including London, Hong Kong and Amsterdam with its headquarters in New York. Galaxy Digital focuses mainly on BTC and ETH, although it also has a diverse crypto index fund. In total, Galaxy Digital’s AUM is more than $800 million. The CEO of Galaxy Digital, Mike Novogratz, is a regular commentator on traditional TV news networks such as Bloomberg. He recently claimed he believes that nonfungible tokens will stay “for the rest of our lives.” They are also known to be involved in mining proof-of-work-based digital assets and launching a regulated investment vehicle for retail investors.

Located in California, Wave Financial offers several investment solutions such as funds: Select 5 Index fund, a BTC Income & Growth Digital Fund, Tokenized Real Asset fund (tokenized Kentucky Whiskey Barrels), Active Hybrid VC fund. Additionally, the fund offers wealth management solutions for crypto treasury and wealth management, alongside protocol treasury and inventory management. According to data shared by Wave Financial, the fund has $500 million in assets under management.

The Cointelegraph Consulting’s 2021 ranking of the largest U.S.-based and regulated digital asset managers only includes asset managers that are dedicated to cryptocurrency and blockchain. Traditional asset managers that have a small allocation to digital assets were not included.

This list also does not include crypto-focused asset managers that are only invested in venture capital and private equity. Cointelegraph Consulting prepared the list, but it’s for investors to decide which of the funds are most in line with their interests.

This article was prepared by Cointelegraph Consulting, and the results of the ranking are based on publicly announced AUMs and data acquired by emailing several digital asset managers. Cointelegraph Consulting is not an investment company, investment advisor or broker/dealer.

This publication is for information purposes only and represents neither investment advice nor an investment analysis or an invitation to buy or sell financial instruments. Specifically, the document does not serve as a substitute for individual investment or other advice.

Disclaimer: Wave Financial is a featured fund from one of Cointelegraph Consulting’s sponsors, and its inclusion did not affect this ranking.