This is the second deal the company announced this week citing "substantially discounted price."

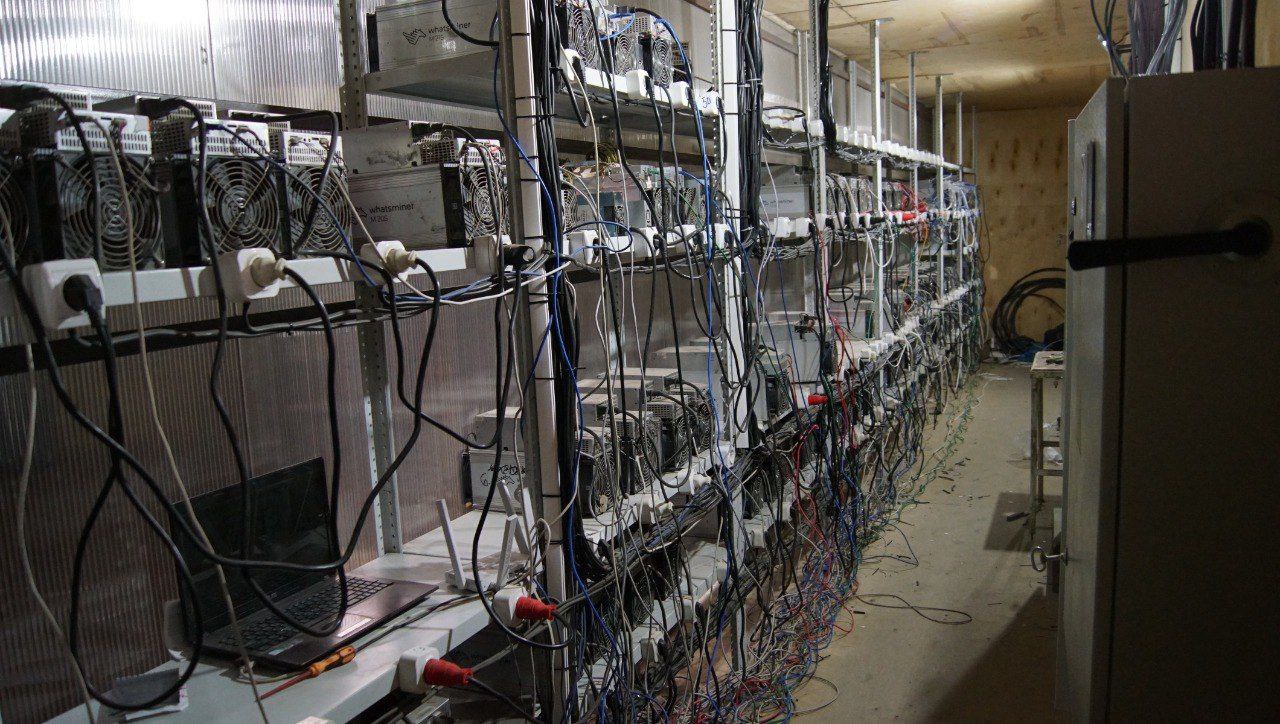

Crypto mining firm CleanSpark announced an agreement on Friday to acquire Mawson's bitcoin mining facility in Sandersville, Georgia for $33 million. The deal is anticipated to increase CleanSpark's hashrate by 1.4 exahashes per second (EH/s) in the next few months, and to 7.0 EH/s by the end of next year.

As part of the agreement, 6,468 last-generation mining ASICs will be purchased for $9.5 million, or $17 per terahash. "These machines, already operating at the acquired site, will add over 558 petahashes per second (PH/s) of computing power immediately upon closing," the company explains.

For the facility and miners, CleanSpark will pay up to $42.5 million, including up to $11 million in CleanSpark stocks and $4.5 million in earn-out commitments. The site in Georgia can support 24,108 latest-generation miners and the company plans to expand to support 70,000 miners producing over 7.0 EH/s in 2023.

G'day mate. $CLSK has agreed to acquire Australian-based @Mawsoninc's #bitcoin mining facility in Sandersville, GA. This marks our 4th site in the state & it’s expected to support 7.0 EH/s of our #hashrate.

— CleanSpark Inc. (@CleanSpark_Inc) September 9, 2022

More info: https://t.co/C9c20IYIhW#renewables #btc #sustainability pic.twitter.com/mdLmwtC5eK

CleanSpark has accelerated its consolidation in a bear market with high energy costs. On Thursday, the company announced a purchase agreement with Cryptech Solutions for 10,000 Bitmain Antminer S19j Pro units for a total price of R$ 28 million.

In July, CleanSpark disclosed the purchase of over 1,000 Bitcoin miners from Whatsminer M30S at a "substantially discounted price". In June, the mining company also bought 1,800 Antminer S19 XP rigs.

During the bull market, the company focused on building infrastructure before ordering equipment months in advance. “This strategy positioned us to make purchases of landed rigs at significantly lower prices, thus reducing the time between deploying capital and hashing, accelerating our return on investment”, said Zach Bradford, CEO of CleanSpark.