U.S. President-elect Donald Trump has appointed former SEC Chair Jay Clayton to a key role, drawing attention to his crypto regulatory legacy and enforcement record. Former SEC Chair Steps Into a Role That Could Redefine Legal Power U.S. President-elect Donald Trump has announced the nomination of former U.S. Securities and Exchange Commission (SEC) Chair Jay […]

U.S. President-elect Donald Trump has appointed former SEC Chair Jay Clayton to a key role, drawing attention to his crypto regulatory legacy and enforcement record. Former SEC Chair Steps Into a Role That Could Redefine Legal Power U.S. President-elect Donald Trump has announced the nomination of former U.S. Securities and Exchange Commission (SEC) Chair Jay […]

Former SEC Chair Jay Clayton has been given a new role by President-elect Donald Trump, who will be inaugurated on Jan. 20.

United States President-elect Donald Trump has announced his former chair of the Securities and Exchange Commission, Jay Clayton, will serve as US Attorney for the Southern District of New York.

Trump spoke highly of Clayton in the Nov. 14 announcement on social media platform Truth Social, noting that he has been a “highly respected business leader, counsel, and public servant.”

”Jay is going to be a strong Fighter for the Truth as we, Make America Great Again,” Trump said.

Source: Donald Trump

Clayton served as SEC Chair between May 4, 2017 until Dec. 23, 2020 and was Trump during his first stint in presidency.

Related: FBI busts $43M crypto and Las Vegas hospitality Ponzi scheme

The Hinman documents have been available to Ripple for over two years, and their public release has been eagerly awaited by many, but some were disappointed by the lack of any real bombshells.

The Hinman documents were finally unsealed and made publicly available on June 12 after a lengthy back and forth between Ripple and the United States Securities and Exchange Commission (SEC), but what exactly do they reveal?

The documents are extensive, and while they can be found in public resources like the Public Access to Court Electronic Records (PACER) or CourtListener, lawyer James Filan tweeted on June 13, compiling them into two URLs.

#XRPCommunity #SECGov v. #Ripple #XRP Here are the Hinman documents, by Exhibit number, in one place. https://t.co/6kUYZ1X2WKhttps://t.co/wZQmalfFkS

— James K. Filan (@FilanLaw) June 13, 2023

Speaking to Cointelegraph soon after the unsealing, pro-XRP lawyer and founder of CryptoLaw John Deaton shared his belief that “the documents themselves don’t impact the judge’s underlying analysis of whether XRP (XRP) was offered/sold by Ripple as an investment contract, or XRP’s status in the secondary markets in the United States.“

This is considered a key defense of Ripple during its legal battle with the SEC. But those keeping a close eye on the case will know that the documents were not expected to do so, despite the then SEC chair Jay Clayton referencing the speech as “the approach we take to evaluate whether a digital asset is a security,” the 2018 speech carried disclaimers that it was the personal views of the then director of corporation finance William Hinman, which “does not necessarily reflect those of the Commission.”

With the Hinman documents being such a hot topic, many other crypto lawyers have also wondered what the documents might mean for XRP and Ether (ETH).

After the documents were unsealed, many onlookers, such as Gabriel Shapiro, general counsel for crypto firm Delphi Labs, took to Twitter calling them a “nothingburger,” which had no impact on the case between Ripple and the SEC.

Hinman emails are a nothingburger though great for ETH. No idea why Ripple thinks these emails help Ripple's case....

— _gabrielShapir0 (@lex_node) June 13, 2023

Pro-XRP lawyer and Hodl Law founder Fred Rispoli had a different take when appearing on the Thinking Crypto podcast on June 15. He suggests they are “explosive” because although “we all knew there’s a revolving door” between regulators and private firms — and “behind the scenes dealings” — the public rarely gets a chance to see it as clearly as it’s displayed in the emails.

In other words, while the documents might not help Ripple regarding an XRP security determination, it does impact the SEC’s credibility. It sheds further light on why Hinman gave the speech despite protests from other SEC divisions.

The documents also highlight what appears to be an acknowledgment from Laura Jarsulic — an attorney with the SEC’s Office of General Counsel — that tokens on a sufficiently decentralized network might exist in a “regulatory gap” where the tokens are “not a security because there’s no ‘controlling’ group,” but “there may be a need for regulation to protect purchasers” as occurs with credit cards and medication.

This might be significant, as current SEC chair Gary Gensler has repeatedly said that he believes all cryptocurrencies except for Bitcoin (BTC) are securities and that rules for crypto already exist.

Ripple’s fair notice defense refers to the argument that the SEC had not provided it with sufficient notice before suing it for committing securities fraud in December 2020.

However, the defense is generally not perceived to be strong, as longstanding court precedent — i.e., the Howey test that determines whether a transaction qualifies as an investment contract or security — is regarded as fair notice.

The FAIR NOTICE DEFENSE is not what a lot of people think it is. I see a lot of comments about how @Ripple’s FND is a slam dunk and Ripple and #XRP will win. Make no mistake about it, Ripple hopes the judge never decides the FND. #XRPHolders would prefer no decision on the FND.

— John E Deaton (@JohnEDeaton1) July 2, 2022

But in the interview with Cointelegraph, Deaton suggested that the documents support Ripple’s argument that the speech sowed market confusion and hindered the ability of market participants to determine exactly what constitutes a security under the Howey test, saying:

“The documents do assist Ripple (and others) in arguing that the speech caused greater confusion in the markets, causing market participants to lack adequate notice of what was prohibited by existing law.”

The Hinman documents show the conversations between various SEC members as they sought to get the speech ready for public release.

As pointed out by Ripple’s chief legal officer Stuart Alderoty in a Twitter thread on June 13, the emails also highlight that Hinman had received feedback from other divisions of the SEC, noting that some of the factors he used when determining that Ether was not a security had no legal basis.

3/A refresher: Hinman, as Head of the SEC’s Corp Fin, gave a speech in June 2018 declaring that a token is not a security once it becomes “sufficiently decentralized” and he invented factors to consider when making a “sufficiently decentralized” determination.

— Stuart Alderoty (@s_alderoty) June 13, 2023

Deaton’s CryptoLaw hosted a panel on June 14, joined by fellow crypto lawyer Jeremy Hogan and former SEC securities lawyer Marc Fagel, who worked at the agency for 16 years.

The Hinman Docs: All-star Legal Panel https://t.co/5I6xAI5H0B

— CryptoLaw (@CryptoLawUS) June 14, 2023

During the panel, Fagel agreed that the email contained no real bombshells relevant to the case, but did highlight some potential conflicts of interest. He said on multiple occasions that he did not want to ascribe motivations to Hinman but added:

“I do try to see both sides of it. So I don’t like to leap to there’s something unethical here, although we can all agree that there’s some conflicted issues here and some really disappointing conduct here.”

Before and after working with the SEC, Hinman worked at a law firm called Simpson Thacher & Bartlett, which was a member of the advocacy organization Enterprise Ethereum Alliance that seeks to drive the use of Ethereum blockchain technology.

According to the watchdog group Empower Oversight Whistleblowers and Research, the group that initially filed the freedom of information request that led to the Hinman documents, Hinman “continued to receive millions of dollars from Simpson Thacher while working at the SEC.”

The implication, as expanded upon by Hogan during the panel, is that Hinman was essentially being paid off to give Ether a free pass and say in his speech that Ether was not a security, which some people have previously referred to as “ETHGate.“

Related: Ripple’s Alderoty calls for probe into Bill Hinman and his infamous speech

Hogan had a similar take, suggesting that the emails did not contain much that Ripple could actively use in the case, but indicated that Hinman should be more concerned about the contents of the emails rather than the SEC, particularly when his earlier drafts of the speech referred to it as the “Ether speech.”

Deaton also said that he believes “the speech documents are good for Ethereum” and “could also help ERC-20 tokens like Dragonchain,” which are governed by the Ethereum blockchain:

“If the SEC claimed the network was sufficiently decentralized, then those tokens have even a better fair notice argument than Ripple.”

This was something also referred to in the Office of General Counsel’s comments, with the division sharing that it had “reservations about including a statement directly about Ether in the speech,” as “it would be difficult for the agency to take a different position on Ether in the future.“

NFT Creator: 'Holy shit, I’ve seen that!’ — Coldie’s Snoop Dogg, Vitalik and McAfee NFTs

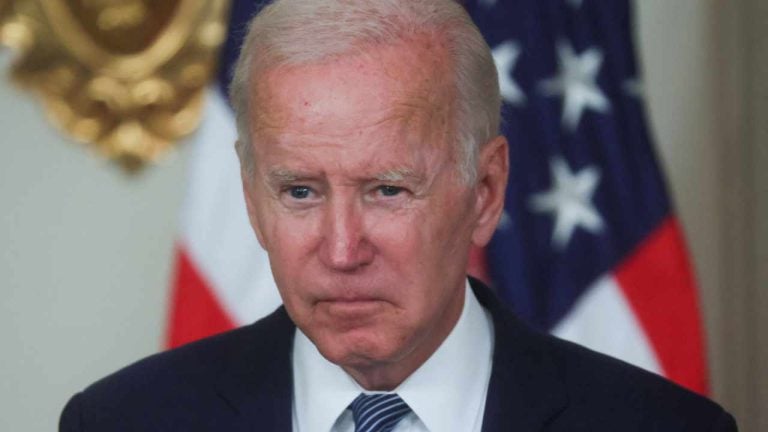

U.S. President Joe Biden has shared his perspective on inflation. “I am more optimistic than I’ve been in a long time,” he said, noting that inflation has not spiked for several months. Many people disagree with Biden, with one saying that “families are poorer than when he took office.” US President Joe Biden’s Views on […]

U.S. President Joe Biden has shared his perspective on inflation. “I am more optimistic than I’ve been in a long time,” he said, noting that inflation has not spiked for several months. Many people disagree with Biden, with one saying that “families are poorer than when he took office.” US President Joe Biden’s Views on […]

Crypto attorney John Deaton is looking at the former Chair of the U.S. Securities and Exchange Commission (SEC) for the lack of regulatory clarity in the digital asset industry. John Deaton is calling out Jay Clayton after the former SEC Chair wrote an article in the Wall Street Journal about crypto regulation. In Clayton’s article, […]

The post XRP-Supporting Lawyer Blasts Former SEC Chair Jay Clayton for Lack of Clarity on Crypto Regulation appeared first on The Daily Hodl.

On September 24, the staff writer for The New Republic, Jacob Silverman, tweeted about a Freedom of Information Act (FOIA) request he filed that was ultimately denied. On the social media platform, Silverman wrote that he got Securities and Exchange Commission (SEC) responses to his FOIA requests and said the responses were “withheld because of […]

On September 24, the staff writer for The New Republic, Jacob Silverman, tweeted about a Freedom of Information Act (FOIA) request he filed that was ultimately denied. On the social media platform, Silverman wrote that he got Securities and Exchange Commission (SEC) responses to his FOIA requests and said the responses were “withheld because of […]

Former top policymakers Jay Clayton and Brent McIntosh has defended the crypto regulatory regimes established during their respective government tenures.

The regulatory pressure is mounting in the U.S., with more politicians questioning whether the current framework is adequate.

An opinion piece penned for Wall Street Journal by former SEC Chairman, Jay Clayton, and former Undersecretary of the Treasury, Brent McIntosh, have defended the United States’ existing regulatory apparatus regarding crypto and warned that excessive rulemaking could stifle innovation.

The discussions come as cryptocurrencies have been thrown into the regulatory spotlight once again in the wake of two crippling ransomware attacks in the U.S. Over the weekend, two senators deliberated on the prospect of banning cryptocurrencies as a solution to the ransomware attacks.

Clayton served as SEC head from May 2017 until December 2020 and stated that the agency did not take up Bitcoin regulation because the asset was declared not to be a security before he took up his position as its head. Clayton has remained in the industry following his departure from the SEC and currently advises One River Asset Management on cryptocurrencies.

McIntosh was the Under Secretary of the Treasury for International Affairs from September 2019 until January 2021, previously serving as General Counsel to the Department of the Treasury between 2017 and 2019.

The pair emphasized the challenge of finding a pragmatic regulatory balance that ensures basic consumer protections without stifling the crypto industry’s growth, warning that the sector could easily be subjected to excessive or insufficient regulatory oversight while praising existing guideline:

“Existing regulatory frameworks provide the tools to address many of the risks of new technologies without stifling their promise.”

They advised policymakers to ground their efforts in the principal objectives underpinning existing financial regulations. These include financial stability and the prevention of fraud and illicit activity.

The pair concluded that a coordinated approach is required that ensures the U.S. retains its role as a financial leader:

“A prompt, coordinated approach to regulatory clarity that builds on our existing knowledge base will empower responsible innovation and ensure that the U.S. financial system continues its leadership role in the formation of capital, the provision of credit, and the maintenance of stability on which the modern global economy depends.”

Those in power appear to be angling for a heavier-handed approach, with Treasury Secretary, Janet Yellen, stating that the misuse of crypto is a growing problem in February.

SEC chairman Gary Gensler also hinted at greater regulatory oversight for U.S. crypto exchanges in early May.

A petition has been started calling on U.S. Securities and Exchange Commission (SEC) Chairman-Designate Gary Gensler to end the lawsuit against Ripple Labs and its executives over XRP tokens. The petition also demands “a thorough investigation of the matters that led to the last-minute lawsuit against Ripple, filed on the last day in office by […]

A petition has been started calling on U.S. Securities and Exchange Commission (SEC) Chairman-Designate Gary Gensler to end the lawsuit against Ripple Labs and its executives over XRP tokens. The petition also demands “a thorough investigation of the matters that led to the last-minute lawsuit against Ripple, filed on the last day in office by […]

The former SEC chairman warns that regulation will come both directly and indirectly.

Former US Securities and Exchange Commission Chair Jay Clayton has stated that Bitcoin has not been classified as a security for a long time.

But speaking on CNBC’s Squawk Box on March 31, Clayton warned that its status as a non-security still does not protect it from the imposition of new regulations which, he warned, could be coming soon.

"Where digital assets land at the end of the day--will be driven in part by regulation both domestic and international, and I expect that regulation will come in this area both directly and indirectly," says Former SEC Chairman Jay Clayton on #bitcoin. pic.twitter.com/voWcgCFqOH

— Squawk Box (@SquawkCNBC) April 1, 2021

Host Andrew Ross Sorkin pointed out that under Clayton’s watch the SEC did not take a position on Bitcoin regulation. Clayton responded that was because the asset was declared not to be a security before he even took up his position as the head of the regulatory body.

“Bitcoin was decided to be not a security before the time I got to the SEC. Therefore, the SEC's jurisdiction over Bitcoin was rather indirect.”

Clayton has remained in the industry following his departure from the SEC in December 2020 and currently advises One River Asset Management on cryptocurrencies.

Although he professes not to have any special insights into what new laws are coming from his time heading up the SEC, he believes the regulatory environment is due for a shake up.

“Where digital assets land at the end of the day […] will be driven in part by regulation—both domestic and international—and I expect, and I’m speaking as a citizen now, that regulation will come in this area both directly and indirectly whether it’s through how these are held at banks, security accounts, taxation and the like. We will see this regulatory environment evolve.”

Clayton’s comments come just a week after billionaire hedge fund manager Ray Dalio warned that the U.S. may ban Bitcoin outright just as they did with gold in the 1930s.

His comments about Bitcoin’s status as a non-security are also interesting in light of Ripple’s appeals to the SEC for documents from the agency to determine how exactly it came to the conclusion that Bitcoin and Ethereum were not securities.

The company and its backers have repeatedly argued that XRP is not a security however the SEC believes it is markedly different due to being morcentralized. Former SEC attorney Marc Powers told Cointelegraph that the agency is executing significant overreach in its case against Ripple and its executives.

Former SEC chair Jay Clayton has joined the advisory council of One River Digital Asset Management, a digital asset investment firm.

Jay Clayton, who served as chair of the U.S. Securities and Exchange Commission between May 2017 to December 2020, has taken advisory roles at multiple firms.

Most recently, he has been appointed to the advisory council of One River Digital Asset Management, a prominent crypto investment firm.

Clayton said about One River CEO Eric Peters: “We were impressed by Eric’s willingness to hear our varying views on the digitization of our monetary, banking, and capital markets ecosystem and One River’s commitment to transparency.”

Clayton is regarded as one of the crypto industry’s top villains because the SEC declined to approve Bitcoin ETFs under his leadership. Under Clayton, the SEC also made it harder for startups to run ICOs and most other types of initial tokens sales.

However, Clayton’s willingness to work with Bitcoin-adjacent firms should not be entirely surprising, given that he stated that Bitcoin is not a security in 2018. Unlike other cryptocurrencies, Bitcoin never went through an ICO or any other fundraiser.

Along with serving on One River’s advisory council, Clayton will rejoin his former law firm Sullivan & Cromwell LLP as a policy council advisor. He will also act as non-executive Chair of Apollo Global Management Inc. and serve as Adjunct Professor at the University of Pennsylvania Carey Law School.

Prior to the economic crisis resulting from the response to COVID-19, One River CEO Eric Peters focused his strategy based on volatility, bringing in returns of around 35% in 2020.

The firm has made significant investments in Bitcoin. In November, it announced a $600 million Bitcoin purchase. In recent statements, Peters additionally confirmed that One River plans to increase its Bitcoin and Ethereum holdings to $1 billion in the first half of 2021.

One River has also received financial backing from the Brevan Howard Asset Management Fund and Ruffer LLP.

At the time of writing this author held Bitcoin and less than $15 of altcoins.