LayerZero Labs announces a snapshot for its native token airdrop, with over 5.8 million wallets participating in the service.

The post LayerZero Labs announces snapshot of its native token airdrop appeared first on Crypto Briefing.

Connext, Chainsafe, Sygma, LiFi, Socket, Hashi, Across, Celer, and Router issued a joint statement criticizing the new token.

A new bridged token from cross-chain protocol LayerZero is drawing criticism from nine protocols throughout the Ethereum ecosystem. A joint statement from Connext, Chainsafe, Sygma, LiFi, Socket, Hashi, Across, Celer, and Router on October 27 called the token’s standard “a vendor-locked proprietary standard,” claiming that it limits the freedom of token issuers.

Today, we're announcing a unified call for

— Connext (@ConnextNetwork) October 27, 2023

Open Bridge Standards

alongside @AcrossProtocol @CelerNetwork @ChainSafeth @buildwithsygma @lifiprotocol @SocketDotTech @routerprotocol and @hashialliance pic.twitter.com/D4CLw2lBD1

The protocols claimed in their joint statement that LayerZero’s new token is “a proprietary representation of wstETH to Avalanche, BNB Chain, and Scroll without support from the Lido DAO [decentralized autonomous organization],” which is created by “provider-specific systems […] fundamentally owned by the bridges that implement them.” As a result, it creates “systemic risks for projects that can be tough to quantify,” they stated. The protocols advocated for the use of the xERC-20 token standard for bridging stETH instead of using LayerZero’s new token.

Lido Staked Ether (stETH) is a liquid staking derivative produced when a user deposits Ether (ETH) into the Lido protocol for staking. On October 25, LayerZero launched a bridged version of stETH, called "Wrapped Staked Ether (wstETH)" on BNB Chain, Avalanche, and Scroll. Prior to this launch, stETH was not available on these three networks.

Since any protocol can create a bridged version of a token, LayerZero was able to launch wstETH without needing the approval of Lido’s governing body, LidoDAO. In addition, both BNB Chain and LayerZero announced the token’s launch on X (formerly Twitter), and BNB Chain tagged the Lido development team in its announcement. Members of LidoDAO later claimed that these actions were an attempt to mislead users into believing that the new token had support from the DAO.

On the same day that LayerZero launched wstETH, they proposed that LidoDAO should approve the new token as the official version of stETH on the three new networks. They offered to transfer control of the token’s protocol to LidoDAO, relinquishing LayerZero’s administration of it. In response, some LidoDAO members complained that this move was intended to create a fait accompli to pressure the DAO into passing the proposal when they otherwise wouldn’t have.

Related: LayerZero partners with Immunefi to launch $15M bug bounty

“There appears to have been a coordinated marketing effort between Avalanche, BNB, and LayerZero with a series of twitter posts and slick videos implying that LidoDAO has already officially accepted the OFT standard,” LidoDAO member Hart Lambur posted to the forum, adding “How is this possible when this is just a proposal?”

Some members also argued that the new token could pose security issues. “Layer Zero is a super centralized option that exposes Ethereum’s main protocol to an unprecedented catastrophe,” LidoDAO member Scaloneta claimed, arguing that a hack in the protocol’s verification layer “would imply that infinite wsteth will be minted.”

Cointelegraph reached out to the LayerZero team for comment through Telegram and email, but did not receive a response by the time of publication. In April, LayerZero raised over $120 million to help build more cross-chain functionality into the Web3 ecosystem and partnered with Radix to bring cross-chain functionality to the Radix Babylon network.

Developers will get a 15% cut of the fees they generate, but only if their app has done more than 125,000 transactions and has existed for three months.

A new program from the Fantom Opera network team will pay developers for the gas fees they generate from users, according to a May 31 announcement. Specifically, the “Gas Monetization Program” will pay eligible developers 15% of the total gas fees their apps generate.

Gas Monetization on #Fantom is live! ⛽

— Fantom Foundation (@FantomFDN) May 31, 2023

The program provides dApps with a sustainable income by offering them a 15% share of the gas fees they generate.

Over 12,000 $FTM has been distributed thus far https://t.co/BqpuKtrZh0

Six Web3 apps have already been approved for the program, including ParaSwap, Beethoven X, Stargate, LayerZero, WOOFi and SpookySwap. These apps have generated over 12,000 Fantom (FTM) in rewards already (worth approximately $3,715), the announcement stated.

The program was inspired by the “Web2 ad-revenue model” implemented by sites like YouTube and Snapchat that pay content creators for their contributions. The Fantom team hopes it will provide developers with an “alternative source of revenue,” leading to a “sustainable” ecosystem for Fantom.

However, not all apps will be eligible for the program. Protocols that have done less than 125,000 transactions or have been live on Fantom for less than three months will be automatically excluded. Others can apply to become part of the program, but Fantom warned that “the criteria are subject to change as the Fantom Foundation assesses their effectiveness.”

The team encountered some pushback from users when it first began discussing the Gas Monetization Program. “There are some who have speculated that the Gas Monetization program might discourage developers from creating gas-efficient contracts, as higher gas fees results in greater FTM rewards for them to claim,” the Fantom team said.

However, Fantom argued that this reasoning is flawed. The team believes app developers will still need to make gas-efficient contracts; otherwise, the apps will be challenged by competitors. The team clarified that apps perceived to be abusing the program may be suspended from participation.

Fantom has been preparing for the Gas Monetization Program since December, when it proposed a 75% cut to the token burn rate to finance it. Later that month, Fantom Foundation director and decentralized finance architect Andre Cronje announced that the team would focus on “gas reform” in 2023 to onboard more developers and users.

Cross-chain interoperability protocol LayerZero’s infrastructure aims to drive liquid staking adoption across the DeFi ecosystem.

Layer-1 blockchain Tenet is set to see its liquid staking derivatives platfrom plug into a cross-chain decentralized finance (DeFi) ecosystem through a partnership with omnichain messaging protocol LayerZero.

Tenet has plugged into LayerZero’s cross-chain protocol to access the wider DeFi ecosystem across a number of different blockchains. The Cosmos-based blockchain is a DeFi-focused ecosystem which provides liquidity and yield products for liquid staking derivatives (LSDs).

LSDs have been a central cog in the DeFi ecosystem for some time. A prime example is Ethereum (ETH) liquid staking pools like Lido allowing users to stake and unstake ETH seamlessly leading to massive amounts of capital being staked for lucrative yields.

Tenet’s network allows users to create projects and tokens which will now be integrated with LayerZero technology. The interoperability opens up users to the broader DeFi ecosystem across a variety of smart contract blockchains.

Tenet’s DeFi blockchain operates using its own diversified proof of stake consensus framework, with its native stablecoin backed by a basket of interest-bearing LSDs from various blockchains.

Staking a basket of blockchain-based assets is touted to remove the risk of network attacks by major token holders. Tenet’s genesis stake of its network security was allocated to ETH, ATOM, BNB, MATIC, ADA, and DOT.

Tenet CEO Gregory Goodman told Cointelegraph that LSDs remain a popular DeFi solution that extends the ability to profit from staked assets:

“They allow you to maximize opportunities, by leveraging on the liquidity of staked assets. LSDs will essentially allow PoS native tokens to maximize their earnings potential.”

Goodman also highlighted the importance of LayerZero’s infrastructure in becoming a key component to the future of DeFi.

“The technology they’ve built is a generation ahead of bridging and avoids some of the key exploits we’ve seen bridges succumb to.”

The DeFi ecosystem has seen its fair share of exploits over the last 12 months. Cross-chain bridge attacks saw more than $2 billion stolen from the DeFi ecosystem, with the infamous Axie Infinity Ronin bridge hack accounting for a significant amount of that figure.

Tenet is also set to launch a bridge using LayerZero to make their omnichain LSDs interoperable with the 27 different blockchains supported by the latter’s network.

Applications built on LayerZero’s cross-chain messaging protocol are gathering momentum primarily due to excitement over a potential airdrop.

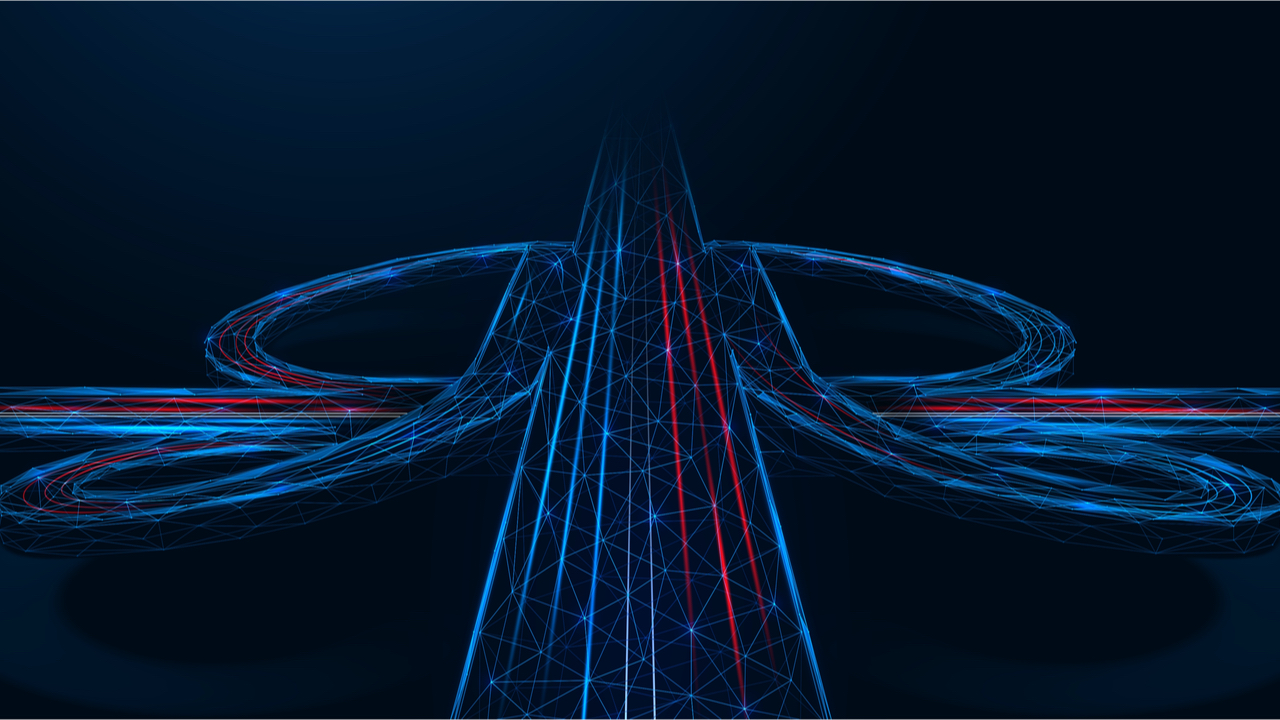

LayerZero is a communication method that facilitates cross-chain applications. Its low-level messaging capabilities enable the development of omni-chain functionalities on top of it, such as decentralized exchanges, money market protocols and numerous other DeFi applications that can benefit from cross-chain liquidity provisions.

The LayerZero platform was launched in September 2021 with Stargate Finance, a cross-chain bridge, as the first application built on it. The project raised $261 million in three funding rounds, doubling its valuation from $1 billion to $2 billionfrom March 2022 to March 2023.

Data analytics firm Nansen reported that decentralized applications (Dapps) built on LayerZero are some of the top-used entities across blockchain platforms like Aribtrum, Optimism, Ethereum, Binance Chain and Polygon.

In the first week of April, LayerZero-powered applications like Stargate and Radiant Finance were most used on Arbitrum and Optimism. On Polygon, Binance Chain and Ethereum, LayerZero and its applications ranked between 7th and 30th concerning user activity.

@LayerZero_Labs raised $120M at a $3B valuation$ZRO airdrop tweets going viral (again)

— Nansen (@nansen_ai) April 6, 2023

Data shows that LayerZero is among the top entities on Arbitrum, Optimism, Avalanche, BNB Chain, Fantom

Sharing some of the multi-chain stats below (with free/public dashboards) pic.twitter.com/HZwc4J4vuG

The primary motivation for the increasing adoption is the speculation around the native token airdrop of LayerZero. The team has included a mention of the ZRO token in their source code on Github, which makes an airdrop toward early users likely.

Stargate Finance is the building block of the LayerZero ecosystem. The cross-chain bridge enables transfers between Ethereum, Binance Chain, Polygon, Aribtrum and Optimism with optimum liquidity and security. The total value locked (TVL) in Stargate pools is $419 million, per DeFiLlama data, second only to the Multichain protocol.

The LayerZero protocol has also been used to bridge isolated ecosystems like Aptos with Ethereum, demonstrating the messaging protocol’s ability to bridge incompatible ecosystems. There’s also a bridge exclusively for Wrapped Bitcoin (WBTC) transfers across Ethereum-compatible blockchains.

Besides bridges, the messaging protocol also finds application in decentralized exchanges and lending protocols. Radiant Capital is the leading lending platform built using LayerZero’s technology. The TVL of the multi-chain market-making protocol has increased to $200 million from less than $30 million in 2023’s start.

InterSwap and Hashflow are building a cross-chain decentralized exchange like Uniswap on top of LayerZero. Pontem Network, a DeFi hub on Aptos, is also leveraging LayerZero’s technology to build its suite of DeFi applications like DEX, lending portal and a NFT marketplace.

The LayerZero ecosystem growth appears to be developing a significant moat in cross-chain applications as the airdrop frenzy brings liquidity and usage to the applications built on it.

While some other cross-chain interoperable platforms are in the works, LayerZero is enjoying a first-mover advantage with a working design.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

A widely followed crypto analyst is bringing attention to 10 upcoming airdrops and advising investors on how to capitalize on them. In a lengthy thread, crypto strategist Miles Deutscher tells his 257,000 Twitter followers to keep an eye out for the following 10 airdrops. According to the trader, airdrops are a great way for investors […]

The post 10 Big Money Airdrops Are Coming to Savvy Crypto Traders, According to Analyst – Here’s How to Capitalize appeared first on The Daily Hodl.

On Monday, Christie’s, the leading British auction house founded 256 years ago in 1766, announced the launch of a new venture fund called Christie’s Ventures. According to the announcement, the company’s venture arm plans to focus on “[Web3] innovation, art-related financial products and solutions, and technologies that enable seamless consumption of art.” Christie’s Ventures to […]

On Monday, Christie’s, the leading British auction house founded 256 years ago in 1766, announced the launch of a new venture fund called Christie’s Ventures. According to the announcement, the company’s venture arm plans to focus on “[Web3] innovation, art-related financial products and solutions, and technologies that enable seamless consumption of art.” Christie’s Ventures to […] Layerzero Labs, the firm behind the interoperability protocol Layerzero, has revealed the company has raised $135 million in a Series A+ finance round led by Andreessen Horowitz (a16z), FTX Ventures, and Sequoia Capital. The new financing brings Layerzero Labs’ overall valuation to $1 billion and the funds will be leveraged to develop cross-chain decentralized applications […]

Layerzero Labs, the firm behind the interoperability protocol Layerzero, has revealed the company has raised $135 million in a Series A+ finance round led by Andreessen Horowitz (a16z), FTX Ventures, and Sequoia Capital. The new financing brings Layerzero Labs’ overall valuation to $1 billion and the funds will be leveraged to develop cross-chain decentralized applications […]