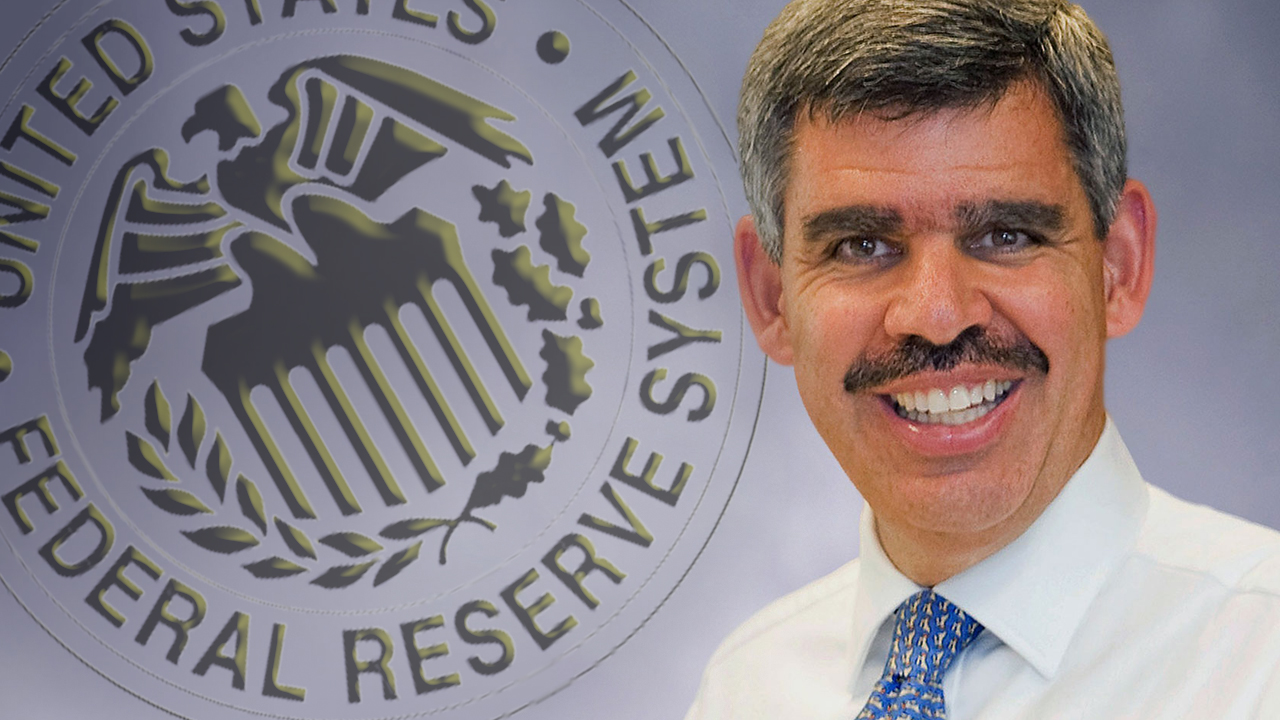

On Monday, December 13, following Friday’s U.S. consumer price index report published by the Bureau of Labor Statistics, Americans are discussing the Federal Reserve. Thousands of tweets concerning the Federal Reserve topic have been trending on Twitter, as inflation has gripped the U.S. economy. Furthermore, Mohamed El-Erian, the chief economic advisor for the German multinational […]

On Monday, December 13, following Friday’s U.S. consumer price index report published by the Bureau of Labor Statistics, Americans are discussing the Federal Reserve. Thousands of tweets concerning the Federal Reserve topic have been trending on Twitter, as inflation has gripped the U.S. economy. Furthermore, Mohamed El-Erian, the chief economic advisor for the German multinational […] The consumer price index (CPI) data released Friday by the U.S. Bureau of Labor Statistics show prices in the United States climbed 6.8% in November compared to 12 months ago. It’s the largest rise in close to forty years, and U.S. policymakers are backing away fast from saying inflation is transitory. Inflation Accelerates in the […]

The consumer price index (CPI) data released Friday by the U.S. Bureau of Labor Statistics show prices in the United States climbed 6.8% in November compared to 12 months ago. It’s the largest rise in close to forty years, and U.S. policymakers are backing away fast from saying inflation is transitory. Inflation Accelerates in the […] Etoro, an Israel-based trading platform, has taken action on its platform regarding the trading of cardano and tron. Now, U.S.-based customers will have limited functionality with these cryptocurrencies on the Etoro platform starting in December. Etoro explained in a post that these new measures were a consequence of “business-related considerations in the evolving regulatory environment.” […]

Etoro, an Israel-based trading platform, has taken action on its platform regarding the trading of cardano and tron. Now, U.S.-based customers will have limited functionality with these cryptocurrencies on the Etoro platform starting in December. Etoro explained in a post that these new measures were a consequence of “business-related considerations in the evolving regulatory environment.” […] Crypto proponents and market observers can now gain insight into Solana’s and Serum’s liquidity infrastructure ecosystem via the analytics and decentralized indexing provider Aleph.im. The cross-blockchain computing project says the induction of Serum Markets will “help surface valuable trading data on Project Serum.” Aleph.im Adds Project Serum Support During the last quarter of the year, […]

Crypto proponents and market observers can now gain insight into Solana’s and Serum’s liquidity infrastructure ecosystem via the analytics and decentralized indexing provider Aleph.im. The cross-blockchain computing project says the induction of Serum Markets will “help surface valuable trading data on Project Serum.” Aleph.im Adds Project Serum Support During the last quarter of the year, […]

This week CRV price rallied toward a new 1-year high, but what’s behind the move?

This week cryptocurrency traders turned their focus to the pack of dog-themed meme tokens as altcoins like Shiba Inu and Dogecoin (DOGE) saw a surge in volume which resulted in SHIB hitting a new all-time high and the remaining Dogecoin clones booking some juicy gains.

Traders are now debating whether the launch of the first Bitcoin (BTC) exchange-traded fund (ETF) kicked off the next leg of the bull market or if meme-tokens rallying is a top signal.

While SHIB, DOGE and Samoyedcoin are the hot flavor of the week, there are other tokens which are equally bullish and posses stronger fundamentals. Take for example, Curve protocol's native CRV token which broke to a near yearly high earlier this week.

Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $2.05 on Sept. 26, the price of CRV has climbed 168% to hit a yearly high of $5.51 on Oct. 28 as its 24-hour trading volume spiked 89% to $1.3 billion.

A few reasons for the uptrend in CRV price include the fact that a majority of the circulating supply of CRV is locked, “Curve wars” that have DeFi protocols competing for CRV deposits and the rising total value locked on the Curve protocol.

A major factor behind CRV's rally is Curve's incentives for holders that lock their tokens on the protocol long-term and earn rewards from staking.

As a result of these incentives more than 347.8 million CRV, or 88.75% of the circulating supply, is currently locked on the Curve protocol with an average vesting time of 3.68 years according to data from Curve.

Another reason for the uptrend in CRV price is the ongoing Curve war between protocols like Yearn.finance and Convex Finance who find themselves competing to offer the most attractive yields to entice CRV holders to lock tokens in their vaults.

It has been 160 days since @ConvexFinance launched. In that time, 69.3m CRV has been farmed.

— CryptoCondom (@crypto_condom) October 24, 2021

At the current rate, $CRV is being farmed at 433k per day...so $CVX emissions will be 80% complete in 70.9days at 100m $CRV farmed....which means January 3rd will be a REALLY GOOD day pic.twitter.com/7fphyoK48c

This has caused a bit of a supply squeeze and it makes sense that the dynamic could continue to pick up pace, especially now that popular DeFi platforms like Abracadabra.money are also increasing their marketshare of CRV deposits.

Essentially, each protocol is "bribing" CRV holders by offering attractive yields so that they will use the governance power granted by staking CRV and holding VeCRV to vote for a higher allocation of stablecoins to the DeFi protocol in question. Many have referred to this process as "buying votes."

Related: US regulators are exploring policy for banks to handle crypto, says FDIC chair

The total value locked (TVL) in Curve also continues to surge and the platform hosts some of the largest stablecoin pools in the DeFi ecosystem.

Data from Defi Llama shows that the TVL on Curve is now at a record high $18.84 billion, making Curve the second-largest protocol by TVL.

The uptick in TVL was primarily caused by Curve’s success in integrating with many of the top layer-one and layer-two protocols with active DeFi ecosystems including Ethereum (ETH), Avalanche (AVAX), Harmony (ONE), Polygon (MATIC), xDAI (STAKE) and Fantom (FTM).

According to data from Cointelegraph Markets Pro, market conditions for CRV have been favorable for some time.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historical and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

As seen in the chart above, the VORTECS™ Score for CRV elevated into the green zone back on Sept. 22 and reached a high of 84 on Sept. 26, around 48 hours before its price began to increase by 150% over the next month.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The Solana-based project is incentivizing automated market makers to interact with its order book across a range of trading pairs.

Project Serum, a decentralized derivatives exchange for the Solana network, has launched a $100 million liquidity mining program as part of a broader effort to attract users to the ecosystem.

The initial allocation was approved by Serum’s decentralized autonomous organization, or DAO, the project announced Thursday. The sum, paid out in Serum’s native SRM token, will be used as a reward mechanism for automated market makers that work directly with Serum’s on-chain order book.

Liquidity mining is an effective tool for DeFi protocols as it incentivizes automated market makers to supply liquidity and enhance the network’s overall operation. As a broader concept, liquidity mining refers to a process whereby a project offers its tokens to anyone willing to deposit funds into a smart contract.

Serum Protocol is in a unique position given Solana’s enormous growth over the past year. The smart contract platform has a total market capitalization of nearly $60 billion, making it the sixth-largest blockchain project in the world. As Cointelegraph reported, Solana Labs, the developer studio incubating Solana projects, raised over $314 million in a private token sale that concluded in June.

Related: Solana DEX raises $18M Series A from Three Arrows Capital, Coinbase Ventures

In terms of total value locked, or TVL, Serum Protocol ranks 11th among decentralized exchanges at $1.58 billion, according to industry sources. By comparison, Curve has over $18.8 billion in TVL while SushiSwap, PancakeSwap and Uniswap each have over $5 billion.

Gelato aims to simply DeFi by automating smart contract operations and helping users rebalance their portfolios.

Smart contract automation network Gelato has become the latest to receive big backing from crypto venture capital giants.

Gelato has raised $11 million in a Series A funding round led by Dragonfly Capital and with participation from ParaFi Capital, Nascent, IDEO CoLab Ventures, and Aave founder Stani Kulechov.

The funds were raised through a closed-door token sale and will go toward onboarding more blockchains to the network and increasing its staff from the current team of 15.

Gelato automates Ethereum smart contract operations by using what it calls “arbitrary logic” and bots. Its most prominent use case is addressing liquidity and volatility issues with cryptocurrency trading. The protocol can protect traders from severe losses by automatically rebalancing portfolios and executing trades on their behalf.

Third-party servers and systems are required to monitor smart contracts and conditions for their execution. Gelato does away with the intermediaries by using a decentralized network of bots to carry out these operations, simplifying DeFi for end users.

Mika Honkasalo of ParaFi Capital explained that:

“Gelato expands the capabilities of smart contracts, which are by default inactive and only execute when a user triggers them.”

Gelato co-founder Hilmar Orth elaborated that Web 3 developers can now plug into an existing decentralized network instead of having to write custom bots run on centralized servers.

The Gelato Network currently supports smart contracts on Ethereum, Polygon and Fantom and will add additional support for Binance Smart Chain, Arbitrum, Optimism, and Avalanche. Several projects are already using the system to automate contracts including MakerDAO, Instadapp, B Protocol, and QuickSwap.

Related: Gelato Network launches ‘G-UNI’ Uniswap v3 management token

In June, Gelato introduced an automated liquidity manager for Uniswap called G-UNI which combined the capital efficiency of Uniswap v3 with the user experience of v2.

In August, Gelato integrated with DeFi aggregator Zerion to improve liquidity management for its users. This enabled Zerion’s 200,000 or so active monthly users to have their Uniswap v3 positions managed automatically.

CELR soars to a new all-time high following the launch of its cross-chain bridge that allows traders to jump back and forth between various layer-1 and layer-2 platforms.

High transaction costs have been a thorn in the side of investors and developers for more than a decade and the issue became worse in 2021 after the emergence of decentralized finance (DeFi) and nonfungible tokens (NFT) led to record-high levels of activity across the cryptocurrency ecosystem.

Since the completion of Ethereum's London hard fork, cross-chain bridges and layer-2 solutions have been revised as options for mitigating the high fees on the Ethereum network. In the past two weeks, Celer, a layer-two scaling solution that utilizes off-chain transaction handling to help increase the throughput capacity of its network, has seen an uptick in user activity.

Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.0398 on Sept. 8, the price of CELR has surged 400% to reach a new all-time high at $0.199 on Sept. 26 as its 24-hour trading volume spiked to $1.27 billion.

Three reasons for the price rally in CELR are the release of the protocols cross-chain software cBridge, new integrations that have led to the expansion of its ecosystem and the increase in overall strength and demand for layer-two solutions.

Arguably the biggest development to come out of the Celer protocol in 2021 has been the release of its cBridge cross-chain bridging solution, which went live on the mainnet on July 22.

At the time of writing, the cBridge supports the transfer of assets between 10 different protocols, including Ethereum, Binance Smart Chain (BSC), Polygon, Fantom and Avalanche.

Data provided by Celer shows that in the two months since the launch of cBridge, the protocol has facilitated the transfer of more than $242 million worth of value between networks as it continues to rise in popularity amongst the crypto community.

A second reason for the gains seen in CELR over the past month has been the expansion of the project's ecosystem.

The launch of Optimism and Arbitrum and Celer's cross-bridge integration to the layer-2 solutions are likely the primary factors backing the rally in CELR price.

When the cBridge was first released, it supported Polygon, Ethereum, BSC, Arbitrum and Optimism. In the two months following the initial launch, it added support for Fantom, xDAI, Avalanche, OKExChain and Heco, effectively doubling its reach and the number of users interacting with the token.

The functionality of the protocol has also led to a handful of integrations such as being added to the TokenPocket and ONTO cryptocurrency wallets. CELR token was also listed on WOO Network and BarterTrade exchanges recent.

Related: Ethereum alternatives and layer-one solutions see steady gains in September

A third reason for the overall strength of CELR has been the increase in demand and activity on layer-two protocols and data from Etherscan shows that the gas price continues to spike higher as Ethereum network activity increases.

Arbitrum and Optimism had their full launches within the past few months following years of development and users have now begun the process of migrating assets to these scaling solutions as DeFi protocols slowly integrate this new technology.

As a way to further capture some of the energy generated following the release of Arbitrum, Celer's cross-chain bridge offers a work-around to the seven-day withdrawal period required when users want to migrate assets from Arbitrum back to Ethereum.

According to data from Cointelegraph Markets Pro, market conditions for CELR have been favorable for some time.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historical and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

As seen on the chart above, the VORTECS™ Score for CELR began to pick up on Sept. 7 and climbed to a high of 75 on Sept. 8, around 48 hours before the price increased by 275% over the next two weeks.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.