BitGo has accused Galaxy of “improper repudiation” and “intentional breach” of the merger in a lawsuit filed with Delaware Chancery Court.

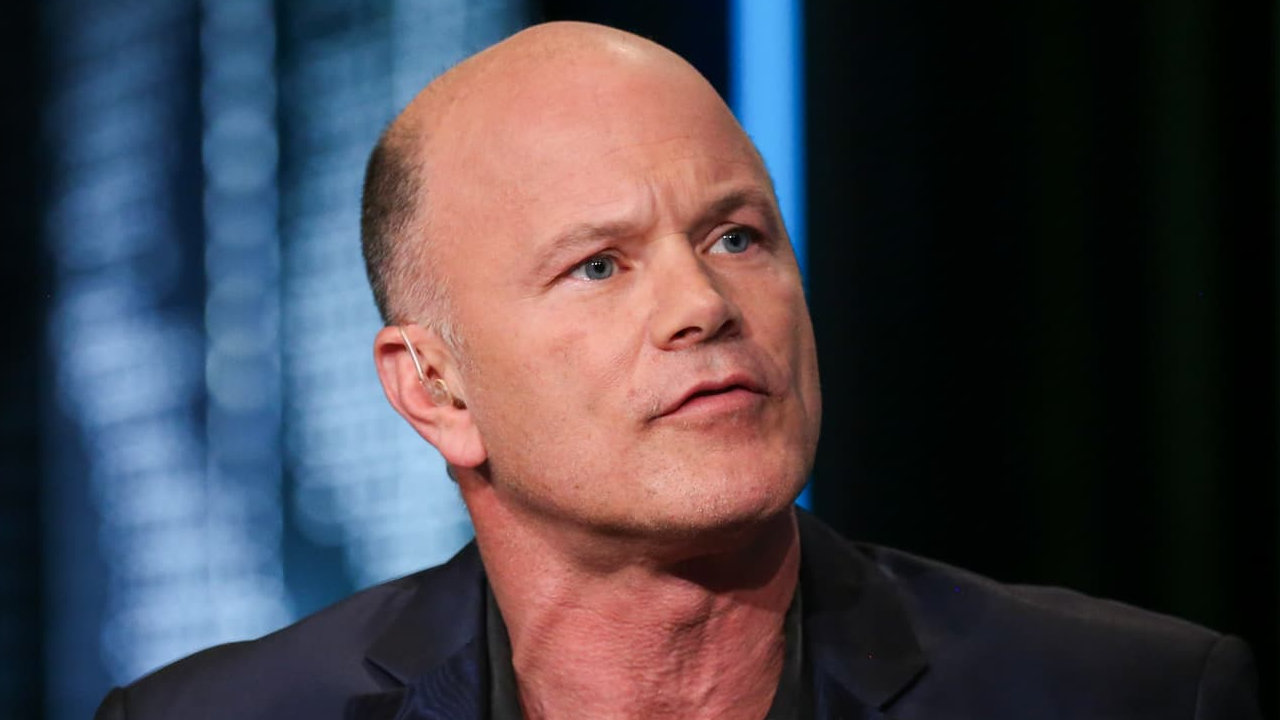

Digital asset custodian BitGo has filed a lawsuit against Mike Novogratz’s cryptocurrency investment firm Galaxy Digital for terminating the former's acquisition.

BitGo took to Twitter on Tuesday to disclose details of its lawsuit against Galaxy after the latter terminated the $1.2 billion acquisition deal with BitGo in mid-August.

Filed on Monday, the lawsuit seeks more than $100 million in damages, accusing Galaxy of “improper repudiation” and “intentional breach” of its acquisition agreement with BitGo, the firm said.

BitGo said they filed the lawsuit with Delaware Chancery Court, stressing that the court documents are expected to become public on Thursday evening. That is in “an abundance of caution” in the event Galaxy wants to “redact some of the allegations before the complaint becomes public,” BitGo noted in a tweet.

As previously reported, Galaxy terminated the BitGo acquisition on Aug. 15. The company argued that it exercised its right to drop the deal in line with the merger agreement after BitGo failed to deliver audited financial statements for 2021.

Galaxy CEO Novogratz said that it was still pursuing its path to the United States listing on Nasdaq. Galaxy also stated that they plan to vigorously defend the firm in a potential case as Galaxy believed that BitGo’s claims were “without merit.”

Both BitGo and Galaxy declined to provide additional comments regarding the lawsuit to Cointelegraph.

Related: CleanSpark acquires mining facility in Georgia for $33 million

The news comes amid BitGo continuing to develop more products and services. The company on Tuesday announced the launch of its Wealth Management platform, aiming to allow registered investment advisors and broker-dealers to have direct access to digital assets.

Founded in 2013, BitGo is a major global digital currency firm focusing exclusively on serving institutional clients, providing custody, liquidity, and security solutions. Last year, the firm reported over $64 billion in assets under custody.