NFT sales experienced a dip this week, dropping 8.78% compared to the previous seven days. Total sales amounted to $77.46 million, with a sharp decrease in both buyers (down 64.47%) and sellers (down 66.40%). Bitcoin NFTs Surge 29.36% as Overall NFT Sales Dropped Over the past week, the digital collectible market struggled, bringing in $77.46 […]

NFT sales experienced a dip this week, dropping 8.78% compared to the previous seven days. Total sales amounted to $77.46 million, with a sharp decrease in both buyers (down 64.47%) and sellers (down 66.40%). Bitcoin NFTs Surge 29.36% as Overall NFT Sales Dropped Over the past week, the digital collectible market struggled, bringing in $77.46 […]

The Framework Ventures-backed platform has surpassed $150 million in TVL, despite a wider downtrend in the NFT market.

Infinex’s latest non-fungible token (NFT) collection has amassed over $40 million worth of sales within the first four days despite the sluggish performance of the top NFT collections.

Infinex is a non-custodial platform offering easy access to onchain protocol and decentralized applications (DApps).

The platform’s new Patron NFT collection surpassed $40 million in sales within the first four days, according to an announcement shared exclusively with Cointelegraph.

A recent report by nftevening.com reveals a troubling state of the non-fungible token (NFT) market, with 96% of NFTs now considered “dead.” The analysis highlights the high unprofitability rate among holders and the fleeting lifespan of most NFTs. NFT Sector Faces Uncertain Path as 2024 Bull Run Bypasses It As highlighted in nftevening.com’s 2024 report, […]

A recent report by nftevening.com reveals a troubling state of the non-fungible token (NFT) market, with 96% of NFTs now considered “dead.” The analysis highlights the high unprofitability rate among holders and the fleeting lifespan of most NFTs. NFT Sector Faces Uncertain Path as 2024 Bull Run Bypasses It As highlighted in nftevening.com’s 2024 report, […] In the past week, non-fungible token (NFT) sales have dipped by 11.66%, totaling $81.7 million. Despite this decrease, there’s been a significant uptick in market activity: the number of NFT buyers has skyrocketed by 172.98%, while NFT sellers have also seen an impressive rise of 120.51% over the same period. NFT Market Chaos: Prices Drop, […]

In the past week, non-fungible token (NFT) sales have dipped by 11.66%, totaling $81.7 million. Despite this decrease, there’s been a significant uptick in market activity: the number of NFT buyers has skyrocketed by 172.98%, while NFT sellers have also seen an impressive rise of 120.51% over the same period. NFT Market Chaos: Prices Drop, […] Sales volumes of non-fungible tokens (NFTs) recorded a more than 37% increase to $277 million in the seven-day period ending April 11. Six of the top 10 collections with the largest sales volumes were Bitcoin-based NFTs. Some experts attribute the renewed interest in NFTs to the rise of real-world assets and NFTs with built-in utility. […]

Sales volumes of non-fungible tokens (NFTs) recorded a more than 37% increase to $277 million in the seven-day period ending April 11. Six of the top 10 collections with the largest sales volumes were Bitcoin-based NFTs. Some experts attribute the renewed interest in NFTs to the rise of real-world assets and NFTs with built-in utility. […]

OpenSea’s co-lead investor, Coatue Management, marked down its investment from $120 million to $13 million.

United States tech investment firm Coatue Management has marked down the value of its stake in nonfungible token (NFT) platform OpenSea by 90%.

On Nov. 7, The Information reported on a document it reviewed showing that Coatue had reduced its investment from $120 million to $13 million — implying that OpenSea has fallen to an on-paper valuation of $1.4 billion.

Coatue also marked down its investment in Web3 payment provider MoonPay by 90%.

In January 2022, OpenSea raised $300 million in a Series C round led by crypto venture capital firm Paradigm and Coatue. The outsized investment saw the NFT platform valued at $13.3 billion.

Following a stubborn bear market and a year-long slump in NFT trading activity, OpenSea announced a 50% reduction in staff on Nov. 3 as part of its plan to relaunch as OpenSea 2.0.

1/9

— Devin Finzer (dfinzer.eth) (@dfinzer) November 3, 2023

OpenSea is making some big changes today to focus on the next version of our product.

OpenSea CEO Devin Fizner said the new version of the platform will focus on upgrading its technology and increasing its speed and quality. To Fizner, a smaller team will allow the platform to remain “nimble and attentive.”

Related: Elon Musk slams NFTs but ends up arguing the case for Bitcoin Ordinals

In August, OpenSea faced criticism after it announced it was retiring its operator filter, a feature that allowed creators to blacklist non-royalties enforcing marketplaces.

Coatue’s markdown comes amid a slump in NFT trading volumes. The sector peaked in 2021, recording over $14 billion in sales during the year. Since then, NFT popularity has been on the decline, with overall trading volumes dropping by 80% since March 2022.

A Nov. 3 report from crypto data firm DappRadar found the NFT market recorded its first month of gains in over a year, notching a $99-million increase month-over-month in October.

Magazine: X Hall of Flame: Simp DAO queen Irene Zhao on why good memes are harder than trading

The Simpsons poked fun at NFTs in their annual halloween special but degens still managed to take advantage of the publicity to hoist an NFT collection to near top of the charts.

Animated television series The Simpsons spent an entire segment mocking nonfungible tokens (NFTs) during the latest 34th annual Treehouse of Horror Halloween special, in a segment called “Wild Barts Can’t Be Token.”

In the special, Homer accidentally mints Bart on the blockchain, and in the ensuing scenes, the creators poke fun at NFTs, all while referencing collections such as the Bored Ape Yacht Club, Doodles, as well as the viral digital artist Beeple.

Get ready for a non-fungible night in tomorrow's #TreehouseOfHorror XXXIV on @FOXTV, next day on @hulu. pic.twitter.com/Y4cSiyp4kD

— The Simpsons (@TheSimpsons) November 4, 2023

The special revolved around poking fun at the speculative nature of NFTs and how the market is largely fueled by the fear of missing out (FOMO).

Once Marge discovers that Bart has become trapped on-chain, she too digitizes herself as NFT. She battles her way through carriages on a virtual train — which is literally powered by FOMO — to rescue Bart, fighting NFT-themed characters all the while.

The final joke lands when Homer finally gives into FOMO and mints himself as NFT. The second he does so, the train runs out of steam and the price of all the NFTs plunge to near-zero, ending the episode with his iconic catchphrase “Doh!”

Despite being the essentially the punchline of an episode-long joke, the NFT community on Crypto Twitter reacted with delight, with Beeple saying that his work appearing on the show was a “bucket list moment” for him as an artist.

Notably, the Simpsons creators even parodied their own NFT collection — Golden Moments — which was first offered in conjunction with Disney+ by the NFT platform VeVe in Nov. 2021.

“We saw that,” wrote the official account for Veve.

We saw that @TheSimpsons pic.twitter.com/nBAQEjJmyp

— VeVe | Digital Collectibles (@veve_official) November 6, 2023

NFT enthusiasts certainly didn’t let the Simpsons roast go to waste, with creators rushing to capitalize on the newfound publicity for NFTs.

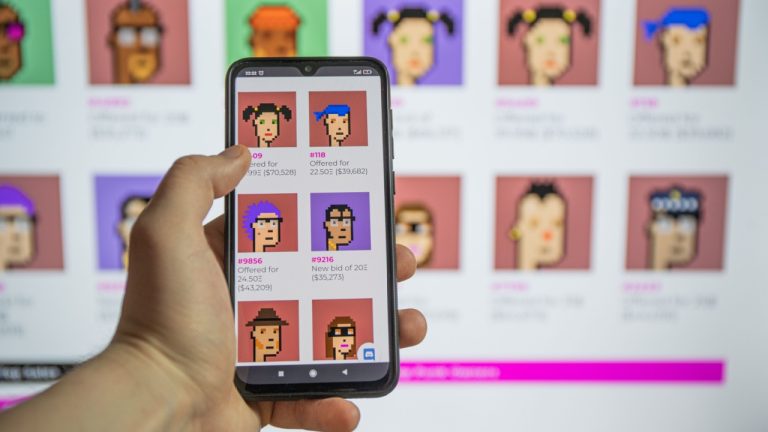

Just hours after the episode first aired, Italian parody artist Rino Russo launched a Simpsons-derived NFT project, which combined the likeness of Simpsons characters with CryptoPunks.

The collection, dubbed Springfield Punks, was launched as a free mint and quickly sold out as NFT fans raced to jump in on the action.

— Rino Russo (@RinaldoRu) November 6, 2023

Bart's an NFT in Treehouse of Horror XXXIV

Celebrate with free Springfield Punks mint live now!!

♂️♂️♂️

Mint Site: https://t.co/E8DD0JhAY6

Contract: https://t.co/o5J43ndaKb #Simpsons #NFTs #Halloween #FreeMint pic.twitter.com/v1D9ccSj4X

At the time of publication, the Simpsons Punks collection has witnessed a whopping 1,377 Ether (ETH) — worth $2.6 million at current prices — in trading volume, making it the third most traded collection on OpenSea in the last 24 hours.

Shpend Sahilu, the social lead for NFT company Yuga Labs announced that he would be stepping down after anti-semitic tweets he posted years ago resurfaced on social media.

Sahilu, better known by the pseudonym NGBxShpend on X, explained that he would be leaving his role at the company, due to his past anti-semitic tweets becoming “a distraction” from the Bored Ape Yacht Club.

“I want to apologize to anyone who I may have let down with tweets I made in poor taste,” he wrote in a Nov. 5 post on X.

Hey everyone, tough day today. I am stepping down from my position at Yuga Labs. Some tweets have resurfaced from my past and it’s become a distraction from the Club and what we’re all about. These tweets do not reflect who I am or what I believe in. It has been an amazing…

— ngbshpend.eth (@NGBxShpend) November 5, 2023

One user attached a screenshot of one of the offending tweets from 2016 in the comments section of the original post, showing him making a joke about Hitler.

Yuga Labs, the company behind the Bored Ape Yacht Club and Crypto Punks, have been accused of perpetuating anti-semitic stereotypes in their artwork by controversial artists Ryder Ripps and Jeremy Cahen. These accusations, which took the form of a knock-off NFT collection led to a more than year-long legal battle.

However, Yuga Labs recently notched a legal victory against the provocative duo, with the court ordering Ripps and Cahen to pay $1.6 million in damages to Yuga Labs for copyright infringement.

After a prolonged and continuous decline in NFT sales, the market seems to be finally showing signs of a recovery, with monthly trading volumes growing for the first time in a year, according to a report from crypto data firm DappRadar.

“The year-long downward trend in NFT trading has been broken. Trading volume is up by 32% from $306 to $405 million, returning almost to levels seen in August,” wrote the report.

DappRadar found that NFT trading volume grew by $99 million in October compared to sales in September, bringing overall trading activity back to levels slightly below that of August.

Despite the seemingly significant increase month-over-month, it's worth noting that October’s $340 million sum pales in comparison to the $1.98 billion of volume witnessed seven months prior in March.

When it came to trading volume, Ethereum-based NFTs still dominated the market, growing more than 50% in October. Meanwhile other networks such as Polygon, Starkware, and Flow saw their sales volume drop 48%, 42% and 32% respectively.

The report made special note of NFT activity on the Solana (SOL) ecosystem, which — after being plagued by the FTX downfall — showed signs of strength, notching a 15% uptick in overall trading volume.

Attendees of the Yuga Labs’ ApeFest event on Nov. 4 in Hong Kong have reported burns, damaged vision and “extreme pain” in their eyes, which they attribute to the use of improper lighting.

NFT marketplace OpenSea announced on Nov. 3 that it would be laying off 50% of its total staff. Co-founder and CEO Devin Finzer broke the news on X saying the company was launching OpenSea 2.0 with a smaller team.

Magazine: Slumdog billionaire — Incredible rags-to-riches tale of Polygon’s Sandeep Nailwal

Metagood CEO Danny Yang attributed the move to the Bitcoin network being seen as a more secure platform for its users, among other reasons.

The team behind nonfungible token collection OnChainMonkey is shifting its entire collection of 10,000 NFTs from Ethereum to Bitcoin, in a massive undertaking expected to take several months.

"A historical transition is on the horizon as we prepare to migrate our flagship collection, OCM Genesis, from Ethereum to Bitcoin,” Metagood co-founder and CEO Danny Yang said in a statement on Sept. 7.

The OnChainMonkeys were first launched in September 2021 on Ethereum, but Yang said the migration to Bitcoin Ordinals was due to its community seeing Bitcoin as offering a more secure platform for its users.

“The Bitcoin Ordinal protocol is better designed for decentralization and security than the Ethereum NFT protocol. High-value NFTs will win on Bitcoin.”

The proposal to migrate to Bitcoin was passed by 99% of OnChainMonkey tokenholders. Yang said this means the community had a high conviction for moving to Bitcoin.

The migration would come at a hefty cost though, with Metagood expecting to fork out over $1 million to ensure the migration process runs smoothly.

Why is the Art and Collectibles market significant for Bitcoin? Why should this matter to you?

— danny huuep (@huuep) August 22, 2023

1. Valuable Market. The wealth associated from art and collectibles by ultra-high net worth individuals (UHNWIs) *alone* accounts for $1.5 TRILLION in value according to Deloitte's…

While the migration process is rather complex, each new OnChainMonkey on Bitcoin will have clear provenance to the corresponding original Ethereum NFT. Holders will receive the corresponding Bitcoin Ordinal once they’ve burned the Ethereum NFT.

However, Yang says the migration shouldn’t be too challenging compared to what Metagood has already accomplished in the Bitcoin Ordinals space:

“We were the first to inscribe 10,000 images of a collection on Bitcoin. We were the first to launch a parent-child collection with OCM Dimensions 300. We pioneered recursive inscriptions on Bitcoin, as well as inscribing Three.js and p5.js for everyone to use.”

However, Ethereum continues to dominate the NFT market, settling $236.8 million in NFTs over the last month, compared to second place Solana ($37.7 million), with Bitcoin ($11.1 million) back in sixth place, according to CryptoSlam.

At the same time, Bitcoin Ordinals transaction volumes plunged 98% between May and mid-August despite rising to popularity in early 2023.

Bitcoin Ordinals is dead.

— danny huuep (@huuep) August 19, 2023

Bitcoin is dead. We heard this many many times over the years. In the case of Bitcoin Ordinals, let's actually understand what actually is dead.

1. Bitcoin Ordinals is a new protocol at release 0.8.2. It's an early release of a protocol that still… https://t.co/NxJP7YY64y

But Yang isn’t concerned, highlighting to Cointelegraph that it is only time before a strong Bitcoin-native NFT ecosystem develops. Both Bitcoin and Ethereum NFT ecosystems can thrive, he added.

Related: Ordinals still make up majority of Bitcoin txs despite price collapse

OnChainMonkey NFTs currently trade at an average floor price of 1.10 Ether (ETH) with over 20,550 ETH in transaction volume from 9,500 items since it launched on NFT marketplace OpenSea in September 2021.

Of the 2,900 owners of the OnChainMonkey NFTs, 31% are unique owners, according to OpenSea.

The arrival of Ordinals and BRC-20 tokens launched in January, which were made possible by the Taproot soft fork executed in November 2021.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Blockchain games aren’t really decentralized… but that’s about to change

Sales of Donald Trump’s digital collectibles surged following the news of his indictment in New York on Thursday. Meanwhile, a report revealed that the market for non-fungible tokens (NFTs) has seen its strongest quarter since early last year, reaching a trading volume of $4.7 billion, despite a weaker March. Trump NFTs Spike as Former President […]

Sales of Donald Trump’s digital collectibles surged following the news of his indictment in New York on Thursday. Meanwhile, a report revealed that the market for non-fungible tokens (NFTs) has seen its strongest quarter since early last year, reaching a trading volume of $4.7 billion, despite a weaker March. Trump NFTs Spike as Former President […] A federal judge, Victor Marrero, ruled on Wednesday that the NBA Top Shot non-fungible tokens (NFTs) issued by Dapper Labs may meet the requirements to be considered an unregistered security. The case arose in 2021 when an NBA Top Shot collector sued Dapper Labs, claiming that the NBA Top Shot NFTs, known as “Moments” issued […]

A federal judge, Victor Marrero, ruled on Wednesday that the NBA Top Shot non-fungible tokens (NFTs) issued by Dapper Labs may meet the requirements to be considered an unregistered security. The case arose in 2021 when an NBA Top Shot collector sued Dapper Labs, claiming that the NBA Top Shot NFTs, known as “Moments” issued […]