On Wednesday, Ord.io, the Ordinals explorer, announced a $2 million pre-seed funding achievement to pioneer the expansion of Runes. Leonidas, the founder of Ord.io, stated that the startup is strategically positioning itself to “serve the next generation of bitcoiners.” Ordinals Explorer Ord.io Receives $2M Boost In 2024, a significant number of startups connected to the […]

On Wednesday, Ord.io, the Ordinals explorer, announced a $2 million pre-seed funding achievement to pioneer the expansion of Runes. Leonidas, the founder of Ord.io, stated that the startup is strategically positioning itself to “serve the next generation of bitcoiners.” Ordinals Explorer Ord.io Receives $2M Boost In 2024, a significant number of startups connected to the […]

Due to their initial lack of utility, Runes will trade akin to volatile memecoins at the beginning, according to pseudonymous DeFi researcher Ignas.

Bitcoin Runes, a new protocol for issuing fungible tokens on the Bitcoin network, is set to go live with the Bitcoin halving later this week.

Yet, the real market opportunity for Runes may only come months after the first wave of investor hype subsides, according to pseudonymous decentralized finance (DeFi) researcher, Ignas, who wrote in an April 17 X post:

Rune floor prices could see a significant drop, mainly because they don’t immediately improve the trading experience of BRC-20 tokens, and because small traders may be priced out of the increasing Bitcoin transaction fees, according to the pseudonymous researcher.

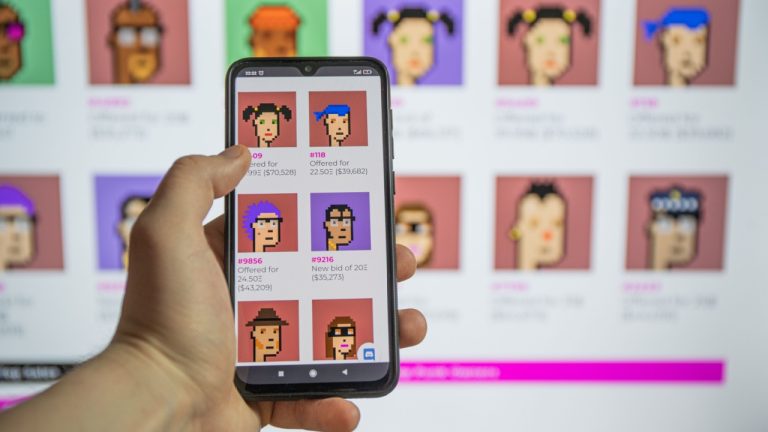

Sales volumes of non-fungible tokens (NFTs) recorded a more than 37% increase to $277 million in the seven-day period ending April 11. Six of the top 10 collections with the largest sales volumes were Bitcoin-based NFTs. Some experts attribute the renewed interest in NFTs to the rise of real-world assets and NFTs with built-in utility. […]

Sales volumes of non-fungible tokens (NFTs) recorded a more than 37% increase to $277 million in the seven-day period ending April 11. Six of the top 10 collections with the largest sales volumes were Bitcoin-based NFTs. Some experts attribute the renewed interest in NFTs to the rise of real-world assets and NFTs with built-in utility. […]

A widely followed cryptocurrency analyst and trader is expressing bullish sentiment on the Bitcoin (BTC) ecosystem tokens over the medium term. The trader pseudonymously known as Altcoin Sherpa tells his 205,600 followers on the X social media platform that he expects Bitcoin Ordinals (ORDI), a protocol that allows text and images to be inscribed on […]

The post Trader Updates Outlook on Ordinals Token That’s Surged Over 2,700% in Three Months, Warns Solana Could Go Lower appeared first on The Daily Hodl.

Bitcoin core developer Luke Dashjr said he played no part in flagging Bitcoin inscriptions as a cybersecurity threat with the NVD, as the listing received a “5.3 Medium” severity score.

Bitcoin core developer Luke Dashjr has denied playing any part in adding Bitcoin inscriptions as a cybersecurity risk on the United States National Vulnerability Database’s (NVD) Common Vulnerabilities and Exposure (CVE) list.

Dashjr courted controversy in a Dec. 6 post to X (formerly Twitter) claiming that inscriptions — used by the Ordinals protocol and BRC-20 creators to embed data on satoshis — exploit a Bitcoin Core vulnerability to “spam the blockchain.”

The Bitcoin network has seen increased congestion over the past few months due to a wider craze around Ordinals’ nonfungible token inscriptions and BRC-20 token minting.

The United States National Vulnerability Database (NVD) flagged Bitcoin’s inscriptions as a cybersecurity risk on Dec. 9.

The National Vulnerability Database (NVD) flagged Bitcoin’s inscriptions as a cybersecurity risk on Dec. 9, calling attention to the security flaw that enabled the development of the Ordinals Protocol in 2022.

According to the database records, a datacarrier limit can be bypassed by masking data as code in some versions of Bitcoin Core and Bitcoin Knots. "As exploited in the wild by Inscriptions in 2022 and 2023," reads the document.

Being added to the NVD’s list means that a specific cybersecurity vulnerability has been recognized, cataloged, and deemed important for public awareness. The database is managed by the National Institute of Standards and Technology (NIST), an agency of the U.S. Department of Commerce.

Following an outsized rally, ORDI became the first BRC-20 token to breach a $1 billion market capitalization.

The Bitcoin Ordinals-based ORDI token has become the first BRC-20 token to top a $1 billion market capitalization after staging triple-digit monthly and weekly percentage gains.

ORDI notched a new all-time high of over $65 on Dec. 5, according to CoinGecko data.

The sudden ORDI price uptick saw it become the first BRC-20 token to reach a $1 billion market cap on Dec.

ORDI has dropped slightly from its high and is trading under $61, which is still an over 2,000% increase from its Sept.

Bitcoin Ordinals was first launched in January by Casey Rodarmor.

Related: Riot Platforms buys $291M in BTC rigs as miners rake it in from Ordinals

Ordinals-inscribed assets rapidly gained in popularity with the wider blockchain community. After a brief decline in inscription activity in October, Binance’s decision to list ORDI on Nov.

Bioniq operates on the Internet Computer Protocol, tapping into native Bitcoin integration to ease the network congestion and high fees associated with Ordinals inscriptions.

A new Bitcoin nonfungible token (NFT) marketplace aims to reduce network fees associated with the advent of Bitcoin Ordinals inscriptions by tapping into the Internet Computer Protocol (ICP).

Developed off the back of the creation of Bitcoin Ordinals in early 2023, Bioniq operates on the ICP and taps into its native Bitcoin integration to power the trade of Bitcoin-based Ordinals inscriptions.

Speaking to Cointelegraph on the eve of the platform’s launch, Bioniq CEO and co-founder Bob Bodily said the project has been in development since February 2023. The team has built a marketplace featuring Ordinals smart contracts auctions on the ICP, a complete cross-chain wallet between Bitcoin and the ICP, as well as an inscription tool.

“It had only been two weeks after Casey Rodarmor released Ord 0.4.0, and I knew Ordinals were going to be absolutely massive.”

The Bioniq team highlighted the growth in the market capitalization of BRC-20 tokens since their inception in Jan. 2023. The market cap now exceeds $3 billion, with over 42.6 million Ordinals minted to date. This has directly affected Bitcoin network congestion, leading to a spike in Bitcoin (BTC) transaction fees last seen since 2021.

Bioniq’s platform features a smart wallet for users to manage private keys using Web3Auth. This allows users to log into the platform using conventional Web2 Google accounts while maintaining noncustodial control of their wallets and assets.

The platform also uses partially signed Bitcoin transactions (PSBTs) through the ICP’s Bitcoin network integration. This unlocks smart contract capabilities for Bitcoin, removing the need for users to use centralized cross-chain bridges.

Building on ICP also allows Bioniq to claim transaction finality times below two seconds, as well as zero gas or network fees. Its architecture provides optimized storage costs, averaging around $5 per gigabyte of data stored annually.

Bodily added that Toniq, the studio behind Bioniq, has been developing on the ICP since May 2021 and has extensive experience building smart contract wallets, marketplaces, NFT launchpads and collateralized NFT lending protocols:

“ICP is a fantastic Bitcoin sidechain right now because it has wonderful Bitcoin primitives at the protocol layer.”

Bodily explains that ICP operates a Bitcoin light node running fully on-chain, which facilitates reading the Bitcoin blockchain via native smart contract calls. The ICP also has a threshold digital signature algorithm, known as an Elliptic Curve Digital Signature Algorithm. The implementation allows ICP smart contracts to sign layer-1 Bitcoin transactions and broadcast them to the mempool.

“These protocol primitives also enabled us to build an Ordinals wrapper entirely at the application layer; we didn’t have to touch the consensus layer of the protocol at all. So it is very fast to build Bitcoin tech on ICP right now,” Bodily added.

Cointelegraph also inquired whether Bioniq’s wrapping process could be a potential barrier to entry for users. Bodily admits that while the process is largely automated by the Bioniq wallet and only requires BTC, there are two considerations that are pertinent for more discerning users.

“Wrapping requires a Bitcoin transaction. This means you have to pay in order to wrap. This is a significant barrier. One way we are addressing the problem is by integrating open Nostr PSBT listings into Bioniq,” Bodily explained.

This integration means that PSBT listings stored on Nostr through decentralized Ordinals marketplaces OpenOrdex or Deezy Place will be accessible on Bioniq. He added that it removes the need to wrap Bitcoin transactions, as users could list directly on Bioniq using open PSBTs.

Perhaps more importantly, Bodily explained that the wrapping process requires “trust assumptions” on both protocols:

“Wrapping over to ICP means in addition to trusting Bitcoin, you are now trusting the Internet Computer Protocol. Some Bitcoin users won’t want the counterparty risk of bridging assets to another chain.”

Bodily adds that Bioniq is focusing on developing user experience ahead of inheriting Bitcoin’s security, which is ensured by the finality of layer-1 transactions. However, he envisions a “nice decentralization path” for applications like Bioniq.

This would involve the evolution from being built on a sidechain with additional trust assumptions to “becoming a Bitcoin sovereign rollup on ICP that is trust minimized.” The final step would see Bioniq becoming a Bitcoin zero-knowledge rollup (ZK-rollup) on the ICP with no additional trust assumptions, inheriting the full security and decentralization of Bitcoin.

“ICP fits perfectly into this plan as well because ICP can provide a replicated execution environment (decentralized sequencer) or validium (extra off-Bitcoin storage for rollups).”

A number of NFT marketplaces already offer Bitcoin Ordinals auctions and trading, which begs the question of what an exclusively Ordinals platform will bring to the ecosystem.

Bodily believes that existing offerings that featured “softer pivots” to Ordinals on their platforms were hamstrung by confusing user experiences. Developing a “dedicated Bitcoin Ordinals marketplace, built for Bitcoin users natively” hinges on developing a native cross-chain, BTC-ICP wallet.

In addition, Bitcoin’s unchallenged position as the preeminent and largest cryptocurrency by market cap remains another drawcard for the continued interest in Bitcoin NFTs into the future.

“If you look at the numbers, 89% of people in the world have heard about Bitcoin, Bitcoin accounts for around 50% of the total crypto market cap, and Ordinals have done over $500 million in volume this year — so there is massive demand.”

Bioniq joins the likes of Ordinals Market as a Bitcoin-only Ordinals marketplace. Gamma is another Ordinals marketplace that directly mints to Bitcoin’s layer-1 chain. Ordswap was an early Ordinals marketplace that has since closed down after losing control of its website to hackers. Meanwhile, multichain platforms like Magic Eden prominently list Bitcoin Ordinals NFTs.

Magazine: Recursive inscriptions: Bitcoin ‘supercomputer’ and BTC DeFi coming soon