Reddit’s non-fungible token (NFT) avatars have produced significant market action in the NFT industry, as the collectible’s secondary market sales reached more than $5 million on October 24 across more than 20,000 sales. The demand for Reddit’s collectible NFT avatars minted on Polygon has also spurred over three million Redditors to leverage Reddit’s Vault blockchain […]

Reddit’s non-fungible token (NFT) avatars have produced significant market action in the NFT industry, as the collectible’s secondary market sales reached more than $5 million on October 24 across more than 20,000 sales. The demand for Reddit’s collectible NFT avatars minted on Polygon has also spurred over three million Redditors to leverage Reddit’s Vault blockchain […] During the last week, non-fungible token (NFT) sales volume has managed to climb 1.9% higher than the week prior with $85 million in NFT sales in seven days. However, the number of NFT buyers slid by 12.63%, and the number of NFT transactions is down 19.19% on October 23, 2022. NFT Sales Record a Slight […]

During the last week, non-fungible token (NFT) sales volume has managed to climb 1.9% higher than the week prior with $85 million in NFT sales in seven days. However, the number of NFT buyers slid by 12.63%, and the number of NFT transactions is down 19.19% on October 23, 2022. NFT Sales Record a Slight […] Five days ago, the Aptos blockchain went live after the project received an influx of capital from venture capital (VC) firms and crypto exchanges like a16z, Binance, and FTX. During the past 24 hours, aptos (APT) is up more than 19% against the U.S. dollar and up 11.1% against bitcoin’s value. The VC-backed blockchain token […]

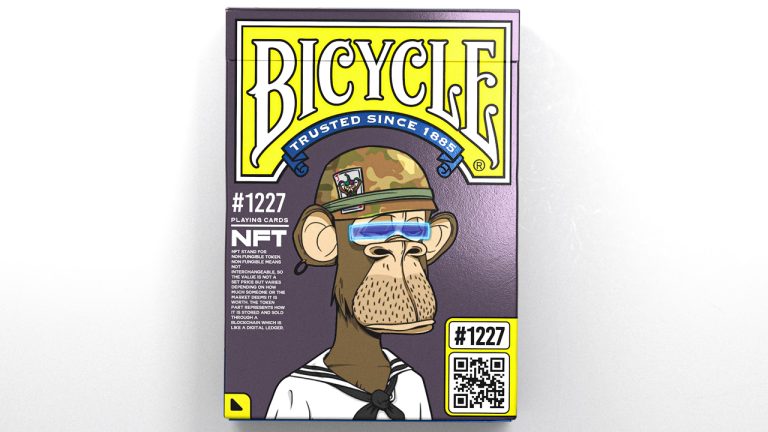

Five days ago, the Aptos blockchain went live after the project received an influx of capital from venture capital (VC) firms and crypto exchanges like a16z, Binance, and FTX. During the past 24 hours, aptos (APT) is up more than 19% against the U.S. dollar and up 11.1% against bitcoin’s value. The VC-backed blockchain token […] Last year, when the non-fungible token (NFT) industry was frothing over, the 137-year-old playing card manufacturer Bicycle issued NFTs called the Genesis Collection and in June, Bicycle purchased Bored Ape Yacht Club #1,227. Bicycle and parent company Cartamundi Group announced on Tuesday that the playing card firm plans to launch a classic Bicycle card deck […]

Last year, when the non-fungible token (NFT) industry was frothing over, the 137-year-old playing card manufacturer Bicycle issued NFTs called the Genesis Collection and in June, Bicycle purchased Bored Ape Yacht Club #1,227. Bicycle and parent company Cartamundi Group announced on Tuesday that the playing card firm plans to launch a classic Bicycle card deck […]

A dormant nonfungible token (NFT) wallet from 2017 with 141 CryptoPunks has been found to have minted the now ludicrously expensive NFTs for a possible $7 each.

Nonfungible token (NFT) sleuths have dug up an old wallet from 2017 that minted 141 CryptoPunks for 0.02 ETH, which was around $7 at the time when the project launched. According to the Twitter user Nansen Intern from the analytics platform the wallet is now valued at 11,300 ETH, or around $14.7 million at current prices.

The wallet has shown no activity since then leading to speculation the owner lost the seed phrase. The wallet is placed in the top ten in terms of CryptoPunks holders and many collectors are reportedly monitoring it in hopes of snapping up a bargain.

1/ This wallet minted 141 Punks for 0.0207 ETH, estimated to now have a value of over 11 thousand ETH

— Nansen Intern (@nansen_intern) October 17, 2022

However, the wallet has had no activity since, for both NFTs and crypto (other than receiving fake tokens)

Lost their seed phrase? pic.twitter.com/Piqe6Epl1W

CryptoPunks was one of the first collections to launch on Ethereum with 10,000 unique NFTs. CryptoSlam reports that it has been the third-highest collection for secondary sales over the past month with a trading volume of $22.8 million,

According to OpenSea, which recently allowed users to submit bulk listings, rare CryptoPunk #9476 sold for a whopping $480,000 (370 ETH) on Oct. 17 proving that the pixelated punks remain popular.

NFT project Street Machine has surged in popularity and price despite a broader downturn in the market.

The cyberpunk anime series is a story-based collection designed by award-winning video game artist SpenzerG who was behind the popular PlayerUnknown's Battlegrounds (PUBG) online shooter.

It is inspired by sci-fi, cyberpunk, and anime pop culture, centering around a sprawling story with an online graphic novel theme.

The collection launched on OpenSea on Oct. 7 and has since surged in volumes and average prices. There are 8,000 story character NFTs in the collection and the floor price is currently 0.473 Ether (ETH), approximately $620.

According to OpenSea, the average price at launch was just 0.04 ETH — around $50 — but by Oct. 18 it had increased 900% to 0.44 ETH (around $570) with daily volumes topping 250 ETH, or around $325,000, late last week.

The team behind the collection aims to emulate the popularity of Yuga Labs’ flagship Bored Ape Yacht Club (BAYC) with branding, merchandise, and commercial rights for holders.

Extremely excited to introduce u to a few of our wonderful community leaders including 3 Street Council and 4 Street Watch members who will be welcoming you in later!

— Street Machine (@STMachineNFT) October 18, 2022

We selected these members for their energy, NFT and crypto experience, and love for anime!

Say hi to...

pic.twitter.com/pDADEO0uUK

Nonfungible tokens are not just for digital art as an entire house has been sold on OpenSea as an NFT. The South Carolina property was listed on Roofstock, a real estate technology company that combines NFTs with physical property.

Related: A slice of the punk: CryptoPunk NFT to be split into thousands of pieces

The three-bedroom home sold for 175,000 USD Coin (USDC) on Oct. 15. Tokenizing property has gained traction over the past year or so as it “creates frictionless transactions, simplifies the process, and makes information more readily available,” according to Roofstock chief blockchain officer Geoffrey Thompson.

A crypto-themed house with NFT art included has also been listed on social media for $1.2 million, according to Newsweek.

Metaverse platform Decentraland is set to host its second virtual music festival in November. The free event will be presented by Kraken and will showcase 100 artists including rock legend Ozzy Osbourne, DJ Dillon Francis, and rapper Soulja Boy.

It's the second year of the Metaverses' music festival, it's inaugural festival in 2021 attracted 50,000 virtual party-goers over four days and featured around 80 artists.

Anime-themed NFT project Azuki has released a Physical Backed Token (PBT) which is an open-source token standard that connects physical items to digital tokens on Ethereum. According to the Oct. 17 announcement, the PBT intends to enable decentralized authentication and tracking of the full ownership of physical items.

The Solana-based Magic Eden NFT marketplace has shifted to optional royalties where buyers can set which royalties they want for a project. This could result in creators not receiving royalties when their artworks are sold and has split the community as reported by Cointelegraph on Oct. 17.

A new layer one blockchain network called Aptos announced the launch of its mainnet on Monday, following a slew of capital injections from a number of venture capital (VC) firms. The blockchain protocol, crafted with a Rust-centric programming language dubbed Move, is backed by VC companies such as Parafi, Andreessen Horowitz (a16z), FTX, and Multicoin […]

A new layer one blockchain network called Aptos announced the launch of its mainnet on Monday, following a slew of capital injections from a number of venture capital (VC) firms. The blockchain protocol, crafted with a Rust-centric programming language dubbed Move, is backed by VC companies such as Parafi, Andreessen Horowitz (a16z), FTX, and Multicoin […]

Despite the change to an optional royalties model, Magic Eden will still have full royalties set by default for all collections and listings.

Solana-based Magic Eden has become the latest NFT marketplace to shift to an optional royalties model, following in the footsteps of X2Y2 in August, albeit reluctantly.

Under the optional royalties model, buyers are given the power to set the royalties they want to contribute to an NFT project, meaning there is a chance that some creators may not receive royalties when their artworks are sold.

In an Oct. 14 post, the NFT marketplace noted that the decision came after "difficult reflection and discussions with many creators” and came as the “market has been shifting towards optional creator royalties for awhile.”

The NFT marketplace shared a graph showing that the number of cumulative wallets using optional royalty marketplaces to buy or sell NFTs skyrocketed in late September.

4/ The market has been shifting towards optional creator royalties for awhile. These charts shows the cumulative wallets that have used optional royalty marketplaces to buy or sell NFTs. pic.twitter.com/wxiU800l2P

— Magic Eden (@MagicEden) October 15, 2022

However, the move has been met with split opinions from Twitter's NFT community, with some seeing the move as positive for the long-term health of the industry, while others have labeled skipping royalties as akin to "theft."

Well-known NFT artist Mike “Beeple” Winkleman pointed out to his 700,000 followers on Oct. 15 that while he doesn’t love what Magic Eden and others are doing, the switch from a seller’s fee to a buyer’s premium could be better for the industry long term.

while I am obviously pro-royalties and don’t love what @MagicEden and others are doing, I do think there is one key change that they hit on… switching from a sellers FEE, to a buyer’s PREMIUM. i think this is actually much more sustainable long term…

— beeple (@beeple) October 15, 2022

Another Twitter user named CaptainFuego, behind Fuego Labs told their nearly 10,000 followers that “Royalties are stupid and shouldn't exist. Glad to see platforms taking this approach.”

Others were more critical of the change. Brocolli DAO argued that “royalties are needed in an immature ecosystem," noting that as per their calculations, they've already lost as much as $27,000 in royalties due to 0% purchases on other marketplaces.

ROYALTIES:

— Broccoli DAO (@Broccoli_DAO) October 15, 2022

After Magic Eden's announcement that they will be making royalties optional, we have taken proactive measures to protect the integrity of our project.

We've run analytics and determined how much we've lost in royalties to 0% purchases on other marketplaces:

/1

“In future we will be blocking anyone who hasn't paid royalties from accessing our Discord channels. Not paying royalties is theft. We will treat it as such," they said.

Cozy the Caller, a self-proclaimed analyst, made a grim prediction to their 108,000 followers, stating “I can see a scenario in which Magic Eden goes 0% and loses their market share to a marketplace enforcing royalties in an innovative way."

honestly unreal I don't know who is advising magic eden but imagine fumbling a billion dollar company man

— Cozy ⓣhe Caller (@cozypront) October 15, 2022

I can see a scenario in which magic eden goes 0% and loses their market share to a marketplace enforcing royalties in an innovative way

such a fumble man unreal

Magic Eden said the change was not taken lightly, and they "have actively been trying to avoid this outcome and spent the last few weeks exploring different alternatives."

Last month, the NFT marketplace attempted to bring forth a royalty enforcement tool called Meta Shield, aimed at deterring NFT buyers trying to skirt creator royalties by giving creators a tool that could flag and blur NFTs that sold bypassing royalties.

Magic Eden noted in its latest post that: “Unfortunately, royalties are not enforceable on a protocol level, so we have had to adapt to shifting market dynamics."

In August, NFT marketplace X2Y2 announced they were introducing a similar option that allows buyers to set the royalty fee when buying an NFT.

The move doesn't appear to have affected the platform's usage; according to data on NFTGo, in the last three months, X2Y2's trading volume is ranked first, surpassing OpenSea.

Cointelegraph has reached out to Magic Eden for further comment but has not received an immediate response at the time of publication.

A CC0 (Creative Commons Zero) NFT is an NFT with a copyright in which the owner permits anyone to use the NFT for commercial gain.

The world of NFTs is in its infancy. As artists and creators explore ways to create and monetize their content, products and platforms are emerging to offer frameworks for creators to operate and build their brands, and monetize them.

It is still the early days for the nonfungible token world. The last couple of years have seen an economic model emerge for artists and creators. With every new business model, there needs to be new distribution strategies that emerge.

NFTs have shown how brands can be monetized. However, relying on a small community to create the distribution capability for the brand is not scalable. As more co-creation models emerge and more platforms to actively promote become mainstream, CC0 NFTs would have the bells and whistles needed to scale their brand outreach.

Another fundamental building block for nonfungible tokens to scale their reach is interoperability. The NFT world is still siloed across different blockchains. Even the cultures of the Ethereum and Solana NFT collections are noticeably different. There is a need for better interoperability across chains, and nonfungible token cultures would need to be agnostic to the infrastructure on which they are created.

As these infrastructural and community collaboration layers get more sophisticated, CC0 nonfungible tokens will have the rails they need to scale their brand beyond a community of 10,000 NFT holders.

As the Web3 world has largely promoted transparency and openness with code, NFT creators and teams are also opting for the same with art. However, that is just the beginning of the journey, and these nonfungible token creators and communities must realize that.

CC0 can sometimes be portrayed as a logical conclusion where the NFT creators hand over the process of building on their creation to their community and beyond. Some NFT collections have had several derivative projects promoting the culture of the NFT almost as brand extensions. However, declaring a project as CC0 is just the beginning.

NFT project teams and creators who take the CC0 route must actively promote the use of the brand and onboard other creators and projects to build brand extensions to their NFT collections.

No open-source software project could have scaled without a strong codebase. Similarly, CC0 NFT projects need a strong creator community to spread the word, get inspired by the original nonfungible token collections and make them household brands. This is only possible through the conscious community-building efforts of the NFT project teams.

Therefore, by going down the CC0 route, NFT creators have almost reduced the burden on its nonfungible tokenholders to promote the brand. Instead, they have a more considerable responsibility with their NFT holders to onboard brand, product and art extensions to their nonfungible tokens.

For instance, if a Nike product line chooses to use a Moonbirds image on their shoes, that increases the awareness of Moonbirds within the retail audience, thereby improving the brand outreach. However, these top-tier brand partnerships must be often forged by the NFT project teams.

The CC0 approach isn’t without its challenges, particularly for the individual NFT holder keen on monetizing their ownership rights on the nonfungible tokens.

NFTs that haven’t embraced CC0 have had NFT holders license the use of their nonfungible tokens to businesses, brands and creative initiatives. Some nonfungible token communities that had gone down the CC0 route had unhappy community members and commercial downsides in the short term.

CC0 allows for the very open use of the NFT brand and art by removing the IP friction points. However, some NFT holders of top communities own their profile picture (PFP) nonfungible tokens to monetize the IP of the NFTs. In some scenarios, NFT holders had lost significant opportunities in licensing contracts when the nonfungible token project team chose to go down the CC0 route.

This approach has its pros and cons like the open source approach to software. There are short-term downside implications for community members who want to tap into the IP rights they had over the NFTs. However, the long-term benefit of building the brand through an open approach is equally alluring for many.

Although one significant project chose CC0 in 2021, many followed suit in 2022, with a CC0 summer that saw many big NFT projects embracing the CC0 route.

Perhaps the first significant NFT project to open the door to the CC0 licensing model was the “Nouns” project. They were soon followed by many nonfungible token projects, including Moonbirds, Cryptoadz, Cryptoteddies and Loot, that chose to go down the CC0 route.

This has given derivative NFT collections more freedom in drawing inspiration from these CC0 collections. Derivative NFTs are typically those that draw design and art inspiration from the parent NFT collection, which often increases the brand outreach of the parent collection. With CC0s on the rise, derivatives had more liberty.

However, this also resulted in commercial implications for the NFT holders and project teams who make fundamental business strategy decisions for the nonfungible token community.

As nonfungible tokens (NFTs) rose to fame over the last couple of years, they were hailed as the solution to digital ownership and intellectual property (IP). However, a new class of NFTs and founders who believe in them have emerged in CC0 NFTs.

CC0 nonfungible tokens are to NFT creators as open source software is to developers. However, the digital ownership and IP protection was the design principle behind NFTs when they first launched. Several projects, including Bored Ape Yacht Club and CryptoPunks, have benefitted from the holders of these NFTs owning the IP to their art.

Nonfungible tokenholders could create revenue opportunities for themselves by allowing creators, businesses and brands to use their NFT artwork for a fee. Other creators, NFT collections and even traditional businesses could use nonfungible token images as a brand-building exercise if they had the permission of the NFT holders.

Recently, a movement termed CC0 NFTs has taken the nonfungible token world by storm. The term CC0 NFTs was inspired by the “Creative Commons Zero” licensing model. As per this model, creators can waive their rights to their art, allowing others to use the artwork freely to build more art, a product or a brand on top of it.

This is akin to the open source movement in operating systems, as Linux chose to open its ecosystems for free use. Similar to the Linux operating system, which has a market cap of $15.95 billion and powers over 85% of smartphones, CC0 NFT collections expect a larger base of projects, artwork and brands using their NFT artwork.

Konami, one of the most influential Japanese game development and publishing companies, has announced it will be introducing Web3 and metaverse technologies into its games. The company opened 13 different job openings for three departments that will be responsible for developing the new projects to spearhead Konami’s latest business strategy. Konami to Enter Metaverse and […]

Konami, one of the most influential Japanese game development and publishing companies, has announced it will be introducing Web3 and metaverse technologies into its games. The company opened 13 different job openings for three departments that will be responsible for developing the new projects to spearhead Konami’s latest business strategy. Konami to Enter Metaverse and […]