According to Michael Hsu, representatives from the crypto industry as well as within the U.S. government could work toward setting standards on stablecoins.

Michael Hsu, the acting head at the United States Office of the Comptroller of the Currency, said stablecoins need standards comparable to the early internet.

In a written statement following his appearance at the Artificial Intelligence and the Economy event in Washington D.C. on Wednesday, Hsu said stablecoins lacked “shared standards,” were “interoperable,” and needed standards similar to those set by the Internet Engineering Task Force and World Wide Web Consortium. According to the OCC head, representatives from the crypto industry as well as within the U.S. government — including the OCC and National Institute of Standards and Technology — could work toward such goals.

Acting Comptroller Issues Statement on Standards for Stablecoins https://t.co/QthxNECOo9

— OCC (@USOCC) April 27, 2022

As the U.S. government bureau tasked with supervising federally licensed banks, the OCC is one of the regulators in the country whose purview crosses into the digital asset space, in addition to the Federal Reserve, the Securities and Exchange Commission and the Commodity Futures Trading Commission. Last Friday, the OCC issued a consent order against Anchorage Digital due to its “failure to adopt and implement a compliance program” in accordance with the Anti-Money Laundering requirements agreed upon by the bureau in January 2021.

Related: Regulators are coming for stablecoins, but what should they start with?

In the United States, both lawmakers and government agencies have been grappling with how to handle stablecoins on a regulatory level in a type of legislative tug-of-war. In November 2021, the President’s Working Group on Financial Markets released a report suggesting that legislation on stablecoins was “urgently needed” and issuers should be subject to “appropriate federal oversight” akin to that of banks. House of Representatives member Patrick McHenry has proposed a state-centered regulatory approach for stablecoins, while Senator Pat Toomey drafted a bill in April suggesting “payment stablecoins” be exempt from many U.S. securities regulations.

The future of crypto adoption will largely depend on which of the competing narratives about digital assets and blockchain’s environmental effects prevails.

Regulation by enforcement, a fast and economical substitute for thorough rulemaking, is widely regarded as some of the U.S. executive agencies’ preeminent approach to crypto regulation. It could be summed up as letting crypto firms explore the boundaries of what is permissible by themselves and then punishing industry participants in case their exploratory actions come to look like a transgression. Others will take heed and learn from the explorer’s negative experience.

While it is the United States Securities and Exchange Commission that gets accused of over-reliance on regulation by enforcement most frequently, other federal agencies do that as well. Last week, the U.S. Office of the Comptroller of the Currency, or OCC, announced cease and desist proceedings against Anchorage Digital, the nation’s first crypto custody firm to be awarded a national bank charter.

The reason is the crypto bank’s alleged failure to implement a compliance program in line with the Bank Secrecy Act and Anti-Money Laundering standards. As Anchorage Digital races to remedy the shortcomings that the OCC pointed out, other industry players hoping to secure a bank charter will be watching closely.

One of the most contentious policy debates around blockchain and cryptocurrency currently unfolds over the industry’s sustainability and environmental effects. From the European Union to individual U.S. states, regulators are continuously on the offensive on this front. The latest push came from a group of U.S. representatives who called for the Environmental Protection Agency, or EPA, to assess crypto mining companies’ compliance with federal environmental statutes. While some of the concerns related to mining operations that use “dirty” energy might be justified, some policymakers’ efforts to ratchet them up to vilify the entire industry are clearly misguided. On Earth Day, Cointelegraph reviewed some of the many blockchain-powered projects designed to do the environmental good and zoomed in on the technology’s capacity to contribute to the climate change fight. The future of crypto adoption will largely depend on which of the competing narratives about digital assets and blockchain’s environmental effects prevails.

Australian regulators were busy last week. Financial compliance enforcement agency AUSTRAC, noting that cybercrime was rising apace with crypto acceptance in the country, released two guides for regulated entities on spotting illicit use of cryptocurrency and payments related to ransomware by customers. The Prudential Regulation Authority was not quite as productive, but it did send out a letter to its regulated entities presenting the roadmap of a regulatory framework for exposure to crypto assets, operational risk and stablecoins to take effect by 2025. It also outlined risk management measures that should be undertaken now. On the bright side, Cosmos Asset Management has received approval for Australia’s first Bitcoin (BTC) exchange-traded fund (ETF) after beating out three competitors to meet regulatory requirements. The fund is to begin trading on April 27 and reportedly stands to take in up to $1 billion. It will be traded on CBOE Australia.

Russian Central Bank governor Elvira Nabiullina spoke before the State Duma on Thursday and hinted that the bank may soften its stance on the digital asset industry as the government struggles to counteract the effects of Western sanctions. Nabiullina also said that the central bank expects to conduct its first settlements with a digital ruble in 2023. The Russian central banker has good reason to be worried as sanctions continue to be piled on. The same day she was speaking, Binance announced that Russian nationals and residents who hold over 10,000 euros, or $10,800, would be restricted from trading, and if they have open futures or derivatives positions, they will have 90 days to close them. These measures are due to the EU’s fifth round of sanctions. One day earlier, the U.S. Treasury announced it was blocking the assets of Russia-based crypto mining services provider BitRiver and its subsidiaries for facilitating sanctions evasion.

The U.S. Office of the Comptroller of the Currency (OCC) says that federal authorities must cooperate in order to properly regulate the crypto industry. In a recent speech, Acting Comptroller of Currency Michael Hsu says that as crypto platforms and adoption grow, so do the risks associated with them. He says the risks create a […]

The post OCC Chief Calls for Collaboration of Federal Entities in Crypto Regulation appeared first on The Daily Hodl.

The U.S. Office of the Comptroller of the Currency (OCC) is outlining the conditions that national banks and federal savings associations must meet before engaging in specified cryptocurrency activities. The regulator says that national banks and federal thrift institutions must “demonstrate that they have adequate controls in place before they can engage in certain cryptocurrency, […]

The post US Regulator Says Banks Must Meet Certain Conditions To Deal in Cryptocurrency appeared first on The Daily Hodl.

A group of U.S. banking regulators is working on how banks can be allowed to offer crypto services and hold cryptocurrencies on their balance sheets. The chairman of the Federal Deposit Insurance Corporation (FDIC) said, “If we don’t bring this activity inside the banks, it is going to develop outside of the banks … The […]

A group of U.S. banking regulators is working on how banks can be allowed to offer crypto services and hold cryptocurrencies on their balance sheets. The chairman of the Federal Deposit Insurance Corporation (FDIC) said, “If we don’t bring this activity inside the banks, it is going to develop outside of the banks … The […]

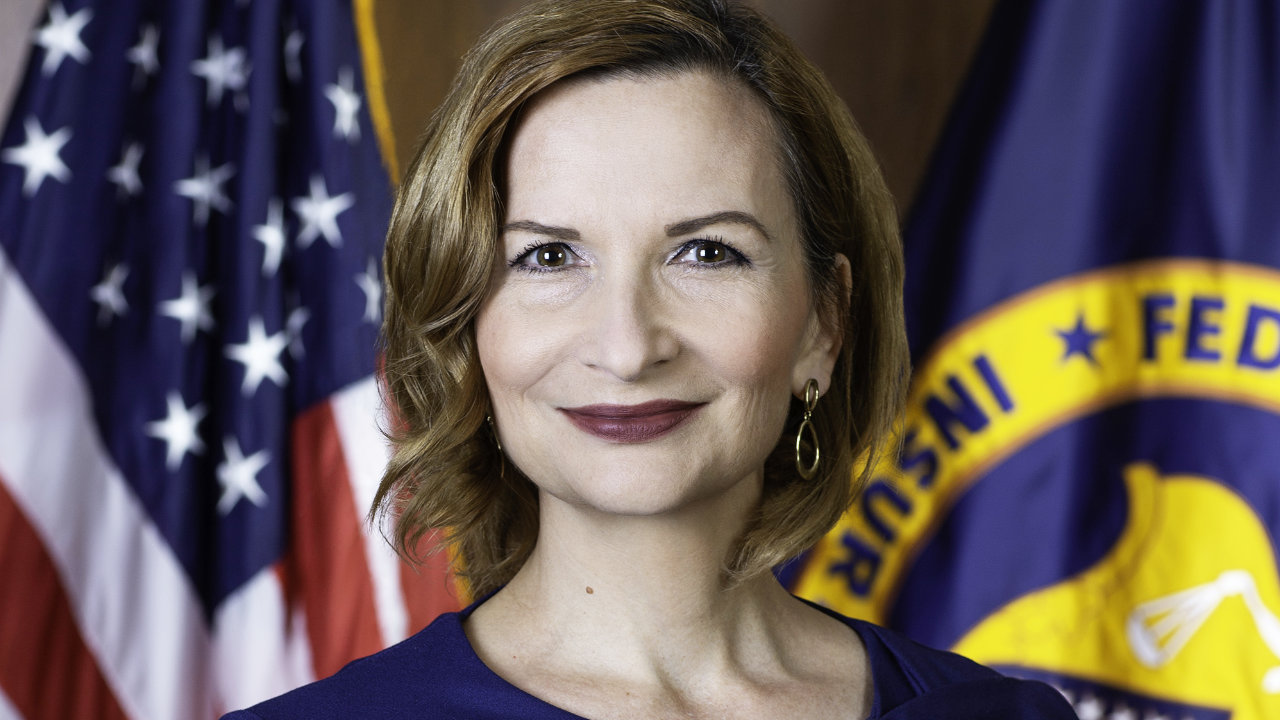

“I don’t think I’ve ever seen a more radical choice for any regulatory spot in our federal government,” said Senator Pat Toomey.

Pat Toomey, a Republican member of the U.S. Senate Banking Committee, is attempting to pressure the nominee to head the Office of the Comptroller of the Currency (OCC) into handing over her 1989 university honors thesis about Karl Marx.

The Biden administration formally nominated Kazakh-born attorney Saule Omarova — who has been characterized by critics as both anti-bank and anti-crypto — to head the financial regulator on Sept. 29. In vague echoes of McCarthyism, Toomey believes the thesis may show that Omarova has sympathies toward Marxist views.

While Omarova has lived in the US since 1991 and previously served as an advisor to George W. Bush, she previously attended Moscow State University during 1988 and 1989 on The Lenin Personal Academic Scholarship.

In an open letter to Omarova published on Oct. 5, Toomey claimed that she had deleted reference to her thesis “Karl Marx’s Economic Analysis and the Theory of Revolution in The Capital” from her current resume with Cornell Law School, adding that the paper was featured on her resume in April 2017.

The archived resume indicates that the paper was written as part of Omarova’s diploma with honors in philosophy. Toomey states he is requesting the document so that the Senate Committee on Banking, Housing, and Urban Affairs can “fully assess the fitness of individuals to serve in Senate-confirmed executive and independent agency positions.”

He said committee staff had first requested the document from Omarova in September but, “we have not received any assurances that the Committee would receive a copy of the paper in a timely fashion.”

The Biden administration has received criticism over Omarova’s nomination, with detractors pointing to her 2020 statements cheering for lawmakers to “effectively end banking as we know it.” Omarova has also characterized cryptocurrency as a symptom of the existing “dysfunctional financial system.”

However, Democrats have praised Biden’s pick for the nomination, with Senator Elizabeth Warren describing Omarova as “an excellent choice to oversee and regulate the activities of our nation's largest banks.”

Speaking to the committee on Oct. 5, Toomey described Omarova as an extreme “radical” whose recent policy prescriptions have included state-directed pricing for wages and good, nationalizing the retail banking industry, and an overall “aversion to anything like free market capitalism.” He continued:

“In 2019, she tweeted, ‘say what you will about the old USSR, there was no gender pay gap there. Market doesn’t always know best [...] Ms. Omarova clearly knows her views are far outside of the mainstream."

Senator Ted Cruz also took aim at Omarova of the potential threat she may pose to crypto, tweeting: “Not only is Saule Omarova, Biden’s pick to lead the OCC, a threat to our traditional economy, she also wants to regulate crypto into oblivion. Crypto faces future-defining government regulations. This nomination needs to be stopped.”

Texas Senator Ted Cruz is among a number of politicians and bankers that are opposed to the nomination of Saule Omarova.

Resistance is mounting to U.S. President Joe Biden’s reported plans to tap a staunch banking and crypto critic to run the Office of the Comptroller of the Currency (OCC).

The proposed nomination of law professor, Saule Omarova, to head the federal bank regulatory agency has raised eyebrows in political and financial circles as she is widely seen as anti crypto and anti big banks.

Texas Republican Senator Ted Cruz has become the latest crypto ally to speak out, claiming that her decisions, if nominated, could change the future of the industry in a tweet on Sept. 28.

“Not only is Saule Omarova, Biden’s pick to lead the OCC, a threat to our traditional economy, she also wants to regulate crypto into oblivion. Crypto faces future-defining government regulations. This nomination needs to be stopped.”

A number of big banks and banking associations are also against the nomination with the American Bankers Association debating whether to publicly fight the decision. ABA President and CEO Rob Nichols said “we have serious concerns about her ideas for fundamentally restructuring the nation’s banking system,” in a statement on Sept. 24.

Ranking Republican on the Senate Banking Committee, Pat Toomey, also spoke out in opposition of the nomination last week stating that he has “serious reservations” given her “extreme leftist ideas.”

President and CEO of the Independent Community Bankers of America, Rebeca Rainey, said that Omarova “would displace locally-based community banking and restrict economic growth in local communities,” according to reports.

The OCC oversees America’s banking giants such as Goldman Sachs, JPMorgan, and Citi Group and would also encompass aspects of the crypto industry.

Omarova, who has previously said she wanted to “end banking as we know it,” is expected to enforce stricter rules. She has also claimed that the rise of cryptocurrencies is “benefiting mainly the dysfunctional financial system we already have.”

She shares views with anti-crypto lawmakers such as Senator Elizabeth Warren in that digital assets threaten to destabilize the economy, according to Bloomberg. For her part, Warren stated that the nomination was “tremendous news,” and looked forward to heavier regulations.

Related: New OCC head requests review of cryptocurrency rules

The OCC has morphed from one of the Treasury’s most crypto-forward agencies into one that changed direction under subsequent leadership. Former head of Coinbase’s legal team, Brian Brooks, joined the OCC in March 2020 and paved the way for legislation allowing banks to custody crypto.

In January, the banking regulator told national banks that they could run independent nodes for distributed ledger networks such as stablecoins. However, then the tone changed. On Sept. 21 acting head of the OCC, Michael Hsu, warned that decentralized finance products are similar to those that catalyzed the global financial crisis in 2008.

While crypto has been mostly weathered past hacks, scams, and crashes, acting OCC head Michael Hsu warns the risks may be multiplying as the technology goes mainstream.

Acting head of the U.S. Office of the Comptroller of the Currency (OCC) Michael Hsu has warned that the exotic financial products developed in some quarters of crypto and DeFi were reminiscent of those that precipitated the 2008 Global Financial Crisis (GFC).

Speaking before the Blockchain Association on Sept. 21, Hsu warned that “innovation for innovation’s sake [...] risks creating a mountain of fool’s good,” drawing analogies between the rapid proliferation of digital asset derivatives and the explosion in mortgage and debt derivatives such a Credit Default Swaps (CDS) that preceded the 2008 global financial crisis:

“I have seen one fool’s gold rush from up close in the lead up to the 2008 financial crisis. It feels like we may be on the cusp of another with cryptocurrencies (crypto) and decentralized finance (DeFi) [...] Crypto/DeFi today is on a path that looks similar to CDS in the early 2000s.”

Hsu notes that “it was nearly impossible to hedge the risk of a borrower defaulting” prior to the creation of CDS in the mid-1990s. However by the time he joined the SEC in 2004 the acting OCC head recounted that credit derivatives promised investors higher risk-adjusted returns using innovative products that “relied heavily on math and financial engineering."

“They believed they were leading a financial revolution, creating an entirely different asset class, using an entirely different set of models. Sound familiar? Today, programmers and coders, instead of quants and financial engineers, are the core innovators.”

Hsu asserts that by the time the crisis unfolded, the original mission of CDS “to create an instrument that could improve risk management and thus lower the cost of credit” had been “turned onto itself, cloaked in impenetrable math and jargon, and supercharged with yield and fees to ensure growth.”

Drawing parallels between exotic DeFi derivatives and the systemic risk that underpinned the collapse of the U.S. housing market in 2008, Hsu noted that “most innovation seems focused on enhancing trading” in crypto today rather than realizing the vision for greater financial autonomy articulated by Satoshi Nakamoto in the Bitcoin Whitepaper

Hsu cites several risks that could destabilize the crypto sector including “a run on a large stablecoin [...] forks, hacks, rug pulls, vampire attacks, and flash loans.” While acknowledging that crypto so far withstood all of the aforementioned incidents thus far, Hsu warns that such threats could loom larger as the cryptocurrency user base grows:

“My hypothesis is that until recently, most users have been hardcore believers in the technology and thus are both understanding of the risks and willing to forgive them. As the scope and reach of crypto/DeFi expands, though, more mainstream users, with regular expectations of safe and sound money, will dominate and drive reactions.”

Ultimately, Hsu’s outlook for crypto isn’t entirely bleak, with the official concluding that if the industry “applies the lessons from the 2008 crisis — anchor innovation in clear purpose, foster an environment for skeptics to speak up, and follow the money — the risks of fool’s gold can be mitigated and the real promise of blockchain innovation can be achieved.”

Related: Biden to nominate anti-crypto and anti-big bank law professor to run the OCC

However, the days Hsu’s tenure heading the OCC appear numbered, with the Biden administration reportedly moving to nominate law professor Saule Omarova to lead the institution.

If nominated, analysts believe Omarova will oversee a tightening of regulations overseeing both the crypto and mainstream financial industries. Omarova previously described digital assets as a tool for private interests to abuse that are outside of regulatory purview.

Omarova has stated she hopes to “end banking as we know it” but believes large financial firms can abuse the crypto market outside of regulators’ view.

The Biden administration reportedly intends to nominate Kazakhstani-American attorney, academic and former policy advisor Saule Omarova to head the Office of the Comptroller of the Currency (OCC) — the institution that oversees the U.S. banking sector.

Omarova has levied criticisms at both crypto assets and the legacy banking sector in the past, having once pledged to “end banking as we know it”. She has characterized cryptocurrency as “benefiting mainly the dysfunctional financial system we already have.”

According to a Sept. 22 report from Bloomberg citing three anonymous sources “familiar with the nomination process,” Omarova could be nominated as soon as this week.

Currently working as a law professor at Cornell University Law School, Omarova is expected to seek tighter regulations for crypto as she has described the sector as threatening the stability of the economy and ripe for abuse from large private financial entities. The academic specializes in banking law and corporate finance.

If confirmed, Omarova’s tenure at the OCC would likely comprise a significant shift from the previous administration, with former Coinbase legal officer and crypto proponent Brian Brooks having headed the agency toward the end of Trump’s presidency.

Omarova has also offered radical prescriptions for the finance industry, having advocated for consumer banking services to exclusively be administered by the Federal Reserve rather than private institutions. She previously served as a special adviser for regulatory policy to the U.S. Treasury Department during George W. Bush’s presidency.

However, analysts don’t believe Omarova will get the OCC jobwithout a fight, with the Democrats currently holding a slim majority in the Senate and the banking sector expected to lobby against her appointment.

If appointed, Omarova would become the first woman to formally lead the agency, although the OCC has been directed by a female acting head in the past.

Related: CFTC commissioner: Agency doesn’t have enforcement resources without Congress

The New York Times reported that the Biden administration had started vetting Omarova for the role in early August.

While the Democrats were previously considering former Treasury official Michael Barr and law professor Mehra Baradaran for the role, they were dropped after the Democrats decided neither candidate was likely to garner enough support to secure confirmation.