Bitcoin price recaptures the $62,000 level as investor grow increasingly concerned about the fiscal health of the US

Bitcoin (BTC) has risen 2.4% since retesting the $59,900 support level on Oct. 3, despite facing initial resistance at $62,000. The gains on Oct. 4 were primarily driven by macroeconomic factors, such as US employment data, expectations of economic stimulus in Japan, and growing concerns about the US financial system.

In the US, the economy is booming, but fiscal conditions deteriorated. Interestingly, the US dollar surged to a 50-day high against other major currencies, including the euro, the British pound, and the Japanese yen.

Historically, the relationship between the US dollar Index (DXY) and Bitcoin has been inversely correlated. However, this latest movement seems to defy that pattern.

The price of Bitcoin fell about $4,000 after Iran fired some 180 ballistic missiles at Israel, escalating the conflict in the Middle East.

Update (Oct. 2 at 5:40 am UTC): A previous version of this article suggested Larry Fink’s comments about Bitcoin as an inflation hedge on Fox Business was recent. This has been amended to reflect the correct date.

Commodities including gold and crude oil rose as the specter of war looms in the Middle East. Still, Bitcoin is moving in the opposite direction, leading to renewed debate over whether it’s a safe-haven asset.

Gold prices gained 1.4% on the day to reach $2,665 per ounce on Oct. 1, just shy of its all-time high, according to Goldprice.org. Meanwhile, crude oil prices spiked as much as 7% to reach $72 per barrel.

Howard Lutnick, CEO of Cantor Fitzgerald, says bitcoin is a commodity. “When you truly understand bitcoin, it’s hard to see it any other way,” he said, adding that the crypto “should be treated like gold and like oil.” While stating that other digital assets may vary, he firmly maintained that BTC is a commodity. Howard […]

Howard Lutnick, CEO of Cantor Fitzgerald, says bitcoin is a commodity. “When you truly understand bitcoin, it’s hard to see it any other way,” he said, adding that the crypto “should be treated like gold and like oil.” While stating that other digital assets may vary, he firmly maintained that BTC is a commodity. Howard […]

Cantor Fitzgerald CEO Howard Lutnick advocates for Bitcoin to be classified as a commodity, citing its similarities to gold and oil.

On Sept. 27, Howard Lutnick, the CEO of financial Cantor Fitzgerald, appeared on Fox Business and urged regulators to classify Bitcoin as a commodity, similar to gold and oil.

In the “Mornings with Maria” interview, Lutnick stated that Bitcoin’s (BTC) status as a commodity is well-established and called for clearer regulation of the cryptocurrency space.

Related: Cantor Fitzgerald CEO to co-lead Trump transition team

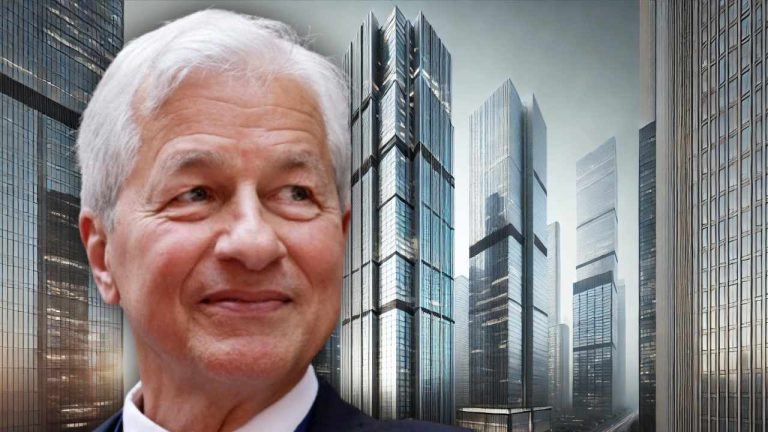

JPMorgan CEO Jamie Dimon has issued a serious warning about escalating geopolitical risks, stating that they pose greater threats to global stability than current economic challenges. His remarks come in light of rising tensions, including attacks on oil tankers and the ongoing Ukraine-Russia war. Dimon cautioned against over-optimism about the U.S. economy, advising a more […]

JPMorgan CEO Jamie Dimon has issued a serious warning about escalating geopolitical risks, stating that they pose greater threats to global stability than current economic challenges. His remarks come in light of rising tensions, including attacks on oil tankers and the ongoing Ukraine-Russia war. Dimon cautioned against over-optimism about the U.S. economy, advising a more […]

LandBridge has a huge amount of land in the middle of America’s oil country, but it also says it can make big money off crypto miners.

LandBridge, a United States firm that acquires large swaths of land for oil and gas production, says it intends to court crypto miners as part of its future strategy — amid the launch of its initial public offering (IPO) on Monday.

The company said on June 17 that it’s offering 14.5 million shares, which it anticipates will be priced between $19 and $22, potentially giving it a valuation of up to $1.6 billion. It plans to be listed on the NYSE under the ticker “LB.”

Regulatory filings show LandBridge owns around 220,000 surface acres in and around the oil and natural gas-rich Delaware subbasin in the Permian Basin area of Texas and New Mexico.

The derivatives arm of the largest US-based crypto exchange is launching retail-sized futures contracts for oil and gold. In a statement, Coinbase Derivatives says that while crypto derivatives remain at the core of its business, it is introducing commodities futures contracts to give customers enhanced trading opportunities in the traditional markets. Commodity futures contracts oblige […]

The post Coinbase Derivatives To Offer Oil and Gold Futures Contracts in Push To Bridge TradFi and Digital Assets appeared first on The Daily Hodl.

Robust BTC derivatives data indicates strong demand for leverage longs.

Bitcoin (BTC) has been trading within a narrow 4.5% range over the past two weeks, indicating a level of consolidation around the $34,700 mark.

Despite the stagnant prices, the 24.2% gains since Oct. 7 instill confidence, driven by the impending effects of the 2024 halving and the potential approval of a Bitcoin spot exchange-traded fund (ETF) in the United States.

Bears expect further macroeconomic data supporting a global economic contraction as the U.S. Federal Reserve holds their interest rate above 5.25% in order to curb inflation. For instance, on Nov. 6, China exports shrank 6.4% from a year earlier in October. Furthermore, Germany reported October industrial production down 1.4% versus prior month on Nov. 7.

The weaker global economic activity has led to WTI oil prices dipping below $78 for the first time since late July, despite the potential for supply cuts from major oil producers. Remarks by U.S. Federal Reserve Bank of Minneapolis President Neel Kashkari on Nov. 6 has set a bearish tone, prompting a 'flight-to-quality' response.

Kashkari stated:

“ We haven’t completely solved the inflation problem. We still have more work ahead of us to get it done."

Investors have sought refuge in U.S. Treasuries, resulting in the 10-year note yield dropping to 4.55%, its lowest level in six weeks. Curiously, the S&P 500 stock market index has reached 4,383 points, its highest level in nearly seven weeks, defying expectations during a global economic slowdown.

This phenomenon can be attributed to the fact that the firms within the S&P 500 collectively hold $2.6 trillion in cash and equivalents, offering some protection as interest rates remain high. Despite increasing exposure to major tech companies, the stock market provides both scarcity and dividend yield, aligning with investor preferences during times of uncertainty.

Meanwhile, Bitcoin's futures open interest has reached its highest level since April 2022, standing at $16.3 billion. This milestone gains even more significance as the Chicago Mercantile Exchange (CME) solidifies its position as the second-largest market for BTC derivatives.

Recent use of Bitcoin futures and options have made media headlines. The demand for leverage is likely fueled by what investors believe are the two most bullish catalyst for 2024: the potential for a spot BTC ETF and the Bitcoin halving.

One way to gauge market health is by examining the Bitcoin futures premium, which measures the difference between two-month futures contracts and the current spot price. In a robust market, the annualized premium, also known as the basis rate, should typically fall within the 5% to 10% range.

Notice how this indicator has reached its highest level in over a year, at 11%. This indicates a strong demand for Bitcoin futures primarily driven by leveraged long positions. If the opposite were true, with investors heavily betting on Bitcoin's price decline, the premium would have remained at 5% or lower.

Another piece of evidence can be derived from the Bitcoin options markets, comparing the demand between call (buy) and put (sell) options. While this analysis doesn't encompass more intricate strategies, it offers a broad context for understanding investor sentiment.

Related: Bitcoin Ordinals see resurgence from Binance listing

Over the past week, this indicator has averaged 0.60, reflecting a 40% bias favoring call (buy) options. Interestingly, Bitcoin options open interest has seen a 51% increase over the past 30 days, reaching $15.6 billion, and this growth has also been driven by bullish instruments, as indicated by the put-to-call volume data.

As Bitcoin's price reaches its highest level in 18 months, some degree of skepticism and hedging might be expected. However, the current conditions in the derivatives market reveal healthy growth with no signs of excessive optimism, aligning with the bullish outlook targeting $40,000 and higher prices by year-end.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Billionaire venture capitalist Chamath Palihapitiya thinks the Federal Reserve will keep interest rates higher for longer as the world witnesses the start of a new war. Palihapitiya tells his 1.6 million followers on the social media platform X that inflation could soar once again on the back of rising oil prices amid the escalating war […]

The post Billionaire Chamath Palihapitiya Says Fed Unlikely To Cut Rates Anytime Soon Amid Breakout of New Armed Conflict appeared first on The Daily Hodl.

Veteran macro investor Luke Gromen says that both Bitcoin (BTC) and gold can flourish as fiscal issues continue to mount within the US economy. In a new interview on the Blockworks Macro YouTube channel, macro investor Luke Gromen says that relentless quantitative easing and a potential pivot from the Federal Reserve will create an environment […]

The post Bitcoin and Gold Can Flourish as US Struggles With Massive Fiscal Problems: Macro Investor Luke Gromen appeared first on The Daily Hodl.