Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, has warned that the U.S. economy is “heading towards a severe deflationary recession,” emphasizing that the Federal Reserve is still tightening. “Typically, when you have commodities collapsing at this velocity in the past, the Fed has already been easing, and they’re still vigilant against that,” he cautioned. Strategist […]

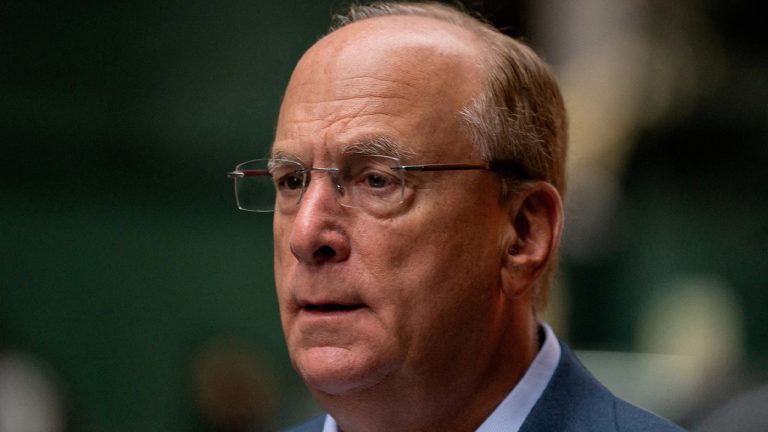

Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, has warned that the U.S. economy is “heading towards a severe deflationary recession,” emphasizing that the Federal Reserve is still tightening. “Typically, when you have commodities collapsing at this velocity in the past, the Fed has already been easing, and they’re still vigilant against that,” he cautioned. Strategist […] Blackrock’s CEO, Larry Fink, stated in an interview on Friday that he does not anticipate a “big recession” in the United States. However, he believes that “inflation is going to be stickier for longer.” In contrast to the U.S. central bank’s 2% goal, Fink predicts that “we’re going to have a 4ish floor in inflation.” […]

Blackrock’s CEO, Larry Fink, stated in an interview on Friday that he does not anticipate a “big recession” in the United States. However, he believes that “inflation is going to be stickier for longer.” In contrast to the U.S. central bank’s 2% goal, Fink predicts that “we’re going to have a 4ish floor in inflation.” […]

Will $30,000 BTC price hold? Bitcoin market structure remains bullish with another 10% gain on the table as sellers refrain from shorting.

Bitcoin (BTC) price rallied over 10% between April 9 and April 14, marking the highest daily close in more than ten months. While some analysts may argue the move justifies a degree of decoupling from traditional markets, both the S&P 500 and gold are near their highest levels in over six months.

Bitcoin’s gains and rally above $30,000 also happened while the dollar strength index (DYX), which measures the U.S. currency against a basket of foreign exchanges, reached its lowest level in 12 months.

The indicator fell to 100.8 on April 14 from 104.7 one month prior as investors priced in higher odds of further liquidity injections by the Federal Reserve.

Related: Bitcoin price teases $30K breakdown ahead of US CPI, FOMC minutes

The latest Federal Reserve’s monetary policy meeting minutes, released on April 12, made explicit reference to the anticipation of a “mild recession” later in 2023 due to the banking crisis. Even if inflation is no longer a primary concern, the monetary authority has little room to raise interest rates further without escalating an economic crisis.

Even if inflation is no longer a primary concern, the monetary authority has little room to raise interest rates further without escalating an economic crisis.

While the global economy may deteriorate in the coming months, recent macroeconomic data has been mostly positive. For example, the European Union's statistics office reported that industrial production in the 20 member countries increased 1.5% month on month in February, whereas economists polled by Reuters expected a 1.0% increase.

Furthermore, China's latest macroeconomic data showed an encouraging trend, with exports increasing 14.8% year on year in March, snapping a five-month decline and surprising economists who expected a 7% decline. As a result, China's trade balance for March was $89.2 billion, far exceeding the $39.2 billion market consensus.

The contrast between the current economic momentum and the forthcoming recession triggered by higher financing costs and a reduced appetite for risk among lenders causes Bitcoin investors to question the sustainability of the $30,000 support.

Let's look at the Bitcoin derivatives metrics to better understand how professional traders are positioned in the current market environment.

Margin markets provide insight into how professional traders are positioned because they allow investors to borrow cryptocurrency to leverage their positions.

OKX, for instance, provides a margin lending indicator based on the stablecoin/BTC ratio. Traders can increase exposure by borrowing stablecoins to buy Bitcoin. On the other hand, Bitcoin borrowers can only bet on the decline of a cryptocurrency's price.

The above chart shows that OKX traders' margin lending ratio decreased between April 9 and April 11. That is extremely healthy as it shows no leverage has been used to support Bitcoin's price gains, at least not using margin markets. Moreover, given the general bullishness of crypto traders, the current margin lending ratio of 15 is relatively neutral.

The long-to-short metric excludes externalities that might have solely impacted the margin markets. In addition, it gathers data from exchange clients’ positions on the spot, perpetual and quarterly futures contracts, thus offering better information on how professional traders are positioned.

There are occasional methodological discrepancies between different exchanges, so readers should monitor changes instead of absolute figures.

Interestingly, despite Bitcoin breaking $30,000 for the first time in 10 months, pro traders have kept their leverage long positions unchanged, according to the long-to-short indicator.

For instance, the ratio for Huobi traders stood firm near 0.98 from April 9 until April 14. Meanwhile, at crypto exchange Binance, the long-to-short slightly increased, favoring longs, moving from 1.12 on April 9 to the current 1.14. Lastly, at crypto exchange OKX, the long-to-short ratio slightly declined, from 1.00 on April 9 to the current 0.91.

Related: Tesla selling Bitcoin last year turned out to be a $500M mistake

Moreover, Bitcoin futures traders were not confident enough to add leveraged bullish positions. Thus, even if Bitcoin price retests $29,000 in terms of derivatives, bulls should be unconcerned because there has been little demand from short-sellers and no excessive leverage from buyers.

In other words, Bitcoin's market structure is bullish, where BTC price can easily rally another 10% to $33,000 given sellers are currently scared to short it.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

BTC price continues to show strength and derivatives data suggests that bulls intend to press Bitcoin higher.

Bitcoin (BTC) price maintained the $30,000 support as lower-than-expected U.S. Consumer Price Index (CPI) data released on April 12. The official inflation rate for March increased 5% year on year, which was slightly less than the 5.1% consensus. It was the lowest reading since May 2021, but is still significantly higher than the Federal Reserve's 2% target.

The data suggests that inflation is no longer the driving force behind Bitcoin’s rally and Investors' focus shifted from the impact of inflationary pressure to potential recession risks after the banking crisis revealed how fragile the financial system was following the Federal Reserve's twelve-month hike in interest rates from 0.10% to 4.85%.

Aside from the Silicon Valley Bank bankruptcy and the government-backed sale of Credit Suisse to UBS, several warning signs of a macroeconomic downturn have emerged.

The most recent ISM Purchasing Managers Index data fell to its lowest level since May 2020, indicating an economic contraction. According to Federal Reserve documents released on April 12, the aftermath of the U.S. banking crisis is likely to push the economy into a "mild recession" later this year. Because of the crisis, some have speculated that the Fed will hold off on raising interest rates, but officials affirmed that more effort is needed to keep inflation under control.

According to a Moody's Analytics report, commercial real estate prices fell 1.6% in February, the most since the 2008 financial crisis. Furthermore, the national office vacancy rate reached 16.5%, indicating the severity of the economic difficulties that businesses are currently facing.

Whatever the reason for Bitcoin's 50% rally between March 11 and April 11, it demonstrates resilience to FUD, including the SEC's Wells Notice against Coinbase on March 22, and the CFTC filing a suit against Binance and its CEO Changpeng Zhao on March 27. By holding the $30,000 support, Bitcoin demonstrates that the positive momentum can continue regardless of whether inflation remains above 5%.

Not everyone is cheering the rally, particularly traders who have placed bearish bets using Bitcoin options. The April 14 open interest for BTC options expiry is $950 million, with $490 million in call (buy) options and $460 million in put (sell) options. Bears have been caught off guard, with less than 7% of their bets exceeding $29,000.

Below are the four most likely scenarios based on the current price action. The number of call (buy) and put (sell) options contracts available on April 14 varies depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

This rough estimate considers only call options in bullish bets and put options in neutral-to-bearish trades. Nonetheless, this oversimplification excludes more complex investment strategies. A trader, for example, could have sold a put option, effectively gaining positive exposure to Bitcoin above a certain price, but this effect is difficult to estimate.

Related: Bitcoin-friendly PPI data boosts bulls as Ether price fights for $2K

Bulls are expected to push Bitcoin above $30,500 on April 14 at 8:00 a.m UTC to profit an additional $100 million. Bears, on the other hand, would need to pressure Bitcoin's price below $29,000 in order to balance the scales. However, bears have recently suffered significant losses as BTC futures short contracts were forcibly liquidated to the tune of $128 million between April 9 and April 11.

As the most likely scenario favors Bitcoin bulls, their profits will most likely be used to reinforce the $30,000 support. Bears might consider licking their wounds and waiting for additional actions from regulators as the macroeconomic scenario is currently bullish for supply capped assets.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The President of the Minneapolis Federal Reserve Bank is issuing a warning, saying that a recession could be around the corner as a banking crisis puts pressure on the US economy. According to a new report by Reuters, President Neel Kashkari says that even though the Fed’s current tactics to combat inflation could cause a […]

The post Fed President Warns of Recession Amid Banking Crisis, Says FOMC Committed to Hammering Inflation appeared first on The Daily Hodl.

After the March rate hike by the Federal Reserve, economists believe that the recent move by Saudi Arabia and several members of the Organization of the Petroleum Exporting Countries (OPEC) to cut oil production could complicate the central bank’s mission. Additionally, the majority of the market is pricing in another 0.25% increase for the May […]

After the March rate hike by the Federal Reserve, economists believe that the recent move by Saudi Arabia and several members of the Organization of the Petroleum Exporting Countries (OPEC) to cut oil production could complicate the central bank’s mission. Additionally, the majority of the market is pricing in another 0.25% increase for the May […] The banking industry in the United States is still struggling after the collapse of three major banks. According to statistics, bank lending in the U.S. has dropped by close to $105 billion in the last two weeks of March, which is the largest decline on record. Additionally, Elon Musk, a Tesla executive and owner of […]

The banking industry in the United States is still struggling after the collapse of three major banks. According to statistics, bank lending in the U.S. has dropped by close to $105 billion in the last two weeks of March, which is the largest decline on record. Additionally, Elon Musk, a Tesla executive and owner of […]

A closely followed crypto analyst is predicting an implosion for Bitcoin (BTC) and altcoins as he believes that a recession and a stock market collapse are on the horizon. In a new strategy session, Nicholas Merten, the host of DataDash, tells his 511,000 YouTube subscribers that Bitcoin bulls are betting on a sustained rally following […]

The post Crypto Analyst Predicts Bitcoin and Altcoin Implosion Amid Incoming Recession and Stock Market Collapse appeared first on The Daily Hodl.

JPMorgan CEO and crypto critic Jamie Dimon is issuing a warning on inflation and a potential incoming economic crisis. In Dimon’s latest annual letter to JPMorgan’s shareholders, he says that the US’ largest bank is prepared for potentially higher interest rates, and higher and longer-lasting inflation. Dimon says that assets across the board, including crypto […]

The post Crypto Critic Jamie Dimon Issues Warning on Inflation, Says Fed Likely To Raise Rates Higher Than Expected appeared first on The Daily Hodl.

Regulatory uncertainty and the recent enforcement actions taken against major crypto exchanges reduces the odds of Bitcoin breaking above $30,000 in the short-term, but investors are still bullish.

Bitcoin (BTC) might have shown strength after successfully defending the $28,000 support amid unfounded rumors regarding Binance, but an interesting development to note is BTC is becoming less correlated to traditional markets after the U.S. Federal Reserve elected to provide emergency liquidity to banks.

This change in attitude from the central bank has caused a shift in the trajectory of US Treasuries as traders sought refuge from the inflationary upward pressure. Bitcoin appears to be agnostic to the movement and its price has been hovering around $28,000 for the past week.

Meanwhile, the yield on the 5-year note fell to 3.50% on April 3, a drop from 3.70% in the previous week. Higher demand for debt instruments reduces payout, resulting in a lower yield. The $152.6 billion in outstanding borrowings from the U.S. Federal Reserve's backstop lending program has been the driving factor.

The general public's lack of trust in banks has also caused them to reconsider what the Federal Deposit Insurance Corporation (FDIC) is and how the Fed no longer controls the inflation trajectory. The question of whether Bitcoin can serve as a reliable store of value during a crisis remains open, but the 70% year-to-date gains certainly demonstrate a point.

According to data from Bank of America, the total assets of money market funds in the United States reached a record high of $5.1 trillion. These instruments invest in short-term debt securities such as the U.S. Treasuries, certificates of deposit and commercial paper. Furthermore, fund manager and analyst Genevieve Roch-Decter, CFA, states that investors have withdrawn $1 trillion from banks because money market funds offer a much higher return.

Good Morning Everyone! Since the recent high, total deposits at U.S banks are down a record $1 trillion. Where did the money go? A lot went to money market funds which just hit a record high. Who wants to make 0.3% with a bank account when you can make 5% in a money market fund! pic.twitter.com/t3RTETIHIA

— Genevieve Roch-Decter, CFA (@GRDecter) April 3, 2023

Even though Bitcoin investors view cryptocurrencies as a safe haven against inflation, a recession would reduce demand for goods and services, resulting in deflation. The risk increased substantially after the March U.S. ISM Purchasing Managers Index data was released. At 46.3, the indicator reached its lowest level since May 2020, below analysts' forecast of 47.5, indicating contraction.

According to Jim Bianco, macro analyst at Bianco Research, this was the 16th time since 1948 that the level had reached such a low point, and in 75% of those instances, a recession followed.

ISM is out today at 46.3, the lowest since May 2020, the month after the COVID recession ended,

— Jim Bianco biancoresearch.eth (@biancoresearch) April 3, 2023

ISM started surveying in 1948. As this chart shows, this is the 16th time the ISM has been 46.3 or lower.

12 (75%) of these instances, the economy was either in recession or about to… pic.twitter.com/5Pw5zfFOrs

Let's examine Bitcoin derivatives metrics to determine the current market position of professional traders.

Bitcoin quarterly futures are popular among whales and arbitrage desks, which typically trade at a slight premium to spot markets, indicating that sellers are asking for more money to delay settlement for a longer period.

As a result, futures contracts on healthy markets should trade at a 5% to 10% annualized premium — a situation known as contango, which is not unique to crypto markets.

Since March 30, the Bitcoin futures premium has been hovering near the neutral-to-bearish threshold, indicating that professional traders are unwilling to turn bullish despite the BTC price remaining near $28,000.

The absence of demand for leverage longs does not always imply a price decline. As a result, traders should investigate Bitcoin's options markets to learn how whales and market makers value the likelihood of future price movements.

The 25% delta skew indicates when market makers and arbitrage desks overcharge for upside or downside protection. In bear markets, options traders increase their odds of a price drop, causing the skew indicator to rise above 8%. Bullish markets, on the other hand, tend to drive the skew metric below -8%, indicating that bearish put options are in less demand.

Related: Bitcoin price bounces after CZ arrest rumors as traders eye $30K next

The 25% skew ratio is currently at -5 because protective put options are trading slightly cheaper than neutral-to-bullish calls. That is a bullish indicator given the recent FUD generated after CFTC sued Binance on March 27. The regulator alleges that Binance and CZ violated regulatory compliance and derivatives laws by offering trading to US customers without registering with market regulators.

So far, Bitcoin has held up well as the baking sector forced the Fed to reverse its credit-tightening policy. However, as long as regulatory uncertainty surrounds major crypto exchanges, Bitcoin is unlikely to break above $30,000.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.