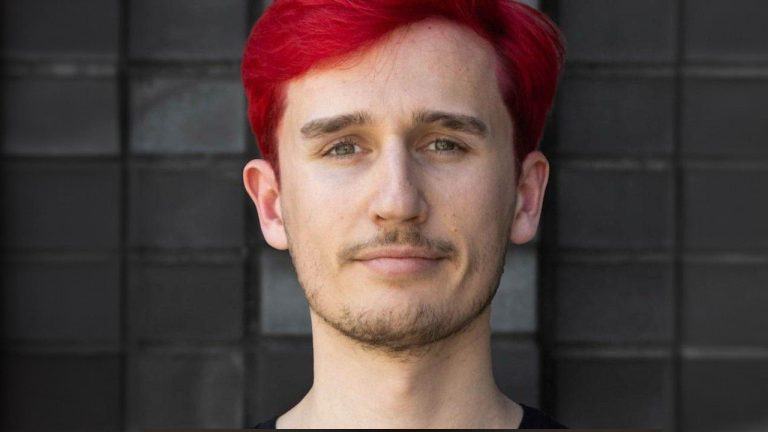

Gnosis founder Martin Köppelmann says Ethereum needs to move away from “centralized” L2s like Base and adopt native rollups.

Gnosis founder Martin Köppelmannn says implementing a web of 128 “native rollups” can save the Ethereum network from being captured by corporate interests and vanishing into obscurity.

Native rollups are layer-2 networks built to Ethereum’s native security standards, meaning that they’re composable, uncensorable, and economically aligned with the original ethos of Ethereum.

Unlike “centralized” rollups, which include L2s like Coinbase-incubated Base, or “based rollups” like Taiko — native rollups offer all of the inherent security and composability of Ethereum.

The Ethereum co-founder said it was “stage 1 or bust” for his acceptance of a layer-2 project’s decentralization progress.

Ethereum co-founder Vitalik Buterin has reiterated his stance on layer-2 decentralization, stating that he only plans to acknowledge scaling solutions at “stage 1” of his decentralization scale.

In a Sept. 12 X post, Buterin said that he takes this “seriously” and that, starting next year, he only plans to publicly mention layer-2 networks that are “stage 1+”.

He added that there “may be a short grace period for new genuinely interesting projects.”

According to Adrian Brink, co-founder of Anoma and Namada, rollups offer little new functionality beyond the Ethereum Virtual Machine (EVM). He argues they are essentially execution-sharding solutions presented as true scaling solutions. Brink instead touts Plasma as the “only true scaling solution out there” because it enables constant data posting to the main chain “regardless […]

According to Adrian Brink, co-founder of Anoma and Namada, rollups offer little new functionality beyond the Ethereum Virtual Machine (EVM). He argues they are essentially execution-sharding solutions presented as true scaling solutions. Brink instead touts Plasma as the “only true scaling solution out there” because it enables constant data posting to the main chain “regardless […]

Crypto investment firm Galaxy Digital is issuing a warning, saying that Bitcoin (BTC) layer-2s are in danger of potentially losing their funds. In a new research post, the crypto firm says Bitcoin’s blocks – or files where information is stored and encrypted – are crowded due to excessive demand. According to Galaxy Digital, BTC layer-2 […]

The post ‘Only a Small Number Can Survive’ – Galaxy Digital Issues Warning to Bitcoin Layer-2s Amid Scarce Blockspace appeared first on The Daily Hodl.

Ethereum layer-2s are proliferating, which means Ethereum will start looking like a much better prospect for new projects in the year ahead.

A major topic in crypto in 2024 is the number of layer-2 (L2) blockchains created on top of the Ethereum network. Major nonfungible token (NFT) collections such as Pudgy Penguins, Bored Ape Yacht Club and Azuki have announced their own L2s — in addition to numerous traditional companies such as Fox Corporations and Flipkart.

This sudden surge in L2s has been treated as a joke by many who believe it to simply be hype. Nonetheless, it is very likely that we will have thousands of L2s within the next year. This will be great for the success of the Ethereum (ETH) ecosystem.

By way of background: The Ethereum network is a first-layer blockchain (L1). Ethereum prioritizes decentralization and security, but it lacks scalability — a problem known as the blockchain trilemma, where only two of those three things can be achieved.

One wallet has upgrade permissions for 12 Ethereum scaling networks, but Conduit founder Andrew Huang says it can’t transact without three signatures which would take a trio of physical attacks.

A single multisignature crypto wallet has permissions from 12 different blockchain networks, implying that if this single wallet is ever compromised — all 12 networks could be drained of their funds with a potential $121 million in losses.

The networks include Zora, Aevo, Hypr, Orderly, Ancient8, Lyra, Mode, Pgn, Parallel and Metal — all created using the Conduit rollup creation software, according to data shared to X on May 19 by L2Beat researcher Luca Donno.

However, the wallet can’t transact without three of five signatures from the team, Conduit founder Andrew Huang told Cointelegraph. The private keys to these signatures are stored on hardware wallets, making a compromise only possible by “physically compromising 3/5 individuals,” he said.

On Thursday, the team behind BNB Chain introduced a novel Rollup-as-a-Service (RaaS) offering for the development of layer two blockchains (L2s) atop the BNB Chain. The team detailed that the service equips sizable decentralized applications (dapps), enterprises, and the BNB Chain with the essential technological framework required for launching specific L2s on BNB Smart Chain […]

On Thursday, the team behind BNB Chain introduced a novel Rollup-as-a-Service (RaaS) offering for the development of layer two blockchains (L2s) atop the BNB Chain. The team detailed that the service equips sizable decentralized applications (dapps), enterprises, and the BNB Chain with the essential technological framework required for launching specific L2s on BNB Smart Chain […]

A brand new altcoin surged by more than 96% over the last three days after its mainnet went live earlier this week. Dymension (DYM) is a layer-1 blockchain that aims to serve as a network for “RollApps,” which the project defines as fast modular chains that work for games, decentralized finance (DeFi) protocols and non-fungible […]

The post New Modular Blockchain Altcoin Surges More Than 96% Just Two Days After Mainnet Launch appeared first on The Daily Hodl.

Consensys zkEVM Linea head Nicolas Liochon says speed and execution will continue to increase as it tweaks its Ethereum layer 2 scaling solution.

Zero-knowledge proof (ZK-proofs) solutions have proved critical in helping scale the Ethereum ecosystem, but proto-danksharding is expected to drastically reduce the cost of roll ups according to Consensys’ zkEVM Linea head Nicolas Liochon.

Speaking exclusively to Cointelegraph Magazine editor Andrew Fenton during Korea Blockchain Week, Liochon estimated that proto-danksharding could further reduce rollup costs by 10 times.

Proto-danksharding, also known by its improvement proposal identifier EIP-4844, is aimed at reducing the cost for rollups, which typically batch transactions and data off-chain and submit computational proof to the Ethereum blockchain.

The Ethereum Foundation is yet to nail down an expected launch data for proto-danksharding but development and testing is still ongoing.

As Liochon explained, Linea delivers 15 times cheaper transactions compared to those made on Ethereum’s layer one, but rollups are still limited by the fact that transactions are posted in calldata in Ethereum blocks.

According to Ethereum’s documentation, rollups are still expensive in terms of their potential because calldata is processed by all Ethereum nodes and the data is stored on chain indefinitely despite the fact that the data only needs to be available for short period.

EIP-4844 will introduce data blocks that can be sent and attached to blocks. The data stored in blobs is not accessible to the Ethereum Virtual Machine and will be deleted after a certain time period - which is touted to drastically reduce transaction costs.

“In reality, the cost of rollups is down to data availability. We are writing all the data to layer one which is why we have exactly the same security. But it’s expensive, it represents 95% of the cost.”

Liochon said that Linea’s prover, which essentially handles the off-chain computation that verifies, bundles and then creates a cryptographic proof of the combined transactions, only represents a fifth of the cost.

This highlights the major hurdle in making ZK-rollups the go-to scaling solution for the Ethereum ecosystem as opposed to other solutions like Optimistic rollups.

Liochon also said that Linea aims to be a general use ZK-rollup that will be used for a variety of decentralized applications and solutions within the Ethereum ecosystem.

"We are a generic rollup. We don't want to have a specific use case or specific domain. It's quite important to support all type of applications, including DeFi, gaming and social."

As Cointelegraph previously reported, Consensys has completed the launch of Linea in Aug. 2023, having onboarding over 150 partners and bridging more than $26 million in ETH.

Magazine: Here’s how Ethereum’s ZK-rollups can become interoperable

Transactions on Optimism recently eclipsed the Arbitrum network, but do the project’s fundamentals support a sustainable growth trajectory?

Optimism (OP) is a Layer 2 scaling solution, which operates as a separate blockchain built on top of Ethereum. Despite having a smaller total value locked (TVL) than its rivals, Optimism may still have the potential to thrive in the increasingly competitive DeFi landscape.

Being one of the pioneers in the DeF space, Optimism initially gained an initial but had to contend with fierce competition. The project has been trailing behind other scaling solutions in terms of daily transactions for the past six months. However, in late July, the situation changed as Optimism finally overtook its main competitor Arbitrum and is showing signs of increasing demand from users.

The increase in Layer 2 activity on Ethereum has been significant, surpassing mainnet activity by more than four times, according to data from L2beat. Various solutions have emerged to address Ethereum's scalability challenges and each Layer 2 project focuses on different aspects such as privacy, specific decentralized applications and NFT marketplaces.

Consequently, the leaderboard of transactions and volumes constantly fluctuates based on demand, and each solution comes with its own advantages and drawbacks.

Optimism operates using rollups, bundling all transactions into a single transaction to be executed on the base layer, inheriting all security features from Ethereum. The philosophy behind Optimism assumes that all transactions are valid unless challenged and proven otherwise, allowing for cost-effective and fast transactions for users.

While Optimism and Arbitrum (ARB) rely on rollups, the core difference lies in Arbitrum's centralized approach where a single entity (sequencer) is responsible for submitting fraud proof. On Optimism, anyone can submit them.

Among the Layer-2 competitors, Optimism has been the standout performer since July 20, experiencing a 47% growth in daily transactions. This growth has enabled Optimism to surpass its competitor Arbitrum in daily transactions for the first time in 6 months.

Furthermore, the Optimism protocol has witnessed a surge in daily active addresses, with a 27.6% increase in 30 days, while Arbitrum's activity declined by 7.5%.

This trend indicates a potential shift in dominance, although drawing conclusions prematurely would be unwise. Arbitrum's main advantage lies in its much larger total value locked (TVL) compared to Optimism.

According to DefiLlama, Arbitrum currently holds a significant TVL of $2.35 billion, whereas Optimism's TVL is comparatively lower at $920 million. Arbitrum's dominance is especially evident in the decentralized finance (DeFi) applications it shares with Optimism, such as Uniswap and AAVE. Additionally, Arbitrum boasts an impressive $500 million TVL in the derivatives exchange GMX.

Two of the main reasons for higher demand on Optimism are increased use from Coinbase and Worldcoin. The project is also on track to implement important privacy mechanisms that could create another use case.

A pivotal moment for Optimism came with the launch of Coinbase's sandbox on July 21, providing developers with a test environment to build and deploy new applications on this Layer 2 solution. This initiative incentivizes the creation of new tools, applications, and protocols, fostering growth and innovation.

One of the projects utilizing Optimism as a scaling solution is Worldcoin, which has been gaining substantial attention. The token airdrop on July 26 further boosted activity on Optimism after supporting Uniswap on the Optimism mainnet. Worldcoin has also deployed most of its Safe wallets on Optimism. This adoption has contributed significantly to the daily activity on the network, accounting for around 40%.

Related: Worldcoin stuck after 70% drop from peak — More downside for WLD price?

Optimism's ecosystem is set to undergo several developments, including two proposals by O(1) Labs and RISC Zero to implement zero-knowledge proof systems. This move will provide the network with its own ZKP layers, akin to developments on Polygon (MATIC) and ZKSync.

The growth in active addresses on Optimism is a positive indicator for the network's success and the successful launch of the Worldcoin project marked a milestone for this scaling solution.

The surge in daily active addresses is also promising, signifying the network's continuous growth and potential opportunities with the successful implementation of its privacy solutions.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.