Despite Bitcoin’s difficulty reaching an all-time high at 46.84 trillion, participants in bitcoin mining have kept the hashrate running stronger than ever before. According to statistics, on March 23, 2023, the hashrate reached a high of 400 exahash per second (EH/s). The 400 exahash equates to 0.4 zettahash or four hundred quintillion hashes per second. […]

Despite Bitcoin’s difficulty reaching an all-time high at 46.84 trillion, participants in bitcoin mining have kept the hashrate running stronger than ever before. According to statistics, on March 23, 2023, the hashrate reached a high of 400 exahash per second (EH/s). The 400 exahash equates to 0.4 zettahash or four hundred quintillion hashes per second. […] After Credit Suisse Group AG announced it would borrow 50 billion Swiss francs from the Swiss National Bank, UBS Group AG is reportedly considering acquiring the banking giant. However, UBS is requesting that the government issue a backstop to protect against any losses if it purchases Credit Suisse. According to unnamed sources familiar with the […]

After Credit Suisse Group AG announced it would borrow 50 billion Swiss francs from the Swiss National Bank, UBS Group AG is reportedly considering acquiring the banking giant. However, UBS is requesting that the government issue a backstop to protect against any losses if it purchases Credit Suisse. According to unnamed sources familiar with the […]

A Binance spokesperson told Cointelegraph that they hired 600 people since January and have no imminent plans for layoffs.

Cryptocurrency exchange Binance is “not planning any layoffs” and is instead trying to fill another 500 roles by the end of June, according to a Binance spokesperson.

The comments came despite a huge spike in crypto layoffs in January — the majority of which were from crypto exchanges. In a statement, the Binance representative said:

“As of today, we are actively hiring for more than 500 roles with the goal of filling them by the end of H1 [...] We are not planning any layoffs.”

The spokesperson was responding to a request for clarification from Cointelegraph on March 1 regarding a tip it had received of possible redundancies at the crypto exchange. The latest comments appear to completely refute this speculation.

At the time of writing, Binance had 463 listings on its job openings page, with roles in business development, communications, customer support and engineering, to name a few.

In January, Binance CEO Changpeng Zhao said that the firm was planning for a hiring spree in 2023, increasing its headcount by 15% to 30%, according to a Jan. 11 report from CNBC.

The spokesperson said that the company has hired more than 600 people since the start of 2023.

According to CoinGecko, 84.8% of the crypto layoffs in January were due to crypto exchanges reducing headcount, including Coinbase, Huobi, Blockchain.com, Crypto.com and Luno.

Coinbase announced it would be reducing its headcount by around 950 on Jan. 10, while Crypto.com announced on Jan. 13 that it would be reducing its workforce by around 500.

Related: Sen. Elizabeth Warren and colleagues demand to see Binance’s balance sheets

Binance has been regarded by some, such as Arcane, as one of the “winners” of 2022, with the fall of crypto exchange FTX and the implementation of zero-fee Bitcoin (BTC) trading leading to it capturing an overwhelming portion of the market.

On the other side of the coin, the exchange has also seen intense scrutiny. Most recently, this has revolved around the alleged shuffling of $1.8 billion in funds which some have compared to the actions of bankrupt crypto exchange FTX.

Binance used $1.8 billion in customer funds for its own purposes, similar to what FTX did

— Genevieve Roch-Decter, CFA (@GRDecter) February 28, 2023

Here we go again

Binance CEO Changpeng Zhao took to Twitter to respond to the allegations, labeling it “FUD” and suggesting it was standard practice for an exchange.

This year has had a tough start for those working in the crypto industry, with at least 14 firms and nearly 3,000 jobs being lost in January before a milder 570 layoffs in February.

But the tide could be turning, with the crypto market cap increasing by over 34% so far in 2023, according to CoinMarketCap, and other firms, such as USDC issuer Circle, also planning to go on a hiring spree.

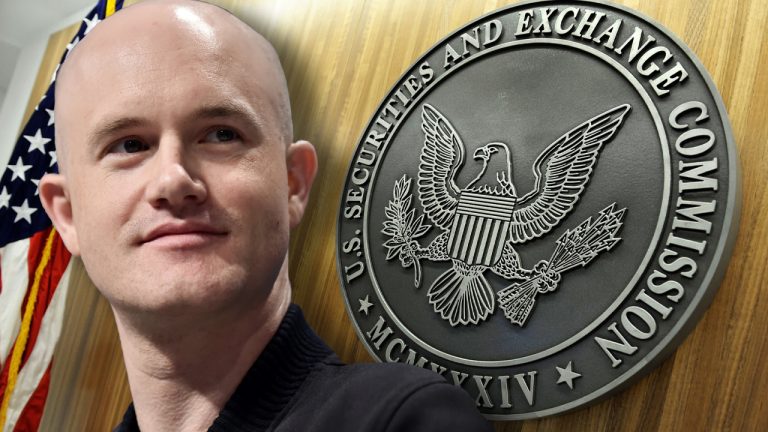

Brian Armstrong, CEO of Coinbase, expressed concern about rumors that the U.S. Securities and Exchange Commission (SEC) may eliminate cryptocurrency staking for retail customers in the United States. Armstrong insisted that “staking is not a security” and that the trend allows users to “participate directly in running open crypto networks.” Coinbase CEO Vocalizes Worry Over […]

Brian Armstrong, CEO of Coinbase, expressed concern about rumors that the U.S. Securities and Exchange Commission (SEC) may eliminate cryptocurrency staking for retail customers in the United States. Armstrong insisted that “staking is not a security” and that the trend allows users to “participate directly in running open crypto networks.” Coinbase CEO Vocalizes Worry Over […] According to a report from South Korea, the Korean subsidiary of Huobi Global is planning to cut ties with the parent company. The management of the trading platform stated that they plan to “strengthen its position” as a domestic cryptocurrency exchange and change its name. Huobi Experiences Significant Withdrawals as Subsidiary Huobi Korea Looks to […]

According to a report from South Korea, the Korean subsidiary of Huobi Global is planning to cut ties with the parent company. The management of the trading platform stated that they plan to “strengthen its position” as a domestic cryptocurrency exchange and change its name. Huobi Experiences Significant Withdrawals as Subsidiary Huobi Korea Looks to […]

Canceled bonuses, pay disputes, massive layoffs and a communication blackout has been claimed as part of the goings-on at the crypto exchange.

Speculation on Twitter that crypto exchange Huobi has laid off staff and shuttered internal communications have prompted the community to advise users to withdraw funds, despite an adviser to the exchange denying the rumors.

In a Jan. 5 tweet, Huobi adviser Justin Sun addressed rumors of purported insolvency, saying the business development of the exchange was “good” and the “security of users’ assets will always be fully protected.”

Sun also seemingly brushed off speculation around disgruntled staff, saying Huobi will “fully respect the legal demands of local employees.”

Earlier, on Jan. 3, crypto journalist Colin Wu reported that Sun changed Huobi employee salaries from being paid in fiat to being paid in either Tether (USDT) or USD Coin (USDC). Wu claimed thstaff who disagreed with the change could be laid off.

Justin Sun's HR is communicating with all Huobi employees to change the salary form from fiat currency to USDT/USDC; employees who cannot accept it may be dismissed. The move sparked protests from some employees. Exclusive https://t.co/QB4sjDyHc7

— Wu Blockchain (@WuBlockchain) January 4, 2023

Citing insiders, Wu reported in December that Huobi canceled year-end bonuses and was preparing to cut up to half of its 1,200 staff.

The move to change the salary payment from fiat to stablecoins sparked protests from some employees, according to Wu.

A Jan. 4 tweet from the Twitter account BitRun claimed that a “communication group with internal employees” at the exchange had been shut down and “all communication and feedback channels with employees” were blocked.

BitRun added they weren’t ruling out a revolt by Huobi employees who could “directly rug away user assets or programmers add backdoor Trojan horses” claiming the practice was “not protected by domestic laws.”

Related: ‘Old money has all but fled,’ Huobi co-founder discusses challenges of running $400M VC fund

Huobi is based in Seychelles, with offices in Hong Kong, the United States, Japan and South Korea. It’s a publicly listed company on the Stock Exchange of Hong Kong.

The ominous warning was enough for one Twitter user to claim Huobi “seems to be melting down in real-time” and others suggested users withdraw funds from the exchange due to the rumors.

If you are using Huobi

— RossStephenson.eth (@magicross7) January 6, 2023

Do consider withdrawing assets till the FUD blows over

Some rather negative sentiment and accusations are going around Twitter aimed against Huobi.

Unverified so do your own due diligence and risk management accordingly.

Huobi Token (HT) is down nearly 7% over 24 hours, according to CoinGecko data.

Cointelegraph contacted Huobi for comment but did not receive a response at the time of publication.

The accounting firm Mazars Group has stopped doing proof-of-reserves (POR) audits for cryptocurrency exchanges and the recently published Binance POR has been removed from the web. Mazars was conducting a number of POR audits for crypto exchanges like Binance, Crypto.com, and Kucoin following the FTX collapse last month. Mazars Group Pauses Crypto Company Audits, Binance […]

The accounting firm Mazars Group has stopped doing proof-of-reserves (POR) audits for cryptocurrency exchanges and the recently published Binance POR has been removed from the web. Mazars was conducting a number of POR audits for crypto exchanges like Binance, Crypto.com, and Kucoin following the FTX collapse last month. Mazars Group Pauses Crypto Company Audits, Binance […] Following the FTX collapse, the largest cryptocurrency exchange by trade volume, Binance, has been surrounded by rumors and speculation in recent times. On Dec. 12, 2022, Reuters reported that U.S. Department of Justice prosecutors have been investigating Binance, according to four people familiar with the matter. Moreover, while a number of crypto assets have risen […]

Following the FTX collapse, the largest cryptocurrency exchange by trade volume, Binance, has been surrounded by rumors and speculation in recent times. On Dec. 12, 2022, Reuters reported that U.S. Department of Justice prosecutors have been investigating Binance, according to four people familiar with the matter. Moreover, while a number of crypto assets have risen […] Last year and during the first half of 2022, speculators assumed the third-largest bitcoin address was a ‘mysterious whale,’ even though the wallet had shown strong characteristics of being a cryptocurrency exchange. The address known as “1P5ZED” has since been replaced by another address, after the wallet started to transfer its entire bitcoin balance in […]

Last year and during the first half of 2022, speculators assumed the third-largest bitcoin address was a ‘mysterious whale,’ even though the wallet had shown strong characteristics of being a cryptocurrency exchange. The address known as “1P5ZED” has since been replaced by another address, after the wallet started to transfer its entire bitcoin balance in […]

Ethereum bull Anthony Sassano and Gnosis co-founder Martin Köppelmann were among those explaining later that the Wrapped Ethereum (wETH) FUD was part of an inside joke.

An inside joke about the “insolvency” of Wrapped Ethereum (wETH) over the weekend has forced influencers to explain it was just a “shitpost” after members of the community took it as real.

The wETH insolvency FUD (fear, uncertainty and doubt) seemingly began to make the rounds on Nov. 26, with false rumors alleging that wETH isn’t backed 1:1 by Ether (ETH) and is insolvent.

Blockchain developer and contributor to the ERC-721A token standard “cygaar” was one of the first to spread the joke, before confirming in a subsequent post that it was in fact a “shitpost” to see who was reading his content.

This is really a test to see who’s been reading my content.

— cygaar (@0xCygaar) November 26, 2022

In fact, only a day before, cygaar tweeted that “WETH cannot ever go insolvent” and that “WETH will always be swappable 1:1 with ETH.”

Ethereum bull and host of The Daily Gwei Anthony Sassano also joined in on the wETH joke with his own parody post on Nov. 27, but had to clarify later that the initial post was “shitpost/ meme” after reading the replies.

Reading the replies I feel like I should clarify

— sassal.eth (@sassal0x) November 27, 2022

This is a shitpost/meme - there is nothing wrong with WETH and you can always redeem 1 ETH for 1 WETH

Though if you don't believe me I'll buy all of your WETH right now for 0.3 ETH

Sell me all you want

Then go fuck off

Gnosis co-founder Martin Köppelmann was another one to get in on the joke, claiming in a Nov. 27 Tweet to his 38,800 Twitter followers that wETH is no longer fully backed by ETH and that “we might see a bank run on redeeming WETH soon.”

Hours later, he said he hoped the joke “did not cause too much confusion,” linking to a thread that explained the joke for those who weren't in the know.

I hope this joke did not caused too much confusion. If you need more context find it here:https://t.co/KDN3NvdO2z

— Martin Köppelmann (@koeppelmann) November 27, 2022

Related: What is wrapped Ethereum (wETH) and how does it work?

Speaking to Cointelegraph, Markus Thielen, the head of research at crypto financial services platform Matrixport has also confirmed that there is little to no truth to the WETH “shitposts.”

wETH’s logic is automated by smart contracts and it isn’t controlled by a centralized entity, he explained:

“I am not too concerned about WETH as it's a smart contract and not stored by a centralized exchange. Since the smart contract is open source, it can be checked for bugs or flaws.”

On the other hand, recent FUD against Wrapped Bitcoin (wBTC) could be warranted, said Thielen, referring to rumors that FTX may have printed 100,000 wBTC out of thin air, as FTX’s Nov. 11 bankruptcy filing does not show any BTC on FTX’s balance sheet.

“WBTC is completely different and here the concerns are valid,” Thielen explained.

wETH is a wrapped version of ETH that is pegged at a 1:1 ratio, which aims to solve interoperability issues on Ethereum-compatible blockchains by allowing for ERC-20 tokens to be exchanged more easily.

wETH was introduced as an ERC-20 token on the Ethereum network for this reason, as ETH follows different rules and thus cannot be directly traded with ERC-20 tokens.

Despite the lighthearted humor behind the jokes, “Dankrad Feist” suggested to his 15,500 Twitter followers in a Nov. 27 Tweet that the comments should be marked “more clearly as jokes” as it “may not be obvious to outsiders.”

A lot of people making jokes about WETH.

— Dankrad Feist (@dankrad) November 27, 2022

Please be aware it may not be obvious to outsiders that it's completely different from bridged assets and there is literally almost zero risk. I think it would be better to mark these more clearly as jokes.

wETH is currently priced at $1,196, at a current ratio of 0.999:1 to ETH, according to data from Coinmarketcap.