Dogecoin, XRP, Stellar and Sandbox saw a larger liquidation share than usual as some top altcoins from the 2020-2021 cycle soared as high as 50%.

Bitcoin retreated after failing to break the $100,000 milestone on Nov. 24, causing one of the largest weekend crypto liquidation events in over half a year.

Over $470 million worth of crypto positions were liquidated over the last 24 hours. Long and short liquidations comprised $352.6 million and $119.9 million, respectively, with altcoins accounting for the vast majority of wiped positions, CoinGlass data shows.

A total of $472.5 million in long and short positions were wiped over the last 24 hours as Bitcoin failed to cross $100,000. Source: CoinGlass

The Zanzibar government has introduced a blockchain sandbox program to encourage entrepreneurship and technological advancements. The program, powered by the Xinfin XDC network and designed by Ledgerfi IT solutions, allows startups to safely test their blockchain-based solutions within the National Blockchain Network. Zanzibar’s sandbox follows a similar initiative in Tanzania, which aims to streamline regulations […]

The Zanzibar government has introduced a blockchain sandbox program to encourage entrepreneurship and technological advancements. The program, powered by the Xinfin XDC network and designed by Ledgerfi IT solutions, allows startups to safely test their blockchain-based solutions within the National Blockchain Network. Zanzibar’s sandbox follows a similar initiative in Tanzania, which aims to streamline regulations […]

The DTCC aims to invite market participants to address pain points and let clients try DTCC products on their own use cases.

The Depository Trust and Clearing Corporation (DTCC) has a sandbox.

The DTCC Digital Launchpad will be an open ecosystem where market participants and technology providers can launch pilots that will have a clear path to production. This comes after a successful proof-of-concept led by the Japan Securities Clearing Corporation (JSCC).

The DTCC has invited a group of participants to the Digital Launchpad to develop initiatives that address critical collateral management pain points and lead to scalable solutions. Their results will be publicized in the first quarter of 2025.

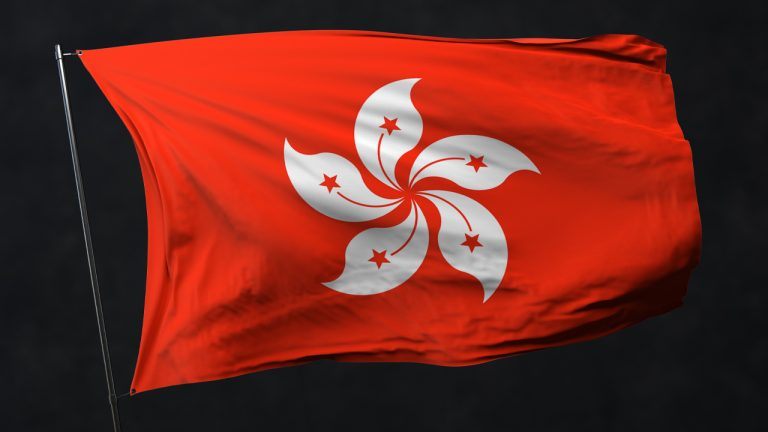

The Hong Kong Monetary Authority has launched a sandbox to test the use of tokenized assets in real-world scenarios. The sandbox aims to promote interbank settlement using tokenized currency and central bank digital currencies. The HKMA will collaborate with other regulators and industry players to support the development of Hong Kong’s tokenization market. Testing Tokenized […]

The Hong Kong Monetary Authority has launched a sandbox to test the use of tokenized assets in real-world scenarios. The sandbox aims to promote interbank settlement using tokenized currency and central bank digital currencies. The HKMA will collaborate with other regulators and industry players to support the development of Hong Kong’s tokenization market. Testing Tokenized […] Standard Chartered Bank (Hong Kong) Ltd. (SCBHK), Animoca Brands, and Hong Kong Telecom (HKT) have united to participate in the Hong Kong Monetary Authority’s (HKMA) stablecoin issuer sandbox, announced in March. Leveraging Zodia Custody’s digital asset capabilities, the collaboration aims to promote sustainable and transparent growth in the digital asset market. Zodia is Standard Chartered’s […]

Standard Chartered Bank (Hong Kong) Ltd. (SCBHK), Animoca Brands, and Hong Kong Telecom (HKT) have united to participate in the Hong Kong Monetary Authority’s (HKMA) stablecoin issuer sandbox, announced in March. Leveraging Zodia Custody’s digital asset capabilities, the collaboration aims to promote sustainable and transparent growth in the digital asset market. Zodia is Standard Chartered’s […]

The bulk of the $90 million reported came from “digital asset advisory.”

Animoca Brands published its first-quarter investor update on July 10. The bottom line up front: Bookings are up significantly for Q1 year-over-year.

The Web3 gaming and venture capital (VC) firm reported bookings in the amount of $90 million for Q1 2024, up 72% from the previous year’s $52 million.

Breaking the bookings down, Animoca Brands reported $65 million from digital asset advisory, which includes “token advisory, trading, and blockchain node operations,” $19 million from its Web3 subsidiaries and startup partnerships, and $6 million from investment management.

The U.S. state of Hawaii’s regulatory sandbox concludes today. Crypto companies will no longer require a Hawaii-issued money transmitter license to conduct business within the state. However, they must comply with federal regulations. Hawaii’s Regulatory Sandbox Concludes The Department of Commerce and Consumer Affairs of Hawaii and the Hawaii Technology Development Corporation (HTDC) issued an […]

The U.S. state of Hawaii’s regulatory sandbox concludes today. Crypto companies will no longer require a Hawaii-issued money transmitter license to conduct business within the state. However, they must comply with federal regulations. Hawaii’s Regulatory Sandbox Concludes The Department of Commerce and Consumer Affairs of Hawaii and the Hawaii Technology Development Corporation (HTDC) issued an […]

Regulators like HKMA and SFC united with local private sector firms like HSBC and HashKey to support the tokenization market in Hong Kong.

The Hong Kong Monetary Authority (HKMA), the financial regulator and central bank of Hong Kong, is collaborating with the industry to explore asset tokenization.

HKMA officially announced on May 7 that it will form a special community comprising industry representatives and regulators to develop tokenization standards.

Called “Project Ensemble Architecture Community,” the community aims to supervise and support the development of tokenization projects in Hong Kong.

The regulations will take effect on Jan. 8, with the Bank of England and U.K. Financial Conduct Authority operating the sandbox.

The United Kingdom Financial Services and Markets Act’s provisions on a digital securities sandbox are scheduled to come into force in January 2024 after being presented to Parliament.

In a Dec. 18 publication, the U.K. government announced the Digital Securities Sandbox (DSS) regulations of the 2023 Financial Services and Markets Act, which were laid before Parliament, paving the way for crypto firms to test products and services in the country. According to the government, the regulations will take effect on Jan. 8, with the Bank of England and the U.K. Financial Conduct Authority operating the sandbox.

“The DSS will allow firms and the regulators to test the use of new technology across our financial markets,” said a memo explaining the bill. “In particular, this will involve trialling the use of developing technology (such as distributed ledger technology, or in general technology that facilitates what are commonly referred to as ‘digital assets’) to perform the activities of a central securities depository (specifically notary, settlement and maintenance), and operating a trading venue.”

The MAS has said that rising malware scam cases in Singapore have nothing to do with cryptocurrencies. On the contrary, it claimed, such scams are more prevalent in the fiat economy.

The Monetary Authority of Singapore (MAS) has said that no businesses have qualified to participate in the FinTech Regulatory Sandbox framework as cryptocurrency payment providers.

Responding to a letter criticizing the Singaporean government’s lack of public consultation and oversight on crypto adoption published in the Financial Times, MAS clarified that the country does not have a “crypto sandbox,” but rather a sandbox that supports a broad range of FinTech experimentation.

The letter criticised Singapore for “unwisely” allowing crypto companies access to Singapore’s FAST (Fast and Secure Transfers) interbank payment system, an electronic funds transfer system that enables customers of the participating entities to transfer Singapore Dollar funds from one entity to another in Singapore.

However, the MAS clarified that all businesses with a valid bank account can access the FAST system, which includes crypto businesses, stating that “Payments through FAST are in fiat currencies, not cryptocurrencies.”

The regulator then stated that the rising malware scam cases in Singapore have got nothing to do with cryptocurrencies, claiming that on the contrary, such scams are more prevalent in the fiat economy:

“These scams entail fraudsters taking control of customers’ mobile devices and effecting unauthorized transfers through the banking system in fiat currencies.”

In its fight against money laundering, Singapore provides operational licenses to crypto businesses that can showcase robust Anti-Money Laundering (AML) controls.

“As these measures are progressively implemented from the end of this year onwards, Singapore will have one of the strictest regulatory regimes in the world governing retail access to cryptocurrencies.”

In this regard, the MAS recently consulted the public on a suite of regulatory measures to mitigate the risks posed by cryptocurrencies to retail customers.

Related: Coinbase signals EU, Canada, Brazil, Singapore and Australia as priorities

Former MAS chair, Tharman Shanmugaratnam — who has historically considered crypto as risky investments — won Singapore’s presidential race.

The president-elect reportedly once called crypto assets “highly volatile” and “highly risky as investment products” in 2021 warnings to Singapore-based users in his role as MAS chair.

Magazine: NFT collapse and monster egos feature in new Murakami exhibition