In a recent motion to dismiss a case brought by the Securities and Exchange Commission (SEC), cryptocurrency exchange Kraken argued that the SEC’s legal theory misinterprets crucial aspects of the case. The court document, dated May 9, 2024, claims the SEC fails to identify legitimate investment contracts involved in the transactions on Kraken’s platform. Kraken […]

In a recent motion to dismiss a case brought by the Securities and Exchange Commission (SEC), cryptocurrency exchange Kraken argued that the SEC’s legal theory misinterprets crucial aspects of the case. The court document, dated May 9, 2024, claims the SEC fails to identify legitimate investment contracts involved in the transactions on Kraken’s platform. Kraken […] A report indicates that the U.S. Securities and Exchange Commission (SEC) has issued a Wells Notice to the financial services provider Robinhood. This action by the SEC concerns the company’s operations in the cryptocurrency sector and its listing of crypto assets. SEC Mulls Enforcement Against Robinhood’s Crypto Ventures, Company Says It Is Cooperating The staff […]

A report indicates that the U.S. Securities and Exchange Commission (SEC) has issued a Wells Notice to the financial services provider Robinhood. This action by the SEC concerns the company’s operations in the cryptocurrency sector and its listing of crypto assets. SEC Mulls Enforcement Against Robinhood’s Crypto Ventures, Company Says It Is Cooperating The staff […] In a significant legal move, Consensys has initiated a lawsuit against the U.S. Securities and Exchange Commission (SEC) to protect the Ethereum blockchain from what it deems overreaching regulations. A report further alleges that the SEC issued a Wells Notice to Consensys, asserting that Metamask functions as an “unlicensed broker-dealer.” Consensys Confronts SEC Following Receipt […]

In a significant legal move, Consensys has initiated a lawsuit against the U.S. Securities and Exchange Commission (SEC) to protect the Ethereum blockchain from what it deems overreaching regulations. A report further alleges that the SEC issued a Wells Notice to Consensys, asserting that Metamask functions as an “unlicensed broker-dealer.” Consensys Confronts SEC Following Receipt […]

The joint group was established in light of the ongoing crypto scandal in Hong Kong involving the JPEX crypto exchange.

The Hong Kong Police Force (HKPF) and the Securities and Futures Commission (SFC) have set up a crypto-focused working group to deal with illicit crypto exchange activities.

In an Oct. 4 statement, the SFC said the group was formed after a meeting with the HKPF on Sept. 28 amid continuing arrests and developments in connection to the Dubai-based JPEX exchange.

Days before the meeting, 11 people were detained for questioning over their possible role in the JPEX scandal, in which the SFC has alleged the firm has been promoting its services in the region without a license.

The working group’s aim is to enhance monitoring and investigation of illegal activities carried out by Virtual Asset Trading Platforms (VATPs) and will share information on suspicious activities, assess risks of suspicious exchanges, and collaborate on investigations.

Hong Kong’s regulators previously flagged they were looking to tighten crypto market regulations in the wake of the JPEX saga.

The group comprises officials from the SFC's enforcement division and HKPF officials from its commercial, cybersecurity and financial intelligence and investigations bureaus.

Related: Hong Kong Stock Exchange launches settlement platform powered by smart contracts

In a statement, SFC enforcement director Christopher Wilson said the regulator looked forward to deploying its resources to combat “problematic VATPs and protect the interest of investors.”

Eve Chung, HKPF’s Assistant Commissioner of Police (Crime), said the working group is instrumental in exchanging intelligence and jointly responding to “challenges arising from VATPs, to better protect the general public of Hong Kong.”

The SFC has since published a list of all licensed, deemed licensed, closing down, and application-pending exchange’s along with a list of “suspicious VATPs.”

Magazine: Are DAOs overhyped and unworkable? Lessons from the front lines

Caitlin Long, CEO of crypto bank Custodia, criticized the U.S. government for its handling of a massive crypto fraud that occurred months before the company’s collapse. She made her remarks in a blog post after disclosing evidence to law enforcement. Long’s post followed Custodia’s unsuccessful application to become a member of the Federal Reserve System, […]

Caitlin Long, CEO of crypto bank Custodia, criticized the U.S. government for its handling of a massive crypto fraud that occurred months before the company’s collapse. She made her remarks in a blog post after disclosing evidence to law enforcement. Long’s post followed Custodia’s unsuccessful application to become a member of the Federal Reserve System, […]

Paxos said it will engage with the US securities regulator on the matter and is prepared to "vigorously litigate if necessary."

Paxos Trust Company has released a statement noting that it "categorically disagrees" with the United States securities regulator which has painted Binance USD (BUSD) as a security.

In the Feb. 13 statement, the BUSD issuer confirmed recent reports that it had received a Wells notice from the United States Securities and Exchange Commission (SEC) over BUSD and its alleged failure to register the offering under federal securities laws.

END/ Paxos remains dedicated to the development of stablecoins, tokenization & #blockchain technology. We’ll continue serving the world’s most respected and established companies to create a more open financial system.

— Paxos (@PaxosGlobal) February 13, 2023

"Paxos categorically disagrees with the SEC staff because BUSD is not a security under the federal securities laws," Paxos said.

The firm noted it had received the notice on Feb. 3, adding that "there are unequivocally no other allegations against Paxos."

"We will engage with the SEC staff on this issue and are prepared to vigorously litigate if necessary," it added.

On Feb. 13, New York Department of Financial Services (NYDFS) ordered Paxos to halt the issuance of BUSD.

Following the order, Paxos announced in a Feb. 13 Twitter post it will halt minting new BUSD tokens effective Feb. 21.

3/ Paxos will continue to manage all outstanding BUSD reserves, ensuring all BUSD are always backed 1:1 with US dollar-denominated reserves held in bankruptcy remote accounts.

— Paxos (@PaxosGlobal) February 13, 2023

However, Paxos has said BUSD will remain fully supported and redeemable to onboarded customers through at least February 2024.

"New and existing Paxos customers will be able to redeem their funds in US dollars or convert their BUSD tokens to Pax Dollar (USDP), a regulated US dollar-backed stablecoin also issued by Paxos Trust," Paxos said.

Related: SEC lawsuit against Paxos over BUSD baffles crypto community

New York State's Department of Financial Services, or NYDFS, reportedly received a complaint from stablecoin issuer Circle regarding Binance's reserves prior to its crackdown on BUSD.

Binance CEO Changpeng "CZ" Zhao says the exchange will continue to support BUSD despite issuer Paxos being ordered to stop minting the stablecoin by the U.S. SEC and New York regulators.

According to a report published on Feb. 12, 2023, the New York-based financial institution and technology company, Paxos, has received a Wells Notice from the U.S. Securities and Exchange Commission (SEC) regarding alleged violations of investor protection laws. Paxos revealed the following day that it would no longer mint BUSD and it was ending its […]

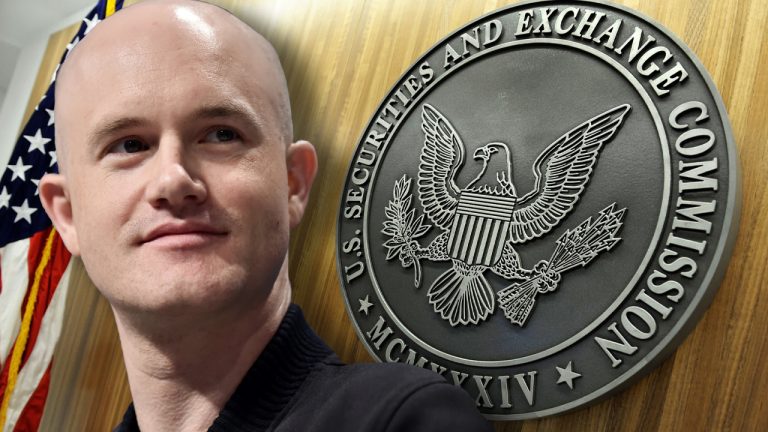

According to a report published on Feb. 12, 2023, the New York-based financial institution and technology company, Paxos, has received a Wells Notice from the U.S. Securities and Exchange Commission (SEC) regarding alleged violations of investor protection laws. Paxos revealed the following day that it would no longer mint BUSD and it was ending its […] Brian Armstrong, CEO of Coinbase, expressed concern about rumors that the U.S. Securities and Exchange Commission (SEC) may eliminate cryptocurrency staking for retail customers in the United States. Armstrong insisted that “staking is not a security” and that the trend allows users to “participate directly in running open crypto networks.” Coinbase CEO Vocalizes Worry Over […]

Brian Armstrong, CEO of Coinbase, expressed concern about rumors that the U.S. Securities and Exchange Commission (SEC) may eliminate cryptocurrency staking for retail customers in the United States. Armstrong insisted that “staking is not a security” and that the trend allows users to “participate directly in running open crypto networks.” Coinbase CEO Vocalizes Worry Over […]

The Filipino securities regulator is moving to enact tighter rules on crypto, crypto companies and other financial products using blockchain technology.

The Philippines Securities and Exchange Commission (SEC) is seeking to bring cryptocurrencies under its scope and beef up its authority over the local cryptocurrency industry under new draft rules.

According to a Jan. 25 report in local media outlet, the Manila Bulletin, the securities regulator put forward for public comment draft rules relating to financial products and services which also cover cryptocurrencies and digital financial products.

The SEC said in a statement the draft rules will operationalize a newly signed law and give it “rule-making, surveillance, inspection, market monitoring, and more enforcement powers.”

The guidelines expand the definition of a security to include “tokenized securities products” or other financial products using blockchain or distributed ledger technology (DLT).

Other financial products, including digital financial products and services relating to those accessed and delivered through digital channels along with their providers, will also come under the SEC’s remit.

The ability to enforce securities regulations is similarly expanded. The SEC would be able to restrict service providers from collecting excessive interest, fees, or charges.

The regulator would also have the power to disqualify or suspend directors, executives or any other employee found to be in violation of the laws. It could also suspend a firm's entire operation.

Local laws allow the SEC to create its own rules for applying legislation in its jurisdiction, the central bank of the Philippines and the country’s insurance regulator is also allowed to create rules to supplement related laws.

Related: Navigating the world of crypto: Tips for avoiding scams

The latest development marks a continuation of the regulator's heavy crackdown on cryptocurrencies.

In late December 2022, the SEC warned the public against using unregistered exchanges that were operating within the country claiming a number of exchanges were “unlawfully allowing” Filipinos to access their platforms.

In August 2022, the Philippine central bank said it was taking a three-year-long break from accepting new virtual asset service provider (VASP) applications, with the process expected to be reopened on Sept. 1, 2025.

Ripple CEO Brad Garlinghouse says that he is “optimistic” that the Securities and Exchange Commission (SEC) lawsuit over xrp “will certainly be resolved in 2023.” He added that it could even be resolved in the first half of this year. “I feel very good about where we are relative to the law and the facts, […]

Ripple CEO Brad Garlinghouse says that he is “optimistic” that the Securities and Exchange Commission (SEC) lawsuit over xrp “will certainly be resolved in 2023.” He added that it could even be resolved in the first half of this year. “I feel very good about where we are relative to the law and the facts, […]