On Tuesday, the U.S. Senate Committee on Banking, Housing, and Urban Affairs, also known as the Senate Banking Committee, held a hearing to discuss the recent bank collapses in the United States and the regulatory response. Throughout the testimonies, digital assets and crypto businesses were mentioned. Senate Banking Committee chairman Sherrod Brown claimed on Tuesday […]

On Tuesday, the U.S. Senate Committee on Banking, Housing, and Urban Affairs, also known as the Senate Banking Committee, held a hearing to discuss the recent bank collapses in the United States and the regulatory response. Throughout the testimonies, digital assets and crypto businesses were mentioned. Senate Banking Committee chairman Sherrod Brown claimed on Tuesday […]

United States President Joe Biden said on Twitter that he is “firmly committed” to holding those responsible for the Silicon Valley Bank and Signature Bank collapse “fully accountable.”

The president of the United States, Joe Biden, has vowed to hold those responsible for the failure of Silicon Valley Bank and Signature Bank while assuring Americans that their deposits are safe.

On March 12, the New York District of Financial Services took possession of Signature Bank. The Federal Reserve said that the crypto-friendly bank was closed to protect the U.S. economy and strengthen public confidence in the banking system.

The Fed also announced a $25 million fund aimed at backstopping certain banks that could face liquidity issues in the future.

Biden tweeted to his 29.9 million followers on March 13 that he’s pleased that the agencies have “reached a solution that protects workers, small businesses, taxpayers and our financial system.”

At my direction, @SecYellen and my National Economic Council Director worked with banking regulators to address problems at Silicon Valley Bank and Signature Bank.

— President Biden (@POTUS) March 13, 2023

I’m pleased they reached a solution that protects workers, small businesses, taxpayers, and our financial system. https://t.co/CxcdvLVP6l

The president added he was also “firmly committed” to holding those responsible for the mess “fully accountable.” He added that he would “have more to say” in an address on Monday, March 13.

Meanwhile, a host of other United States politicians have also shared praise over the recent federal regulator actions aimed at stemming contagion from the recent banking collapses.

U.S. Senator Sherrod Brown and Representative Maxine Waters said they were also pleased to see that both insured and uninsured SVB depositors would be covered, according to March 12 statement by the U.S. Senate Banking and Housing Committee:

“Today’s actions will enable workers to receive their paychecks and for small businesses to survive, while providing depository institutions with more liquidity options to weather the storm.”

“As we work to better understand all of the factors that contributed to the events of the last several days and how to strengthen guardrails for the largest banks, we urge financial regulators to ensure the banking system remains stable, strong, and resilient, and depositors’ money is safe,” the statement added.

Silicon Valley Bank depositors, both insured & uninsured, will be made whole by the plan from the FDIC, the Federal Reserve, the Treasury & the White House. And the Fed has created a new facility to support all banks that need liquidity to ensure our banking system is safe.

— Maxine Waters (@RepMaxineWaters) March 13, 2023

Meanwhile, U.S. Securities Exchange Commission Chairman Gary Gensler has used the moment to double down on his agency’s pursuit of wrongdoers, without naming any industries in particular.

The chairman reinforced that the SEC would be on the lookout for violators of U.S. securities laws in a March 12 statement:

“In times of increased volatility and uncertainty, we at the SEC are particularly focused on monitoring for market stability and identifying and prosecuting any form of misconduct that might threaten investors, capital formation, or the markets more broadly.”

“Without speaking to any individual entity or person, we will investigate and bring enforcement actions if we find violations of the federal securities laws,” the SEC chairman added.

The shuttering of SVB temporarily triggered the depegging of Circle's USD Coin (USDC) to as low as $0.88 on March 11, as $3.3 billion of Circle’s $40 billion USDC reserves are held by SVB.

However, USDC is nearly back at $1 after the Federal Reserve confirmed that all customer deposits at Signature Bank and SVB would be made in “whole.”

Related: US Fed announces $25B in funding to backstop banks

Another prominent crypto-bank, Silvergate Bank, announced last week that it would shut down and voluntarily liquidate “in light of recent industry and regulatory developments.”

Shortly after, Gensler wrote a March 9 opinion piece for The Hill that threatened U.S. crypto companies to “do their work within the bounds of the law” or be met with enforcement action.

As Chair of @SECGov, I have one goal with regard to the crypto markets: to ensure that investors and the markets receive all the protections that they would in any other securities market. How?

— Gary Gensler (@GaryGensler) March 9, 2023

Read my op-ed in @thehill:

The demise of the crypto-friendly bank has prompted discussion about who tipped the first domino, and where crypto firms can turn for their banking needs.

The voluntary liquidation of Silvergate Bank has sparked many to share their thoughts about the source of its troubles and the broader impact of the crypto-friendly bank’s collapse on crypto.

From lawmakers to crypto analysts, crypto firm executives to commentators — nearly everyone’s had something to say regarding the recent announcement from Silvergate.

Some United States lawmakers have used the moment to make a comment about the state of the crypto industry, labeling it a “risky, volatile sector,” which “spreads risk across the financial system.”

Senator Elizabeth Warren called Silvergate’s failure “disappointing, but predictable,” calling for regulators to “step up against crypto risk.”

As the bank of choice for crypto, Silvergate Bank's failure is disappointing, but predictable. I warned of Silvergate's risky, if not illegal, activity—and identified severe due diligence failures. Now, customers must be made whole & regulators should step up against crypto risk.

— Elizabeth Warren (@SenWarren) March 8, 2023

Senator Sherrod Brown also chimed in, sharing his concern that banks that get involved with crypto are putting the financial system at risk and reaffirming his desire to “establish strong safeguards for our financial system from the risks of crypto.”

The senators’ remarks have sparked criticism from the community, some of whom argue it was not a crypto problem and that fractional-reserve banking was to blame — as Silvergate held far more in-demand deposits compared to cash on hand.

.@SenSherrodBrown, you’re wrong that #crypto triggered Silvergate’s issue. What did it was $13.3bn in demand deposits that depositors cld withdraw in minutes, but only $1.4bn of cash. Had $SI held $13.3bn of cash, the bank run wouldn’t have impaired its capital. Not a crypto… https://t.co/nGlfHwUcBN

— Caitlin Long ⚡️ (@CaitlinLong_) March 8, 2023

Several companies have instead used the recent announcement from Silvergate to reiterate their lack of or now-severed ties with the firm.

Binance CEO Changpeng Zhao assured customers on Twitter that the crypto exchange does not have assets stored with Silvergate, while peer exchange Coinbase has also assured its followers that no customer funds were held by the bank.

Update: We’re sorry to see Silvergate make the tough decision to wind down their operations. They were a partner & contributors to the growth of the cryptoeconomy. Coinbase has no client or corporate cash at Silvergate. Client funds continue to be safe, accessible & available. https://t.co/78oMrLQ6VH

— Coinbase (@coinbase) March 9, 2023

Meanwhile, Nic Carter, co-founder of venture firm Castle Island and crypto intelligence firm Coin Metrics, suggested that it was the government that “hastened the collapse” of Silvergate by launching investigations and legal attacks on it.

“They’re the arsonist and the firefighter in one,” he wrote.

The CEO of financial services firm Lumida — Ram Ahluwalia — had a similar take, arguing in a tweet that Silvergate faced a bank run after a senator’s letter had undermined public trust in the firm. He saidthat “Silvergate was denied due process.”

Related: Marathon Digital terminates credit facilities with Silvergate Bank

In an earlier blog post, Carter referred to “Operation Choke Point 2.0” as being underway, claiming that the U.S. government is using the banking sector to organize “a sophisticated, widespread crackdown against the crypto industry.”

Others believe the collapse of Silvergate won’t necessarily hurt the crypto industry, but along with proposed changes to tax laws, would exacerbate the exodus of crypto firms from the U.S.

- Silvergate winding down operations in light of “regulatory developments”

— Tom ️ (@thomasjeans) March 9, 2023

- Proposed changes to capital gains

- Proposed elimination of tax loss harvesting

none of these are bad for crypto…

they’re just reasons for passionate builders to operate outside the US

With Silvergate winding down, some have also asked where crypto firms will turn to now.

Coinbase, which previously accepted payments via Silvergate, announced on March 3 that it would facilitate institutional client cash transactions for its prime customers with its other banking partner, Signature Bank.

Signature Bank, however, announced in December that it intended to reduce its exposure to the crypto sector by reducing deposits from clients holding digital assets.

To further reduce its crypto exposure, on Jan. 21 Signature imposed a minimum transaction limit of $100,000 on transactions it would process through the SWIFT payment system on behalf of crypto exchange Binance.

Federal Reserve Chairman Jerome Powell has outlined several risks related to crypto activities during a hearing before the Senate Committee on Banking, Housing, and Urban Affairs. While stating that the Fed sees turmoil, fraud, a lack of transparency, and run risk in the crypto space, he stressed: “We don’t want regulation to stifle innovation.” Fed […]

Federal Reserve Chairman Jerome Powell has outlined several risks related to crypto activities during a hearing before the Senate Committee on Banking, Housing, and Urban Affairs. While stating that the Fed sees turmoil, fraud, a lack of transparency, and run risk in the crypto space, he stressed: “We don’t want regulation to stifle innovation.” Fed […]

Despite suggesting a possible ban, U.S. Senator Sherrod Brown stated it would be “very difficult” to do so because activity “would go offshore.”

United States Banking Committee chairman Sherrod Brown has suggested that the Securities Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) should perhaps consider a ban on cryptocurrencies.

Brown’s comments were made during a Dec. 18 appearance on NBC’s “Meet the Press,” although the senator quickly added that a ban would be difficult to enforce:

“We want them to do what they need to do at the same time, maybe banning it, although banning it is very difficult because it would go offshore, and who knows how that would work.”

In response to a host's earlier question about Senator Jon Tester, who believes cryptocurrencies should be banned, Brown said thathe shares the “same thought.”

The Ohio representative saidthat over the last 18 months he has been “educating” his colleagues and the public on the dangers of cryptocurrencies, calling for imminent and aggressive action to be taken.

“I’ve already gone to the Treasury and the Secretary and asked for a government-wide assessment through all the various regulatory agencies [....] The SEC has been particularly aggressive, and we need to move forward that way and legislatively if it comes to that,” he added.

Brown cited FTX’s shock collapse as an example of why a ban may be worth considering but added it “is only one huge part of this problem.”

He argued cryptocurrencies are “dangerous” and a “threat to national security,” citing North Korean cybercriminal activity, drug trafficking, human trafficking and the financing of terrorism as some of the problems they've exacerbated.

The Banking Committee chairman has expressed his skepticism toward crypto for over a year now, having most recently voiced concerns on the matters of stablecoin issuance as well as cryptocurrency advertising and marketing campaigns.

Brown released a Nov. 30 statement calling for an “all-of-government” approach to regulate the industry and on Dec. 13 applauded the U.S. Department of Justice for filing criminal charges against former FTX CEO Sam Bankman-Fried, who’s currently behind bars in the Bahamas awaiting extradition to the U.S.

I applaud the @TheJusticeDept and the Bahamian authorities for holding Sam Bankman-Fried accountable.

— Sherrod Brown (@SenSherrodBrown) December 13, 2022

The @SenateBanking and Housing Committee will continue working to uncover crypto's risks to consumers, our financial system, and our national security. https://t.co/dsSJ09PzYx

Related: US senator: There's 'no reason why' crypto should exist

Not all of Senator Brown’s peers seem to share his thoughts.

Senator Tom Emmer stated on Nov. 23 that FTX’s fall wasn’t a “crypto failure” but rather a failure caused by centralized actors.

Emmer also holds the view that crippling regulation would stifle industry innovation in the U.S., causing it to lose its position of global market dominance — something that many believe to be already unfolding.

It should also be noted that the incoming chairman of the House Committee on Financial Service, Patrick McHenry, is pro-crypto. This week he called for a delay on crypto tax changes in order to seek more clarification on the original, “poorly drafted” tax provision.

A U.S. lawmaker has demanded answers from Apple CEO Tim Cook and Google CEO Sundar Pichai about their measures against fake cryptocurrency apps appearing in the Apple App Store and the Google Play store. “Millions of Americans use mobile apps to invest in unregulated digital assets,” said Senator Sherrod Brown. “Reports have emerged of fake […]

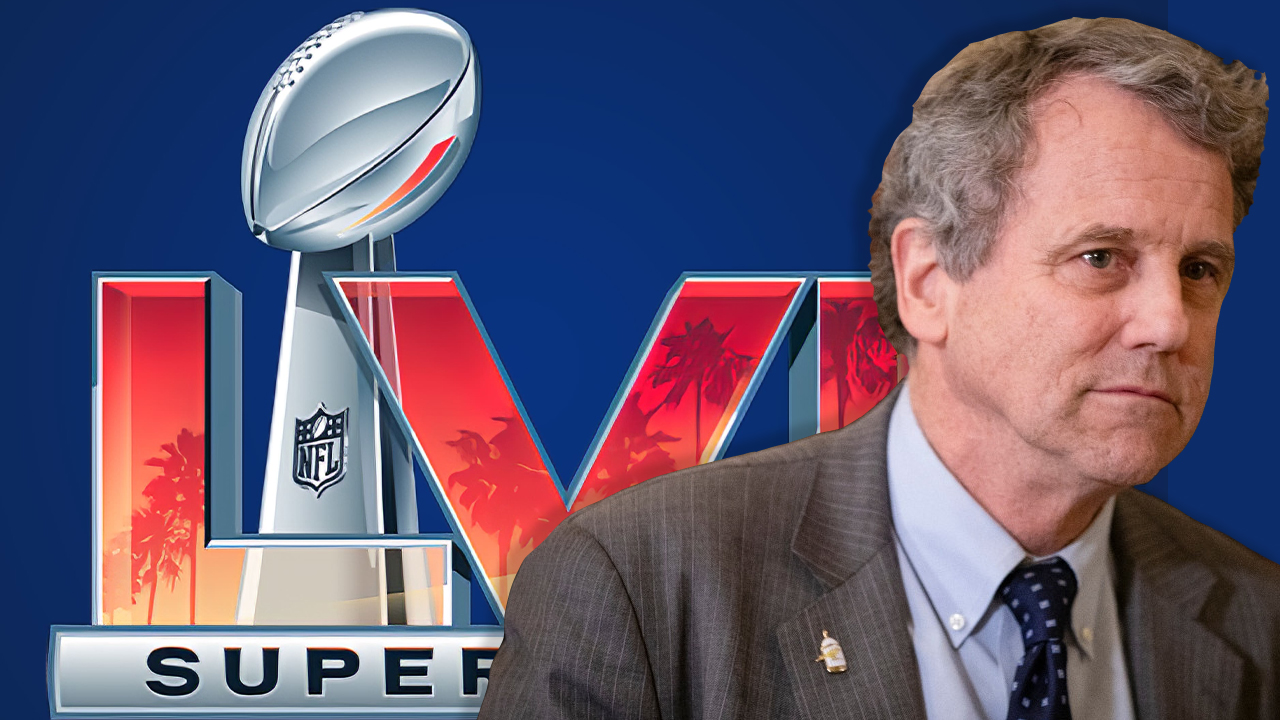

A U.S. lawmaker has demanded answers from Apple CEO Tim Cook and Google CEO Sundar Pichai about their measures against fake cryptocurrency apps appearing in the Apple App Store and the Google Play store. “Millions of Americans use mobile apps to invest in unregulated digital assets,” said Senator Sherrod Brown. “Reports have emerged of fake […] The United States senator from Ohio and Senate Banking Committee chief Sherrod Brown is not a fan of cryptocurrencies. This week during Tuesday’s stablecoin hearing, Brown criticized all the cryptocurrency companies who advertised during the Super Bowl this past weekend and stressed that he’s “never seen the Federal Reserve buy a multimillion-dollar commercial for U.S. […]

The United States senator from Ohio and Senate Banking Committee chief Sherrod Brown is not a fan of cryptocurrencies. This week during Tuesday’s stablecoin hearing, Brown criticized all the cryptocurrency companies who advertised during the Super Bowl this past weekend and stressed that he’s “never seen the Federal Reserve buy a multimillion-dollar commercial for U.S. […] U.S. Senator Sherrod Brown has sent letters to cryptocurrency exchanges and stablecoin issuers, including Coinbase, Gemini, Binance, and Tether, asking how they are protecting consumers and investors. “I have significant concerns with the non-standardized terms applicable to redemption of particular stablecoins,” the senator said. US Senator Raises Concerns Regarding Stablecoins U.S. Senator Sherrod Brown (D-Ohio), […]

U.S. Senator Sherrod Brown has sent letters to cryptocurrency exchanges and stablecoin issuers, including Coinbase, Gemini, Binance, and Tether, asking how they are protecting consumers and investors. “I have significant concerns with the non-standardized terms applicable to redemption of particular stablecoins,” the senator said. US Senator Raises Concerns Regarding Stablecoins U.S. Senator Sherrod Brown (D-Ohio), […] U.S. Senator Sherrod Brown says cryptocurrencies are not real dollars and they “put Americans’ hard-earned money at risk.” Referring to decentralized finance (defi) as “a shady, diffuse network of online funny money,” he said, “if we want a solution to Americans’ legitimate fears about our banking system, shady start-ups are not the answer.” Senator Brown’s […]

U.S. Senator Sherrod Brown says cryptocurrencies are not real dollars and they “put Americans’ hard-earned money at risk.” Referring to decentralized finance (defi) as “a shady, diffuse network of online funny money,” he said, “if we want a solution to Americans’ legitimate fears about our banking system, shady start-ups are not the answer.” Senator Brown’s […]