US Congressman Tom Emmer (R-Minnesota) thinks crypto-critical lawmakers and regulators just want to maintain their control over the country’s financial system. Emmer, the House Majority Whip and a crypto supporter, says in a new interview with Laura Shin that crypto shouldn’t be a partisan issue. He calls crypto-skeptical Senator Elizabeth Warren (D-Massachusetts) a “control-freak senator.” […]

The post US Congressman Tom Emmer Says ‘Control Freak’ Senators and ‘Bad-Faith’ Regulators Want To Control Crypto appeared first on The Daily Hodl.

The crypto-friendly congressman questioned Gary Gensler’s supposed ‘open door policy” suggesting that he “might have an open door, but it is an enter-at-your-own-risk-door.”

Crypto-friendly Congressman Tom Emmer has slammed U.S. Securities and Exchange Commission (SEC) chair Gary Gensler for his approach to cryptocurrency regulation, labeling him as a “bad faith regulator.”

Great interview by @laurashin with @GOPMajorityWhip! Congress is working in their districts this week and next, but expect a VERY busy last 2 weeks of April for crypto policy as legislation and oversight of the regulators ramps up. Stay tuned https://t.co/ZSsTFJ9pt7

— Ron Hammond (@RonwHammond) April 7, 2023

During an April 7 appearance on the Unchained podcast hosted by author and crypto journalist Laura Shin, Emmer didn’t mince his words as he questioned Gensler’s oversight on the crypto sector:

“This guy in my mind, is a bad-faith regulator. He’s been blindly spraying the crypto community with enforcement actions while completely missing the truly bad actors.”

Emmer pointed to the example of Coinbase, which before being slapped with a Wells Notice by the SEC in March, was actively trying to work with the agency by getting compliance feedback on staking products, among other things.

“Gary Gensler might have an open door, but it is an enter-at-your-own-risk door, because what he does is, despite several meetings over several months, Gary Gensler’s SEC refused to provide feedback,” he said, adding that:

“And instead, after all these meetings and nothing happening, the SEC slapped Coinbase with a Wells Notice regarding the very issues on which Coinbase was asking for their feedback.”

Since Gensler took over the helm of the SEC back in April 2021, he has repeatedly suggested that the agency has an amicable ‘open door policy’ and called on crypto firms to register with the SEC to maintain compliance with securities law.

This is mostly down to his view that nearly all crypto assets apart from Bitcoin (BTC) are classified as securities, and thus the sector should be primarily regulated by the SEC.

Related: US lawmaker accuses FDIC of using banking instability to attack crypto

Despite this, Coinbase CEO Brian Armstrong has highlighted the difficulty of dealing with the SEC on several occasions, while other figures such as Kraken CEO Jesse Powell have echoed similar sentiments.

A major issue raised by many in the crypto community is the apparent anti-crypto-focused ‘regulation by enforcement’ approach stemming from the SEC and broader U.S. government.

Commenting on such, Emmer ultimately stated:

“This is clearly not the way the government should be serving Americans, and that it sends a clear message, I believe, to the broader crypto community, and that directly is ‘Gary Gensler is not regulating in good faith’.”

And if not, why is our government controlling one of the few private sector 24/7 money rails that supported the digital economy?

— Tom Emmer (@GOPMajorityWhip) March 29, 2023

A U.S. lawmaker has introduced the Blockchain Regulatory Certainty Act to ensure that developers and non-custodial service providers in the crypto space are not considered money transmitters and are not subject to the same level of regulation as custodial cryptocurrency exchanges. “The longer we delay providing this commonsense clarification, the greater risk that this transformative […]

A U.S. lawmaker has introduced the Blockchain Regulatory Certainty Act to ensure that developers and non-custodial service providers in the crypto space are not considered money transmitters and are not subject to the same level of regulation as custodial cryptocurrency exchanges. “The longer we delay providing this commonsense clarification, the greater risk that this transformative […]

Ted Cruz said it is “more important than ever” to ensure the financial privacy of American citizens is preserved.

Republican Senator Ted Cruz has introduced a bill to block the United States Federal Reserve from launching a “direct-to-consumer” central bank digital currency (CBDC).

In a March 21 statement, Cruz said he introduced the bill to prevent the Fed from developing a retail CBDC “which could be used as a financial surveillance tool by the federal government.”

Cruz stated it’s “more important than ever” to ensure U.S. policy on digital currencies protects “financial privacy, maintain’s the dollar’s dominance and cultivates innovation,” and added:

“CBDCs that fail to adhere to these three basic principles could enable an entity like the Federal Reserve to mobilize itself into a retail bank, collect personally identifiable information on users, and track their transactions indefinitely.”

Cruz claimed the federal government has “no authority to unilaterally establish” a CBDC.

“We should be empowering entrepreneurs, enabling innovation, and increasing individual freedom — not stifling it,” he stressed.

The federal government has no authority to unilaterally establish a central bank currency.

— Senator Ted Cruz (@SenTedCruz) March 21, 2023

Read about my new bill in @FoxBusiness: Ted Cruz introduces bill blocking Fed from adopting central bank digital currencyhttps://t.co/LoX3u41nA4

Cruz’s anti-CBDC bill has the backing of Republican Senators Mike Braun of Indiana and Chuck Grassley of Iowa.

In statements, both expressed the belief that a CBDC would be used as a surveillance tool.

If the bill is passed into law, it would ensure that the state isn’t “snooping” on the finances of hardworking Americans, Grassley stated:

"The American people ought to be able to spend their money how they choose without the possibility that every transaction could be tracked by the government."

The anti-CBDC bill is a second attempt by Cruz, Braun and Grassley, who introduced a similar bill on March 30, 2022 to prohibit the Fed from issuing a CBDC directly to individuals.

However, nearly 12 months later, the bill still hasn’t moved past the introduction phase.

Meanwhile, considerable progress is being made on a U.S. dollar CBDC since President Joe Biden signed an executive order to “Ensuring Responsible Development of Digital Assets” in March, 2022.

In November, the Federal Reserve Bank of New York and several large financial firms including BNY Mellon, Citi, HSBC, and Wells Fargo participated in a 12-week digital dollar pilot program with MasterCard and SWIFT.

Related: ‘Programmable money should terrify you’ — Layah Heilpern

Cruz, Braun and Grassley aren’t the only U.S. politicians fighting to stamp out CBDCs.

On March 20, Florida’s Governor Ron DeSantis called on state lawmakers to introduce legislation banning the digital dollar in Florida.

DeSantis compared the digital dollar to China’s digital yuan and claimed the e-CNY has been used to extensively “monitor citizen behavior,” saying:

“Any way they can get into society to exercise their agenda, they will do it. So, what the central bank digital currency is all about is surveilling Americans and controlling behavior of Americans.”

No CBDC in Florida https://t.co/p9pwSTmrlN

— Ron DeSantis (@GovRonDeSantis) March 20, 2023

U.S. Congressman Tom Emmer recently introduced an anti-CBDC bill of his own on Feb 22.

Emmer also spoke of the privacy concerns surrounding CBDCs saying a programmable dollar could be “easily weaponized” as a spying tool to “choke out politically unpopular activity.”

Magazine: Are CBDCs kryptonite for crypto?

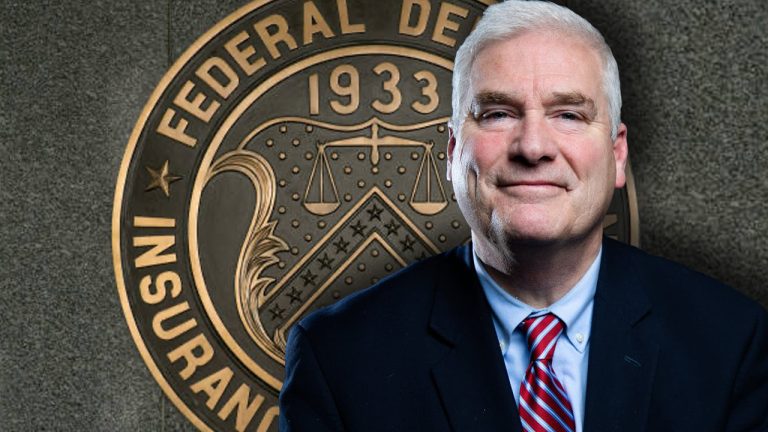

On Wednesday, Tom Emmer, the U.S. Republican congressman from Minnesota, revealed he sent a letter to Martin Gruenberg, the chairman of the Federal Deposit Insurance Corporation (FDIC), regarding reports that the FDIC is “weaponizing recent instability” in the U.S. banking industry to “purge legal crypto activity” from the United States. Specifically, Emmer asked Gruenberg if […]

On Wednesday, Tom Emmer, the U.S. Republican congressman from Minnesota, revealed he sent a letter to Martin Gruenberg, the chairman of the Federal Deposit Insurance Corporation (FDIC), regarding reports that the FDIC is “weaponizing recent instability” in the U.S. banking industry to “purge legal crypto activity” from the United States. Specifically, Emmer asked Gruenberg if […]

A Republican House leader says Congress will shape the future of Bitcoin (BTC) and cryptocurrency in the US – not the White House. House majority whip Tom Emmer is outlining a list of pro-crypto proposals making their way through the House of Representatives that he believes would bring constructive clarity to the emerging industry. And […]

The post Future of Bitcoin and Crypto Will Be Determined by Congress – Not the Biden Administration, Says House GOP Leader appeared first on The Daily Hodl.

Congressman Tom Emmer made the anti-central bank digital currency comments to an audience at the Cato Institute, a libertarian think tank in Washington.

United States Representative Tom Emmer believes the launch of programmable central bank digital currency in the country could strip American citizens of their financial privacy.

Speaking on March 9 at the Cato Institute, a Washington D.C.-based libertarian think tank, Emmer explained that the programmable CBDC would be “easily weaponized” as a spying tool to “choke out politically unpopular activity,” among other things:

"As the federal government seeks to maintain and expand financial control to which it has grown accustomed, the idea of the central bank digital currency has gained traction within the institutions of power in the United States as a government-controlled programmable money that can be easily weaponized into a surveillance tool.”

The Minnesota congressman introduced the CBDC Anti-Surveillance Act on Feb. 22 to halt the progress of the Digital Dollar Project, which has seen considerable developments in how it would be used since the second version of its white paper was released in mid-January.

“Recent actions from the Biden Administration make it clear that they are not only itching to create a digital dollar but they are willing to trade Americans' right to financial privacy for the surveillance-style CBDC,” he added.

The Blockchain Regulatory Certainty Act

— Tom Emmer (@GOPMajorityWhip) March 9, 2023

The Securities Clarity Act

The Safe Harbor for Taxpayers with Forked Assets Act

The CBDC Anti-Surveillance State Act

The future of crypto in the US will be determined by Congress and the American People - not the Administrative State. pic.twitter.com/OQ0uwxjVxX

Emmer suggested that the blockchain-enabled “ownership economy” is “threatening” many bureaucrats in Washington, as it “shifts economic power from centralized institutions back into the hands of the people.”

While the latest Federal Reserve discussion paper explained that it would only issue the CBDC in the context of “broad public and cross-governmental support," Emmer and many others are concerned with the potential dangers that could ensue:

“It not only tracks transaction level data down to the individual user but also the ability to program the CBDC to choke out politically unpopular activity.”

Related: ‘Programmable money should terrify you’ — Layah Heilpern

Emmer also argued that decentralized cryptocurrencies can serve as a solution to the mismanagement of the U.S. monetary system and restore many of the “American values” that led the nation to become an economic powerhouse in the 20th century — privacy, individual sovereignty and free markets.

He added that by even experimenting with CBDCs, the U.S. is going against these values:

“Nothing could be more dangerous than adhering to a manufactured sense of urgency like this and ultimately developing a CBDC that is not open, permissionless and private.”

Fanusie doesn’t believe the Chinese-led CBDC movement on the global stage will replace the U.S. dollar, but it may cause a series of geopolitical headaches.

A cryptocurrency researcher and former CIA analyst believes the United States government’s relatively slow start on Central Bank Digital Currency (CBDC) development may result in it losing grip on controlling the global financial system.

Yaya Fanusie, the policy head at the crypto advocacy group the Crypto Council for Innovation explained in a Feb. 28 Bloomberg interview that sanctioned states are looking to transact on financial infrastructure that isn’t controlled or heavily influenced by the U.S. in order to move funds more freely cross-borders.

If the U.S. continues to sit on the “sidelines” and lag behind on CBDC adoption, Fanusie believes this may spell “trouble” and cause unforeseen “geopolitical implications” over time:

Fanusie explained that state-issued CBDCs could be a part of this financial infrastructure that becomes globally adopted, and that if the U.S. has little influence over these new standards, then this “impacts U.S state economic statecraft.”

“The potency of our sanctions power comes from the centrality of the U.S. to the financial global infrastructure. So if that shifts a little bit, it doesn't mean that China is going to take over or that the yuan is going to displace the dollar but if there's a viable new rail where sanctioned actors can now transact, that’s trouble.”

The U.S. Federal Reserve has however recently made progress on its CBDC — the Digital Dollar Project — having released the latest version of its whitepaper on Jan. 18:

Today we are proud to release DDP's 2023 white paper update where we revisit our "champion model" proposed in 2020, provide recommendations to the US government and private sector and look ahead to the next stage in #CBDC developments @giancarloMKTS https://t.co/bX5u4zfqMc pic.twitter.com/si2joxbkq9

— The Digital Dollar Project (@Digital_Dollar_) January 18, 2023

However, the Federal Reserve has not received approval from the U.S. government to proceed with the CBDC project.

Fanusie highlighted that China has benefited from a near-first mover advantage, having explored CBDCs since 2014 and launching the pilot version of its digital yuan (e-CNY) on Jan. 4, 2022, which Fanusie says has processed “millions of transactions” across “millions of wallets” so far.

Fanusie added that there is an “array of pilots” testing out smart contracts to add programmability into the CBDC and that China helping other countries adopt similar standards.

He added there is possibly an unspoken “race” going on in the CBDC frontier as nations look to gain a geopolitical edge.

“That's happening whether we want to like it or not.”

However previous commentators on the CBDC race between China and the U.S. have said that China’s CBDC ambition is purely about domestic dominance rather than trying to beat the U.S. dollar.

Related: What are CBDCs? A beginner's guide to central bank digital currencies

CBDCs run on state-controlled ledgers, which are reported to be more efficient and easier to use in some cases than decentralized public networks, such as Bitcoin and Ethereum.

However, some opponents of CBDCs believe states are adopting blockchain-powered CBDCs to maintain a degree of financial control over their citizens.

Part of the pushback in the U.S. recently came from pro-crypto U.S. Congressman Tom Emmer, who recently introduced the CBDC Anti-Surveillance State Act in an effort to protect the financial privacy of U.S. citizens from actions by the Federal Reserve:

Today, I introduced the CBDC Anti-Surveillance State Act to halt efforts of unelected bureaucrats in Washington, DC from stripping Americans of their right to financial privacy. pic.twitter.com/lONbHFZMk7

— Tom Emmer (@GOPMajorityWhip) February 22, 2023

Daleep Singh argues that crowding out cryptocurrencies by establishing a CBDC in the United States would protect the country's national interests.

The creation of a United States digital dollar would “crowd out” the cryptocurrency ecosystem and protect the national security of the U.S. according to a former top advisor in president Joe Biden’s administration.

Daleep Singh — a former Deputy National Security Advisor for International Economics in the Biden administration — made the comments at a Feb. 28 Senate Banking Committee hearing, suggesting that cryptocurrencies facilitate ransomware attacks and contribute to the evasion of U.S. sanctions.

Singh believes the U.S. government embracing a Central Bank Digital Currency (CBDC) “is the single best step that we could take [to protect national interests] because it would crowd out the ecosystem of crypto.”

Singh frames “crowding out” as a desirable development in his discussion of a CBDC but the phrase is generally used by economists to refer to how investments from governments can drive down or eliminate investments from private firms that could limit job creation and slow economic growth.

In an interview with Cointelegraph in May 2022, Franklin Noll — the president of Consulting firm Noll Historical Consulting — also suggested that CBDCs could crowd out crypto, noting:

“The downside for crypto is that CBDCs will work to crowd out private cryptocurrencies, especially stablecoins focused on retail payment areas. Cryptocurrencies will stay in niches in the payment system where they serve unique functions and provide specialized services.”

While China has implemented its own CBDC, the U.S. is still exploring the potential benefits and risks associated with CBDCs.

Yana Fanusie, the policy lead at the crypto advocacy group Crypto Council for Innovation suggested in a Mar. 1 interview with Bloomberg that China is “leading the way” on CBDC development while the U.S. is “on the sidelines.”

Related: Bank of England has no tech skills to issue CBDC yet: Deputy governor

He added that developing alternative financial rails could spell “trouble” to the U.S. as they affect the “potency” of its power to enforce sanctions.

Others are more critical of the digital dollar plans such as Representative Tom Emmer, who introduced legislation on Feb. 22 prohibiting the Federal Reserve from implementing monetary policy based on a CBDC and issuing a digital dollar directly to individuals.

Emmer is concerned that a CBDC could impact the financial privacy of American citizens, and be developed into a “dangerous surveillance tool.”

The Biden admin wants to create a surveillance-style digital dollar that is NOT:

— Tom Emmer (@GOPMajorityWhip) February 28, 2023

❌Open

❌Permissionless

❌Private

That's why I introduced legislation to prevent unelected bureaucrats from stripping Americans of their right to financial privacy. pic.twitter.com/55e2nfmlJy