“We’re seeing people up and down the Cabinet who have been supportive of digital assets, innovation, and AI,” said TRM Labs’ Ari Redbord.

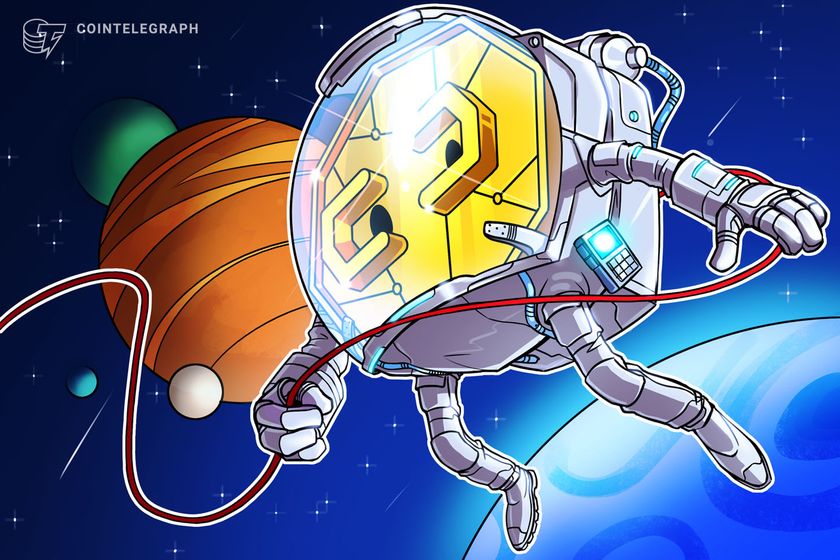

Recent pro-crypto political appointments in the United States have led to excitement for crypto like a “space race” that could see the US become a key part of the digital asset industry, according to TRM Labs’ Ari Redbord.

“There’s this excitement and cadence of almost a space race where the US is now in a position to keep up with the rest of the world or even surpass the rest of the world,” said Ari Redbord, head of legal and government affairs at TRM Labs, on CNBC’s Squawk Box on Jan. 6.

Redbord, a former prosecutor, pointed out that there have been several pro-crypto key appointments in US federal agencies since Donald Trump’s presidential election victory.