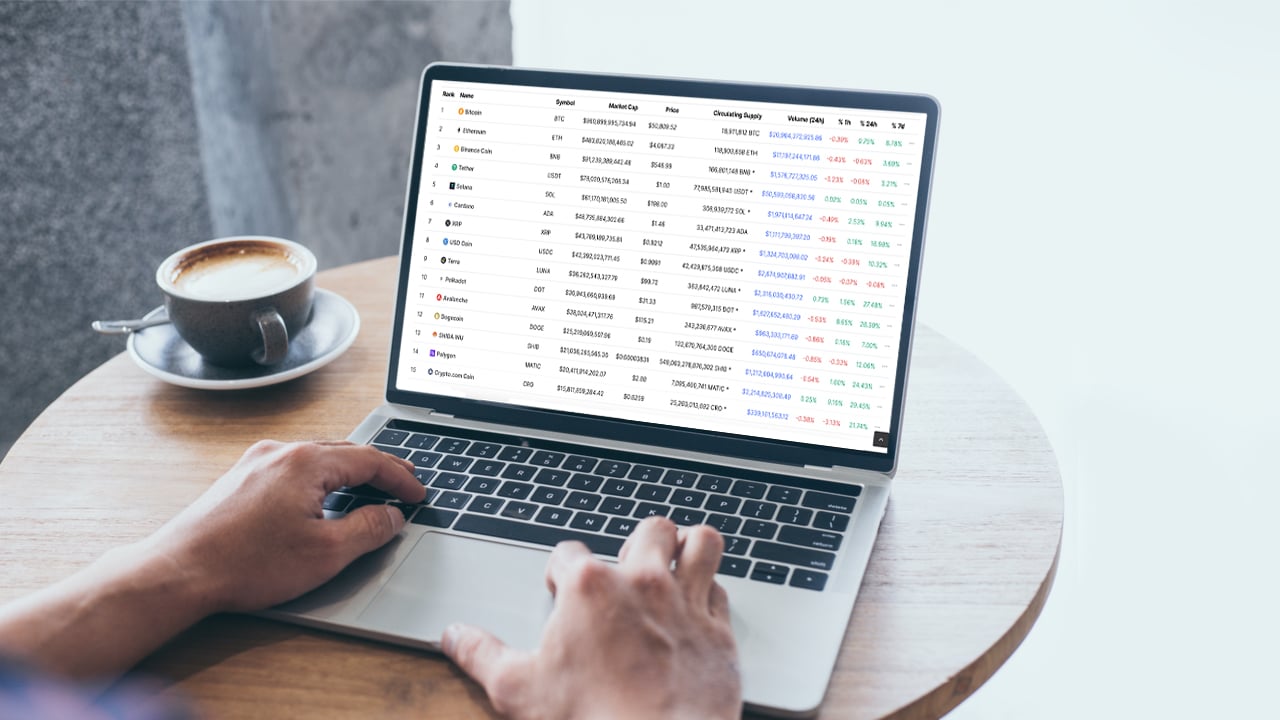

2021 has been a bullish year for crypto assets. While prices have risen a great deal, the top ten and top twenty rankings in terms of market capitalization have also changed significantly. A great number of coins have either been pushed down or have entered the crypto economy’s top positions in terms of overall market […]

2021 has been a bullish year for crypto assets. While prices have risen a great deal, the top ten and top twenty rankings in terms of market capitalization have also changed significantly. A great number of coins have either been pushed down or have entered the crypto economy’s top positions in terms of overall market […] With three days left until the end of 2021, the Ethereum network and its native token ether have had a phenomenal year as ether has increased more than 450% in value in 12 months. 145 days ago, on August 5, the Ethereum network implemented the London hard fork and since that day, 1,283,226 ether worth […]

With three days left until the end of 2021, the Ethereum network and its native token ether have had a phenomenal year as ether has increased more than 450% in value in 12 months. 145 days ago, on August 5, the Ethereum network implemented the London hard fork and since that day, 1,283,226 ether worth […] Since December 8, the stablecoin economy has grown 3.59% in 17 days as numerous stablecoin market valuations have issued more fiat-pegged tokens this month. On Saturday, December 25, the stablecoin economy’s $167 billion market valuation represents 6.68% of the entire $2.49 trillion crypto market economy. Stablecoin Issuance Jumps 3.5% There’s a great number of stablecoins […]

Since December 8, the stablecoin economy has grown 3.59% in 17 days as numerous stablecoin market valuations have issued more fiat-pegged tokens this month. On Saturday, December 25, the stablecoin economy’s $167 billion market valuation represents 6.68% of the entire $2.49 trillion crypto market economy. Stablecoin Issuance Jumps 3.5% There’s a great number of stablecoins […] UST, one of the stablecoins of the Terra project, has become the largest stablecoin by market capitalization today, after having surpassed its Ethereum-based rival, DAI. UST is now the largest decentralized stablecoin in the market, closing a year of growth for the Terra ecosystem, which is now among the most valuable top ten cryptocurrency projects […]

UST, one of the stablecoins of the Terra project, has become the largest stablecoin by market capitalization today, after having surpassed its Ethereum-based rival, DAI. UST is now the largest decentralized stablecoin in the market, closing a year of growth for the Terra ecosystem, which is now among the most valuable top ten cryptocurrency projects […]

The bullish setup also emerged as crypto custodian BitGo announced that it would add AVAX to its service portfolio.

Avalanche (AVAX) strengthened its case for a potential upside run towards $160 in the coming sessions as it broke out of a classic bullish pattern earlier this week.

Dubbed "bull flag," the pattern emerges when the price consolidates lower/sideways between two parallel trendlines (flag) after undergoing a strong upside move (flagpole). Later, in theory, the price breaks out of the channel range to continue the uptrend and tends to rise by as much as the flagpole's height.

AVAX went through a similar price trajectory across the last 30 days, containing a roughly 100% flagpole rally to nearly $150, followed by over a 50% flag correction to $72, and a breakout move above the flag's upper trendline (around $85) on Dec. 15.

AVAX price continued rallying after breaking out of its bull flag range, reaching almost $120 on Friday but eyeing a further leg up towards its bullish continuation target near $160. The level appeared after adding the height of AVAX's flagpole, which is around $75, to the current breakout point near $85.

The recent buying period in the Avalanche market picked momentum also because of a flurry of positive catalysts this week.

AVAX jumped nearly 10.50% on Tuesday as Avalanche added the native version of USDC, a dollar-pegged stablecoin issued by Circle, on its blockchain.

Additionally, a report penned by Bank of America analysts published on Dec. 10, called Avalanche a viable alternative to the leading smart contract platform Ethereum. That coincided with AVAX gaining another 16%.

On Thursday, AVAX rallied to its two-week high after BitGo, a crypto custodian with over $64 billion worth of assets under management, announced that it would support the token.

Nonetheless, a modest selloff at the local price top pushed AVAX lower. Th recover Friday as Avalanche announced that it has collaborated with web3 accelerator DeFi Alliance to launch a gaming accelerator program.

1/ Avalanche is collaborating with @DeFiAlliance to bring its accelerator programs to the Avalanche community

— Avalanche (@avalancheavax) December 17, 2021

Apply by Jan 7 here: https://t.co/6HcJOLxKxA

Before you apply, check these reasons why Avalanche should be your preferred platform: pic.twitter.com/GhdHBhQNgb

All the events mentioned above pointed towards the Avalanche ecosystem's growth. For instance, with USDC, the project promised to provide a viable alternative to Ethereum's highly expensive Tether (USDT) stablecoin transactions.

Moreover, by gaining BitGo as AVAX's institutional custodian, Avalanche appears to be prepping for catering to accredited investors. Mike Belshe, CEO of BitGo, explained:

“Institutional custody is not the same as retail custody, and BitGo wallets and custody were designed from the ground up to meet the needs of institutional investors, and BitGo is the only independent qualified custodian focused on building the right market structure and facilities to enable institutions to enter the digital asset space with confidence.”

One of the remaining downside risks around AVAX concerns the crypto market performance, on the whole.

In detail, AVAC rallied in a week that witnessed the entire cryptocurrency market capitalization lose more than $114 billion, with leading crypto assets Bitcoin (BTC) and Ether (ETH) plunging over 7% and 5% week-to-date. Concerns over the Federal Reserve's tapering plans catalyzed the market selloff.

Therefore, it appears that traders looked at AVAX as their short-term hedge against the crypto market drop, largely driven by a string of positive news.

Moreover, the AVAX/BTC pair was up nearly 40% week-to-date at around 0.00245 BTC at the time of writing, with the pair's relative strength index (RSI) entering overbought territory. That could prompt AVAX to weaken against BTC in the coming sessions.

Related: ‘Monster bull move’ means whales could secure the next Bitcoin price surge

A similar outcome may be possible in AVAX/USD's case as its weekly RSI treads near overbought levels.

However, the pair is likely to retain its bullish bias as long as it holds above its 20-week exponential moving average (20-week EMA) as support. As shown in the chart above, the green wave has been capping AVAX's downside attempts since August 2020.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The price of an Ethereum (ETH) challenger is surging after global internet finance firm Circle announces native support for USD Coin (USDC) on the smart contracts platform. In a new blog post, Avalanche (AVAX) announced their USDC integration to enable more seamless transactions and payment options for developers and users of decentralized finance protocols, enterprise […]

The post Top Ethereum Competitor Skyrockets As Crypto Payments Firm Circle Announces Support appeared first on The Daily Hodl.

USDC, the second leading stablecoin by market cap, has been launched on the Avalanche blockchain as a native token. Previously, users wanting to get USDC in Avalanche had to bridge it via Ethereum. Now, Circle, the issuer of usd coin (USDC), will allow users to mint the tokens directly on Avalanche’s C-Chain, saving on fees […]

USDC, the second leading stablecoin by market cap, has been launched on the Avalanche blockchain as a native token. Previously, users wanting to get USDC in Avalanche had to bridge it via Ethereum. Now, Circle, the issuer of usd coin (USDC), will allow users to mint the tokens directly on Avalanche’s C-Chain, saving on fees […]

Yet another stablecoin philanthropy initiative launched by Circle during the past year.

Circle, the company that created the USDC stablecoin, announced a partnership with public charity Endaoment to create a disaster relief fund. The fund will help mid-western American communities impacted by last week's deadly tornadoes. The two entities hope to raise $1 million in grants to support the American Red Cross and local non-profits.

Via Endaoment, blockchain enthusiasts will be able to directly contribute USDC or other cryptos using connected wallets with a minimum donation of $20. The funds will be distributed in $20,000 intervals to seven participating charities, the Team Western Kentucky Tornado Relief Fund, Center for Disaster Philanthropy, Team Rubicon, All Hands and Hearts, Midwest Food Bank NFP, American Red Cross, and Mutual Aid Relief. At the time of publication, the fund has received over $4,600 in donations.

Robert Heeger, founder, and CEO of Endaoment, said the following regarding the partnership:

"It is through incredible partners like Circle that we have been able to grant more than $11 million worth of donations to nearly 300 nonprofits this year. With Circle's support, we can expand our reach and continue to empower the community to allocate charitable gifts to causes in need of funding autonomously."

An unusual cluster of tornadoes swept across the U.S. Midwestern and Southern states the week prior, with wind speeds reaching as high s 150 mph (241.4 km/h). Kentucky was one of the hardest-hit states, with at least 74 fatalities and more than 100 missing persons still accounted for.

A man whose home was destroyed during the deadly tornado outbreak in Kentucky, plays a hymn on his piano that was spared during the storm. Beauty in the midst of sorrow and pain. pic.twitter.com/9goymGYK3L

— Travis Akers (@travisakers) December 13, 2021

Shark Tank investor Kevin O’Leary says he’s optimistic about Coinbase’s long-term potential despite the considerable drop in the company’s stock price. In an interview with CNBC’s Halftime Report, O’Leary notes that while pressure from regulators stifled Coinbase’s plans to offer yields on the USD Coin (USDC) stablecoin in the US, the crypto exchange’s Lend product […]

The post Shark Tank Star Kevin O’Leary Bullish on Coinbase Despite Heavy Correction of Crypto Exchange’s Stock – Here’s Why appeared first on The Daily Hodl.