As the TON blockchain is open-source and permissionless, individual users and projects must be careful to ensure their own safety.

The Open Network (TON), a blockchain platform integrated with Telegram, has experienced record-breaking growth in 2024. The number of onchain-activated wallets surged from approximately 1 million in January to over 9 million in June.

However, TON’s massive inflow of new users has not been overlooked by scammers. In June 2024, blockchain security firm SlowMist issued a warning on increasing phishing attacks on the TON ecosystem.

As the TON Foundation ambitiously expects to onboard 500 million users by 2028, it raises the question of how to properly protect users from attacks of all possible vectors without hindering rapid adoption.

Once HeyGen’s AI-generated digital avatar is available to the public, users will be able to create a video with a real life-like digital avatar in just two minutes.

The rise of artificial intelligence (AI) has been subject to growing concerns over identity verification tools on cryptocurrency exchanges.

With rapidly evolving AI technology, the process of creating deepfake proofs of identity is becoming easier than ever. The concerns about AI-enabled risks in crypto have triggered some prominent industry executives to speak out on the matter.

Changpeng Zhao, CEO and founder of major global crypto exchange Binance, took to X (formerly Twitter) on Aug. 9 to raise the alarm on the use of AI in crypto by bad actors.

“This is pretty scary from a video verification perspective. Don’t send people coins even if they send you a video,” Zhao wrote.

This is pretty scary from a video verification perspective. Don't send people coins even if they send you a video... ♂️ https://t.co/jvjZGHihku

— CZ Binance (@cz_binance) August 9, 2023

Like many other crypto exchanges, Binance’s internal Know Your Customer (KYC) processes require crypto investors to submit video evidence for processing certain transactions.

Binance CEO referred to an AI-generated video featuring HeyGen co-founder and CEO Joshua Xu. The video specifically included Xu’s AI-generated avatar, which looks just like the real HeyGen CEO and reproduces his facial expressions as well as voice and speech patterns.

“Both of these video clips were 100% AI-generated, featuring my own avatar and voice clone,” Xu noted. He added that HeyGen has been progressing with some massive enhancements to its life-style avatar’s video quality and voice technology to mimic his unique accent and speech patterns.

“This will be soon deployed to production and everyone can try it out,” Xu added.

Once available to the public, the AI tool will allow anyone to create a real life-like digital avatar in just “two minutes,” the HeyGen CEO said.

The public exposure to AI generation tools like HeyGen could potentially cause serious identity verification issues for cryptocurrency exchanges like Binance. Like many other exchanges, Binance practices KYC measures involving a requirement to send a video featuring the user and certain documents to get access to services or even to withdraw funds from the platform.

Related: AI mentions skyrocket in major tech companies’ Q2 calls

Binance’s statement video specifically requires users to submit the video along with the picture of their identity document, such an ID card, driver’s license or passport. The policy requires users to mention the date and certain requests on the video record.

“Please do not put watermarks on your videos and do not edit your videos,” the policy reads.

Binance chief security officer Jimmy Su previously warned about AI deepfake-associated risks as well. In late May, Su argued that AI tech is getting so advanced that AI deepfakes may soon become undetectable by a human verifier.

Binance and HeyGen did not immediately respond to Cointelegraph’s request for comment. This article will be updated pending new information.

Magazine: AI Eye: AI’s trained on AI content go MAD, is Threads a loss leader for AI data?

The EU’s EBSI Vector project and blockchain service provider, Protokol, are creating a blockchain-based cross-border credential verification program for EU citizens.

The European Commission has moved to impleme educational and professional credentials will be verified across borders.

In an announcement on June 7, the Web3 and blockchain solutions provider, Protokol, revealed a collaboration with EBSI Vector, a European Union-funded project creating a decentralized framework for cross-border verification.

The project will use blockchain technology to develop the forthcoming credential verification solution, which aims to simplify the process for EU citizens to have their credentials recognized and accepted in different countries.

Lars Rensing the CEO of Protokol said the goal is to create a more open, secure and decentralized digital infrastructure for the EU and beyond.

“We believe that blockchain and Web3 technology have enormous potential to transform a wide range of industries and prepare them for the future.”

Users, EU citizens, will be issued a digital wallet created by Protokol to store and use their digital credentials.

According to the announcement, the project will ultimately incorporate other EU initiatives, such as EUeID for further solutions to create smoother interactions between people and organizations.

Related: Cumberland Labs unveils SaaS API for public blockchains and DeFi protocols

This work with Protokol is part of a larger project creating an interoperable framework for EU-wide blockchain-based services called the European Blockchain Services Infrastructure (EBSI) initiative.

Leaders in the EU have been proactive in welcoming but also regulating emerging Web3 technologies. On May 31, regulators signed the Markets in Crypto-Assets (MiCA) bill into law, following the finance minister’s final approval.

MiCA was first introduced in 2020 and has since been a major topic of discussion in the industry. The bill’s main aim is the creation of a consistent regulatory framework for crypto assets for member states of the EU.

Companies in the space have been eyeing the final call on the regulation. The blockchain technology platform Bakkt said it’s looking toward the EU post-MiCA.

Magazine: BitCulture: Fine art on Solana, AI music, podcast + book reviews

The technology is getting so advanced, deepfakes may soon become undetectable by a human verifier, said Jimmy Su, Binance's Chief Security Officer.

Deepfake technology used by crypto fraudsters to bypass know-your-customer (KYC) verification on crypto exchanges such as Binance is only going to get more advanced, Binance's chief security officer warns.

Deepfakes are made using artificial intelligence tools that use machine learning to create convincing audio, images or videos featuring a person’s likeness. While there are legitimate use cases for the technology, it can also be used for scams and hoaxes.

Deep fake AI poses a serious threat to humankind, and it's no longer just a far-fetched idea. I recently came across a video featuring a deep fake of @cz_binance , and it's scarily convincing. pic.twitter.com/BRCN7KaDgq

— DigitalMicropreneur.eth (@rbkasr) February 24, 2023

Speaking to Cointelegraph, Binance chief security officer Jimmy Su said there has been a rise in fraudsters using the tech to try and get past the exchange’s customer verification processes.

“The hacker will look for a normal picture of the victim online somewhere. Based on that, using deep fake tools, they’re able to produce videos to do the bypass.”

Su said the tools have become so advanced that they can even correctly respond to audio instructions designed to check whether the applicant is a human and can do so in real-time.

“Some of the verification requires the user, for example, to blink their left eye or look to the left or to the right, look up or look down. The deep fakes are advanced enough today that they can actually execute those commands,” he explained.

However, Su believes the faked videos are not at the level yet where they can fool a human operator.

“When we look at those videos, there are certain parts of it we can detect with the human eye,” for example, when the user is required to turn their head to the side,” said Su.

“AI will overcome [them] over time. So it's not something that we can always rely on.”

In August 2022, Binance’s chief communications officer Patrick Hillmann warned that a “sophisticated hacking team” was using his previous news interviews and TV appearances to create a “deepfake” version of him.

The deepfake version of Hillmann was then deployed to conduct Zoom meetings with various crypto project teams promising an opportunity to list their assets on Binance — for a price, of course.

Hackers created a "deep fake" of me and managed to fool a number of unsuspecting crypto projects. Crypto projects are virtually under constant attack from cybercriminals. This is why we ask most @binance employees to remain anonymous on LinkedIn. https://t.co/tScNg4Qpkx

— Patrick Hillmann (@PRHillmann) August 17, 2022

“That's a very difficult problem to solve,” said Su, when asked about how to combat such attacks.

“Even if we can control our own videos, there are videos out there that are not owned by us. So one thing, again, is user education.”

Related: Binance off the hook from $8M Tinder ‘pig butchering’ lawsuit

Binance is planning to release a blog post series aimed at educating users about risk management.

In an early version of the blog post featuring a section on cybersecurity, Binance said that it uses AI and machine learning algorithms for its own purposes, including detecting unusual login patterns and transaction patterns and other "abnormal activity on the platform."

AI Eye: ‘Biggest ever’ leap in AI, cool new tools, AIs are the real DAOs

Adam Back, Roger Ver, Brad Garlinghouse, and Andreas Antonopoulos were among those not showing a blue checkmark on their Twitter accounts after legacy verification was sunsetted.

Despite their large numbers of followers — and being potential targets for scammers impersonating them — not every major Crypto Twitter personality has signed up or been given a blue checkmark since the platform removed legacy verification on April 20.

In a debate that’s almost exclusively limited to die hard enthusiasts of the social media platform, many individuals have opted not to pay Twitter $8 each month to retain a blue checkmark formerly given as a symbol of verification. Though it’s unclear whether certain high-profile figures in the crypto space have chosen to pay for the ‘Twitter Blue’ subscription to retain their verification status, some of their profiles still show the checkmark.

Among those staying in the game Elon Musk seemingly wants members of the platform to play in order to drive additional revenue to Twitter include the CEO himself, Ethereum co-founder Vitalik Buterin, Binance CEO Changpeng Zhao, Gemini co-founders Cameron and Tyler Winklevoss, Litecoin (LTC) creator Charlie Lee, Pixelmatic CEO Samson Mow, podcaster Anthony ‘Pomp’ Pompliano, Ripple CTO David Schwartz, and MicroStrategy executive chair Michael Saylor. Musk said he was personally footing the bill in order for certain users to keep their blue checkmarks, including Star Trek actor William Shatner with his 2.5 million followers.

William Shatner criticized Elon Musk over paid verification last month and then randomly thanked him for something vague and unspecified yesterday

— Matt Binder (@MattBinder) April 20, 2023

now he’s got a Twitter Blue verification badge lol pic.twitter.com/VLGPXK8Sw1

At the time of publication, however, some of the biggest names in the crypto industry have opted not to pay for the social media platform’s initiative. Blockstream CEO Adam Back, Bitcoin Cash (BCH) proponent Roger Ver, Ripple CEO Brad Garlinghouse, Bitcoin (BTC) educator Andreas Antonopoulos, venture capital investor Tim Draper, and crypto influencer WhalePanda were among those Twitter accounts not showing a blue checkmark.

Musk, a proponent of Dogecoin (DOGE) well known for trolling Twitter users before and following his $44-billion takeover of the platform in October 2022, has implemented several changes related to the verification of users and attempts to drive additional revenue to the site. Though the CEO claimed one of his goals was to reduce the number of scammer tweets and bots, the $8 monthly subscription model launched in November 2022 resulted in several accounts boasting the blue checkmark alongside the legacy checkmarks.

Y’all complaining about an $8 verification badge to protect your followers.

— Ben Armstrong (@Bitboy_Crypto) April 22, 2023

Meanwhile in 2021 I paid $20k for mine to protect my followers.

The change in Twitter’s blue checkmark system led to many users unaware of the paid option to mistake fake accounts for real ones, resulting in financial hardship in the case of one impersonating pharmaceutical company Eli Lilly. A user set up an account with a similar name to the firm, paid for the blue checkmark, and claimed the company would offer free insulin, resulting in its stock dropping roughly 5%.

Musk’s decision to sunset legacy blue checkmarks effectively removed the verification status for which Twitter had become known, though there are additional labels and other types of checkmarks for organizations, businesses, and governmental leaders. For example, gold checkmarks reportedly costing $1,000 per month are intended for verified business accounts, but the platform has reportedly been giving some away for free — as well as taking them back. Accounts held by Binance, Binance.US, Gemini, Kraken, KuCoin, OKX, Floki Inu, and others currently show the gold mark.

First Elon Musk blocked us

— Public Citizen (@Public_Citizen) April 21, 2023

Then he unblocked us

Then he gave us a gold checkmark for free

Then we tweeted about his rocket exploding and he took our gold checkmark away...

We live rent free in the head of a “genius billionaire”

Many have shunned the changes to Twitter and its subscription model. Even some of those who were given their blue checkmarks for free have rejected them.

“I know some people are upset about losing their verification,” said comedian Mike Drucker. “But it’s about to become much easier to know who to block.”

I think Mr. Musk should give my blue check to charity. I recommend the Prytula Foundation, which provides lifesaving services in Ukraine. It's only $8, so perhaps Mr. Musk could add a bit more.

— Stephen King (@StephenKing) April 22, 2023

How to lose your Twitter Blue checkmark:

— Thandrie Davis ️⚧️ (@TheyAreThandrie) April 23, 2023

1. Click "Profile."

2. Click "Edit Profile."

3. Change your name here. Note that this doesn't change your @ username, just the display name next to it.

4. Click Save.

Unless they change things, this will remove your legacy checkmark. pic.twitter.com/doIoGnDlwz

Ripple CTO David Schwartz, who suggested he had purchased a blue checkmark, said he had done so to prevent being “perfectly impersonated by anonymous accounts.” Content creator Wendy O, also known as Crypto Wendy, cited concerns about bots on the platform but also said she had paid the $8 for her blue checkmark.

Related: Elon Musk changes Twitter icon to Doge after seeking lawsuit dismissal

It’s unclear how many in the crypto space have actively signed up for the subscription service or been gifted a checkmark, but Twitter’s change in policy has not completely stopped accounts promoting scams or compromising companies. Crypto exchange KuCoin reported that a bad actor took over its Twitter account on April 24 and posted “fake activity” leading to losses for users.

Magazine: Musk hints at suing Microsoft, US Rep. wants Gensler fired, and more

On April 5, 2023, the independent blogger Andy Baio published a post on his Waxy Blog that explained every version of macOS from Mojave 10.14.0 to the current version hosts a copy of Satoshi Nakamoto’s seminal Bitcoin white paper. Mac users can type a simple command in the terminal, and all nine pages describing Nakamoto’s […]

On April 5, 2023, the independent blogger Andy Baio published a post on his Waxy Blog that explained every version of macOS from Mojave 10.14.0 to the current version hosts a copy of Satoshi Nakamoto’s seminal Bitcoin white paper. Mac users can type a simple command in the terminal, and all nine pages describing Nakamoto’s […] Worldcoin, a project co-founded by Sam Altman, who is also a co-founder of artificial intelligence (AI) startup Openai, announced the launch of World ID, a digital proof of personhood ID protocol. The protocol allows for an AI-resistant verification of humanness online, using a device called the orb to scan the iris of each person for […]

Worldcoin, a project co-founded by Sam Altman, who is also a co-founder of artificial intelligence (AI) startup Openai, announced the launch of World ID, a digital proof of personhood ID protocol. The protocol allows for an AI-resistant verification of humanness online, using a device called the orb to scan the iris of each person for […]

Under the direction of Elon Musk, Twitter rolled out the ‘Twitter Blue’ subscription as a means to discourage spam bots and fake accounts on the platform.

With Twitter allowing users to verify their accounts for a monthly fee, the number of accounts with a blue checkmark — previously associated with prominent figures — has flooded the social media platform. A browser extension available for Chrome, Firefox and Safari plans to bring back the balance by revealing the accounts that have paid $8 for subscribing to Twitter Blue.

Under the direction of Elon Musk, Twitter rolled out the ‘Twitter Blue’ subscription as a means to discourage spam bots and fake accounts on the platform. However, when the service was initially launched in November 2021, trolls took it as an opportunity to verify parody accounts and propagate fake information.

While a subsequent KYC requirement stifled the account verification of suspicious accounts, the number of verified accounts on Twitter skyrocketed — reintroducing doubt among users. A browser extension named Eight Dollars allows users to spot the difference between actual verified accounts and Twitter Blue users.

This Chrome extension is very useful!!

— m (@mayavada) April 2, 2023

Twitter now doesn't show whether accounts are verified or paid, but this plugin called Eight Dollars does.

Very useful in distinguishing a genuine account from the sad sap reply guys who paid for the blue check. https://t.co/ggRjNyZmBv pic.twitter.com/q7waI2EiK1

The extension shows how each account gained its verification badge. For users that paid for the Twitter Blue subscription, the extension will display a ‘paid’ text right next to the blue checkmark. For the rest, it will simply show ‘verified.’

The above screenshot shows an example of how a parody account of Elon Mush paid for verification. As a result, the extension helps identity scam accounts.

Moreover, Twitter users showed support for the software extension as it effectively reintsates transparency across the social media platform, as evidenced by the screenshot of the reviews above.

Related: ‘CryptoGPT’ Twitter accounts spring up as hashtag trends on Twitter

Musk, along with more than 2,600 tech industry leaders and researchers, signed an open letter calling for a halt on artificial intelligence (AI) development.

We're calling on AI labs to temporarily pause training powerful models!

— Future of Life Institute (@FLIxrisk) March 29, 2023

Join FLI's call alongside Yoshua Bengio, @stevewoz, @harari_yuval, @elonmusk, @GaryMarcus & over a 1000 others who've signed: https://t.co/3rJBjDXapc

A short on why we're calling for this - (1/8)

The request, however, split the community as many notable entrepreneurs opposed the petition.

Count me among the people who think this is a bad idea.

— Brian Armstrong (@brian_armstrong) March 31, 2023

There are no “experts” to adjudicate this issue, and many disparate actors will never agree. Committees and bureaucracy won’t solve anything.

As with many technologies, there are dangers, but we should keep marching… https://t.co/iM0sKOVTaw

Armstrong believed that every technology poses a certain amount of danger, but the goal should be to keep moving forward.

Magazine: Simon Dixon on bankruptcies, Celsius and Elon Musk: Crypto Twitter Hall of Flame

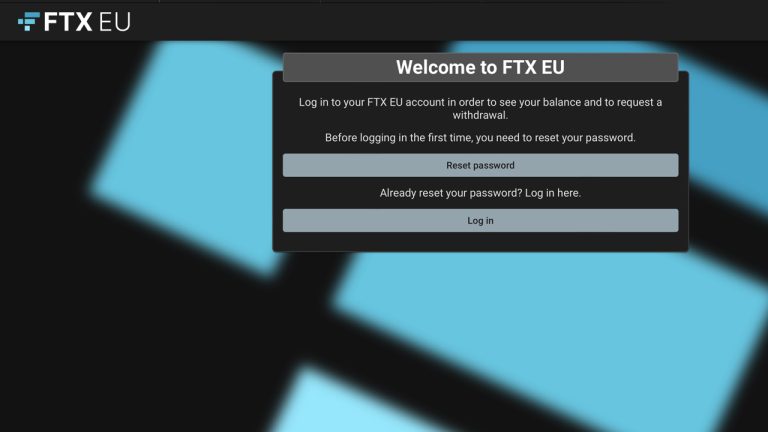

FTX’s European subsidiary, FTX Europe, has launched a new website, ftxeurope.eu, for users to withdraw funds from the now-defunct cryptocurrency platform. Withdrawal requests must be submitted through the new website and will be “subject to customary know-your-customer and anti-money-laundering checks.” FTX’s European Arm Opens Withdrawals to Customers According to a press release published on Friday, […]

FTX’s European subsidiary, FTX Europe, has launched a new website, ftxeurope.eu, for users to withdraw funds from the now-defunct cryptocurrency platform. Withdrawal requests must be submitted through the new website and will be “subject to customary know-your-customer and anti-money-laundering checks.” FTX’s European Arm Opens Withdrawals to Customers According to a press release published on Friday, […]

Zero-knowledge proofs have powered the development of Ethereum layer 2s, and now they’re coming to Bitcoin.

Bitcoin (BTC) users will soon be able to use zero-knowledge proofs (ZK-proofs) to expedite the process of verifying individual blocks and, eventually, the entire blockchain.

ZeroSync Association, a Swiss-based nonprofit, is developing tooling which allows users to validate the state of the Bitcoin network without having to download the blockchain or trust a third party for verification.

ZeroSync was formed to develop and maintain open-source software that enables succinct ZK-proofs on the Bitcoin blockchain. The group uses StarkWare’s proprietary Zero-Knowledge Scalable Transparent Argument of Knowledge (zk-STARK) validity proofs to generate ZK-proofs for the Bitcoin network.

The tool promises to overhaul the process of verifying the Bitcoin blockchain, which still requires node operators to download a large amount of data to synchronize the correct state of the Bitcoin network.

ZeroSync is using ZK-proofs to eventually generate valid proof and verify the latest state of the blockchain almost instantaneously.

ZK-proofs have been a revelation for the Ethereum ecosystem, with various proof methods powering several layer-2 scaling platforms, including Polygon, Arbitrum, Optimism and StarkNet.

Related: Polygon’s ‘holy grail’ Ethereum-scaling zkEVM beta hits mainnet

An announcement from the ZeroSync Association highlights the promise of ZK-proofs for blockchain scalability and privacy by providing “almost-fixed-size” proofs verifying large computations.

The project’s work pioneers the application of ZK-proofs for the Bitcoin network, with the organization describes Bitcoin’s relative simplicity and the Unspent Transaction Output (UTXO) model as a unique value proposition for applying recursive proofs.

ZeroSync notes that the ZK-Proof tools do not require consensus changes or additional trust assumptions for the Bitcoin network and its users. The organization is building a software development kit that will allow developers to generate custom validity proof for specific use cases without needing indepth domain expertise.

ZeroSync is in the process of building a client for fast initial block download as well as implementing the first complete proof of Bitcoin consensus. The client will allow users to sync a full node without making code changes to Bitcoin core.

ZeroSync is using the Cairo programming language, pioneered by StarkWare, to create STARK-provable programs for computations.

ZeroSync’s tool is currently in a prototype state but has the ability to prove the validity of individual assumed valid blocks, which verify all Bitcoin rules except for scripts. The team also has a working in-browser demo verifier for STARK proofs of Bitcoin blocks.

The ZeroSync Association was initially funded by Geometry and StarkWare but is establishing a nonprofit entity to enable ongoing development and maintenance from stakeholders within the Bitcoin community.

A statement from StarkWare president and co-founder Eli Ben-Sasson, who co-invented zk-STARKS, summed up the magnitude of ZK-proofs coming to the Bitcoin ecosystem:

“After years of frustration about slow syncing, users will be able to sync with the network much faster, and with less computation. It’s a technological leap akin to the transition from slow dial-up internet to high-speed broadband.”

Lightning Labs, the team behind the Bitcoin layer-2 Lightning Network payment system, is a contributing partner to ZeroSync’s project.

The firm intends to use ZeroSync to power compressed transaction history proofs for its Taproot Asset Representation Overlay (Taro) protocol, which aims to power the issuance of digital assets on the Bitcoin blockchain.