Seven months ago, the top rebase crypto tokens by market capitalization were collectively worth $8.03 billion and since then, the entire rebase token economy has lost more than 92%, dropping to $577 million. Olympus has dropped 99% since the asset’s all-time high (ATH), klima dao shed 99.9%, and wonderland is down 99.8% from its ATH. […]

Seven months ago, the top rebase crypto tokens by market capitalization were collectively worth $8.03 billion and since then, the entire rebase token economy has lost more than 92%, dropping to $577 million. Olympus has dropped 99% since the asset’s all-time high (ATH), klima dao shed 99.9%, and wonderland is down 99.8% from its ATH. […] Terra’s new LUNA 2.0 token has lost 54% in value in the last two weeks, after reaching $11.33 per unit on May 30. Meanwhile, the whistleblower Fatman has accused Terra’s co-founder Do Kwon of cashing out $2.7 billion a few months before the UST de-pegging incident. Kwon, however, has been keeping tabs on Fatman’s accusations […]

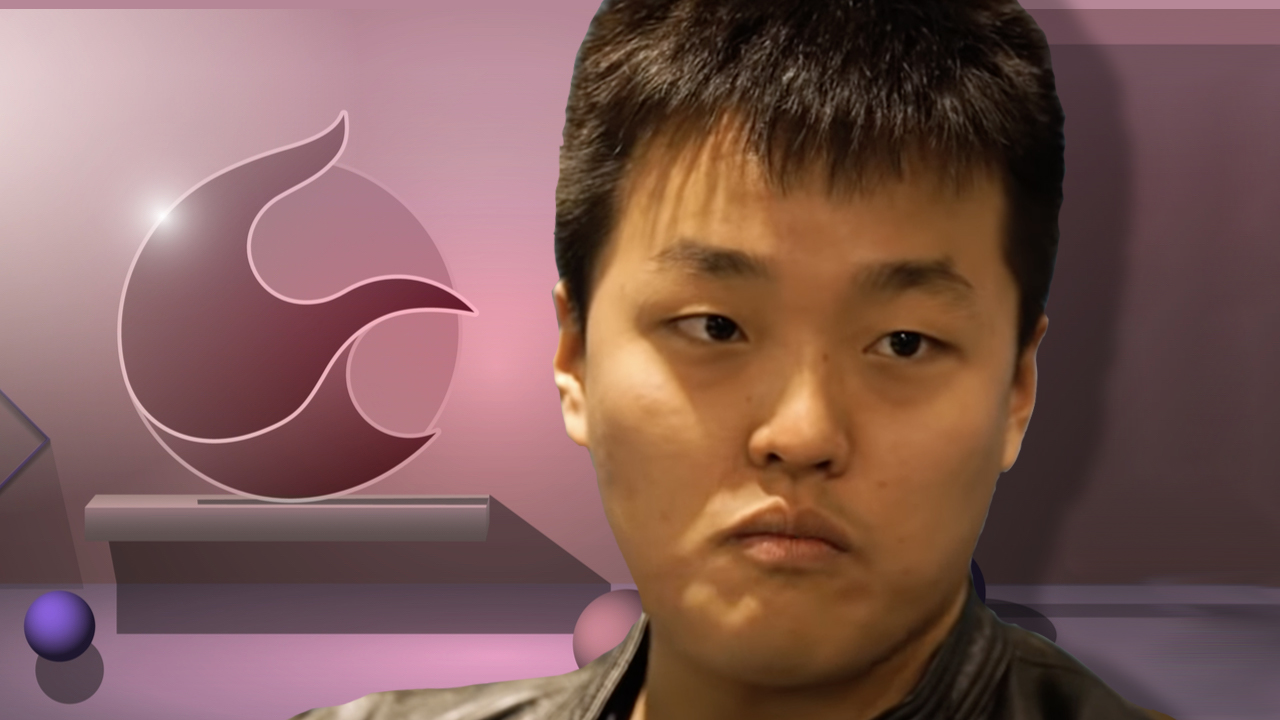

Terra’s new LUNA 2.0 token has lost 54% in value in the last two weeks, after reaching $11.33 per unit on May 30. Meanwhile, the whistleblower Fatman has accused Terra’s co-founder Do Kwon of cashing out $2.7 billion a few months before the UST de-pegging incident. Kwon, however, has been keeping tabs on Fatman’s accusations […]

Wonderland endured a turbulent week of revelations and risks closure, Wormhole was hacked for the second-highest ever DeFi sum, and the Ethereum hash rate hits a new high — all coming to you in this week’s Finance Redefined.

Welcome to the latest edition of Cointelegraph’s decentralized finance newsletter.

It’s been a tumultuous week of doxxing, hacks, bailouts and new highs in the decentralized finance space. Read on to recap the most impactful stories of the last seven days.

This article represents a conspectus of the full email newsletter. For the full edition, sign up via the box below.

Following the revelatory identification of previously anonymous QuadrigaCX co-founder Michael Patryn as the founder of DeFi protocol Wonderland — known on social media as @0xSifu — a subsequent community vote decided upon the permanent closure of Wonderland for outstanding security concerns.

The saga commenced when DeFi investigator Zachxbt doxxed Patryn to be Sifu, a figure with a notorious reputation within the digital asset space for alleged fraudulent and illicit activity, most notably regarding the $145-million losses incurred at Canadian-based cryptocurrency exchange QuadrigaCX in December 2018.

Having been made aware of Sifu’s real identity one month prior to this week’s announcement, Daniele Sestagalli, co-founder of Wonderland and stablecoin protocol Abracadabra, posed a crucial question to the community members: “Do we wind down or continue to fight for the aspect of an investment DAO being a revolutionary new organization?” Sestagalli stated his personal preference to be the latter, to fight.

From a technical perspective on Jan. 15, Wonderland recorded a near all-time high of $776.64 million in total value locked, or TVL. However, as a consequence of the exposure, the TVL figure dropped substantially to $78.57 million on Jan. 25, marking an 89.9% demise. At the time of writing, the figure has somewhat recovered to $408.59 million.

In true Web3 style, the decision to “Wind down Wonderland and give the treasury back to its holders” was put to a community snapshot vote. The two-day governance participation resulted in a split decision, an inconclusive majority with 116,000 TIME tokens allocated to the decision of no, and 95,000 to yes.

In response to this, co-founder Sestagalli assessed that “the duty of the team is to enact the will of the token holders. As the vote is so close to 50/50 there is only one path forward, it is to reimburse/unwind,” confirming this in a follow-up tweet.

1/

— Daniele never asks to DM (@danielesesta) January 30, 2022

Wonderland experiment is coming to an end. It is clear from the vote that the community is divided. The core and heart of Wonderland is still the community. If we cannot find agreement on wether to continue or not, it means that we failed.

Discussions within the community are vehemently ongoing in a bid to find an accommodating solution to the Wonderland saga for all involved. Proposals currently at the forefront are a merger with Abracadabra or a transition to a DAO structure with greater transparency.

DeFi bridging protocol Wormhole suffered a significant security exploit on its network this week to the tune of 120,000 Wrapped Ether (wETH) tokens, equivalent to $321 million at the time of impact — the second-largest hack in the history of decentralized finance behind Poly Network’s seismic $610-million breach in August 2021.

Wormhole is known within the industry for its cross-chain token bridge service in which users can transfer crypto assets between chains such as Ethereum, Solana and Polygon, among others, without interacting with centralized exchanges.

After analyzing blockchain data, it was uncovered that the attacker minted 120,000 wETH on Solana and then proceeded to redeem 93,750 wETH for Ether (ETH) worth $254 million. The remaining wETH was swapped for Solana (SOL) and USD Coin (USDC) on Solana.

Following on from this, the hacker utilized a portion of the funds on an asset-buying spree that included SportX (SX), Meta Capital (MCAP), Finally Usable Crypto Karma (FUCK) as well as the highly anticipated soon-to-be-released asset, Bored Ape Yacht Club Token (APE).

In response, the Wormhole team pledged to the community that the token supply, in addition to the one-to-one backed asset total, would be fully reinstated and is offering a generous whitehat bug bounty reward to the malicious entity for full recompensation of the funds.

The hack risked serious cascading ramifications for protocols and platforms within the Solana ecosystem that rely on the wETH supply for collateral. If their assets were not backed with wETH, investors would have been unable to utilize the service, perhaps lose confidence, and, therefore, short the asset. Solana fell around 13% in the fallout of the news.

In a fortuitous turn of events, Wormhole’s parent company, Jump Crypto, stepped in to bailout the platform and restore all lost funds, an action confirmed by Wormhole in a tweet.

1/2

— Wormhole (@wormholecrypto) February 3, 2022

All funds have been restored and Wormhole is back up.

We're deeply grateful for your support and thank you for your patience.

Despite a resolution for the platform’s affected users, concerns still remain as to the whereabouts of the $321 million in lost funds, in addition to the intentions of the hacker within the marketplace.

Quantitative insights from popular data aggregation site Glassnode this week revealed that the hash rate for Ethereum reached a new all-time high of 1.11 petahash per second (PH/s) on Jan. 28, surpassing the previous figure of 1.08 PH/s established just 15 days prior.

Fluctuations in the hash rate of proof-of-work (PoW) networks such as Bitcoin and Ethereum are prime indications of additional nodes joining the network, scenarios that ultimately result in higher security and more expansive decentralization of the network.

#Ethereum $ETH Mining Difficulty just reached an ATH of 13,119,856,939,346,200

— glassnode alerts (@glassnodealerts) February 1, 2022

Previous ATH of 13,076,339,792,989,700 was observed on 23 January 2022

View metric:https://t.co/s9t4z96wMA pic.twitter.com/Cxk3JMg1Qp

In December 2021, participants of the Ethereum network implemented the Arrow Glacier upgrade, an initiative designed to delay the activation of a coding mechanism that is set to halt production of mining activities on the network, otherwise known as the “difficulty bomb.”

It is widely expected that Ethereum’s transition to PoS will occur during the latter half of 2022, with Arrow Glacier being the final upgrade, a market sentiment recognized by one of the core developers facilitating the upgrade, Tim Beiko, during a recent commentary.

Analytical data reveals that DeFi’s total value locked slightly increased by 8.87% across the week to a figure of $109.92 billion, attempting to recover from the market downturn in recent weeks.

Tezos (XTZ) reported the highest score in the top 100 following its partnership with Manchester United at 31.60%. Maker (MKR) came in second with a respectable 25.54% gain, while Convex Finance (CVX) recorded a 19.46% increase. Curve DAO Token (CRV) and Oasis Network (ROSE) gained 15.29% and 11.79%, respectively.

Interviews, features and other cool stuff

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us again next Friday for more stories, insights and education in this dynamically advancing space.

Data suggests $34,000 was the bottom and BTC’s recent performance could be a sign that traders are beginning to open fresh longs.

Cryptocurrencies had a volatile week after Bitcoin's (BTC) sudden crash to $33,000 on Jan. 24. However, the sharp 9% drop fully recovered within 8 hours after BTC price regained the $36,000 support.

On Jan. 26, Bitcoin rallied to $38,960 but it could not sustain the level and corrected by 8.8% in the following 8 hours. When factoring in the recent ups and downs, Bitcoin managed to only gain a meager 1.6% over the past seven days.

Even with the considerable price swings, the aggregate futures contracts liquidations were relatively low. Longs (buyers) had $570 million futures terminated, while shorts (sellers) faced $690 million. Data shows that Bitcoin futures represented 41% of the total $1.25 billion liquidations.

The total crypto market capitalization presented a modest 1.6% weekly increase, in line with Bitcoin's performance.

Notice how the Jan. 24 price is forming higher lows and currently shows support at $1.75 trillion. Even with the price being 22% down in 2022, the total crypto market capitalization showed a healthy 12.5% bounce since the Jan. 24 low.

Investors seem to be digesting this week's regulatory news where United States Congressman Ted Budd submitted an amendment to scrub a bill provision allowing the U.S. Treasury to unilaterally prohibit certain financial transactions without public input.

If passed in its current form, the America COMPETES Act of 2022 would result in a significant blow to the cryptocurrency industry, as Coin Center's executive director Jerry Brito stated.

Investors were negatively impacted by news that the U.S. White House is reportedly preparing an executive order on crypto to make government agencies conduct risk analysis on cryptocurrency as a national security threat.

Steady bearish newsflow might have been the cause for cryptocurrencies’ recent price action but there were some stellar performances from Metaverse tokens.

Apple (AAPL) CEO, Tim Cook, said in an investors' call on Jan. 27 that metaverse applications have a lot of potential and that his company is investing in augmented reality developments on its devices.

The news was enough to catapult metaverse-related tokens by up to 36%, including Flow, The Sandbox (SAND), Decentraland (MANA), Enjin Coin (ENJ), and Arweare (AR).

On the other hand, Terra (LUNA) was impacted after the Avalanche-based reserve currency Wonderland Money (TIME) announced that a pending proposal would determine whether the project closes up shop or not. As a result, the MIM stablecoin dipped below 1.00 and some speculate that this may have had a knock-on effect on Terra's LUNA and UST token.

Scalability and interoperability blockchain solutions Cosmos (ATOM), Fantom (FTM), and Harmony (ONE) presented negative performances after the Ethereum hash rate surpassed 1.11 PH/s, its highest level ever registered. A higher hash rate indicates that more miners are joining the network, which helps to cement blockchain security.

The OKEx Tether (USDT) premium measures the difference between China-based peer-to-peer (P2P) trades and the official U.S. dollar. Figures above 100% indicate excessive demand for cryptocurrency investing. On the other hand, a 5% discount usually indicates heavy selling activity.

The Tether indicator continued to display strength as it stood above 99% over the past seven days. That is in stark contrast to three weeks ago when panic selling from China-based traders drove the indicator to a 4% discount.

To confirm that the crypto market structure has improved, traders should analyze the CME's Bitcoin futures contracts premium. This metric analyzes the difference between longer-term futures contracts to the current spot price in regular markets.

Whenever this indicator fades or turns negative (backwardation), it suggests that there is bearish sentiment.

These fixed-month contracts usually trade at a slight premium, indicating that sellers request more money to withhold settlements for longer. As a result, futures should trade at a 0.5% to 2% premium in healthy markets, a situation known as contango.

Notice how the indicator flirted with the backwardation from Jan. 18 to 24 as Bitcoin dipped below $42,000. However, as BTC showed signals that $33,000 could have been a local bottom, the futures markets recovered a healthy 0.5% premium.

Considering that the aggregate cryptocurrency market capitalization is down 22% in 2022, the market structure looks primed for a recovery.

Barring a significant change in these fundamentals, Bitcoin bulls are probably beginning to feel comfortable adding positions below $40,000.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

The DeFi debacle has caused ripples across the ecosystem as the project head looks to wind things up.

The co-founder of the embattled Wonderland decentralized finance project is preparing to pull the plug following a deeply divided community vote.

On Jan. 30, Wonderland co-founder Daniele Sestagalli tweeted that the Avalanche-based reserve currency experiment is coming to an end. He added that the divided community “means that we failed.”

The vote to save or wind down the project came after Sestagalli asked former partner and Wonderland treasury head Michael Patryn (who goes by the pseudonym ‘0xSifu’) to step down late last week.

Patryn, who has changed his name on a number of occasions, was sensationally revealed on Jan. 27 to be the co-founder of the defunct Canadian crypto exchange QuadrigaCX. He has also been previously convicted of credit card fraud and pleaded guilty to several related offenses in the early 2000s.

1/

— Daniele never asks to DM (@danielesesta) January 30, 2022

Wonderland experiment is coming to an end. It is clear from the vote that the community is divided. The core and heart of Wonderland is still the community. If we cannot find agreement on wether to continue or not, it means that we failed.

There were several active votes on the Wonderland governance forum, however, the vote to wind down the project and return the treasury back to its holders had 55% voting to save it and 45% in favor of disbanding at the time of writing. Sestagalli said that the division has resulted in a single path forward:

“The duty of the Team is to enact the will of the token holders. As the vote is so close to 50/50 there is only one path forward, it is to reimburse/unwind.”

He added that he is working with the team on a new proposal. However, it was pointed out by those in favor of keeping the project going that the community was not split. They suggested that the token allocation was split, which raised other concerns among the community.

I am ready to listen to what you have in mind, so please do not take this as FUD or hate, I just want to correct a point here

— 0x von Bismarck (@0xVonBismarck) January 30, 2022

The community is not split 50-50. The token allocation is. The community as individuals voted overwhelmengly No and against all odds, we eeked out a win pic.twitter.com/nBS3cCRe39

A number of alternative proposals have been put forward to save the project from going under. These include another ongoing discussion on a potential merger with Wonderland and Abracadabra, a DeFi lending protocol and yield strategy generator.

Additionally, on Jan. 31, a lengthy proposal for Wonderland 2.0 was published by members of the community known as “Frogs” suggesting a transition of the existing protocol and treasury to a new DAO structure with a more transparent governance system.

Related: Daniele Sestagalli discusses Wonderland’s future after QuadrigaCX co-founder dox

The DeFi imbroglio has had ripple effects throughout the ecosystem with other networks such as Terra also feeling the impacts. The close ties between Wonderland and Abracadabra’s MIM (Magic Internet Money) token have also impacted Terra’s ecosystem since MIM is used for yield farming with the Terra stablecoin, UST.

The stablecoin has dipped below its peg recently on Wonderland concerns, and this has had a knock-on effect on LUNA which is used for its price-stabilization mechanism.

LUNA prices are currently down 13% over the past 24 hours as investors have been liquidating. Meanwhile, Wonderland’s native TIME token has crashed nearly 60% since the debacle began last week and is now languishing 96% down from its Nov. 7 all-time high of just over $10K.

"Some people said Wonderland should just be wound down and funds be given back to token holders. I believe this is the easy way out," says Sestagalli.

On Friday, Daniele Sestagalli, co-founder of decentralized finance, or DeFi, protocol Wonderland and stablecoin protocol Abracadabra, issued a statement on the path forward after the doxing of his colleague Michael Patryn:

“Do we wind down or continue to fight for the aspect of an investment DAO [decentralized autonomous organization] being a revolutionary new organization? For the option that I am for, which is to fight and bring someone new and experienced to manage the treasury.”

The day prior, an investor uncovered the identity of Wonderland's chief financial officer to be Patryn, who was the former co-founder of defunct Canadian cryptocurrency exchange QuadrigaCX. Over $145 million worth of QuadrigaCX customers' funds are still missing after the mysterious death of its co-founder in late 2018. In addition, Patryn was convicted of operating a credit card fraud scheme under a different name in 2002.

Although no allegations of misconduct have been made about Patryn's tenure at Wonderland, the thought of appointing an individual with past criminal financial mishaps to manage the protocol's treasury raised alarms among many Wonderland users. In a forum proposal cited by Sestagalli, its author, a co-founder of Bastion trading known as "TheSkyHopper," calls for the immediate removal of 0xSifu (Michael Patryn) from treasury management and proposed for members of his firm to join in as replacements. One user, El_jefe_NYC, commented:

“This is EXACTLY the type of action Dani needed to do in these hard times. That's how a leader is supposed to react. We will grow back MUCH stronger moving forward.”

Wonderland is a reserve currency protocol built on the Avalanche blockchain. On Jan. 2, before the recent crypto market turmoil and the Michael Patryn dox, Wonderland's treasury balance amounted to $1.9 billion in total value locked. However, that has dropped to $278 million at the time of publication.