Crypto transaction success rate hinges on user location: Report

A new report from Cointelegraph Research and Onramper revealed that fiat-crypto transactions have a 50% failure rate due to several factors, including user location.

The crypto community continually seeks ways to bridge the gap between traditional finance and fiat currencies with decentralized finance (DeFi) tools. Crypto on-ramp platforms are a primary way users can cross between these two financial ecosystems.

However, a new report from Cointelegraph Research and Onramper, a crypto-based financial services provider, revealed that 50% of fiat-crypto transactions fail, even after Know Your Customer completion.

Moreover, due to difficulties in the transaction process, transaction abandonment during the purchase flow can be as high as 90%.

The survey looked at nine of the largest fiat-crypto onramps, including Coinify, MoonPay, Transak and Wyre, among others.

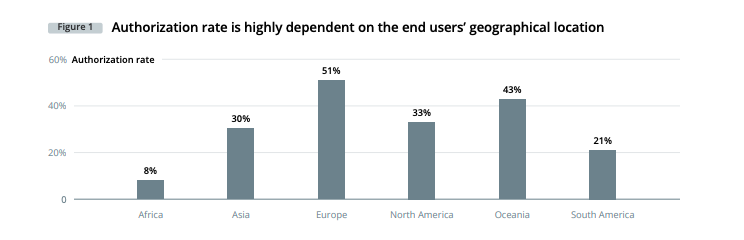

According to the data, the performance of various onramps widely differs, though one of the main factors includes user location. Europe had the highest success rates in transactions, while the lowest are found in Africa and South America.

Other factors that affected transactions on crypto onramps include payment methods, the fiat used to to convert to crypto and available trading pairs. Bank transfers as a payment method were proven superior in transaction success rates, achieving close to 100% success in two instances.

Related: Credit cards can bridge Web2 to Web3, says music industry exec

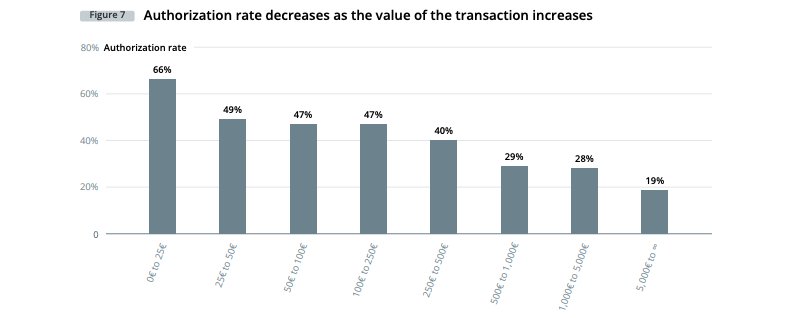

Additionally, transaction value was a major indicator of success, with smaller transactions worth $0–26 achieving a 66% authorization rate, compared to transactions with values more than $5,000, which typically have an authorization rate of 19%.

The research concluded that potential solutions to transaction authorization issues could be for token service providers to offer as wide a range as possible of aggregated onramps in a single interface. Another is dynamically routing transactions to give users the best option for their situations.

Recently, at the World Economic Forum, Tether chief technology officer Paolo Ardoino called the platform’s stablecoin Tether (USDT), an on-ramp for Bitcoin (BTC).

The Hong Kong Monetary Authority also described its upcoming retail central bank digital currency as a potential on-ramp into the DeFi space.

Go to Source

Author: Savannah Fortis