Ethereum Could Skyrocket by up to 3,805%, According to $101,900,000,000 Asset Manager – Here’s the Timeline

Giant investment manager VanEck believes that Ethereum (ETH) could hit a five-figure price over the coming years.

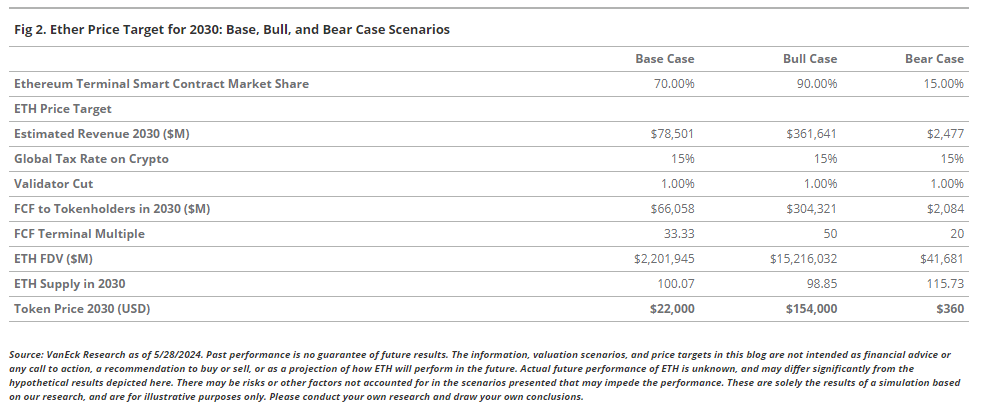

In a new research report, VanEck says that its 2030 base case target for Ethereum is $22,000, a gain of 472% from the current price, while its bull case target for the same period is $154,000, a 3,905% rally from the current level.

The global investment manager says that Ethereum’s potential price rally will be driven by an increase in its free cash flows – the amount of ETH available from the Ethereum network’s operations after subtracting all network costs such as gas fees used for transactions and smart contracts.

“Ethereum is a successful digital economy that attracts approximately 20 million monthly active users while settling $4 trillion in settlement value and facilitating $5.5 trillion in stablecoin transfers over the last twelve months. Ethereum secures over $91.2 billion in stablecoins, $6.7 billion in tokenized off-chain assets, and $308 billion in digital assets. The centerpiece asset of this financial system is the ETH token…

…We project ETH’s 2030 valuation based upon a forecast of $66 billion in free cashflows generated by Ethereum and accruing to the ETH token.”

Ethereum is trading at $3,845 at time of writing.

VanEck, which currently boasts $101.9 billion in assets under management, says that Ethereum currently generates more revenues per user than some major household brands.

“Ethereum monthly active user generates $172 in annual revenue, comparable to Apple Music, $100; Netflix, $142; and Instagram, $25. We categorize Ethereum as a platform business similar to the Apple App Store or Google Play.”

According to the global investment manager, some of the downside risks facing Ethereum include regulatory ones.

“a. Depending upon regulation. ETH or many of the assets within its ecosystem may be classified as securities. This could cause many Ethereum businesses to have to register with the SEC or face serious legal consequences.

b. The largest financial firms have substantial lobbyist presence as well as former employees appointed to the highest levels of most governments around the world. These former employees could create regulatory moats that disfavor disrupters like Ethereum.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Cristina Conti/Inky Water

The post Ethereum Could Skyrocket by up to 3,805%, According to $101,900,000,000 Asset Manager – Here’s the Timeline appeared first on The Daily Hodl.

Go to Source

Author: Mark Emem